Ahold Delhaize Says on Track for Merger Targets as Earnings Rise--Update

25 Août 2016 - 11:47AM

Dow Jones News

(Adds details.)

By Maarten van Tartwijk

AMSTERDAM--Koninklijke Ahold Delhaize NV said Thursday its

mega-merger got off to a good start after the newly merged

supermarket operators reported solid standalone results in the

second quarter, driven in part by a robust performance in the

U.S.

The Dutch-Belgian company, which will report combined results as

of the third quarter, said both Ahold and Delhaize enjoyed an

improved financial performance in the months before the merger's

closure on July 24.

"We have started our new chapter as Ahold Delhaize with good

momentum, with these two strong sets of pre-merger results," said

Chief Executive Dick Boer.

The roughly $31 billion deal has created one of the largest

supermarket operators in the U.S., combining Ahold's Stop &

Shop Giant chains with Delhaize's Food Lion and Hannaford chains.

It would give the grocers new muscle in a time of increasing

competition from discounters such as Wal-Mart Stores Inc. and

declining food prices.

Ahold posted underlying operating profit of 355 million euros

($400 million) in the three months to the end of June, a 7% rise

from last year, while sales rose 3% to EUR8.95 billion. The grocer

appeared to weather the impact of price deflation in the U.S.,

recording identical sales growth, excluding gasoline in the U.S.,

of 1.2%, up from a 0.4% decline last year.

"Given deflation of [around] 1%, this is the best volume

increase enjoyed by Ahold in living memory," analysts at Jefferies

said.

Ahold's underlying operating margin increased to 4% from 3.8%,

while net profit rose 7% to EUR209 million.

Delhaize, which disclosed its financial results in July, posted

a 10% rise in underlying operating profit to EUR247 million, while

revenue rose 3% to EUR6.29 billion. It recorded same-store sales

growth in the U.S. of 2.9%.

Jefferies said the results could give investors some comfort on

the merger, which was agreed in 2015 following years of speculation

about a potential tie-up. The combination is expected to result in

EUR500 million in annual cost-savings by 2019 of which EUR30

million will be realized this year.

Ahold Delhaize said it intends to sell another 10 stores in the

U.S. after agreeing to divest 86 stores to get merger approval from

the Federal Trade Commission. The additional disposals will be

concentrated in the Richmond area, the company said, without giving

further detail.

Write to Maarten van Tartwijk at maarten.vantartwijk@wsj.com

(END) Dow Jones Newswires

August 25, 2016 05:32 ET (09:32 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

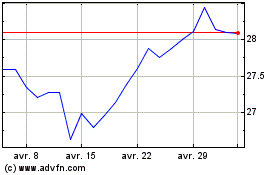

Koninklijke Ahold Delhai... (EU:AD)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

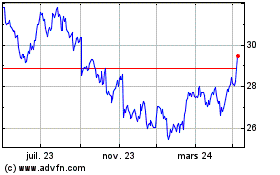

Koninklijke Ahold Delhai... (EU:AD)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024