CGG launches its share capital increase with

preferential subscription rights for an amount of approximately

€112.2 million through the issuance of new shares, each with one

warrant attached

- Subscription price: €1.56 per new share, each with one

warrant attached

- Subscription ratio: 13 ABSAs for 4 Rights

- Subscription period: from January 22, 2018 to February

2, 2018 inclusive

- Trading period for Rights: from January 18, 2018 to

January 31, 2018 inclusive

- The transaction is part of CGG's financial restructuring

plan and allows the subscribers to take part in the recovery of the

sector through the Warrants #2

- The transaction is backstopped by DNCA (in cash) for up to

approximately €71.39 million and by the Senior Note holders for the

remaining unsubscribed portion (by way of set-off against

claims)

Paris, France - January 17, 2018

CGG (the "Company") announces today the

terms of its share capital increase with preferential subscription

rights (the "Rights") for an amount of approximately €112.2

million (including share premium) (the "Rights Issue"), by

way of an issuance of shares of the Company (the "New

Shares") each with one warrant attached (the "Warrants

#2" and together with the New Shares, the "ABSAs").

Main terms of the Rights Issue

The Rights Issue will result in the creation of

71,932,731 ABSAs, at a subscription price of €1.56 per share (i.e.

€0.01 nominal and €1.55 share premium) representing a maximum gross

product (including share premium) of €112,215,060.36 (assuming that

the Rights Issue is fully subscribed in cash).

Each shareholder of CGG will receive one Right

for each share recorded in its securities account (enregistrement

comptable) at the end of the fiscal day on January 17, 2018. The

ABSA subscription will be made at the subscription price of €1.56

per ABSA (i.e. €0.01 nominal and €1.55 share premium), four Rights

allowing their holder to subscribe for 13 ABSAs irreducibly.

Subscriptions on a reducible basis will be

admitted but may be reduced in the event of oversubscription of the

Rights Issue in excess of 71,932,731 ABSAs. The ABSAs not

subscribed on an irreducible basis will be allocated to holders of

Rights who have placed orders on a reducible basis and allocated

among them subject to such reduction.

The Rights Issue will be open to the public in

France only and in private placements to institutional investors

outside of France.

Key characteristics of the Warrants

#2

The Warrants #2 will be securities giving access

to the share capital within the meaning of articles L. 228-91 et

seq. of the French Code de commerce. The exercise of Warrants #2

allows the subscribers of the ABSAs (or their transferees) to take

part in the recovery of the sector if CGG's share price exceeds

€4.02 per share.

One (1) Warrant #2 will be attached to each New

Share. Upon issuance, each Warrant #2 will be detached from the New

Share to which it was originally attached.

The Warrants #2 will be listed on Euronext Paris

separately from the existing shares of the Company, under the ISIN

code FR0013309622.

Three (3) Warrants #2 will entitle their holder

to subscribe to two (2) new shares (the "Exercise Ratio"),

for a subscription price of €4.02 per new share (the holders having

to exercise their Warrants #2 by multiples of three) during a

period of five years from the date on which all of the transactions

involved in the Company's financial restructuring are implemented.

This date will be the subject of a press release.

The Exercise Ratio may be adjusted as a result

of transactions that the Company implements following the issuance

of the Warrants #2 (scheduled for February 21, 2018), in accordance

with applicable French laws and regulations and in compliance with

contractual provisions, to protect the rights of holders of

Warrants #2 (no adjustment will be made as a consequence of the

securities issuances contemplated in the financial restructuring

plan).

The new shares issued upon the exercise of the

Warrants #2 will be ordinary shares of the Company of the same

class as the existing shares. They will entitle their holders to

all rights attached to them from their date of issue and to all

distributions decided by the Company after that date and

applications will be submitted periodically to have them admitted

to trading on Euronext Paris under the same quotation line as

existing shares (ISIN code: FR0013181864).

Conditions to the settlement and

delivery

The transactions provided for under the

safeguard plan and the Chapter 11 plan (including the Rights Issue)

shall be regarded as a whole so that if one of them cannot be

implemented, none of them will be implemented. The settlement and

delivery of the Rights Issue must occur (i) before February 28,

2018 (or any later date as may be determined in accordance with the

terms of the Lock-Up Agreement entered into by the Company on June

13, 2017 (the "Lock-Up Agreement") and the restructuring

support agreement which provides for the backstop commitment of

DNCA Invest and the entities managed by DNCA Finance (the "DNCA

Entities") (the "Restructuring Support Agreement") and

(ii) concurrently with the settlement and delivery of the other

securities to be issued by the Company in connection with the

Company's restructuring plan.

The settlement and delivery of the Rights Issue

and, more generally, the completion of the financial restructuring

plan, remain subject to the satisfaction (or waiver) prior to the

settlement and delivery of the Rights Issue, of certain conditions

precedent set forth in the private placement agreement dated June

26, 2017 (the "Private Placement Agreement") and in the

preparatory documents for the issuance of the New First Lien Notes

and the Second Lien Notes (the "Preparatory Documents"). In

addition, persons who have committed to subscribe to the Second

Lien Notes in the context of the Private Placement Agreement have

the right, under certain conditions, to terminate such agreement

prior to the settlement and delivery of the Rights Issue. The

Restructuring Support Agreement providing for the backstop

commitment of the DNCA Entities of the Rights Issue may be

terminated under certain conditions, prior to the settlement and

delivery of the Rights Issue.

The settlement and delivery of the Rights Issue,

as well as the transactions provided for in the Company's financial

restructuring plan might not be implemented in the following

cases:

- the breach of any representation and warranty or any covenant

made by the Company or certain of its subsidiaries pursuant to the

Private Placement Agreement, in each case in any material

respects;

- the absence of execution or delivery of the final documentation

related to the issuance of the New First Lien Notes and the Second

Lien Notes;

- the occurrence or existence of any event having individually or

in the aggregate a Material Adverse Effect (as such term is defined

hereafter);

- a decision of a competent court or authority restraining or

otherwise preventing the implementation of all or part of the

Company's financial restructuring plan;

- an insolvency event of the Company or certain of its

subsidiaries (except as resulting from the Company's financial

restructuring plan);

- a default under the Secured Loans or Senior Notes

documentation, provided that such default has not been waived;

- a material breach of the Lock-Up Agreement by the Company or

certain of its subsidiaries, any of the Senior Noteholders or any

of the Secured Lenders, if such breach is not cured or remedied

within five business days; or

- a material breach of the Restructuring Support Agreement by the

Company that would have a significant adverse impact on the

implementation or completion of the Company's financial

restructuring plan, if not cured within 5 business days.

In the event that the settlement and delivery of

the Rights Issue is not implemented, investors that acquired Rights

on the market would have acquired rights that are no longer valid,

leading them to incur a loss equal to the purchase price of such

Rights. In addition, if the Rights Issue is not implemented, the

subscriptions to the Rights Issue will be cancelled and the amount

of subscription prices paid will be returned without interest to

the subscribers by the authorized intermediaries.

Subscription commitments and

intentions

Apart from the backstop commitment of the DNCA

Entities described below in the amount of approximately €71.39

million to be paid in cash, the Company is not aware of the

intentions of shareholders or the members of the Company's board of

directors or management bodies in connection with the Rights

Issue.

Backstop

In accordance with the Company's financial

restructuring plan, the portion of the Rights Issue not subscribed

by the holders of Rights on an irreducible and on a reducible basis

will be subscribed:

- by the DNCA Entities in an amount of up to €71,390,326.24 in

cash;

- by the holders of Senior Notes (if needed after first

implementing the backstop commitment from the DNCA Entities set

forth above), by way of set-off on a pro rata basis against the

face value of part of their claims under the Senior Notes.

The backstop commitment in cash by the DNCA

Entities will be compensated by a fee equal to 10% of the amount

committed (approximately €7.14 million), which will be paid in

cash, whether or not their backstop commitment is actually

implemented. However, no compensation or fee will be paid in

respect of such backstop commitment if any of the steps of the

Company's financial restructuring plan are not completed. No fee

will be paid in respect of the backstop commitment of the holders

of Senior Notes.

The backstop commitments referred to above

relate to the entire Rights Issue but do not constitute a

performance guarantee (garantie de bonne fin) within the meaning of

Article L. 225-145 of the French Commercial Code. They may, under

certain conditions, be terminated prior to the settlement and

delivery of the Rights Issue.

Use of the proceeds

The funds raised in cash from the Rights Issue

and the issue of the Second Lien Notes (net of backstop and

commitment fees and other costs, expenses or fees related thereto)

will be used as follows:

- first, up to $250 million[1], to provide for CGG group's

financial and operating needs (including (i) the payment of accrued

interest under the Convertible Bonds that has not been equitized in

the context of the issue of Creditor Shares 1 (i.e. an amount of

approximately €4.46 million), and (ii) the payment of

restructuring-related fees and expenses other than the backstop

fees and expenses and all other fees relating to the Rights Issue

and the issue of the Second Lien Notes);

- secondly, to make the initial repayment, on a pro rata basis,

to the secured lenders holding senior first lien secured claims on

American subsidiaries of the CGG group, the amount of such

repayment being limited to a maximum of $150 million in

aggregate;

- the balance would be kept by the Company to cover (i) its

financial needs (including the payment of restructuring-related

fees and expenses other than, inter alia, subscription and backstop

fees and expenses) and (ii) any delay in the group's

redeployment.

.

Timetable of the Rights Issue

The subscription period of the Rights Issue will

begin on January 22, 2018 and end on February 2, 2018 at the end of

the trading session. The listing and trading of the Rights on

Euronext Paris (ISIN code FR0013310265) will begin on January 18,

2018 and will end on January 31, 2018 at the end of the trading

session. The Rights that are not exercised before the end of the

subscription period, i.e. before February 2, 2018 at the end of the

trading session, will automatically lapse.

The settlement and delivery and the admission to

trading on Euronext Paris of the New Shares and the Warrants #2 are

scheduled for February 21, 2018. The New Shares will entitle their

holders to all rights attached to them, from their date of issue,

and to all distributions decided by the Company after that

date.

The New Shares will be immediately assimilated

to the existing CGG shares and will trade on the same quotation

line as the existing shares under ISIN code FR0013181864. The

Warrants #2 will be quoted separately under the ISIN code

FR0013309622.

For the purpose of this press release:

"Convertible Bonds" means, together, (i)

the convertible bonds (obligations à option de conversion et/ou

d'échange en actions nouvelles ou existantes), bearing interest at

a rate of 1.75% and maturing on January 1, 2020, issued by the

Company on June 26, 2015, and (ii) the convertible bonds

(obligations à option de conversion et/ou d'échange en actions

nouvelles ou existantes), bearing interest at a rate of 1.25% and

maturing on January 1, 2019, issued by the Company on November 20,

2012;

"Material Adverse Effect" means any

material adverse effect or material adverse change in (a) the

ability of the Company or its group to implement or complete the

financial restructuring plan by February 28, 2018 or such other

date as may be determined in accordance with the Lock-Up Agreement

and the Restructuring Support Agreement; or (b) the consolidated

financial position, assets or business of the Company and its

controlled subsidiaries, taken as a whole, in each case unless it

arises out of, results from, or is attributable to the signature,

announcement or execution of the Private Placement Agreement, the

Lock-Up Agreement or the Restructuring Support Agreement (as

applicable) or other documents relating to the restructuring or

transactions contemplated herein or in such documents, including

the financial restructuring plan;

"New First Lien Notes" means the new

first lien notes to be issued by CGG Holding (U.S.) Inc., in

connection with the safeguard plan in exchange for claims under the

Secured Loans not repaid in cash;

"Second Lien Notes" means a new notes

issuance in an amount of $375 million by way of an issuance by the

Company of new high yield second-lien notes governed by New York

law;

"Secured Lenders" means the lenders under

the facilities comprising the Secured Loans; and

"Senior Notes" means, together, (i) the

high yield notes, bearing interest at a rate of 5.875% and maturing

in 2020, issued by the Company on April 23, 2014, (ii) the high

yield notes, bearing interest at a rate of 6.5% and maturing in

2021, issued by the Company on May 31, 2011, January 20, 2017 and

March 13, 2017, and (iii) the high yield notes, bearing interest at

a rate of 6.875% and maturing in 2022, issued by the Company on May

1, 2014.

About CGG:

CGG (www.cgg.com) is a fully integrated

Geoscience company providing leading geological, geophysical and

reservoir capabilities to its broad base of customers primarily

from the global oil and gas industry. Through its three

complementary businesses of Equipment, Acquisition and Geology,

Geophysics & Reservoir (GGR), CGG brings value across all

aspects of natural resource exploration and exploitation. CGG

employs around 5,300 people around the world, all with a Passion

for Geoscience and working together to deliver the best solutions

to its customers.

CGG is listed on the Euronext Paris SA (ISIN:

0013181864) and the New York Stock Exchange (in the form of

American Depositary Shares. NYSE: CGG).

Contacts

| Group

CommunicationsChristophe BarniniTel: + 33 1 64 47 38 11E-Mail:

: invrelparis@cgg.com |

Investor RelationsCatherine LeveauTel: +33 1 64 47 34

89E-mail: : invrelparis@cgg.com |

Notice

This announcement does not, and shall not, in

any circumstances constitute a public offering of securities or an

invitation to the public in connection with any offer.

The distribution of this document may be

restricted by law in certain jurisdictions. Persons into whose

possession this document comes are required to inform themselves

about and to observe any such restrictions. Any failure to comply

with these restrictions may constitute a violation of the

securities laws of any such jurisdiction.

This announcement is an advertisement and not a

prospectus within the meaning of Directive 2003/71/EC of the

European Parliament and of the Council of

4 November 2003, as amended (the "Prospectus

Directive").

With respect to the member States of the

European Economic Area which have implemented the Prospectus

Directive, no action has been undertaken or will be undertaken to

make an offer to the public of the securities referred to herein

requiring a publication of a prospectus in any relevant member

State. As a result, the securities may not and will not be offered

in any relevant member State except in accordance with the

exemptions set forth in Article 3(2) of the Prospectus

Directive, if they have been implemented in that relevant member

State, or under any other circumstances which do not require the

publication by CGG of a prospectus pursuant to Article 3 of the

Prospectus Directive and/or to applicable regulations of that

relevant member State.

This document is not an offer of securities for

sale nor the solicitation of an offer to purchase securities in the

United States of America or any other jurisdiction where such offer

may be restricted. Securities may not be offered or sold in the

United States of America absent registration under the U.S.

Securities Act of 1933, as amended

(the "Securities Act"), or an exemption from

registration. The securities of CGG described herein have not been

and will not be registered under the Securities Act, and CGG does

not intend to make a public offer of its securities in the United

States of America.

This document is only being distributed to, and

is only directed at (i) persons who are outside the United Kingdom,

(ii) persons in the United Kingdom that are "investment

professionals" falling within Article 19(5) of the Financial

Services and Markets Act 2000 (Financial Promotion) Order 2005 (as

amended) of the United Kingdom (the "Order"), (iii) persons

who fall within Article 49(2)(a) to (d) ("high net worth

companies, unincorporated associations, etc.") of the Order, or

(iv) any other persons to whom an invitation or inducement to

engage in investment activity (within the meaning of

Article 21 of the Financial Services and Markets Act 2000) in

connection with the issue or sale of any securities may otherwise

lawfully be communicated or caused to be communicated (all such

persons together being referred to as "Relevant Persons").

This document is directed only at Relevant Persons and must not be

acted on or relied on by persons who are not Relevant Persons. Any

investment or investment activity to which this document relates is

available only to Relevant Persons and will be engaged in only with

Relevant Persons. Any person other than a relevant person should

not act or rely on this document or any of its contents.

[1] This amount being

converted into euro on the basis of the exchange rate provided for

in the safeguard plan, i.e. EUR 1 = USD 1.1206.

Attachments:

http://www.globenewswire.com/NewsRoom/AttachmentNg/d614c2bf-7cb7-49b1-a439-4caf3bc49fc8

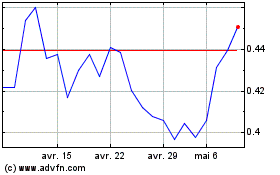

CGG (EU:CGG)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

CGG (EU:CGG)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024