Bank Of England To Allow EU Banks, Insurers To Operate In UK Post-Brexit

20 Décembre 2017 - 10:49AM

RTTF2

The Bank of England announced on Wednesday that it will allow EU

banks and insurers to operated normally in the U.K. post-Brexit and

is undertaking a review of its authorizing and supervision policies

for international firms.

"The foundation of the Bank of England's approach is the

presumption that there will continue to be a high degree of

supervisory cooperation between the UK and the EU," the bank said

in a statement.

"On this basis, EEA banks and insurers may...apply for

authorization to operate as a branch in the UK."

Deputy Governor and Prudential Regulation Authority CEO Sam

Woods said in a letter to international financial services firms

that this assumption may be revisited as Brexit negotiations

proceed, implying that things could change if the talks fail.

"In the event of a non-cooperative relationship, however, there

could be implications for how we oversee some EEA firms in the UK,"

the bank said.

In a parliament select committee hearing, BoE Governor Mark

Carney said if co-operation with EU does not materialize, the EEA

banks would be asked to create subsidiaries.

The approach to authorization and supervision of international

firms will be out for consultation until February 2018 and the PRA

will be open for applications from the beginning of 2018, the bank

said.

The bank also said that it does not expect any implication of

the proposed policy for the current operations of banks and

insurers from non-EEA countries such as the US, Switzerland and

Japan. This is because the UK has an appropriate level of third

country supervisory cooperation with their home state supervisors

in light of the systemic importance of the relevant firms.

According to the central bank, there are 160 branches of

international banks in the UK, of which 77 are from the EEA, with

assets totaling GBP 4 trillion. There are also 110 branches of

international insurers in the UK, of which 80 are from the EEA, the

bank added.

The BoE also said that it is issuing guidance to on its approach

to international central counterparties, or CCPs.

Deputy Governor Jon Cunliffe said in a letter to CCPs that the

government announced on Wednesday that it intends to give the BoE

new powers under UK law to recognize non-UK CCPs.

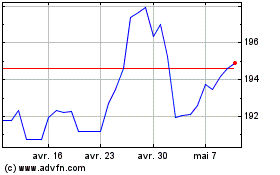

Sterling vs Yen (FX:GBPJPY)

Graphique Historique de la Devise

De Mar 2024 à Avr 2024

Sterling vs Yen (FX:GBPJPY)

Graphique Historique de la Devise

De Avr 2023 à Avr 2024