BONDUELLE - 2014-2015 FY Turnover: Another year of strong turnover growth exceeding objective

04 Août 2015 - 7:01AM

BONDUELLE

A French SCA

(Partnership Limited by Shares) with a capital of 56,000,000

Euros

Head Offices: La Woestyne 59173 Renescure,

France

Business

registration number: 447 250 044 (Dunkerque Registrar of

Businesses)

2014-2015

Financial Year Turnover

Another year of

strong turnover growth

exceeding objective for Bonduelle in FY

2014-2015

In a rather demanding environment

in FY 2014-2015 - sluggish consumption and concentration of

distribution in Europe, fire at the Tecumseh plant (Canada),

Russian embargo and the rouble devaluation - the Bonduelle Group

records another financial year of strong growth, higher than the

announced objective, later revised upward, again demonstrating the

pertinence of its business model and resilience to the fluctuating

environment.

Global Turnover

Activity by Geographic

Region

Total

consolidated turnover

(in € million) |

FY

2014-2015 |

FY

2013-2014 |

Current Exchange rate |

Constant scope of consolidation and exchange rates |

Q4

2014 -2015 |

Q4

2013 -2014 |

Current Exchange rate |

Constant scope of consolidation and exchange rates |

| Europe

Zone |

1,281.3 |

1,281.- |

0.-% |

0.-% |

326.1 |

335.7 |

- 2.9% |

- 3.-% |

|

Non-Europe Zone |

700.6 |

640.1 |

9.4% |

12.5% |

167.1 |

139.3 |

20.-% |

14.1% |

| Total |

1,981.8 |

1,921.1 |

3.2% |

4.1% |

493.2 |

475.- |

3.8% |

2.2% |

Activity by Operating

Segments

Total

consolidated turnover

(in € million) |

FY

2014-2015 |

FY

2013-2014 |

Current Exchange rate |

Constant scope of consolidation and exchange rates |

Q4

2014 -2015 |

Q4

2013 -2014 |

Current Exchange rate |

Constant scope of consolidation and exchange rates |

| Canned |

1,023.6 |

1,025.1 |

- 0.1% |

2.3% |

235.5 |

243.5 |

- 3.3% |

- 2.7% |

| Frozen |

561.9 |

527.8 |

6.5% |

5.2% |

146.3 |

127.6 |

14.7% |

7.2% |

| Fresh processed |

396.3 |

368.2 |

7.6% |

7.6% |

111.4 |

103.9 |

7.2% |

7.2% |

| Total |

1,981.8 |

1,921.1 |

3.2% |

4.1% |

493.2 |

475.- |

3.8% |

2.2% |

The group's turnover stands at

1,981.8 million of Euro for FY 2014-2015 (1st of

July 2014 - 30th of June

2015) against 1,921.1 million of Euro last FY, an increase of 4.1%

at constant exchange rates, higher than the annual objective

revised upward in February to 2 to 3 % at constant rates. After

taking into account the adverse impact of currencies that is - 17.5

million of Euro and - 0.9%, mainly related to a 20% devaluation of

the rouble, the group reports a growth of + 3.2% on published

figures.

The group thus experienced 4 quarters of growth, last quarter

reporting an increase of + 2.2% on a like-for-like basis* and of +

3.8% on published figures and saw, over the full FY, all its

operating segments - canned, frozen and fresh processed - growing

on a like-for-like basis*.

Europe

Zone

The turnover of the Europe zone

(65% of the total turnover) reported a stability both on a

published and constant basis.

This stability masks the strong sales of branded products:

Bonduelle and Cassegrain in all the various operating segments of

the group driven by innovation (broadening of the Cassegrain range,

sustainable development of the line of steamed products, renewal of

the retail frozen ranges and success of the snacking range in the

delicatessen segment notably) and by the reinforcement of the

presence of the group in the media. This dynamic allowed the group

to strengthen its market position in globally stable

markets.

Some voluntary declines in volumes for the canned private label

segment as a result of unsatisfactory price levels, and a food

service segment remaining difficult for the frozen category explain

the overall development of the zone.

Non-Europe

Zone

Despite adverse exchange rate

movements, the Non-Europe zone (35% of the total turnover) reported

a published growth of + 9.4% and a 12.5% growth at constant

exchange rates in line with past performances.

In Northern America, affected by the fire at the plant of Tecumseh

in the middle of harvest season, Bonduelle continued to consolidate

its positions in Canada, in a better market environment, and its

strong expansion in the US of its frozen operating segment in

retail and food service. The investments and productivity gains

obtained in the plants acquired in 2012, coupled with the

acquisition of the Lethbridge plant over the FY support the volume

growth and the continued market share gains.

In Eastern Europe, the group recorded once again a strong turnover

growth. Essentially locally produced, the Russian activity has not

suffered from the embargo measures and the rouble devaluation,

highlighting here the relevance of the set-up of a local production

plant in 2004 and reinforced by the external growth in 2012. The

activity in Ukraine, where the group only has a commercial

presence, obviously impacted by the geopolitical context, is not

significant.

In Brazil, with a turnover accounting for less than 2% of the

group, Bonduelle continued its business growth despite a

substantial slowdown in consumption and price levels remaining

low.

Outlooks

The outstanding commercial

performance recorded over this FY supports the growth prospects for

the current operating result of 2014-2015, reviewed upward in

February to + 7 to +12 % at constant exchange rates.

* at constant

scope of consolidation and exchange rates

Next financial event:

- 2014-2015 FY

Results

:

29th of September

2015 (prior to stock exchange trading session)

About Bonduelle

Bonduelle, a family business, was established in

1853. Its mission is to be the world reference in "well-living"

through vegetable products. Prioritising innovation and long-term

vision, the group is diversifying its operations and geographical

presence. Its vegetables, grown across more than 128,000 hectares

all over the world, are sold in 100 countries under various brand

names and through various distribution channels and technologies.

Expert in agro-industry with 58 industrial sites or own

agricultural production, Bonduelle produces quality products by

selecting the best crop areas close to its customers.

Bonduelle is listed on the Euronext compartment B

- Indices: CAC MID & SMALL - CAC ALL-TRADABLE - CAC ALL

SHARES

Code ISIN: FR0000063935 - Code Reuters: BOND.PA -

Code Bloomberg: BON FP

AvisFinancier150804enGB

This

announcement is distributed by NASDAQ OMX Corporate Solutions on

behalf of NASDAQ OMX Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: BONDUELLE via Globenewswire

HUG#1943237

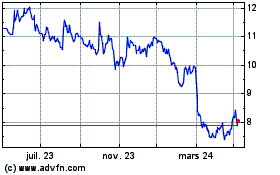

Bonduelle (EU:BON)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

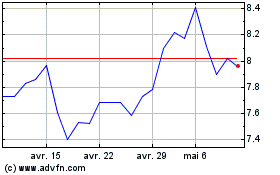

Bonduelle (EU:BON)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024