By Natalia Drozdiak

BRUSSELS -- Apple Inc. is battling the European Commission's

call to fork over EUR13 billion ($14.5 billion) in back taxes

without the army of lobbyists and public relations campaigners

typical in such fights.

The iPhone maker spent less than EUR900,000 in 2015 to lobby the

EU institutions and doesn't employ any full-time lobbyists here;

only five people work part-time, according to public filings. By

contrast, Alphabet Inc.'s Google spent at least EUR4.25 million

last year and employs more than 10 people.

Other U.S. technology companies, including Alphabet, Amazon.com

Inc. and Qualcomm Inc., also are trying to convince the European

Commission, the EU's antitrust regulator, that their tax regimens

or pricing policies aren't breaching its rules.

But Apple's lack of a presence in the EU capital stands in

contrast with many of its U.S. technology peers, which have built a

European lobbying presence to try to sway investigations and

potential legislation, such as rules covering copyrights and

internet-based communications services.

For example, Apple was unsuccessful in gathering information

over the last two years from the commission about the evolving

theory the EU was resting its case on, said people familiar with

the matter.

"You may not always agree with what they [the commission] do but

this is the center for regulation for our industry," John Frank,

Microsoft's vice president for European affairs, said at a

conference here this month. Microsoft, which spent roughly as much

on lobbying the EU last year as Google did, has had tussles with

the commission that go back to the early 1990s.

Since then, the commission has pushed forward a raft of

regulations and investigations aimed at altering the behavior of

U.S.-based internet superpowers.

"The European Commission has become the new center of gravity,

the greatest threat to large companies that might have antitrust

issues," said Frank R. Baumgartner, professor at University of

North Carolina at Chapel Hill and co-author of Lobbying and Policy

Change: Who Wins, Who Loses, and Why.

The EU recently surpassed the U.S. in terms of the number of

registered organizations lobbying its institutions, according to

Transparency International. As of Sept. 7, the EU registered 9,756

organizations, compared with 9,726 in the U.S.

For companies that are the subjects of antitrust and state-aid

investigations, attempting to influence the commission's

competition directorate, known as DG COMP, is a tricky task.

People familiar with the directorate say there is limited leeway

for influencing the outcome of any competition investigation. The

regulator can't stray too far from previous case law in its

decisions to ensure the ruling is upheld in court when the

companies inevitably appeal it.

Companies can try to lobby other parts of the commission to get

these other departments to feed the firm's perspectives into the

competition directorate's work, according to Karl Isaksson,

chairman of EPACA, an association of public affairs firms.

Some chief executives, including Apple's Tim Cook and Google CEO

Sundar Pichai, have made the trek to Brussels to clarify their

positions directly with the EU's antitrust chief Margrethe

Vestager. A top Google executive recently stressed the importance

of "educating" EU lawmakers about how the company works.

Asked about Google's lobbying in Brussels, spokesman Mark Jansen

said "European politicians have many questions for Google and about

the internet [and] we're working hard to answer those

questions."

Amazon and Qualcomm declined to comment on their efforts.

Google's experience with the commission's many antitrust

investigations over the years may suggest a bigger Apple lobbying

presence in Brussels wouldn't have had a meaningful impact on the

regulator's decision.

American companies in Brussels also lack a direct national

representation within EU institutions. That disadvantage doesn't

exist for, say, French companies that can lobby through their

national government, via their own members of the European

Parliament, or to their own commissioner. Top commission officials

say they meet frequently with U.S. companies.

Apple's peers have worked to advertise the benefits Europe

derives from their activities. Google has mounted public-relations

campaigns in Europe, such as an initiative to support digital

journalism. Amazon also frequently promotes the ways in which it

helps small European businesses to sell their products across the

bloc's internal borders.

Still, "I don't know what [Apple] would have done differently,"

said a person close to the commission's competition office. "It's

not a question of behavior; it's a question of what's in the

numbers and what's on the table."

Write to Natalia Drozdiak at natalia.drozdiak@wsj.com

(END) Dow Jones Newswires

September 25, 2016 15:17 ET (19:17 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

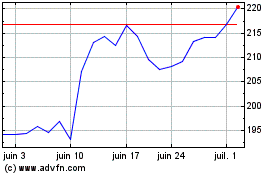

Apple (NASDAQ:AAPL)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

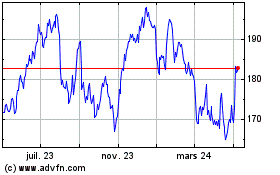

Apple (NASDAQ:AAPL)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024