This is

a correction of the announcement from 07:15 13.02.2017 CET. Reason

for the correction: Page 7 - Full-year 2016 net sales of

Lighters in Developing markets were stable at actual currency (in

the high-single digits on a constant currency basis).

BIC Group - Press

Release

Clichy - 13 February 2017

Follow BIC latest news

on

@BicGroup

Full Year 2016 Results

Good and

Well-Balanced 2016 Results in all Consumer Categories

BIC Graphic

Strategic Review partially completed

Proposed Ordinary

Dividend[1] for 2016: 3.45 euros per share (+1.5%)

| In million euros |

FY 2016 as

published[2] |

Discontinued

operations2 |

FY 2016 restated for

discontinued operations2 |

| Net Sales |

2,025.8 |

246.6 |

2,272.4 |

| Change |

+1.6% |

|

+1.4% |

| Change on a constant currency basis |

+4.9% |

|

+4.2% |

| Gross Profit |

1,065.3 |

79.4 |

1,144.7 |

| Normalized2 Income From

Operations |

409.1 |

9.8 |

418.9 |

| Normalized IFO margin

excluding the impact of the special employee bonus[3] |

20.6% |

|

18.9% |

| Income from Operations |

403.4 |

-48.4 |

355.0 |

| Net Income Group Share |

249.7 |

- |

249.7 |

| Earnings Per Share Group Share (in euros) |

5.32 |

- |

5.32 |

| Normalized Earnings Per Share Group Share (in euros) |

6.24 |

- |

6.24 |

| Net cash position |

222.2 |

- |

222.2 |

Bruno Bich,

Chairman and Chief Executive Officer, said: "Our solid 2016 results are further testimony to the quality

and strength of our business model. In a fast-moving and

challenging market environment, such as in Shavers in the U.S., Net

Sales growth was robust and consistent across all consumer

categories. Despite the planned increase in operational investment,

Normalized Income from Operations remained healthy.

In 2017, the

volatility of currencies and the unpredictable global environment

will require increased levels of agility from our teams to ensure

continued success. We plan to deliver mid-single digit organic

growth in Net Sales. We will continue to launch new products and

strengthen our distribution, with a focus on e-commerce in

developed markets.

To enhance

long-term growth, we plan another year of selected investments in

R&D, CAPEX and Brand Support. The total impact of these

investments on Normalized Income From Operations margin will be

approximately -100 basis points compared to 2016, excluding

major currency fluctuations."

FY 2016 Net Sales

were 2,025.8 million euros, up 1.6% (+4.9% on a constant currency

basis).

As Restated for discontinued operations

FY 2016 Net Sales were 2,272.4

million euros, up 1.4% (+4.2% on a constant currency basis). The

negative impact of currency fluctuations (-2.8%) was mainly due to

the depreciation of Latin American currencies against the

euro.

- Consumer

business grew 5.3% on a constant currency basis (Europe +6.5%,

North America +2.7%, Developing Markets +7.5%).

- BIC Graphic

Net Sales decreased by 1.9% on a constant currency basis.

Income From Operations and Normalized Income From

Operations

FY 2016 Gross Profit margin came

in at 52.6%, compared to 51.7% for FY 2015. Excluding the impact of

the special employee bonus in 2016 and the negative impact of the

Argentinian ARS in 2015, Gross Profit margin would have grown by

0.7 points.

FY 2016 Normalized IFO was 409.1

million euros (i.e., a Normalized IFO margin of 20.2% or 20.6%

excluding the impact of the special employee bonus).

As Restated for discontinued operations

FY 2016 Gross

Profit margin came in at 50.4%, compared to 49.7% for FY 2015.

Excluding the impact of the special employee bonus in 2016 and the

negative impact of the Argentinian ARS in 2015, Gross Profit margin

would have grown by 0.9 points. Q4 2016 Gross

Profit margin was 51.6% compared to 48.3% in Q4 2015. Excluding

the negative impact of the Argentinian ARS in 2015, Q4 normalized

Gross Profit would have increased by 2.7%.

FY 2016

Normalized IFO was 418.9 million euros (i.e., a Normalized IFO

margin of 18.4% or 18.9% excluding the impact of the special

employee bonus). Q4 2016 Normalized IFO was

105.8 million euros.

- Consumer

business Normalized IFO margin stood at 21.0% for FY 2016, a

decline of 0.9 points on FY 2015 (down 0.5 points excluding the

impact of the special employee bonus), attributable to increased

investment in brand support and research and development. Q4 2016

Normalized IFO margin was 20.2% compared to 16.9% in Q4 2015.

- BIC Graphic

Normalized IFO margin decreased by 0.9 points for FY 2016 to 2.4%

(if the impact of the special employee bonus is excluded, it was

stable at 3.3%). Q4 2016 Normalized IFO margin was 8.2%, compared

to 11.3% in Q4 2015.

Key components of the change in

Normalized IFO margin

(in % points) |

Q4 2015

vs. Q4 2014 |

Q4 2016

vs. Q4 2015 |

FY 2015

vs. FY 2014 |

FY 2016

vs. FY 2015 |

|

|

-0.8 |

+2.5 |

+0.6 |

+1.0 |

|

|

-0.9 |

+0.5 |

-0.3 |

-0.7 |

|

|

+0.1 |

+0.2 |

-0.2 |

-0.1 |

|

|

-1.0 |

+0.3 |

-0.1 |

-0.6 |

|

|

-0.1 |

-0.5 |

+0.3 |

-0.7 |

| Total change in Normalized IFO margin

excluding the special employee bonus |

-1.8 |

+2.5 |

+0.6 |

-0.4 |

| Special employee bonus |

- |

- |

- |

-0.5 |

|

|

- |

- |

- |

-0.3 |

|

|

- |

- |

- |

-0.2 |

| Total change in Normalized IFO

margin |

-1.8 |

+2.5 |

+0.6 |

-0.9 |

| Non-recurring items |

9M |

Q4 |

FY |

| (in million euros) |

2015 |

2016 |

2015 |

2016 |

2015 |

2016 |

| Income From Operations |

345.7 |

307.7 |

94.2 |

47.4 |

439.9 |

355.0 |

| IFO margin |

20.5% |

18.2% |

16.8% |

8.2% |

19.6% |

15.6% |

| Restructuring costs (BIC Graphic, Lighters, Middle-East and

Africa) |

+4.5 |

+5.4 |

- |

+4.9 |

+4.5 |

+10.4 |

| Impairment recognized for BIC Graphic North America and

Asia sourcing |

|

|

|

+54.6 |

|

+54.6 |

| Divestment of Fuel Cell business (net of restructuring

costs) |

-2.2 |

- |

- |

- |

-2.2 |

- |

| Gains

on real estate operations |

- |

- |

-9.2 |

- |

-9.2 |

- |

| Retiree Medical Adjustment in the U.S. |

- |

- |

- |

-1.1 |

- |

-1.1 |

| Impact of lump sum election for terminated vested pension

participants in the U.S. |

-4.6 |

- |

- |

- |

-4.6 |

|

| Impact of the reevaluation of intercompany accounts payable

in Argentina (IAS 21) |

- |

- |

+3.6 |

- |

+3.6 |

- |

| Normalized IFO |

343.4 |

313.1 |

88.6 |

105.8 |

432.0 |

418.9 |

| Normalized IFO margin |

20.4% |

18.5% |

15.8% |

18.3% |

19.3% |

18.4% |

| Special employee bonus |

- |

+11.4 |

- |

- |

- |

+11.4 |

| Normalized IFO excluding the special employee

bonus |

343.4 |

324.5 |

88.6 |

105.8 |

432.0 |

430.3 |

| Normalized IFO margin excluding the

special employee bonus |

20.4% |

19.2% |

15.8% |

18.3% |

19.3% |

18.9% |

Income before tax fell back to

408.2 million euros, compared to 457.0 million euros for FY 2015.

Net finance revenue was a positive 4.8 million euros compared to a

positive amount of 32.6 million euros for FY 2015.

As Restated for discontinued operations

Income before

tax fell back to 354.3 million euros, compared to 466.7 million

euros for FY 2015. Net finance revenue was a negative 0.8 million

euros compared to a positive amount of 26.8 million euros for FY

2015, due to favorable FY 2015 fair value adjustments to U.S.

dollar denominated financial assets when compared to December 2014.

In Q4 2016, net finance revenue decreased to a positive

1.5 million euros down from a positive 8.9 million euros in Q4

2015.

Net Income From Discontinued Operations

Net Income From Discontinued

Operations was a negative 35.8 million euros compared to a positive

5.8 million euros in 2015, due to the impact of the reassessment of

BIC Graphic North America and Asia Sourcing carrying value.

Net income Group Share was 249.7 million euros in FY 2016, a 23.2%

drop. The effective tax rate in FY 2016 was 29.5%.

As Restated for discontinued operations

Q4 2016 net income Group Share was

36.0 million euros, down by 50.1%.

EPS Group Share was 5.32 euros,

compared to 6.89 euros in FY 2015, down by 22.8%.

As Restated for discontinued operations

Normalized EPS Group Share

decreased by 7.8% period on period, from 6.77 euros in FY 2015 to

6.24 euros in FY 2016. EPS Group Share in Q4 2016 was 0.77 euros

compared to 1.53 euros in Q4 2015, i.e., a 49.7% decrease.

At the end of December 2016, the

Group's net cash position stood at 222.2 million euros.

Change in net cash position

(in million euros) |

2015 |

2016 |

| Net Cash position (beginning of the period -

December) |

320.2 |

448.0 |

|

|

+367.1 |

+298.7 |

- Of which

operating cash flow

|

+435.6 |

+417.2 |

- Of which change

in working capital and others

|

-68.5 |

-118.5 |

|

|

-120.7 |

-180.8 |

|

|

-134.8 |

-277.0 |

|

|

-26.3 |

-81.6 |

|

|

+9.6 |

+2.5 |

|

|

+14.0 |

- |

|

|

+11.6 |

- |

|

|

+7.3 |

+12.4 |

| Net Cash position (end of the period - December) |

448.0 |

222.2 |

Net cash from operating activities

was +298.7 million euros with +417.2 million euros generated in

operating cash flow. The negative 118.5 million euros change

in working capital and other items was mainly related to an

increase in trade receivables due to an increase in Q4 sales. Net

cash was also negatively impacted by increased investments in CAPEX

as well as by dividend payments (including the special dividend)

and share buybacks.

Shareholders' remuneration

In 2016, Shareholders'

Remuneration totaled 358.6 million euros:

-

277.0 million euros related to the payment of

dividends (for the 2015 fiscal year): ordinary dividend of 3.40

euros per share and special dividend of 2.50 euros per share paid

in June 2016.

-

81.6 million euros in share buy-backs at the end

of December 2016 (652,745 shares purchased at an average price of

124.96 euros per share).

2016 Operational Trends by Category (Operating

Segments)

| |

Q4 2015 |

Q4 2016 |

Change in % |

Change on a constant currency basis |

FY 2015 |

FY 2016 |

Change

in % |

Change on a constant currency basis |

| Stationery |

|

|

|

|

|

|

|

|

| Net

Sales |

152.4 |

165.6 |

+8.6% |

+7.8% |

727.0 |

736.6 |

+1.3% |

+5.2% |

| IFO |

4.0 |

9.1 |

+126.7% |

|

83.7 |

66.2 |

-20.9% |

|

| IFO

margin |

2.6% |

5.5% |

|

|

11.5% |

9.0% |

|

|

| Normalized IFO margin |

2.0% |

5.4% |

|

|

11.5% |

9.2% |

|

|

| Normalized IFO margin excluding the

special employee bonus |

2.0% |

5.4% |

|

|

11.5% |

9.6% |

|

|

| Lighters |

|

|

|

|

|

|

|

|

| Net

Sales |

175.0 |

187.9 |

+7.4% |

+5.2% |

675.7 |

696.4 |

+3.1% |

+5.6% |

| IFO |

61.1 |

73.7 |

+20.6% |

|

260.9 |

275.3 |

+5.5% |

|

| IFO

margin |

34.9% |

39.2% |

|

|

38.6% |

39.5% |

|

|

| Normalized IFO margin |

33.7% |

39.1% |

|

|

38.2% |

39.8% |

|

|

| Normalized IFO margin excluding the

special employee bonus |

33.7% |

39.1% |

|

|

38.2% |

40.2% |

|

|

| Shavers |

|

|

|

|

|

|

|

|

| Net

Sales |

108.8 |

117.3 |

+7.8% |

+6.6% |

452.0 |

467.0 |

+3.3% |

+7.0% |

| IFO |

19.4 |

18.4 |

-4.8% |

|

83.3 |

68.6 |

-17.6% |

|

| IFO

margin |

17.8% |

15.7% |

|

|

18.4% |

14.7% |

|

|

| Normalized IFO margin |

16.5% |

15.5% |

|

|

18.5% |

14.9% |

|

|

| Normalized IFO margin excluding the

special employee bonus |

16.5% |

15.5% |

|

|

18.5% |

15.4% |

|

|

| Other Products |

|

|

|

|

|

|

|

|

| Net Sales |

14.6 |

14.2 |

-3.1% |

-3.2% |

67.6 |

61.0 |

-9.8% |

-9.0% |

| Total Consumer business |

|

|

|

|

|

|

|

|

| Net

Sales |

450.9 |

485.0 |

+7.6% |

+6.1% |

1,922.4 |

1,961.0 |

+2.0% |

+5.3% |

| IFO |

80.7 |

98.7 |

+22.4% |

|

426.7 |

407.3 |

-4.6% |

|

| IFO

margin |

17.9% |

20.4% |

|

|

22.2% |

20.8% |

|

|

| Normalized IFO margin |

16.9% |

20.2% |

|

|

21.9% |

21.0% |

|

|

| Normalized IFO margin excluding the

special employee bonus |

16.9% |

20.2% |

|

|

21.9% |

21.4% |

|

|

| BIC Graphic |

|

|

|

|

|

|

|

|

| Net

Sales |

108.5 |

94.6 |

-12.8% |

-13.6% |

319.3 |

311.5 |

-2.5% |

-1.9% |

| IFO |

13.5 |

-51.4 |

NA |

|

13.1 |

-52.2 |

NA |

|

| IFO

margin |

12.5% |

-54.3% |

|

|

4.1% |

-16.8% |

|

|

| Normalized IFO margin |

11.3% |

8.2% |

|

|

3.3% |

2.4% |

|

|

| Normalized IFO margin excluding the

special employee bonus |

11.3% |

8.2% |

|

|

3.3% |

3.3% |

|

|

Full Year 2016

Stationery

full-year 2016 Net Sales increased by 1.3% (+5.2% on a constant

currency basis). Full year 2016 volumes grew by 1.5%.

The Stationery market continued to

show positive momentum in 2016 with mid-single digit growth in

value terms well balanced between developed and developing markets.

In a relentlessly competitive environment, we held on to market

share or made gains in most geographies especially in developing

markets where we had a record year in Brazil and in certain regions

such as the Middle-East and Africa. In line with our strategy, we

have accelerated our R&D and Brand Support investment which

helped fuel our net sales growth and successful new product

launches.

Developed

Markets

- Net Sales registered high-single

digit growth in Europe with market share gains

in most countries thanks to good execution, especially during the

Back-to-School season and enhanced brand support. We actively

supported our products with communication programs such as the "4

colorsTM" TV

campaigns broadcast throughout the region and the coloring campaign

in France, the UK, Spain and Eastern countries.

- Despite a very competitive

environment in North America, Net Sales

registered low-single digit growth, as we continued to benefit from

the success of our "Champion Brand" products such Cristal®,

Atlantis® and Xtra-Fun Graphite pencils with market share gains in

all of their respective segments.

Developing

markets

Net Sales posted low-single digit

growth and most of the regions performed well.

- We continued our successful

expansion in Latin America, supported by

regional advertising campaigns, notably in the ball pen and

coloring segments. In Brazil, BIC reinforced its position with

strong market share gains, driven by higher brand support

investment and in-store visibility; we consolidated our leadership

in the Modern Mass market channel.

- In the Middle-East and Africa, BIC delivered strong growth

along with an outstanding performance in South Africa across the

whole range, particularly in the Ball Pen and Coloring

segments.

- In India,

Cello Pens Net Sales decreased mid-single digit. Domestic sales

were flat in a competitive environment. We continued to streamline

our product portfolio and to focus on higher value-added items such

as the ButterflowTM range.

Full Year 2016 Stationery

normalized IFO margin was 9.2% compared to 11.5% in 2015. Excluding

the impact of the special employee bonus, Normalized IFO margin for Stationery would have been

9.6%. The year-on-year drop is attributable to the impact of an

increase in operating expenses, as well as significant investment

in Brand Support.

Fourth Quarter 2016

Fourth quarter

2016 Net Sales were up 8.6% (+7.8% on a constant currency

basis), with mid-single digit growth in Europe and a solid

performance in North America (high-single digit growth). In

Developing countries, net sales growth was in the high-single

digits thanks to a very good back-to-school sell-in, notably in

Brazil and South Africa. In India, Cello Pens delivered an improved

performance in domestic sales.

Q4 2016

Normalized IFO margin was 5.4% compared to 2.0% in Q4 2015,

attributable to a strong increase in sales, a favorable FX impact

during the quarter and favorable phasing of Brand Support expenses

compared to Q4 2015.

Full Year 2016

Full-year 2016

Net Sales of Lighters grew by 3.1% (+5.6% on a constant currency

basis). Full year 2016 volumes were up 2.3%.

Developed

markets

- In Europe,

growth in Net Sales was in the mid-single digits, driven by Western

Europe and distribution gains in Eastern Europe. In all of these

countries, we benefited from the solid performance of our core

products and our utility lighters.

- North

America achieved mid-single digit growth, driven by the success

of added-value sleeves.

Developing

Markets

Full-year 2016 net sales were

stable at actual currency (in the high-single digits on a constant

currency basis).

- In Latin

America, high-single digit growth in Net Sales was underpinned

by distribution gains especially in Mexico, and despite a tough

business environment in Brazil.

- In the Middle-East and Africa, growth was driven by the North

African region on the back of strong visibility and distribution

gains.

Full-year 2016

Normalized IFO margin for Lighters was 39.8% compared to 38.2%

in 2015. Excluding the impact of the special employee bonus,

Normalized IFO margin for Lighters would have been

40.2%, reflecting a higher gross profit margin.

Fourth Quarter 2016

Fourth quarter

2016 Net Sales were up 7.4% (+5.2% on a constant currency

basis), with a solid performance in North America and a strong

growth in the Middle-East and Africa.

Q4 2016 Normalized IFO margin was 39.1%

compared to 33.7% in Q4 2015 benefiting from a higher gross profit

margin and more favorable absorption of operating expenses.

Full Year 2016

Full-year 2016

Net Sales of Shavers grew by 3.3% (+7.0% on a constant currency

basis). Full-year 2016 volumes were up by 0.6%.

In 2016, we continued to reinforce

our positions in most geographies, especially in Latin America and

Eastern Europe. Thanks to the "Great value" positioning of our

products, consumers continued to use BIC® shavers and our new

products helped us to win new consumers.

Developed Markets

- In Europe,

Full-year Net Sales achieved high-single digit growth with solid

performances in Eastern regions underpinned by distribution gains

and successful new products launches in the region, such as the

BIC® Flex 3 for men and BIC® Simply Soleil® for women.

- In North

America, the total US wet shave market declined by 5.0% at the

end of December 2016. The one-piece segment declined by 6.1%,

reflecting consumer attrition due to less promotional activity and

good performances by private labels. Despite this context, Net

Sales were stable and we gained market share (+1.4 points to

28.0%[6] in value

terms) thanks to our best value/quality positioning across our

entire product range and a very strong new product pipeline (the

BIC® Flex 5 and the BIC® Soleil® Shine shavers).

Developing

Markets

Net Sales posted double-digit

growth, with solid performance across all regions.

- In Latin

America, the increase in sales was driven by the success of all

product ranges (BIC® 3, BIC® Comfort 3 and BIC® Soleil). This

growth was also supported by distribution gains and brand support

investments in the region, such as TV campaigns in Brazil to

promote the BIC® Comfort 3 and BIC® Soleil shavers.

- The Middle-East

and Africa benefited from the good performance across all

regions and in all product ranges, especially in BIC® 1 and BIC® 3

shavers. We maintained our solid positions.

Full-year 2016

Normalized IFO margin for Shavers was 14.9% compared to 18.5%

in 2015. Excluding the impact of the special employee bonus,

Normalized IFO margin for Shavers would have been

15.4%. This year-on-year decrease was due to increased

investment in Research and Development and in brand support.

Fourth Quarter 2016

Fourth quarter

2016 Net Sales were up 7.8% (+6.6% on a constant currency

basis), driven by the good performance in Europe and developing

markets, notably in Latin America.

Q4 2016 Normalized IFO margin was 15.5%,

compared to 16.5% in Q4 2015 due to a negative FX impact on Gross

Profit margin and continued investment in research and

development.

Full-year 2016

Net Sales of Other Consumer Products decreased by 9.8% (-9.0% on a

constant currency basis). Fourth quarter 2016 Net Sales were down

3.1% (-3.2% on a constant currency basis).

BIC Sport registered a

double-digit decline in its full-year Net Sales on a constant

currency basis notably due to an increasingly competitive

environment in the U.S.

Full-year 2016

Normalized IFO for Other Consumer Products was a negative 2.7

million euros (negative 2.5 million euros excluding the impact

of the special employee bonus), compared to a negative 3.4 million

euros in 2015. Q4 2016 Normalized IFO for

Other Consumer Products was a negative 2.5 million euros, compared

to a negative 3.8 million euros in Q4 2015.

BIC Graphic

Full-year 2016 Net Sales decreased by 2.5% (-1.9% on a constant

currency basis). Fourth quarter 2016 Net Sales were down 12.8%

(-13.6% on a constant currency basis).

Customers continued to recognize

the vast expertise of BIC Graphic in the fields of quality, safety

compliance and trademarks. We continued to enhance our customer

service and we benefited from our "Good value" positioning and new

products launches.

Full-year 2016 Normalized IFO margin for BIC

Graphic was 2.4% compared to 3.3% in 2015. Excluding the impact

of the special employee bonus, Normalized IFO

margin would have been 3.3%. Q4 2016 Normalized IFO margin for

BIC Graphic was 8.2% compared to 11.3% in Q4 2015, due to timing

impact in Calendars' sales.

Following the BIC Graphic

strategic review initiated in February 2016 and after conducting a

careful review of the business, the following decisions have been

made:

- BIC Graphic Europe operations

will report to the European BIC Consumer Product business. The

European BIC Graphic team will focus on implementing a plan to

develop a sustainable business model while developing innovative

services and maintaining BIC Graphic's imprinting and decorating

expertise. In Developing Markets, BIC Graphic operations that have

a sustainable business model will report to the local consumer

business.

- Strategic alternative discussions

regarding BIC Graphic North America and the Asia Sourcing

operations are still on-going. We expect to be able to communicate

the outcome of these discussions in the coming weeks.

2017 OPERATIONAL OUTLOOK AND LONG-TERM STRATEGIC

PRIORITIES

2017 operational outlook[7]

In 2017, the volatility of

currencies and the unpredictable global environment will require

increased levels of agility from our teams to ensure continued

success. We plan to deliver mid-single digit organic growth in Net

Sales. We will continue to launch new products and strengthen our

distribution, with a focus on e-commerce in developed markets.

To enhance long-term growth, we

plan another year of selected investments in R&D, CAPEX and

Brand Support. The total impact of these investments on Normalized

Income From Operations margin will be approximately -100 basis

points compared to 2016, excluding major currency fluctuations.

Stationery

In 2017, our objective is to deliver organic sales growth and to

gain market shares through:

-

new product launches, resulting from increased

R&D investment;

-

our strong "champion brand" strategy buoyed by

higher brand support investment;

-

new emerging channels such as e-commerce, in

developed countries;

-

more qualified distribution channels in

developing countries.

Lighters

We will continue to leverage our proven safety and quality classic

and added-value products, to drive sales increases with new

added-value sleeve designs in developed markets. In Developing

countries, we will consolidate our footprint and enhance BIC® brand

awareness.

Shavers

We will continue to enhance product performance and sell at an

affordable price. We expect the U.S. market to continue to

slowdown: in this context, we will step up promotional activities

for our added-value products. We forecast continued growth in Latin

America and Eastern Europe.

Thanks to increased R&D

investment, our growth will be boosted by major new product

launches, including:

-

the BIC® Hybrid

5 shaver, in North America, which offers the best of our

technology (moveable blades, optimized pivot.) at a fair

price;

-

the BIC®

Soleil® Sensitive

shaver, in Latin America, a more advanced version of our BIC®

Soleil® shaver.

-

BIC Shave Club, a direct to

consumer online-only subscription service with a refillable shaver

will be tested in France in Spring 2017.

Group long-term strategic priorities

-

Continue to create long-term value by

outperforming our markets and achieving low to mid-single digit

organic growth in sales, thanks to:

-

expanded distribution networks in all

geographies;

-

increased focus on value-added segments in

developed markets;

-

enlarged consumer base in developing

markets.

-

Grow Normalized Income From Operations through

increased productivity as we invest in our people, in brand support

and in Research and Development with a focus on quality and

innovative new products.

-

Maintain strong cash generation to:

-

continue to grow the business organically,

-

finance strategic bolt-on acquisitions,

-

sustain total Shareholders' remuneration.

Appendix - FY 2016 Results as published

BIC Group Net Sales by

geography

(in million euros) |

|

| |

|

FY 2015 |

FY 2016 |

|

| Europe |

|

|

|

|

| Net

Sales |

|

527.8 |

544.8 |

|

| North America |

|

|

|

|

| Net

Sales |

|

791.8 |

812.0 |

|

| Developing Markets |

|

|

|

|

| Net

Sales |

|

673.8 |

669.0 |

|

Condensed profit and loss account as

published

(in million euros) |

|

| |

FY 2015 |

FY 2016 |

As published |

|

| Net sales |

1,993.4 |

2,025.8 |

+1.6% |

|

| Cost of

goods |

962.6 |

960.5 |

|

|

| Gross Profit |

1,030.8 |

1,065.3 |

+3.4% |

|

|

Administrative & other operating expenses |

-606.4 |

-661.9 |

|

|

| Income from operations |

424.4 |

403.4 |

-4.9% |

|

| Finance

revenue/costs |

32.6 |

4.8 |

|

|

| Income before tax |

457.0 |

408.2 |

-10.7% |

|

| Income

tax expense |

-136.3 |

-122.7 |

|

|

| Net

Income From Continuing Operations |

320.7 |

285.5 |

-11.0% |

|

| Net Income From Discontinued Operations |

5.8 |

-35.8 |

NA |

|

| Group net income |

326.5 |

249.7 |

-23.5% |

|

|

Non-controlling interests |

1.4 |

- |

|

|

| NET INCOME GROUP SHARE |

325.1 |

249.7 |

-23.2% |

|

| Earnings

Per Share From Continuing Operations (in euros) |

6.77 |

6.09 |

|

|

| Earnings Per Share From Discontinued Operations (in

euros) |

0.12 |

-0.77 |

|

|

| Earnings per share Group share (in

euros) |

6.89 |

5.32 |

-22.8% |

|

| Average number of shares outstanding (net of treasury

shares) |

47,173,339 |

46,898,827 |

|

|

Condensed balance sheet as published

(in million euros) |

December 31,

2015 |

December 31,

2016 |

| Assets |

|

|

| Property, plant &

equipment |

508.5 |

564.4 |

| Investment

properties |

2.2 |

2.1 |

| Other non-current

assets |

192.9 |

204.2 |

| Goodwill and

intangible assets |

421.7 |

372.7 |

| Non-current assets |

1,125.3 |

1,143.4 |

| Inventories |

478.4 |

468.1 |

| Trade and other

receivables |

440.0 |

483.1 |

| Other current

financial assets and derivative instruments |

76.3 |

31.1 |

| Cash and cash

equivalents |

385.2 |

243.8 |

| Other current

assets |

31.0 |

51.5 |

| Current assets |

1,410.9 |

1,277.6 |

| Assets Held For Sale |

- |

152.7 |

| TOTAL ASSETS |

2,536.2 |

2,573.7 |

| Liabilities & shareholders' equity |

|

|

| Shareholders' equity |

1,849.5 |

1,792.6 |

| Non-current

borrowings |

2.4 |

1.4 |

| Other non-current

liabilities |

304.3 |

297.8 |

| Non-current liabilities |

306.7 |

299.2 |

| Trade and other

payables |

124.9 |

118.7 |

| Current

borrowings |

7.8 |

49.6 |

| Other current

liabilities |

247.2 |

261.3 |

| Current liabilities |

379.9 |

429.6 |

| Liabilities Held For Sale |

- |

52.3 |

| TOTAL

LIABILITIES & SHAREHOLDERS' EQUITY |

2,536.2 |

2,573.7 |

Cash flow statement as

published

(in million euros) |

2015 |

2016 |

| Group Net

income |

326.5 |

249.7 |

| Net

income from discontinued operations |

5.8 |

-35.8 |

| Net income from continuing operations |

320.7 |

285.5 |

| Amortization and

provisions |

100.0 |

165.4 |

| (Gain)/Loss from

disposal of fixed assets |

-13.0 |

-0.2 |

| Others |

22.1 |

2.3 |

| CASH FLOW FROM OPERATIONS |

435.6 |

417.2 |

| (Increase) / decrease

in net current working capital |

-24.0 |

-62.8 |

| Others |

-44.5 |

-55.7 |

| Net

Cash from operating activities from continuing operations |

351.4 |

276.2 |

| Net

Cash from operating activities from discontinued

operations |

15.7 |

22.5 |

| NET CASH FROM OPERATING ACTIVITIES (A) |

367.1 |

298.7 |

| Net capital

expenditure |

-105.8 |

-178.9 |

| (Purchase)/Sale of

other current financial assets |

-23.8 |

46.1 |

| Divestiture of

Sheaffer assets and Fuel Cell business |

14.0 |

0 |

| Other

Investments |

1.8 |

0.3 |

| Net

Cash from investing activities from continuing

operations |

-108.5 |

-127.2 |

| Net

Cash from investing activities from

discontinued operations |

-5.4 |

-5.3 |

| NET CASH FROM INVESTING ACTIVITIES (B) |

-113.8 |

-132.5 |

| Dividends paid |

-134.8 |

-277.0 |

| Repurchase of Cello

Pens minority interests |

-74.0 |

0.0 |

|

Borrowings/(Repayments) |

-0.1 |

19.8 |

| Share buy-back program

net of stock-options exercised |

-16.7 |

-79.1 |

| Others |

-2.2 |

-3.2 |

| Net

Cash from financing activities from continuing

operations |

-224.2 |

-291,5 |

| Net

Cash from financing activities from

discontinued operations |

-3.5 |

-48,0 |

| NET CASH FROM FINANCING ACTIVITIES (C) |

-227.8 |

-339.5 |

| NET INCREASE/ (DECREASE) IN CASH AND CASH EQUIVALENTS

NET OF BANK OVERDRAFTS (A+B+C) |

25.6 |

-173.2 |

| OPENING CASH AND CASH EQUIVALENTS NET OF BANK

OVERDRAFT |

348.5 |

380.6 |

| Net increase /

decrease in cash and cash equivalents net of bank overdraft

(A+B+C) |

25.6 |

-173.2 |

| Exchange

difference |

6.5 |

10.0 |

| CLOSING CASH AND CASH EQUIVALENTS NET OF BANK

OVERDRAFT |

380.6 |

217.4 |

Reconciliation with

Alternative Performance Measures

| Normalized IFO reconciliation |

|

| (in million euros) |

2015 |

2016 |

| Income From Operations |

424.4 |

403.4 |

| Restructuring costs |

+4.5 |

+6.6 |

| Divestment of Fuel Cell business (net of restructuring

costs) |

-2.2 |

- |

| Gains

on real estate operations |

-7.8 |

- |

| Impact of lump sum election for terminated vested pension

participants in the U.S. |

-3.1 |

- |

| Retiree Medical Adjustment in the U.S. |

- |

-0.9 |

| Impact of the reevaluation of intercompany accounts payable

in Argentina (IAS 21) |

+3.6 |

- |

| Normalized IFO |

419.4 |

409.1 |

| Special employee bonus |

- |

8.8 |

| Normalized IFO excluding the special employee

bonus |

419.4 |

417.9 |

| Normalized EPS reconciliation |

|

| (in euros) |

2015 |

2016 |

| EPS |

6.89 |

5.32 |

| Impairment recognized

for BIC Graphic North America and Asia sourcing |

|

+0.78 |

| Normalized EPS excluding impairment recognized for BIC

Graphic North America and Asia sourcing |

|

6.10 |

| Restructuring

costs |

+0.06 |

+0.15 |

| Divestment of Fuel

Cell business (net of restructuring costs) |

-0.03 |

|

| Gain on real estate

operations |

-0.13 |

|

| Impact of lump sum

election for terminated vested pension participants in the

U.S. |

-0.07 |

|

| Retiree Medical

Adjustment in the U.S. |

|

-0.01 |

| Impact of the

reevaluation of intercompany accounts payable in Argentina (IAS

21) |

+0.05 |

|

| Normalized EPS |

6.77 |

6.24 |

Net cash reconciliation

(in million euros - rounded figures) |

December 31,

2015 |

December 31,

2016 |

| Cash and cash

equivalents (1) |

385.2 |

243.8 |

| Other current

financial assets (2)[8] |

73.0 |

29.4 |

| Current borrowings

(3) |

-7.8 |

-49.6 |

| Non-current borrowings

(4) |

-2.4 |

-1.4 |

| NET CASH POSITION (1) + (2) - (3) - (4) |

448.0 |

222.2 |

Appendix - FY 2016 results restated for

discontinued operations

BIC Group Net Sales by

geography

(in million euros) |

Q4 2016 vs. Q4 2015 |

|

|

FY 2016 vs. FY 2015 |

| |

Q4 2015 |

Q4 2016 |

Change

in % |

Constant

currency

basis |

FY 2015 |

FY 2016 |

Change

in % |

Constant

currency

basis |

| Group |

|

|

|

|

|

|

|

|

| Net Sales |

559.4 |

579.5 |

+3.6% |

+2.3% |

2,241.7 |

2,272.4 |

+1.4% |

+4.2% |

| Europe |

|

|

|

|

|

|

|

|

| Net

Sales |

118.9 |

116.8 |

-1.7% |

-0.1% |

527.8 |

544.8 |

+3.2% |

+5.3% |

| North America |

|

|

|

|

|

|

|

|

| Net

Sales |

259.9 |

261.5 |

+0.6% |

-1.0% |

1,040.1 |

1,058.6 |

+1.8% |

+1.8% |

| Developing Markets |

|

|

|

|

|

|

|

|

| Net Sales |

180.6 |

201.2 |

+11.4% |

+8.5% |

673.8 |

669.0 |

-0.7% |

+7.1% |

| |

|

|

|

|

|

|

|

|

Volume

(billions of units per year) |

2015 |

2016 |

| Stationery (including Cello Pens) |

6.8 |

6.9 |

| Lighters |

1.5 |

1.6 |

| Shavers |

2.6 |

2.6 |

Impact of change in perimeter and

currency fluctuations on Net Sales

(in %) |

Q4 2015 |

Q4 2016 |

FY 2015 |

FY 2016 |

| Perimeter |

-0.4 |

- |

-0.6 |

- |

| Currencies |

+2.0 |

+1.3 |

+7.7 |

-2.8 |

| Of which USD |

+6.4 |

+0.7 |

+8.7 |

+0.1 |

| Of which BRL |

-3.6 |

+2.1 |

-1.7 |

-0.2 |

| Of which ARS |

-0.1 |

-0.8 |

+0.1 |

-0.9 |

| Of which INR |

+0.3 |

0.0 |

+0.5 |

-0.2 |

| Of which MXN |

-0.4 |

-0.7 |

+0.1 |

-0.8 |

| Of which RUB and UAH |

-0.3 |

0.0 |

-0.4 |

-0.2 |

Sensitivity of net sales to key currency

changes

(in % ) |

2015 |

2016 |

| +/- 5% change in USD |

+/-2.2 |

+/-2.2 |

| +/- 5% change in BRL |

+/-0.4 |

+/-0.4 |

| +/- 5% change in MXN |

+/-0.2 |

+/-0.2 |

IFO and Normalized IFO by

category

(in million euros) |

Q4 2015 |

Q4 2016 |

FY 2015 |

FY 2016 |

| Group |

|

|

|

|

| Income From Operations |

94.2 |

47.4 |

439.9 |

355.0 |

| Normalized Income From operations |

88.6 |

105.8 |

432.0 |

418.9 |

| Stationery |

|

|

|

|

| Income From Operations |

4.0 |

9.1 |

83.7 |

66.2 |

| Normalized Income From operations |

3.1 |

8.9 |

83.4 |

67.5 |

| Lighters |

|

|

|

|

| Income From Operations |

61.1 |

73.7 |

260.9 |

275.3 |

| Normalized Income From operations |

59.0 |

73.5 |

257.9 |

277.3 |

| Shavers |

|

|

|

|

| Income From Operations |

19.4 |

18.4 |

83.3 |

68.6 |

| Normalized Income From operations |

18.0 |

18.2 |

83.6 |

69.6 |

| Other Products |

|

|

|

|

| Income From Operations |

-3.8 |

-2.5 |

-1.2 |

-2.9 |

| Normalized Income From operations |

-3.8 |

-2.5 |

-3.4 |

-2.7 |

| Total Consumer business |

|

|

|

|

| Income From Operations |

80.7 |

98.7 |

426.7 |

407.3 |

| Normalized Income From operations |

76.3 |

98.0 |

421.5 |

411.6 |

| BIC Graphic |

|

|

|

|

| Income From Operations |

13.5 |

-51.4 |

13.1 |

-52.2 |

| Normalized Income From operations |

12.3 |

7.8 |

10.4 |

7.3 |

Condensed profit and loss

account

(in million euros) - unaudited |

|

Q4 2016 vs. Q4 2015 |

|

|

FY 2016 vs. FY 2015 |

| |

Q4 2015 |

Q4 2016 |

Change

in % |

Constant

currency basis |

FY 2015 |

FY 2016 |

Change

in % |

Constant

currency basis |

| Net sales |

559.4 |

579.5 |

+3.6% |

+2.3% |

2,241.7 |

2,272.4 |

+1.4% |

+4.2% |

| Cost of

goods |

289.0 |

280.7 |

|

|

1,128.7 |

1,127.7 |

|

|

| Gross Profit |

270.4 |

298.8 |

+10.5% |

|

1,113.0 |

1,144.7 |

+2.8% |

|

|

Administrative & other operating expenses |

176.2 |

251.4 |

|

|

673.1 |

789.7 |

|

|

| Income from operations |

94.2 |

47.4 |

-49.7% |

|

439.9 |

355.0 |

-19.3% |

|

| Finance

revenue/costs |

8.9 |

1.5 |

|

|

26.8 |

-0.8 |

|

|

| Income before tax |

103.1 |

48.8 |

-52.6% |

|

466.7 |

354.3 |

-24.1% |

|

| Income

tax expense |

31.0 |

12.8 |

|

|

140.2 |

104.6 |

|

|

| Income

from associates |

- |

- |

|

|

- |

- |

|

|

| Group net income |

72.1 |

36.0 |

-50.1% |

|

326.5 |

249.7 |

-23.5% |

|

|

Non-controlling interests |

- |

- |

|

|

-1.4 |

- |

|

|

| NET INCOME GROUP SHARE |

72.1 |

36.0 |

-50.1% |

|

325.1 |

249.7 |

-23.2% |

|

| Earnings per share Group share (in

euros) |

1.53 |

0.77 |

-49.7% |

|

6.89 |

5.32 |

-22.8% |

|

| Average number of shares outstanding (net of treasury

shares) |

47,173,339 |

46,898,827 |

|

|

47,173,339 |

46,898,827 |

|

|

Condensed balance sheet

(in million euros) - unaudited |

December 31,

2015 |

December 31,

2016 |

| Assets |

|

|

| Property, plant &

equipment |

508.5 |

589.3 |

| Investment

properties |

2.2 |

2.1 |

| Other non-current

assets |

192.9 |

223.1 |

| Goodwill and

intangible assets |

421.7 |

388.0 |

| Non-current assets |

1,125.3 |

1,202.5 |

| Inventories |

478.4 |

518.9 |

| Trade and other

receivables |

440.0 |

522.9 |

| Other current

financial assets and derivative instruments |

76.3 |

31.1 |

| Cash and cash

equivalents |

385.2 |

243.8 |

| Other current

assets |

31.0 |

54.5 |

| Current assets |

1,410.9 |

1,371.2 |

| TOTAL ASSETS |

2,536.2 |

2,573.7 |

| Liabilities & shareholders' equity |

|

|

| Shareholders' equity |

1,849.6 |

1,792.6 |

| Non-current

borrowings |

2.4 |

1.4 |

| Other non-current

liabilities |

304.3 |

300.9 |

| Non-current liabilities |

306.7 |

302.3 |

| Current

borrowings |

7.8 |

49.6 |

| Trade and other

payables |

124.9 |

148.8 |

| Other current

liabilities |

247.2 |

280.3 |

| Current liabilities |

379.9 |

478.7 |

| TOTAL LIABILITIES & SHAREHOLDERS' EQUITY |

2,536.2 |

2,573.7 |

Working capital

(in million euros) - unaudited |

|

December

31,

2015 |

December

31,

2016 |

| Total Working Capital |

|

605.2 |

686.1 |

| Of

which, inventories |

|

478.4 |

518.9 |

| Of

which, Trade and other receivables |

|

440.0 |

522.9 |

| Of which, Trade and other payables |

|

-124.9 |

-148.8 |

Cash flow statement

(in million euros) - unaudited |

2015 |

2016 |

| Group Net income |

326.5 |

249.7 |

| Amortization and

provisions |

100.0 |

165.4 |

| (Gain)/Loss from

disposal of fixed assets |

-13.0 |

-0.2 |

| Others |

22.1 |

2.3 |

| CASH FLOW FROM OPERATIONS |

435.6 |

417.2 |

| (Increase) / decrease

in net current working capital |

-24.0 |

-62.8 |

| Others |

-44.5 |

-55.7 |

| NET CASH FROM OPERATING ACTIVITIES (A) |

367.1 |

298.7 |

| Net capital

expenditure |

-105.8 |

-178.9 |

| (Purchase)/Sale of

other current financial assets |

-23.8 |

46.1 |

| Divestiture of

Sheaffer assets and Fuel Cell business |

14.0 |

- |

| Other Investments |

1.8 |

0.3 |

| NET CASH FROM INVESTING ACTIVITIES (B) |

-113.8 |

-132.5 |

| Dividends paid |

-134.8 |

-277.0 |

| Repurchase of Cello

Pens minority interests |

-74.0 |

- |

|

Borrowings/(Repayments) |

-0.1 |

19.8 |

| Share buy-back program

net of stock-options exercised |

-16.7 |

-79.1 |

| Others |

-2.2 |

-3.2 |

| NET CASH FROM FINANCING ACTIVITIES (C) |

-227.8 |

-339.5 |

NET INCREASE/ (DECREASE) IN CASH AND

CASH EQUIVALENTS NET OF BANK OVERDRAFTS

(A+B+C) |

25.6 |

-173.2 |

| OPENING CASH AND CASH EQUIVALENTS NET OF BANK

OVERDRAFTS |

348.5 |

380.6 |

| Net increase /

decrease in cash and cash equivalents net of bank overdrafts

(A+B+C) |

25.6 |

-173.2 |

| Exchange

difference |

6.5 |

10.0 |

| CLOSING CASH AND CASH EQUIVALENTS NET OF BANK

OVERDRAFTS |

380.6 |

217.4 |

| |

Number of shares

acquired |

Weighted average price in € |

Amount

in M€ |

| February

2016 |

117,908 |

126.78 |

14.9 |

| March

2016 |

115,379 |

130.22 |

15.0 |

| April

2016 |

8,400 |

122.42 |

1.0 |

| May

2016 |

91,678 |

124.14 |

11.4 |

| June

2016 |

153,660 |

119.11 |

18.3 |

| July

2016 |

- |

- |

- |

| August

2016 |

- |

- |

- |

| September

2016 |

12,021 |

130.98 |

1.6 |

| October

2016 |

52,848 |

127.40 |

6.7 |

| November

2016 |

63,851 |

124.39 |

7.9 |

| December

2016 |

37,000 |

125.30 |

4.6 |

| Total |

652,745 |

124.96 |

81.6 |

Capital and voting rights, December 31, 2016

As of December 31, 2016, the total

number of issued shares of SOCIÉTÉ BIC was 47,552,202 shares,

representing:

-

69,098,170 voting rights,

-

68,230,150 voting rights excluding shares

without voting rights.

Total number of treasury shares

held at the end of December 2016: 868,020.

-

Constant currency basis:

constant currency figures are calculated by translating the current

year figures at prior year monthly average exchange rates.

-

Comparative basis: at

constant currencies and constant perimeter. Figures at constant

perimeter exclude the impacts of acquisitions and/or disposals that

occurred during the current year and/or during the previous year,

until their anniversary date. All Net Sales category comments are

made on a comparative basis.

-

Normalized IFO: normalized

means excluding non-recurring items as detailed on page 3.

-

Normalized IFO margin:

Normalized IFO as percentage of net sales.

-

Net cash from operating

activities: principal revenue-generating activities of the

entity and other activities that are not investing or financing

activities.

-

Net cash position: Cash and

cash equivalents + Other current financial assets - Current

borrowings - Non-current borrowings.

-

FY 2016 as published:

Figures presented within the "as published" caption are taken

directly from the consolidated financial statements as of and for

the 12 month-periods ended December 31, 2015 and 2016 and present

BIC Graphic NAM & Asian Sourcing as discontinued operations in

accordance with IFRS.

-

FY 2016 restated for

discontinued operations: Figures presented within the "restated

for discontinued operations" caption are based on the restatement

of the discontinued activities classification and aim at presenting

information that is consistent with the historical

presentation.

*

*

*

SOCIETE BIC

consolidated and statutory financial statements as of December 31,

2016, were approved by the Board of Directors on February 10, 2017.

The Group's Auditors have performed their audit procedures on the

consolidated financial statements and the audit reports relating to

the certification of the consolidated and statutory financial

statements are in the process of being issued. A presentation

related to this announcement is also available on the BIC website

(www.bicworld.com).

This document contains forward-looking statements.

Although BIC believes its estimates are based on reasonable

assumptions, these statements are subject to numerous risks and

uncertainties. A description of the risks borne by BIC appears in

the "Risk factors" section of BIC's 2015 Registration Document

filed with the French financial markets authority (AMF) on March

23, 2016.

| Investor Relations: +33 1 45 19 52 26 |

Press Contacts |

Sophie

Palliez-Capian

sophie.palliez@bicworld.com |

Albane de

La Tour d'Artaise albane.delatourdartaise@bicworld.com |

Katy

Bettach

katy.bettach@bicworld.com |

Priscille

Reneaume: +33 1 53 70 74 70

preneaume@image7.fr |

For more information, please consult the corporate

website: www.bicworld.com

2017

Agenda (all dates to be confirmed)

| First

quarter 2017 results |

26 April

2017 |

Conference

call |

| 2017

AGM |

10 May

2017 |

Meeting -

BIC Headquarters |

| Second

quarter 2017 results |

03 August

2017 |

Conference

call |

| Third

quarter 2017 results |

25 October

2017 |

Conference

call |

BIC is a world

leader in stationery, lighters, shavers and promotional products.

For more than 60 years, BIC has honored the tradition of providing

high-quality, affordable products to consumers everywhere. Through

this unwavering dedication, BIC has become one of the most

recognized brands in the world. BIC products are sold in more than

160 countries around the world. In 2016, BIC recorded Net Sales of

2,025.8 million euros. The Company is listed on "Euronext Paris"

and is part of the SBF120 and CAC Mid 60 indexes. BIC is also part

of the following Socially Responsible Investment indexes:

CDP's Climate A List, CDP's Supplier Climate A List, CDP Supplier

Engagement Leader Board, FTSE4Good indexes, Ethibel Sustainability

Index (ESI) Excellence Europe, Euronext Vigeo - Eurozone 120,

Euronext Vigeo - Europe 120, Stoxx Global ESG Leaders

Index.

[1] Payable from May 24, 2017 subject to approval at the AGM of

May 10, 2017.

[3] Excluding the special bonus awarded to employees who were

not granted shares under our performance share plan.

[4] Gross Profit margin excluding promotions and investments

related to consumer and business development support.

[5] Total Brand Support: consumer

and business development support + advertising, consumer and trade

support.

[6] Source: IRI total market YTD through 25-DECEMBER-2016

(one-piece shavers) - in value terms.

[7] The 2017 perimeter includes

Stationery, Lighters, Shavers, Other Consumer Products as well as

BIC Graphic operations outside North America and Asia

Sourcing.

[8] In the balance sheet at December 31, 2016, the line "Other

current financial assets and derivative instruments" also includes

1.7M€ worth of derivative instruments.

BIC_FY 2016 Results_Press

Release_13FEB17

This

announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: BIC via Globenewswire

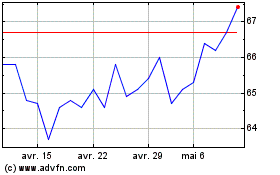

Societe BIC (EU:BB)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Societe BIC (EU:BB)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024