By Jonathan Cheng in Seoul and Kane Wu in Hong Kong

This time last year, South Korean private-equity firm MBK

Partners LP was shopping around a rich prize--the South Korean

operations of ING Groep NV, which it had acquired in 2013 as part

of a planned downsizing of the Amsterdam-based financial giant.

Among the final bidders was a trio of Chinese players:

state-owned China Taiping Insurance Holdings Co., Shanghai-based

conglomerate Fosun Group and private-equity firm JD Capital, people

familiar with the matter said at the time.

But as South Korea's government finalized its plans to deploy a

U.S. missile-defense system that is fiercely opposed by Beijing,

the Chinese bidders got cold feet, telling MBK that they would wait

for a better opportunity, according to people familiar with the

matter.

Months later, that better opportunity hasn't arrived. So on

Thursday, MBK's executives will begin a global roadshow for an

initial public offering of ING Life Korea, in hopes that it can

sell the company to smaller investors. The deal could value the

company at nearly $3 billion.

MBK's abrupt change of tack highlights the broad ripples being

felt by the worsening geopolitical standoff over North Korea's

nuclear and missile program, which has prompted Washington and

Seoul to push ahead with the controversial missile-defense system,

called Terminal High-Altitude Area Defense, or Thaad.

On Wednesday, Gu Zhipeng, vice president of JD Capital's parent,

Jiuding Group, confirmed that the company would no longer be

involved in the acquisition of ING Life Korea. He said the company

couldn't proceed because of the recent deterioration in relations

between China and South Korea. Mr. Gu added that none of the

group's subsidiaries or the group itself have plans to invest in

South Korea. China Taiping said it had nothing to disclose in

relation to ING Life Korea. Fosun declined to comment.

Lotte Group, South Korea's fifth-largest conglomerate and the

owner of the golf course in South Korea that will host the Thaad

battery, has also been in China's crosshairs. Chinese authorities

have shut down dozens of Lotte stores in mainland China in apparent

retaliation for its role in deploying the missile-defense

system.

Thaad is expected to be a major topic of discussion when Chinese

President Xi Jinping arrives in Florida for a two-day summit

meeting with U.S. President Donald Trump. On Tuesday, 26 U.S.

senators signed a letter calling on Mr. Trump to push back against

any Chinese retaliation related to Thaad deployment.

Separately, the Chinese government has also imposed capital

controls on many of its own companies, preventing some potential

buyers from pursuing already-tough deals.

Beijing is seeking to tighten control on money flowing out of

the nation, concerned that such capital flight could shake

confidence in its economy and potentially weaken the yuan, after a

record year of overseas deal making by Chinese companies. Last

year, Chinese companies announced overseas deals worth a collective

$217 billion, according to Dealogic.

Jiuding Group's Mr. Gu said Beijing's new capital-control

measures were also a factor in its decision not to proceed with the

acquisition of ING Life Korea.

The new geopolitical hurdles to deal making are an extra

headache for private-equity companies in Asia, which have looked

increasingly to Chinese entities as some of the biggest potential

buyers. Even when Chinese players don't win, their participation in

sales can push up the value of bids.

Beijing-based Anbang Insurance Group Co., which has turned heads

with its aggressive bids on flashy hotel properties and for its

ties with Mr. Trump's son-in-law, Jared Kushner, has been

particularly active in South Korea's insurance market.

Last year, Anbang bought the South Korean operations of

Germany's Allianz SE for $3 million in a deal that won regulatory

approval late last year. In 2015, Anbang bought control of South

Korea's No. 8 insurer, Tong Yang Life Insurance Co., for $1

billion.

MBK, which was set up in 2005 by a team of former executives

from Carlyle Group LP led by Michael B. Kim, bought ING Life Korea

from its Dutch parent company for $1.6 billion in 2013.

Last year, MBK, which has $14.6 billion of capital under

management, hired Morgan Stanley to sell South Korea's

fifth-largest by assets at an asking price of more than $3

billion.

ING Life Korea, which has about 30.7 trillion Korean won ($27.2

billion) in assets, is considered one of the most attractive

financial assets in South Korea, with a strong capital base, a book

value of about 5 trillion won and net income last year of 290

billion won.

Some of the potential Chinese buyers haven't formally withdrawn

from the process, but they have asked repeatedly for more time on

the bid, the people said, and could bid for the 59.1% majority

stake that MBK will hold in ING Life Korea even after floating

40.9% of the company in the IPO.

Write to Jonathan Cheng at jonathan.cheng@wsj.com and Kane Wu at

Kane.Wu@wsj.com

(END) Dow Jones Newswires

April 05, 2017 07:31 ET (11:31 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

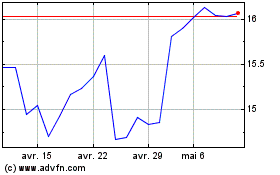

ING Groep NV (EU:INGA)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

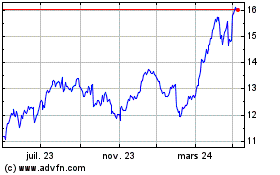

ING Groep NV (EU:INGA)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024