Australian Dollar Advances Amid Risk Appetite

20 Juin 2017 - 6:53AM

RTTF2

The Australian dollar climbed against its major rivals in early

European deals on Tuesday amid risk appetite, as European shares

rose following record close on Wall Street overnight, led by a

rebound in technology shares.

Investors are awaiting the decision from index provider MSCI on

whether to include China A-shares in its emerging markets index

after rejecting it on three previous occasions.

Oil prices rose amid mild weakness in the dollar, although

concerns over supply glut kept investors nervous.

Minutes from the Reserve Bank of Australia's June 6 meeting

showed that members of the board observed that the country's rate

of economic growth is expected to continue gradually over the next

few years.

The bank added that the economic outlook, in its current

condition, continues to be supported by low interest rates.

Data from the Australian Bureau of Statistics showed that

Australia's house prices rose 2.2 percent on quarter in the first

three months of 2017.

That was in line with expectations and down from 4.1 percent in

the previous three months.

The aussie showed mixed performance in the Asian session. While

the aussie held steady against the yen and the euro, it rose

against the kiwi. Against the greenback, it fell.

The aussie climbed to 0.7623 against the greenback, following a

decline to a session's low of 0.7585. The next possible resistance

for the aussie-greenback pair is seen around the 0.78 region.

The aussie advanced to 85.07 against the Japanese yen, its

highest since April 3. Continuation of the aussie's uptrend may see

it challenging resistance around the 86.00 area.

The aussie edged up to 1.0075 against the loonie, off its early

low of 1.0027. If the aussie-loonie pair extends rise, 1.02 is

likely seen as its next resistance level.

The aussie firmed to 1.4626 against the euro, a level not seen

since May 3. The aussie is poised to target 1.44 as the next

resistance level.

Figures from the European Central Bank showed that the Eurozone

current account surplus declined to the lowest level in more than

two years in April.

The current account surplus fell to EUR 22.2 billion in April

from EUR 35.7 billion in March. This was the lowest since November

2014, when the surplus totaled EUR 21.65 billion.

The aussie rose back to 1.0502 against the NZ dollar, from a low

of 1.0476 hit at 2:15 am ET. The aussie had earlier set a 4-day

high of 1.0520 in the Asian session. Next likely resistance level

for the aussie is seen around the 1.06 area.

Survey figures from ANZ bank showed that New Zealand's consumer

confidence improved for the second straight month in June.

The ANZ Roy Morgan Consumer Confidence Index rose to 127.8 in

June from 123.9 in May. Moreover, the latest reading was the

highest in five months.

Looking ahead, at 4:45 am ET, the Swiss National Bank Chairman

Thomas Jordan delivers opening remarks at the Swiss International

Finance Forum, in Bern.

In the New York session, U.S. current account for the first

quarter and Canada wholesale sales for April are due.

Dallas Fed President Robert Kaplan speaks about the economy and

monetary policy at the Commonwealth Club in San Francisco at 3:00

pm ET.

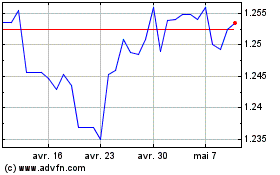

Sterling vs US Dollar (FX:GBPUSD)

Graphique Historique de la Devise

De Mar 2024 à Avr 2024

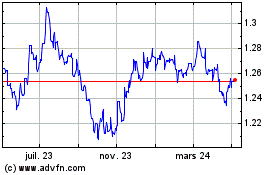

Sterling vs US Dollar (FX:GBPUSD)

Graphique Historique de la Devise

De Avr 2023 à Avr 2024