Australian Dollar Rises On Strong Jobs Data

14 Septembre 2017 - 5:15AM

RTTF2

The Australian dollar strengthened against other major

currencies in the Asian session on Thursday, after data showed that

Australia's economy has added more jobs than expected in

August.

Data from the Australian Bureau of Statistics showed that the

Australian economy added 54,200 jobs to 12,269,000 in August,

beating forecasts for an addition of 20,000 jobs following the

addition of 27,900 jobs in the previous month.

The unemployment rate in Australia held steady at a seasonally

adjusted 5.6 percent in August. That was in line with expectations

and unchanged from the July reading.

The participation rate ticked up to 65.3 percent, exceeding

expectations for 65.1 percent, which would have been unchanged.

Full-time employment increased 40,100 to 8,392,300 and part-time

employment increased 14,100 to 3,876,700. Unemployment decreased

1,100 to 727,500.

In other economic news, data from the National Bureau of

Statistics showed that China's industrial production climbed 6

percent year-on-year in August, slower than the 6.4 percent

increase seen in July.

Output growth was forecast to accelerate to 6.6 percent. The

pace of expansion was also the weakest seen so far this year.

Similarly, retail sales growth eased to 10.1 percent in August

from 10.4 percent in July. This was the slowest growth since

January to February this year and below the expected rate of 10.5

percent.

During January to August, fixed asset investment increased 7.8

percent from previous year, after rising 8.3 percent in the first

seven months of the year. The latest annual expansion was the

slowest since 1999.

In the Asian trading, the Australian dollar rose to a

1-1/2-month high of 88.74 against the yen, nearly a 4-week high of

1.4813 against the euro and a 2-day high of 1.1054 against the NZ

dollar, from yesterday's closing quotes of 88.23, 1.4882 and

1.1023, respectively. If the aussie extends its uptrend, it is

likely to find resistance around 89.00 against the yen, 1.46

against the euro and 1.11 against the kiwi.

Against the U.S. dollar, the aussie edged up to 0.8016 from

yesterday's closing value of 0.7985. The aussie may test resistance

near the 0.81 region.

Against the Canadian dollar, the aussie climbed to 0.9755 from

an early 2-day low of 0.9706. The aussie is likely to find

resistance around the 0.99 region.

Looking ahead, the Swiss National Bank is set to publish the

outcome of its monetary policy meeting at 3:30 am ET. The bank is

expected to hold the interest rate on sight deposits at -0.75

percent and the target range for the three-month Libor between

-1.25 percent and -0.25 percent.

At 7:00 am ET, the Bank of England releases the outcome of its

monetary policy meeting as well as minutes. Economists expect the

bank to retain interest rates unchanged at 0.25 percent and asset

purchase target at GBP 435 billion.

In the New York session, U.S. weekly jobless claims for the week

ended September 9, U.S. CPI data for August and Canada new housing

price inde for July are slated for release.

At 11:30 am ET, Deutsche Bundesbank President Jens Weidmann is

expected to speak about monetary policy after a crisis at Goethe

University, in Frankfurt.

At 12:00 pm ET, European Central Bank Executive Board Member

Yves Mersch will participate in closing session "Economic and

Financial Priorities for relaunching the Eurozone and the EU" at

Eurofi Financial Forum 2017 "What way forward for the EU27 and

Eurozone?" in Tallinn.

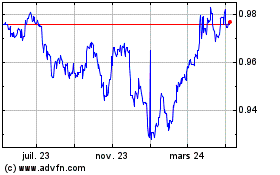

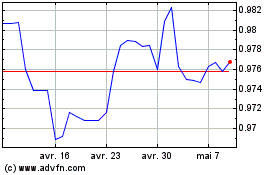

Euro vs CHF (FX:EURCHF)

Graphique Historique de la Devise

De Mar 2024 à Avr 2024

Euro vs CHF (FX:EURCHF)

Graphique Historique de la Devise

De Avr 2023 à Avr 2024