Beter Bed dividend proposal approved

20 Mai 2016 - 8:00AM

The Annual General Meeting of Beter Bed Holding

N.V. held on 19 May 2016 declared a final dividend of € 0.48 per

ordinary share of nominally € 0.02 each for the 2015 financial

year.

An interim dividend of € 0.39 was paid in November

2015. The total dividend for 2015 consequently amounts to € 0.87,

resulting in a pay-out ratio of 85%. A dividend of € 0.65 was paid

for 2014 (pay-out ratio: 85%). The final dividend will be paid

entirely in cash.

The following schedule will apply to the payment

of the dividend:

23 May 2016 listing

ex-dividend

24 May 2016 record

date

7 June 2016 payment of dividend

Dividend policy

The dividend policy of Beter Bed Holding is aimed at maximising

shareholder returns while maintaining a healthy capital position.

The company's objective is to, subject to certain conditions, pay

out at least fifty percent of the net profit to shareholders. This

will be done in the form of payment of an interim dividend

following publication of the third-quarter figures and payment of a

final dividend following the adoption of the financial statements

and following the approval of the dividend proposal by the Annual

General Meeting. This method makes it possible to spread the

payment of dividend evenly across the year. The company's solvency

must never fall below thirty percent on any given publication date

as a result of the payment of dividend. The net interest-bearing

debt/EBITDA ratio may never exceed two.

Profile

Beter Bed Holding is a European retail organisation that strives to

offer its customers a comfortable and healthy night's rest every

night at an affordable price. The company does this via stores and

its own webshops through the formulas:

-

Matratzen Concord, located in

Germany, Switzerland and Austria.

-

Beter Bed, located in the

Netherlands and Belgium.

-

Beddenreus, located in the

Netherlands.

-

El Gigante del Colchón, located

in Spain.

-

Literie Concorde, located in

France.

The retail formulas ensure products of good

quality, offer better advice than their competitors and always

offer the best possible deal.

Beter Bed Holding is also active as a wholesaler of branded

products in the bedroom furnishing sector via its subsidiary DBC

International. The international brand M Line is sold in the

Netherlands, Germany, Belgium, Austria, Switzerland, Spain and

France.

At the end of March 2016 the total number of

stores was 1,151. In 2015, the company achieved net revenue of €

385.4 million. 70.1% of this figure was realised outside the

Netherlands.

Beter Bed Holding N.V. has been listed on the

Euronext Amsterdam since December 1996 and its shares (BBED

NL0000339703) have been included in the AScX Index.

For more information:

| Ton Anbeek |

Bart Koops |

| Chief Executive Officer |

Chief Financial Officer |

| +31 (0)413 338819 |

+31 (0)413 338819 |

| +31 (0)6 53662838 |

+31 (0)6 46761405 |

| ton.anbeek@beterbed.nl |

bart.koops@beterbed.nl

|

Please click on the link below

for the Pdf version of the press release.

press release

20-5-2016.pdf

This

announcement is distributed by NASDAQ OMX Corporate Solutions on

behalf of NASDAQ OMX Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: Beter Bed Holding NV via Globenewswire

HUG#2012256

Beter Bed Holding NV (EU:BBED)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

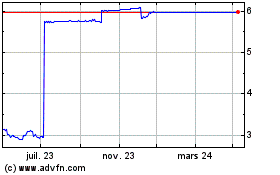

Beter Bed Holding NV (EU:BBED)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024