Brunel International NV: H1 2017: Disappointing half year, first signs of recovery

18 Août 2017 - 8:00AM

Amsterdam, 18 August 2017

Key points Q2 2017

- Revenue down by 18% to EUR 189 million

- EBIT down to EUR -1 million

Key points H1 2017

- Revenue down by 18% to EUR 385 million

- EBIT down to EUR 5 million

Brunel International (unaudited) |

|

| P&L

amounts in EUR million |

|

|

|

|

|

|

|

|

|

| |

Q2 2017 |

Q2 2016 |

Change % |

|

|

H1 2017 |

H1 2016 |

Change % |

|

|

Revenue |

188.9 |

231.2 |

-18% |

a |

|

385.3 |

469.6 |

-18% |

b |

| Gross

Profit |

39.7 |

47.7 |

-17% |

|

|

86.9 |

95.6 |

-9% |

|

| Gross

margin |

21.0% |

20.6% |

|

|

|

22.6% |

20.4% |

|

|

| Operating

costs |

40.8 |

40.2 |

2% |

c |

|

82.4 |

79.0 |

4% |

d |

| EBIT |

-1.2 |

7.5 |

-116% |

|

|

4.6 |

16.6 |

-73% |

|

| EBIT

% |

-0.6% |

3.2% |

|

|

|

1.2% |

3.5% |

|

|

| |

|

|

|

|

|

|

|

|

|

| Average

directs |

9,201 |

9,336 |

-1% |

|

|

9,093 |

9,629 |

-6% |

|

| Average

indirects |

1,496 |

1,500 |

0% |

|

|

1,478 |

1,526 |

-3% |

|

| Ratio

direct / indirect |

6.2 |

6.2 |

|

|

|

6.2 |

6.3 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

| a -19 % at constant

currencies |

|

|

|

|

|

|

|

| b -19 % at constant

currencies |

|

|

|

|

|

|

|

| c 2 % at constant

currencies |

|

|

|

|

|

|

|

| d 4 % at constant

currencies |

|

|

|

|

|

|

|

H1 2017 results by division

| Brunel Global Business (unaudited) |

|

| P&L

amounts in EUR million |

|

|

|

|

|

|

|

|

|

| |

Q2 2017 |

Q2 2016 |

Change % |

|

|

H1 2017 |

H1 2016 |

Change % |

|

|

Revenue |

81.1 |

119.8 |

-32% |

a |

|

163.2 |

248.3 |

-34% |

b |

| Gross

Profit |

9.2 |

13.3 |

-30% |

|

|

18.7 |

27.3 |

-31% |

|

| Gross

margin |

11.4% |

11.1% |

|

|

|

11.5% |

11.1% |

|

|

| Operating

costs |

11.3 |

12.7 |

-11% |

c |

|

22.7 |

25.0 |

-9% |

d |

| EBIT |

-2.0 |

0.6 |

-446% |

|

|

-3.9 |

2.3 |

-270% |

|

| EBIT

% |

-2.5% |

0.5% |

|

|

|

-2.4% |

0.9% |

|

|

| |

|

|

|

|

|

|

|

|

|

| Average

directs |

4,418 |

4,656 |

-5% |

|

|

4,351 |

4,911 |

-11% |

|

| Average

indirects |

510 |

598 |

-15% |

|

|

507 |

613 |

-17% |

|

| Ratio

direct / Indirect |

8.7 |

7.8 |

|

|

|

8.6 |

8.0 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

| a -33 % at constant

currencies |

|

|

|

|

|

|

|

| b -36 % at constant

currencies |

|

|

|

|

|

|

|

| c- 12 % at constant

currencies |

|

|

|

|

|

|

|

| d -12 % at constant

currencies |

|

|

|

|

|

|

|

Key points Q2 2017

- Revenue down by 32% to EUR 81 million

- Gross margin 11.4%, up from 11.1% last year

- EBIT down by 446% to EUR -2 million

Key points H1 2017

- Revenue down by 34% to EUR 163 millionGross

margin 11.5%, up from 11.1% last year

- EBIT down by 270% to EUR -4 million

Revenue

Revenue in Q2 decreased by 32% year on year, and 1% compared to Q1.

The regions Americas, Middle East and Russia achieved growth

compared to Q1, offset by a decline in Australia and South East

Asia. In Australia and South East Asia, significant projects were

largely completed in the course of Q2. We are working on several

initiatives to speed up our diversification. We expect that some of

these initiatives will start contributing in the second half of the

year.

Gross

profit

The gross margin increased slightly as a result of a change in the

mix, both across the globe and between activities.

Operating

costs

Cost savings in our existing business are partly offset by

investments in new initiatives, as a result operating costs in Q2

decreased by 11%.

| Brunel Europe (unaudited) |

| P&L

amounts in EUR million |

|

|

|

|

|

|

|

|

|

Q2 2017 |

Q2 2016 |

Change % |

|

|

H1 2017 |

H1 2016 |

Change % |

| Revenue |

107.8 |

111.4 |

-3% |

|

|

222.1 |

221.3 |

0% |

| Gross Profit |

30.4 |

34.4 |

-11% |

|

|

68.2 |

68.4 |

0% |

| Gross margin |

28.2% |

30.9% |

|

|

|

30.7% |

30.9% |

|

| Operating costs |

27.3 |

24.8 |

10% |

|

|

54.9 |

49.3 |

11% |

| EBIT |

3.2 |

9.6 |

-67% |

|

|

13.3 |

19.1 |

-30% |

| EBIT % |

3.0% |

8.6% |

|

|

|

6.0% |

8.6% |

|

|

|

|

|

|

|

|

|

|

|

| Average directs |

4,783 |

4,680 |

2% |

|

|

4,742 |

4,718 |

1% |

| Average indirects |

934 |

859 |

9% |

|

|

921 |

870 |

6% |

| Ratio direct /

Indirect |

5.1 |

5.4 |

|

|

|

5.1 |

5.4 |

|

Brunel Europe consists of Brunel Germany, Brunel Netherlands,

Brunel Belgium, Brunel Czech Republic, Brunel Switzerland and

Brunel Austria.

Key points Q2 2017

- Revenue down by 3% to EUR 108 million

- Gross margin 28.2%, down from 30.9% last

year

- EBIT down by 67% to EUR 3 million

Key points H1 2017

- Revenue up by 1 million to 222 million

- Gross margin 30.7%, down from 30.9% last

year

- EBIT down by 30% to EUR 13 million

Brunel Germany (unaudited) |

| P&L

amounts in EUR million |

|

|

|

|

|

|

|

|

|

Q2 2017 |

Q2 2016 |

Change % |

|

|

H1 2017 |

H1 2016 |

Change % |

| Revenue |

52.0 |

52.9 |

-2% |

|

|

108.3 |

102.5 |

6% |

| Gross Profit |

16.4 |

18.9 |

-13% |

|

|

37.3 |

35.8 |

4% |

| Gross margin |

31.5% |

35.7% |

|

|

|

34.4% |

34.9% |

|

| Operating costs |

13.5 |

12.6 |

6% |

|

|

27.2 |

24.5 |

11% |

| EBIT |

2.9 |

6.3 |

-54% |

|

|

10.1 |

11.3 |

-11% |

| EBIT % |

5.6% |

11.9% |

|

|

|

9.3% |

11.0% |

|

|

|

|

|

|

|

|

|

|

|

| Average directs |

2,274 |

2,174 |

5% |

|

|

2,265 |

2,160 |

5% |

| Average indirects |

423 |

405 |

4% |

|

|

412 |

416 |

-1% |

| Ratio direct /

Indirect |

5.4 |

5.4 |

|

|

|

5.5 |

5.2 |

|

Revenue

On 1 April, the new law came into effect and to comply we had to

renew our union trade agreement. Some of our customers have

suspended us as supplier until we had our new union trade agreement

in place, what caused a temporary hiccup in the growth. We

finalized the renewal at the end of July. This renewed agreement

offers us a strong competitive advantage. Revenue per working day

increased by 3%. Headcount at 30 June 2017 is 3% above last year's

headcount.

Working days

| |

Q1 |

Q2 |

Q3 |

Q4 |

FY |

| 2017 |

65 |

59 |

65 |

60 |

249 |

| 2016 |

62 |

62 |

66 |

62 |

252 |

Gross

Profit

Gross margin adjusted for working days is 34.8% (2016: 35.7%).

Additional price pressure is mainly due to volumetric

customers.

Operating

costs

Operating costs in H1 increased with 11% mainly driven by

strengthening the commercial organization to facilitate further

growth.

| Brunel Netherlands (unaudited) |

| P&L

amounts in EUR million |

|

|

|

|

|

|

|

|

|

Q2 2017 |

Q2 2016 |

Change % |

|

|

H1 2017 |

H1 2016 |

Change % |

| Revenue |

46.6 |

49.2 |

-5% |

|

|

94.5 |

100.9 |

-6% |

| Gross Profit |

12.3 |

13.4 |

-9% |

|

|

26.6 |

28.5 |

-6% |

| Gross margin |

26.3% |

27.3% |

|

|

|

28.2% |

28.2% |

|

| Operating costs |

11.6 |

10.2 |

14% |

|

|

23.5 |

20.7 |

13% |

| EBIT |

0.6 |

3.2 |

-81% |

|

|

3.2 |

7.7 |

-59% |

| EBIT % |

1.3% |

6.5% |

|

|

|

3.3% |

7.6% |

|

|

|

|

|

|

|

|

|

|

|

| Average directs |

2,181 |

2,173 |

0% |

|

|

2,153 |

2,224 |

-3% |

| Average indirects |

437 |

381 |

15% |

|

|

437 |

381 |

15% |

| Ratio direct /

Indirect |

5.0 |

5.7 |

|

|

|

4.9 |

5.8 |

|

Revenue

The revenue development is a mix of a decline in freelancers

(impact -10%) and growth in own employees (impact +5%). Q2 2017 had

one less working day compared to last year. Revenue per working day

decreased by 4%. The growth in Engineering and Legal is more than

offset by the decline in the other business lines. Headcount at 30

June 2017 is 2% above last year's headcount.

Working days

| |

Q1 |

Q2 |

Q3 |

Q4 |

FY |

| 2017 |

65 |

61 |

65 |

63 |

254 |

| 2016 |

63 |

62 |

66 |

64 |

255 |

Gross

Profit

The gross margin adjusted for working days is 27.5% (2016: 27.3%).

The increase in gross margin due to the change in mix is largely

offset by a lower productivity.

Operating

costs

The operating costs increased due to continuous investment in sales

force and technology.

Effective tax rate

The effective tax rate in the first half year of 2017 is 75.6%. Due

to the seasonality in Europe our tax rate is higher in the first

half of the year. For the full year, we project the effective tax

rate to come down significantly.

Risk

profile

Reference is made to our 2016 Annual Report (pages 57 - 75).

Reassessment of our earlier identified risks and the potential

impact on occurrence has not resulted in required changes in our

internal risk management and control systems.

Cash

position

Brunel's cash position decreased to EUR 127 million, due to the

seasonality and the dividend payment in June.

Outlook for

2017

The Netherlands will return to revenue growth from Q3 onwards, and

Germany will continue to grow. For Global Business we expect

revenue to remain flat for the next couple of months until the

impact of our initiatives becomes visible. There is some

uncertainty around the timing of the first revenues from these

initiatives, but we expect to achieve an EBIT of at least EUR 15

million for the full year.

Jan Arie van Barneveld, CEO of

Brunel International N.V.: "We knew the first half

year would be tough, but we have reached the bottom of the trough

sooner than expected. Our actual performance has been improving day

by day. With Europe on a growth track, and all the initiatives in

Global Business, I'm confident that we will return to sustainable

growth pretty quickly"

Statement of the

Board of Directors

The Board of Directors of Brunel International N.V. hereby declares

that, to the best of its knowledge, the interim financial

statements give a true and fair view of the assets, liabilities,

financial position and result of Brunel International N.V. and the

companies jointly included in the consolidation, and that the

interim report gives a true and fair view of the information

referred to in the eighth and, insofar as applicable, the ninth

subsection of Section 5:25d of the Dutch Act on Financial

Supervision and with reference to the section on related parties in

the interim financial statements.

Amsterdam, 18 August

2017

Brunel International N.V.

Jan Arie van Barneveld

(CEO)

Peter de Laat (CFO)

Brunel Q2 and H1 2017 results

Brunel Q2 and H1 2017 appendix

This

announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: Brunel International NV via Globenewswire

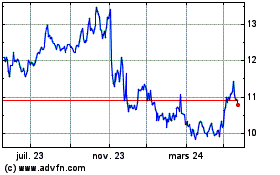

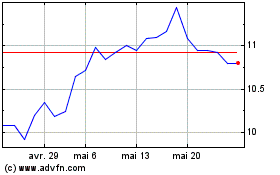

Brunel International NV (EU:BRNL)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Brunel International NV (EU:BRNL)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024