ArcelorMittal Swings to Profit, Expresses Hope About Trump Policies -- Update

10 Février 2017 - 12:05PM

Dow Jones News

By Christopher Alessi

FRANKFURT--Steelmaker ArcelorMittal SA said Friday it swung to a

profit in the fourth quarter of 2016, while its chief executive

sounded an optimistic note about 2017 and the potential impact of

President Donald Trump's proposed economic policies on the

company.

Net profit for the period ended Dec. 31 was $403 million,

compared with a loss of $6.69 billion during the same period a year

earlier.

The company returned to profitability mainly because of a lack

of exceptional charges stemming from a decline in international

steel prices, which caused losses in 2015.

"As we enter into 2017, I see there is a positive momentum both

in the business and the market," Chief Executive Lakshmi Mittal

said in an interview Friday.

Mr. Mittal noted rising steel demand in the crucial U.S. market

and said Mr. Trump's promises to invest in U.S. infrastructure and

manufacturing are "good for us" and would help the steel industry

at large.

He also suggested the Trump administration could provide a

bulwark against a glut of Chinese steel on the global market. "I

hope that with Trump's new administration, strong trade actions

will help to address to China's overcapacity," Mr. Mittal

added.

China has flooded the world market with an excess of less

expensive steel and aluminum, helping to trigger a continuing

consolidation in the steel industry. The U.S. Commerce Department

late last year launched an investigation into whether Chinese

steelmakers are transporting steel through Vietnam to evade U.S.

import tariffs.

Mr. Mittal said that impending consolidation in the industry

would be "good for everyone."

Luxembourg-based ArcelorMittal said last year that it planned to

team up with Italy's privately held Marcegaglia SpA to take over

the ailing Ilva steel plant in Italy, which is Europe's largest

single steel plant and a producer of flat-steel products. The deal,

if it goes ahead, would solidify ArcelorMittal's position atop the

European flat-steel market, ahead of Germany's Thyssenkrupp AG.

Thyssenkrupp is in talks to combine its steel operations with

India's Tata Steel Ltd., a move Mr. Mittal said he hopes will come

to fruition.

ArcelorMittal, the world's largest steelmaker, said it expects

to increase capital expenditure in 2017 to $2.9 billion from $2.4

billion last year, a result of recovering steel markets. The

company said it expects global apparent steel consumption to

continue to expand in 2017, growing by between 0.5% and 1.5%.

The company early last year was forced to tap shareholders with

a $3.1 billion rights issue to shore up its balance sheet after the

slump in steel prices in 2015. That move, along with improved

market conditions last year, helped it reduce its net debt to

$11.06 billion at the end of 2016 from $15.68 billion in 2015.

Chief Financial Officer Aditya Mittal on a conference call with

reporters Friday lauded the progress but cautioned that markets

"remain volatile" largely as a result of Chinese overcapacity.

ArcelorMittal's fourth-quarter sales rose 1% to $14.1 billion as

a result of higher steel shipment volumes, higher average steel

selling prices and higher iron-ore reference prices. But those

gains were offset by lower market-priced iron-ore shipments, the

company said.

Write to Christopher Alessi at christopher.alessi@wsj.com

(END) Dow Jones Newswires

February 10, 2017 05:50 ET (10:50 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

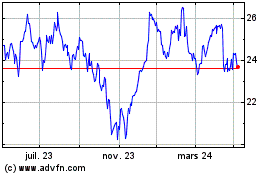

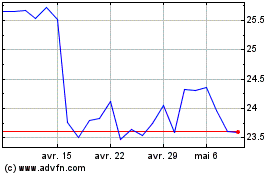

ArcelorMittal (EU:MT)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

ArcelorMittal (EU:MT)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024