BONDUELLE - Quarter 3 FY 2016-2017 Turnover: Strong activity growth

03 Mai 2017 - 6:00PM

BONDUELLE

A French SCA

(Partnership Limited by Shares) with a capital of 56,000,000

Euros

Head Offices: La Woestyne 59173 Renescure,

France

Business

registration number: 447 250 044 (Dunkerque Registrar of

Businesses)

Quarter 3 FY

2016-2017 Turnover

(1st of January -

31st of March

2017)

Strong activity

growth for quarter 3

Strong organic growth, positive exchange rate

effect

and consolidation start of Ready Pac Foods

The Bonduelle Group's turnover for

quarter 3 of FY 2016-2017 stands at 526.8 million of Euro, an

increase of 11.7% driven by the combined effect of a solid organic

growth (+ 2.2%), favourable exchange rates (+ 4.-%) and the

integration of Ready Pac Foods (+ 5.5%) into the company as of

March 21st 2017. Over

the first 9 months of this FY, growth increased by + 4.7% based on

reported figures and + 2.-% on a like for like basis*.

Activity by

Geographic Region

Total

consolidated turnover

(in € millions) |

9 months

2016-2017 |

9 months

2015-2016 |

Variation at current exchange rates |

Variation at constant scope of consolidation and exchange

rates |

3rd quarter

2016-2017 |

3rd quarter

2015-2016 |

Variation at current exchange rates |

Variation at constant scope of consolidation and exchange

rates |

| Europe Zone |

947.3 |

950.1 |

- 0.3% |

- 0.2% |

315.2 |

312.3 |

0.9% |

0.9% |

| Non-Europe

Zone |

605.1 |

533.3 |

13.5% |

6.-% |

211.6 |

159.5 |

32.7% |

4.5% |

| Total |

1,552.4 |

1,483.4 |

4.7% |

2.-% |

526.8 |

471.8 |

11.7% |

2.2% |

Activity

by Operating Segments

Total

consolidated turnover

(in € millions) |

9 months

2016-2017 |

9 months

2015-2016 |

Variation at current exchange rates |

Variation at constant scope of consolidation and exchange

rates |

3rd quarter

2016-2017 |

3rd quarter

2015-2016 |

Variation at current exchange rates |

Variation at constant scope of consolidation and exchange

rates |

| Canned |

744.5 |

730.8 |

1.9% |

1.-% |

240.- |

221.5 |

8.3% |

3.9% |

| Frozen |

487.4 |

453.2 |

7.5% |

6.1% |

168.7 |

153.3 |

10.-% |

4.5% |

| Fresh processed |

320.5 |

299.3 |

7.1% |

- 1.8% |

118.2 |

96.9 |

21.9% |

- 5.6% |

| Total |

1,552.4 |

1,483.4 |

4.7% |

2.-% |

526.8 |

471.8 |

11.7% |

2.2% |

Europe

Zone

For quarter 3, the Europe zone

showed renewed growth with + 0.9% both on a like for like basis*

and reported figures. An all the more remarkable performance over

the past 3 months, given the fact that the fresh ready to use

segment was heavily affected by adverse weather conditions in

December and January in Spain and Italy, but more than offset by a

return to growth for the canned segment and a very sharp activity

rise for the frozen segment. For the first 9 months of this FY, the

activity remained virtually unchanged both on a like for like

basis* and reported figures.

Non-Europe

Zone

The Non-Europe zone recorded over

quarter 3 a + 32.7% growth, the favourable exchange rates (Russian

rouble and Canadian dollar, notably) and the integration of Ready

Pac Foods, as of March 21st 2017 (USD

28.3 million) have boosted the growth on a comparable basis* (+

4.5%). A sharp upturn of the activity in Eastern Europe (Russia and

the Community of Independent States) was also observed.

For the first 9 months, the Non-Europe zone recorded a growth of +

13.5% based on reported figures and + 6% on a like for like

basis*.

Highlights

Recovery of the

rouble

The return to a dynamic GDP growth

in Russia, translated into a clear revaluation of its currency. The

on-going embargo on imports fosters local production.

Acquisition of

Ready Pac Foods in the US

On the 21st of March

2017, Bonduelle announced the vesting of Ready Pac Foods.

Based in California, Ready Pac Foods is the #1 producer of

single-serve salad bowls in the U.S. through its Bistro Bowl® suite

of products and its legacy of innovation and culinary expertise.

Ready Pac Foods is also a producer of fresh-cut produce, offering

packaged salads, fresh-cut fruits, and mixed vegetables to its

retail and foodservice customers. With 4 production facilities

located in Irwindale (CA), Jackson (GA), Florence and Swedesboro

(NJ), and employs about 3,500 full-time employees. Ready Pac Foods

generates approximately $800m of revenues, with a national presence

in the U.S. and a wide customer base.

This milestone transaction is a key step in Bonduelle's strategic

ambition VegeGo! 2025 of being "the world reference in "well

living" through vegetable products". This acquisition will

strengthen Bonduelle's international footprint and dramatically

change its profile, making the U.S. the largest country of

operations, continuing a longstanding track record of successful

acquisitions in North America, in particular Aliments Carrière,

Canada, in 2007 and Allens, USA in 2012, and the fresh category,

its first business segment.

This acquisition, which is fully compatible with Bonduelle's strong

financial profile, perfectly fits with its strategic plan and will

strengthen its leadership positions in its core business

lines:

- development of Bonduelle's snacking segment in the consumer

convenience and healthy food segments,

- increasing presence in the fast growing segment of fresh prepared

vegetables,

- reinforcement of footprint in North America, of a size, post

transaction, equivalent to the European Union in Bonduelle's

geographical portfolio.

Outlooks

The Bonduelle Group confirms its

turnover growth target of + 2% to + 3% and the stability of its

operating profitability on a like for like basis*, excluding the

Ready Pac Foods acquisition.

* at constant

currency exchange rate and scope of consolidation basis

Next financial events:

- 2016-2017 FY

Turnover:

2nd of August

2017 (after stock exchange trading session)

- 2016-2017 FY

Results:

3rd of October

2017 (prior to stock exchange trading session)

About Bonduelle

Bonduelle, a family business, was established in

1853. Its mission is to be the world reference in "well-living"

through vegetable products. Prioritising innovation and long-term

vision, the group is diversifying its operations and geographical

presence. Its vegetable, grown over more than 130,000 hectares all

over the world, are sold in 100 countries under various brand names

and through various distribution channels and technologies. Expert

in agro-industry with 58 industrial sites or own agricultural

production, Bonduelle produces quality products by selecting the

best crop areas close to its customers.

Bonduelle is listed on Euronext compartment

B

Euronext indices: CAC MID & SMALL - CAC ALL

TRADABLE - CAC ALL SHARES

Bonduelle is part of the Gaïa non-financial

performance index and employee shareholder index

(I.A.S.)

Code ISIN : FR0000063935 - Code Reuters : BOND.PA

- Code Bloomberg : BON FP

Quarter 3 FY 2016-2017

Turnover

This

announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: BONDUELLE via Globenewswire

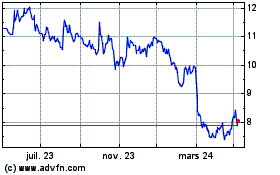

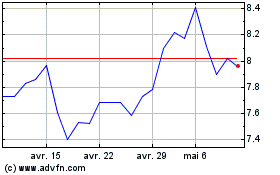

Bonduelle (EU:BON)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Bonduelle (EU:BON)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024