2017 First Quarter

Results

Q1-2017: Net

income up sharply for both

Crédit Agricole Group and Crédit Agricole

S.A.,

strong commercial momentum in all business

lines

| Crédit Agricole Group* |

Stated net income Group share

€1,600m

+95.6% Q1/Q1 |

Stated revenues

€8,249m

+15.2% Q1/Q1 |

Fully-loaded CET1 ratio

14.5%

500bps above the P2R[1] |

-

Good commercial momentum throughout the Group:

retail banks, businesses and Large customers

-

Underlying[2] net income Group share: €1,654m, +33.3% Q1/Q1

-

Underlying2 revenues:

€8,334m, +6.7% Q1/Q1

-

Cost of risk down: 26bps annualised[3]

-

70% of 2017 funding programme completed at

end-April

* Crédit Agricole S.A. and 100% of Regional

Banks. |

| Crédit Agricole S.A. |

Stated net income Group share

€845m

x3.7 Q1/Q1 |

Stated revenues

€4,700m

+23.7% Q1/Q1 |

Fully-loaded CET1 ratio

11.9%

340 bps above the P2R1 |

-

Acceleration in growth: continued strong

commercial momentum in all business lines

-

Underlying2 revenues +14%

Q1/Q1, +10.0% Q1/Q1 excl. Corporate centre (business lines

only)

-

Strong growth in Asset gathering, Large

customers and Corporate centre driven by recurring benefits of

Eureka

-

Underlying2

NIGS €895m, x2.3 Q1/Q1, underlying2 earnings per share: €0.27, x2.8 Q1/Q1

-

Sharp increase in underlying2 net income Group

share of the business lines: +44% Q1/Q1, increased contribution

from all business lines

-

Tight cost control: 8.3pp improvement in

underlying2 cost/income ratio Q1/Q1 to 62.7% excl. SRF

-

Firm grip on risk in all business lines: cost of

credit risk 37 bps3

-

Non-specific provision for legal risk: €40m

(non-deductible)

-

Note: target CET1 ratio of

11% at end-2019, 250 bps above the P2R1 (8.50% at 01/01/19)

|

This press

release comments on the results of Crédit Agricole S.A. and those

of Crédit Agricole Group, which comprises the Crédit Agricole S.A.

entities and the Crédit Agricole Regional Banks, which own 56.6% of

Crédit Agricole S.A.

Crédit Agricole Group

In line with

previous quarters, the Group's results for the first quarter of

2017 reflect strong business momentum in all components of Crédit

Agricole Group, including the retail banks, specialised business

lines and Large customers. Operating expenses remain well

controlled, despite investment in business development, and the

cost of credit risk remains low. The Group's profitability was

therefore excellent, with stated net income Group share of 1,600

million euros and underlying[4] net income Group share of 1,654 million euros,

excluding this quarter's specific items. The fully-loaded Common

Equity Tier 1 ratio at end-March 2017 was stable compared with

end-2016 at 14.5%, among the best in the sector and well above the

regulatory requirements[5].

In line with its "Strategic

Ambition 2020" medium-term plan (MTP), the Group is capitalising on

its stable, diversified and profitable business model to support

organic growth in all its business lines, largely through synergies

between the specialised business lines and the retail networks, and

to maintain a high level of operating efficiency while generating

capacity to invest in business development.

As announced at the end of 2016 at

the time of Amundi's proposed acquisition of Pioneer Investments,

the Group's asset management company completed its 1.4 billion

euros rights issue at the end of March 2017. Crédit Agricole Group

sold some of its subscription rights to reduce its percentage

interest in Amundi from 75.7% to 70%, including 68.5% held by

Crédit Agricole S.A. (74.1% previously). However, Amundi's first

quarter results were consolidated at the old percentage interest,

as the rights were not sold until the very end of the quarter.

Liquidity in Amundi shares has improved significantly as a result

of the rights issue and the broader free float arising from the

reduction in Crédit Agricole Group's percentage interest. It should

be noted that the value of the Group's holding in Amundi has

increased significantly since the rights issue, despite the

dilution of its percentage interest, and is well above the amount

invested by the Group in this transaction. The closing of the

acquisition of Pioneer Investments should occur late in the first

half of 2017, or perhaps early in the second, and is expected to

have a impact of -35 basis points on Crédit Agricole

Group's fully-loaded CET1 ratio (-60 basis points for Crédit

Agricole S.A.).

The Group also announced in a

press release issued on 24 April 2017 that it is in preliminary

discussions with the Bank of Italy and the Italian Interbank

Deposit Protection Fund with a view to the acquisition of three

Italian savings banks. Their integration by Crédit Agricole

Cariparma SpA would increase its customer base by about 20% and

contribute to its expansion in some attractive regions of Italy

without changing its geographical positioning, as these banks

operate in neighbouring areas. All of the doubtful loans carried on

their balance sheets would be derecognised prior to the

integration. This transaction forms part of the Group's aim of

strengthening its position in Italy, in line with Strategic

Ambition 2020 and with the Group's strict rules as regards return

on investment and risk profile of new acquisitions. It is subject

to a positive outcome of the due diligence process, which is due to

begin soon. Based on information available to date, the acquisition

would have a negative impact of less than 10 basis points

on the fully-loaded CET1 ratio for both Crédit Agricole Group and

Crédit Agricole S.A.

In the first quarter of 2017,

Crédit Agricole Group's stated net income Group share

came to 1,600 million euros versus

818 million euros in the first quarter of 2016. Excluding

specific items[6] of -54

million euros in the first quarter of 2017 versus -423 million

euros in the first quarter of 2016, underlying net income Group

share6 came to 1,654 million euros, compared with 1,241

million euros in the first quarter of 2016, a year-on-year increase

of +33.3%.

Specific items6 this quarter

included only the usual volatile accounting items: revaluation of

own debt in line with changes in issuer spread (-7 million euros in

net income Group share compared with +16 million euros in

the first quarter of 2016), DVA (Debt Valuation

Adjustment, -31 million euros versus

+9 million euros) and loan portfolio hedges in Large

customers (-16 million euros versus 0). In the first

quarter of 2016, specific items6 also included the balance of the

liability management operation completed ahead of the operation to

simplify the Group's structure ("Eureka") for an amount of

-448 million euros in net income Group share. Specific

items therefore totalled -54 million euros in

the first quarter of 2017 versus

-423 million euros in the first quarter of 2016.

Table 1.

Crédit Agricole Group - consolidated

results

|

€m |

Q1-17

Stated |

Q1-16

Stated |

Var. Q1/Q1

Stated |

Q1-17

underlying |

Q1-16

underlying |

Var. Q1/Q1

underlying |

|

|

|

|

|

|

|

|

|

Revenues |

8,249 |

7,159 |

+15.2% |

8,334 |

7,810 |

+6.7% |

|

Operating expenses excl.SRF |

(5,206) |

(5,122) |

+1.6% |

(5,206) |

(5,122) |

+1.6% |

|

SRF |

(274) |

(239) |

+14.8% |

(274) |

(239) |

+14.8% |

| Gross operating income |

2,769 |

1,799 |

+54.0% |

2,855 |

2,450 |

+16.5% |

| Cost

of risk |

(478) |

(554) |

(13.7%) |

(478) |

(554) |

(13.7%) |

| Cost

of legal risk |

(40) |

- |

n.m. |

(40) |

- |

n.m. |

|

Equity-accounted entities |

218 |

126 |

72.5% |

218 |

126 |

72.5% |

| Net

income on other assets |

(0) |

25 |

n.m. |

(0) |

25 |

n.m. |

|

Change in value of goodwill |

- |

- |

n.m. |

- |

- |

n.m. |

| Income before tax |

2,469 |

1,396 |

+76.9% |

2,554 |

2,047 |

+24.8% |

|

Tax |

(789) |

(488) |

+61.7% |

(822) |

(714) |

+15.2% |

| Net

income from discontinued operations |

15 |

- |

n.m. |

15 |

- |

n.m. |

| Net income |

1,695 |

908 |

+86.6% |

1,747 |

1,333 |

+31.1% |

| Non

controlling interests |

(95) |

(90) |

+5.2% |

(93) |

(92) |

+1.0% |

| Net income Group share |

1,600 |

818 |

+95.6% |

1,654 |

1,241 |

+33.3% |

| Cost/Income ratio excl.SRF |

63.1% |

71.5% |

-8.4 pp |

62.5% |

65.6% |

-3.1 pp |

In the first quarter, underlying revenues6 were up +6.7% year on year

8,334 million euros, thanks to a positive contribution to

growth from all business lines. The Regional Banks' revenues were

up excluding the impacts of the Group's transaction to simplify its

structure last year (negative impact of

-174 million euros before tax). Despite an increase in

eurozone long rates since the fourth quarter of 2016, bringing them

up to their highest level since the first quarter of 2016, they

nonetheless remain low and the short end of the curve is still in

negative territory. These low interest rates continued to put

pressure on the interest margin on intermediation activities,

particularly in Retail banking in France and Italy. This triggered

a wave of home loan renegotiations in France, which even escalated

with the increase in rates as of November, culminating in a record

level of monthly renegotiations in January 2017

(2.1 billion euros for LCL that month for example). These

renegotiations were accompanied by high volumes of loan

restructuring fees or early repayment penalties, which had a

temporary positive effect on retail banking revenues in France, but

the impact of the renegotiations will continue to depress interest

interest over the coming quarters.

Alongside this increase in

revenues, operating expenses remained well

controlled at 5,480 million euros, a year-on-year

increase of +2.2% and +1.6% excluding the

contribution to the Single Resolution Fund (SRF), which increased

by +14.8% to 274 million euros. It should be noted that

in 2016, an additional SRF contribution was recognised in the

second quarter. Operating expenses did not include any specific

items[7] in the

first quarter either of 2017 or 2016

This led to a highly positive jaws

effect between underlying7 revenues and operating expenses and the

underlying7 cost/income ratio excluding SRF therefore improved by more than 3 percentage points

(3.1) to 62.5% versus 65.6% in the first

quarter of 2016. Underlying gross operating income7 also increased

significantly, by +16.5% year-on-year to

2,855 million euros.

Cost of credit

risk decreased by 13.7% at 478 million euros versus

554 million euros in the

first quarter of 2016. As in previous quarters, cost

of risk relative to outstandings remained low at

26 basis points[8]. In

addition to cost of credit risk, a non-specific provision for legal

risk of 40 million euros was recognised this quarter in

the financial statements of CACIB (Large customers).

The sharp increase in the

contribution from equity-accounted entities (+72.5% to

218 million euros) offset the absence of gains on other

assets this quarter, compared with a gain of

25 million euros in the

first quarter of 2016. Underlying7 pre-tax income increased by +24.8% year-on-year.

Underlying7 net income Group share

increased even more, by +33.3% to 1,654 million euros,

due to the gain on disposal of Credicom in Greece

(15 million euros after tax), a decrease in the

underlying7 effective tax rate from 37.2% in the first quarter of

2016 to 35.2% this quarter, and stable non-controlling

interests.

The Regional

Banks continued to enjoy buoyant business momentum both in

lending (+5.3% at end-March 2017 versus end-March 2016) and

deposits (+4.6%). Growth in home loans (+7.6%) accelerated further

compared with the growth rate at end-December 2016, as did growth

in demand deposits (+17.6%), while consumer finance outstandings

were up sharply (+9.1% year-on-year). Lastly, the strong momentum

in personal and property insurance continued apace. This commercial

performance of the Regional Banks made a significant contribution

to growth in Crédit Agricole S.A.'s business lines, many

of whose products they distribute as the Group's leading

distribution channel.

The year-on-year comparison of

the Regional Banks' first quarter revenues

were affected by the transaction to simplify the

Group's structure ("Eureka"), which took place last year.

Stated revenues were down -0.9% year-on-year to 3,529 million

euros. Excluding these effects[9]

(-174 million euros) and in the absence of any movement

in home purchase savings provisions in the first quarter of either

2017 or 2016, underlying7 revenues increased by +3.9%, thanks to

growth in both interest income (+1.5%) and fee and commission

income (+3.2%) compared with the first quarter of 2016. Operating expenses increased by +3.5% to

2,178 million euros and by +3.4% excluding SRF, giving a

cost/income ratio excluding SRF of 61.7%.

Cost of risk decreased by -21.4% year-on-year

to 116 million euros. In all, the

Regional Banks' contribution to Crédit Agricole Group's

underlying7 net income

Group share was 755 million euros in the first quarter 2017, a

year-on-year decrease of -8.6%. Excluding the

impacts of the transaction to simplify the Group's structure, net

income Group share was up +5.1%.

The performance of the other

Crédit Agricole Group business lines is described in

detail in the section of this press release on Crédit Agricole

S.A.

During the quarter,

Crédit Agricole Group's financial solidity remained

strong, with a fully-loaded Common Equity Tier 1

(CET1) ratio of 14.5%, stable compared with end-December 2016.

This ratio provides a substantial buffer above the distribution

restriction trigger applicable to Crédit Agricole Group as of

1 January 2019, set at 9.5% by the ECB. The impact of the

consolidation of Pioneer Investments is estimated at -35 basis

points, as of mid-2017.

The TLAC ratio was 20.5% at 31

March 2017, excluding eligible senior preferred debt, versus 20.3%

at end-December 2016. This level already exceeds the 2019 minimum

requirement of 19.5%, whereas the regulatory calculation of this

ratio allows for the inclusion of eligible senior preferred debt

(up to 2.5%). After the successful inaugural issue of senior

non-preferred debt at the very end of 2016, just after the

enactment of the law authorising such issues, the Group further

strengthened its TLAC ratio by issuing 3.4 billion euros equivalent

of senior non-preferred debt in the first four months of the

year.

The phased-in leverage ratio stood

at 5.7%, stable compared with end-December 2016.

Credit Agricole Group's liquidity

position is robust. Its banking cash balance sheet, at 1,116

billion euros at 31 March 2017, showed a surplus of stable funding

over LT applications of funds of 116 billion euros, up by +5

billion euros compared with end-December 2016 and by +2 billion

euros compared with the first quarter of 2016. It exceeded the

Medium Term Plan target (of over 100 billion euros). The surplus of

stable funds financed the HQLA securities portfolio generated by

the LCR requirement of customer and customer-related activities.

Liquidity reserves including valuation gains and haircuts

related to the securities portfolio amounted to 255 billion euros,

covering gross short-term debt almost three times over.

Crédit Agricole Group issuers

raised 14.1 billion euros equivalent of debt on the market in the

first quarter of 2017, of which 52% was raised by Crédit Agricole

S.A. (7.3 billion euros), versus just over 33 billion euros for the

whole year 2016. Credit Agricole Group also placed 1.3 billion

euros of bonds in its retail networks (Regional Banks, LCL and

Cariparma). After a particularly active month of April,

Crédit Agricole S.A. had issued a total of

11.3 billion euros since the beginning of the year,

completing 70% of its 2017 market funding programme.

* *

*

Dominique Lefebvre, Chairman of

SAS Rue La Boétie and Chairman of Crédit Agricole S.A.'s

Board of Directors, commented the Group's results and activities

for the first quarter of 2017: "In the first

quarter of 2017, Crédit Agricole Group once again

demonstrated the robustness of its Universal customer-focused

banking business model and the synergies that could be generated by

a customer approach common to the various business lines. This was

reflected in strong business momentum and results, which bodes well

for the success of our Strategic Ambition 2020

plan."

Crédit Agricole S.A. Q1-2017: sustained activity in all businesses

-

Good business momentum in all businesses

-

High net inflows in asset management and

unit-linked savings/retirement assets

-

Excellent commercial performance in Specialised

financial services and all Large customers businesses

-

High level of cross-selling, in line with

"Strategic Ambition 2020" MTP targets

-

Underlying revenues up +14% Q1/Q1[10], +10.0%

Q1/Q1 for business lines excluding Corporate centre

Good financial performance

-

Very good level of results:

Underlying10 net income

Group share of 895 million euros, x2.3 vs low baseline in

Q1-16, with a strong contribution from all business lines, all of

which delivered growth vs Q1-1610

-

Firm grip on underlying operating

expenses10 (+1.6%

Q1/Q1, +0.7% excluding SRF) despite strong business momentum

-

Continued improvement in underlying10 cost/income

ratio: >8 points Q1/Q1 excl. SRF10

-

Cost of credit risk down (-10.6% Q1/Q1) to

37bps[11]; provision

for legal risk[12]: 40

million euros

Continued excellent level of financial robustness

Crédit Agricole S.A.'s Board of

Directors, chaired by Dominique Lefebvre, met on 10 May 2017 to

examine the financial statements for the first quarter of 2017.

In the first quarter of

2017, stated net income Group share came to

845 million euros. Specific items10 for the quarter

were limited to an impact of -50 million euros on net

income Group share (-81 million euros before tax and

non-controlling interests), exclusively due to recurring volatile

accounting items (issuer spread, DVA and loan portfolio hedges in

Large customers). In the first quarter of 2016, specific items10

had an impact on net income Group share of

-167 million euros (-395 million euros before

tax and non-controlling interests), mainly reflecting transactions

in preparation for the transaction to simplify the Group's

structure (non-taxable dividends received from the Regional Banks

for +256 million euros and upfront payment of the

liability management operation for -683 million euros

before tax)10.

Excluding specific items10,

underlying10 net income Group share for the first quarter of 2017

was 895 million euros, 2.3 times higher than in the first

quarter of 2016, which was a low base for comparison, even on an

underlying basis10.

Underlying10 earnings per share came to 0.27 euros per share,

2.8 times higher than in the first quarter of 2016.

It should be noted that, as is the

case for each first quarter of the year, net income Group share

includes a high level of charges arising from IFRIC 21, which

requires annual charges to be recognised in the quarter in which

they are due, and not spread across the year. In first quarter of

2017, these charges totalled about 338 million euros

before tax, or 317 million euros in net income Group

share, including 224 million euros in SRF

(228 million euros in 2016 and

192 million euros in the first quarter of 2016).

As in previous quarters, these

excellent underlying13 results were

driven mainly by strong growth in revenues coupled with good cost

control and low cost of risk, including a decrease in cost of

credit risk, i.e. excluding the non-specific provision for legal

risk (40 million euros).

Revenue growth

was driven by strong business momentum in all Crédit Agricole

S.A. Group's business lines and distribution

networks, as well as the Regional Banks which distribute their

products. This momentum reflects an improvement in economic

activity in the Group's core European markets, but above all, the

robustness of the Universal customer-focused banking model, which

encourages cross-selling between the specialised business lines and

the retail banks and between the specialised business lines

themselves. Cross-selling is a core component of the "Strategic

Ambition 2020" plan and drives the Group's revenue growth.

Activity was

buoyant in all business lines:

-

in insurance, 209,000 new

property & casualty contracts were sold (net of terminations)

in the first quarter of the year alone, bringing the total number

of in-force contracts to more than 12.3 million at end-March;

in life insurance, net inflows in unit-linked (UL) business

totalled 1.1 billion euros in the first quarter of

2017 versus 0.7 billion euros in the first quarter of

2016, raising the share of UL products in total gross inflows to a

record level of 28.2%, up +9 percentage points

year-on-year;

-

in Asset management

(Amundi), assets under management grew by +14.2% over one year

to 1,128 billion euros, mainly due to strong inflows of

+32.5 billion euros in the first quarter of 2017;

-

the Retail banks,

especially in France and Italy, delivered stronger growth in loans

and customer assets than in previous quarters. At LCL, home loans

grew by +7.7% over one year, lending to small businesses by +11.2%,

demand deposits by +17.0% and the number of new property &

casualty insurance contracts by +9.4%; Retail banking in Italy

performed equally well, with home loans up +10.3%, lending to large

corporates up +24.2% and off-balance sheet customer assets up

+4.9%;

-

Specialised financial

services continued to grow, with new consumer finance loans

totalling 10.2 billion euros, a year-on-year increase of

+12.2%, and new leasing business of 1.1 billion euros, a

year-on-year increase of +21.5%;

-

Large customers enjoyed

buoyant activity in fixed-income, forex and credit business, and

strong momentum in investment banking; CACIB increased its market

share as bookrunner of euro bond issues by +0.7 of percentage

point to 6.7%; It is leader in project finance in EMEA region with

a 6.3% market share (+3.6 percentage points) and it

is global leader, all currencies combined, in green financing,

acting as bookrunner for 16 green bond issues in the first quarter

of 2017, and arranging the first Green Capital Note issue of

3 billion US dollars. Moreover, illustrating its

risk distribution policy "Distribute to Originate", Financing

activities showed an average primary syndication rate over the

12 months preceding end-March 2017 of 35%, i.e. 8 points

higher compared to 2013, while sales volumes on the secondary

market increased by +13% year-on-year in the first quarter of 2017

compared with the same quarter of 2016.

Driven by this strong momentum in

all business lines, underlying revenues were up

+14.0% compared with the first quarter of 2016.

Underlying[13] revenues

of the business lines (excluding Corporate centre) increased by

+10.0%. Good control over operating expenses,

which increased by +1.6% or +0.7% excluding SRF[14],

generated a strong jaws effect, thereby improving

the underlying13 cost/income ratio excluding SRF by more than

8 percentage points (8.3) year-on-year to 62.7%.

Cost of credit

risk was stable at 399 million euros (versus

402 million euros in the first quarter of 2016), but this

quarter it included a non-specific provision for legal risk of

40 million euros. Cost of credit risk therefore decreased

by -10.6% to 359 million euros, representing

37 basis points of consolidated outstandings[15]

versus 39 basis points in the first quarter of 2016, still

below the 50 basis points assumption in the Medium-Term

Plan.

Thanks to these items and a good

contribution from equity-accounted entities,

which increased by +75.1% or +92 million euros mainly due

to a very high contribution from Eurazeo recognised in Corporate

centre and an increase in the contribution from the consumer

finance joint ventures, underlying pre-tax income before operations

sold and non-controlling interests increased by +85.1% to

1,368 million euros.

As a result of more modest growth

in underlying[16] tax (effective tax rate of 32.4% versus 38.6% at first

quarter 2016) and non-controlling interests,

coupled with a 15 million euros gain on the disposal of

Credicom in Greece, underlying net income Group share

increased by +126% or 2.3 times compared with the first

quarter of 2016.

Table 2.

Crédit Agricole S.A. - consolidated

results

|

€m |

Q1-17

Stated |

Q1-16

Stated |

Var. Q1/Q1

Stated |

Q1-17

underlying |

Q1-16

underlying |

Var. Q1/Q1

underlying |

| |

|

|

|

|

|

|

| Revenues |

4,700 |

3,799 |

+23.7% |

4,781 |

4,194 |

+14.0% |

| Operating expenses

excl.SRF |

(2,996) |

(2,975) |

+0.7% |

(2,996) |

(2,975) |

+0.7% |

| SRF |

(232) |

(201) |

+15.6% |

(232) |

(201) |

+15.6% |

| Gross operating income |

1,472 |

623 |

x 2.4 |

1,553 |

1,018 |

+52.5% |

| Cost of risk |

(359) |

(402) |

(10.6%) |

(359) |

(402) |

(10.6%) |

| Cost of legal

risk |

(40) |

- |

n.m. |

(40) |

- |

n.m. |

| Equity-accounted

entities |

215 |

123 |

+75.1% |

215 |

123 |

+75.1% |

| Net income on other

assets |

(1) |

- |

n.m. |

(1) |

0 |

n.m. |

| Change in value of

goodwill |

- |

- |

n.m. |

- |

- |

n.m. |

| Income before tax |

1,287 |

344 |

x 3.7 |

1,368 |

739 |

+85.1% |

| Tax |

(343) |

(12) |

x

29.3 |

(373) |

(238) |

+57.1% |

| Net income from

discontinued or held-for-sale operations |

15 |

- |

n.m. |

15 |

- |

n.m. |

| Net income |

959 |

332 |

x 2.9 |

1,009 |

501 |

x 2 |

| Non controlling

interests |

(114) |

(105) |

+8.7% |

(114) |

(107) |

+6.8% |

| Net income Group Share |

845 |

227 |

x 3.7 |

895 |

394 |

x 2.3 |

| Net earnings per share (€) |

0.25 |

0.03 |

n.m. |

0.27 |

0.10 |

x 2.8 |

| Cost/Income ratio excl.SRF (%) |

63.7% |

78.3% |

-14.6 pp |

62.7% |

70.9% |

-8.3 pp |

By business

line, more than half of the growth in underlying16 revenues

(+587 million euros or +14.0%) came from Large customers

(+286 million euros or +23.7% and +13.7% excluding xVA),

driven by a good commercial performance and a weak base for

comparison in the first quarter of 2016. The second largest

contributor was Corporate centre (+140 million euros)

thanks to the full impact of Eureka (+222 million euros

including liability management) compared with the first quarter of

2016, followed by Asset gathering (+72 million euros or

+6.1%), Retail banking (+51 million euros or +3.5%) and

Specialised financial services (+38 million euros or

+5.9%), thanks to their strong business momentum. It should be

noted that the increase in LCL's revenues

(+69 million euros or +8.2%) benefited from the positive

cumulative impacts of home loan renegotiation fees and early

repayment penalties (+32 million euros compared with the

first quarter of 2016) and the funding cost adjustment

(+18 million euros), coupled with strong business

momentum (commissions up +3,7% versus first quarter 2016) more than

offsetting the persistent negative effects of low interest rates on

margins.

The weak growth in underlying16 operating expenses (+21 million euros or

+0.7% year-on-year excluding SRF) reflects strong cost control in

all business lines, the increase being mainly due to sustained

business activity in Large customers (+27 million euros

or +3.4%) and investment in business development in Asset gathering

(+35 million euros or +5.9%) and Specialised financial

services (+3 million euros or +1.0%). Operating expenses

continued to decline in Retail banking (-31 million euros or

-3,0%), particularly at LCL (-26 million euros or

-4.1%).

Cost of credit

risk remained low, down -43 million euros or -10.6%

year-on-year, excluding the legal risk provision recognised in

Large customers. The main contributors to this decrease were

Specialised financial services (-27 million euros or

-22.5% year-on-year), International retail banking

(-22 million euros or -17.5%) and Large customers

(-16 million euros or -12.8%).

The cost of risk

on outstandings[17] is down

for the retail banking in Italy for the nine last quarters, to

87 basis points, and that of Consumer finance (CACF)

stands at 134 basis points versus 140 in the first

quarter of 2016 and also in the fourth quarter 2016, which was

marked by a tightening of the provisioning parameters in support of

the restart of the activity in spite of a strengthening of the

provisions parameters on Agos. By contrast, cost of risk for LCL

has more than doubled to 48 million euros

(+26 million euros or +118%), but relative to a very low

baseline in the first quarter of 2016 (22 million euros).

Compared with the quarterly average in 2016

(46 million euros), cost of risk in the first quarter of

2017 increased by just +6.2%, representing

19 basis points of outstandings17.

At end-March 2017,

Crédit Agricole S.A.'s capital ratios remained high, with

a ratio Common Equity Tier 1 (CET1) ratio of

11.9%, a decrease of -15 basis points compared

with end-December 2016. The change over the quarter stemmed

from stated net income Group share for the period (+27 basis

points), offset by the provision for dividends and the AT1 coupon

(-19 basis points), a decrease in unrealised gains on

available-for-sale securities (-12 basis points) and other

changes (-11 basis points). Risk-weighted

assets were down slightly over the quarter to 300 billion

euros versus 301 billion euros at 31 December 2016.

The phased-in leverage ratio stood

at 4.7% at end-March 2017 as defined in the Delegated Act adopted

by the European Commission, a decrease of

-30 basis points compared with end-December 2016.

The LCR ratio for both Credit

Agricole S.A. and the Group remained in excess of 110% at end-March

2017.

At end-April 2017, Credit Agricole

S.A. had completed 70% of its annual medium- to long-term market

funding programme of 16 billion euros. It raised

7.9 billion euros equivalent of senior preferred debt and

3.4 billion euros equivalent of senior non-preferred

debt.

* *

*

Philippe Brassac, Chief Executive

Officer, commented: "The first quarter was in line

with 2016 as regards implementation of the "Strategic Ambition

2020" medium-term plan. All Crédit Agricole S.A. group entities

enjoyed strong growth in business momentum, which was reflected in

a high level of revenues and earnings. This quarter was a

successful new milestone in the achievement of our Plan

targets."

Corporate social responsibility

Crédit Agricole Group was the

first French bank to obtain certification for its anti-corruption

and bribery system. Issued by SGS, this BS 10500 certification is

recognition of the Group's determination and the quality of its

anti-corruption and bribery programme. It confirms that corruption

and bribery risks are properly identified and analysed and that the

programme applied by Crédit Agricole is designed to mitigate these

various risks by drawing on best international practices. The

certification covers all of the Crédit Agricole Group's business

lines. It bears witness to the Group's commitment to put compliance

and ethics at the heart of its business development.

Appendix 1 - Specific items, Crédit Agricole Group and Crédit

Agricole S.A.

Table 1.

Crédit Agricole Group- Specific items of

Q1-17

|

|

Specific items of

Q1-17 |

|

Specific items of

Q1-16 |

|

€m |

Gross impact |

Impact on NIGS |

|

Gross impact |

Impact on NIGS |

|

|

|

|

|

|

|

| DVA

running (LC) |

(48) |

(31) |

|

13 |

9 |

| Loan

portfolio hedges (LC) |

(24) |

(16) |

|

- |

- |

|

Issuer spreads (Corporate centre) |

(13) |

(7) |

|

19 |

16 |

|

Liability management upfront payments (Corporate centre) |

- |

- |

|

(683) |

(448) |

| Total impact on revenues |

(86) |

(54) |

|

(651) |

(423) |

|

|

|

|

|

|

|

| Asset gathering |

|

- |

|

|

- |

| Retail banking |

|

- |

|

|

- |

| Specialised financial

services |

|

- |

|

|

- |

| Large customers |

|

(47) |

|

|

9 |

| Corporate centre |

|

(7) |

|

|

(432) |

Table 2.

Crédit Agricole S.A. - Specific items of

Q1-17

| |

|

Specific items of

Q1-17 |

|

Specific items of

Q1-16 |

| €m |

|

Gross impact |

Impact on NIGS |

|

Gross impact |

Impact on NIGS |

| |

|

|

|

|

|

|

| DVA running (LC) |

|

(48) |

(31) |

|

13 |

9 |

| Loan portfolio hedges

(LC) |

|

(24) |

(15) |

|

- |

- |

| Issuer spreads

(Corporate centre) |

|

(8) |

(4) |

|

19 |

16 |

| Regional Banks'

dividends (Corporate centre) |

|

- |

- |

|

256 |

256 |

| Liability management

upfront payments (Corporate centre) |

|

- |

- |

|

(683) |

(448) |

| Total impact on revenues |

|

(81) |

(50) |

|

(395) |

(167) |

| |

|

|

|

|

|

|

| Asset gathering |

|

|

- |

|

|

- |

| Retail banking |

|

|

- |

|

|

- |

| Specialised financial

services |

|

|

- |

|

|

- |

| Large customers |

|

|

(46) |

|

|

9 |

| Corporate centre |

|

|

(4) |

|

|

(176) |

Appendix 2 - Crédit Agricole Group: stated and underlying

income statement

Table 3.

Crédit Agricole Group - Reconciliation

between the stated and the underlying results

|

€m |

Q1-17

Stated |

Specific items |

Q1-17

underlying |

Q1-16

Stated |

Specific items |

Q1-16

underlying |

Var. Q1/Q1

underlying |

| |

|

|

|

|

|

|

|

| Revenues |

8,249 |

(86) |

8,334 |

7,159 |

(651) |

7,810 |

+6.7% |

| Operating

expenses |

(5,206) |

- |

(5,206) |

(5,122) |

- |

(5,122) |

+1.6% |

| Contribution of Single

Resolution Funds (SRF) |

(274) |

- |

(274) |

(239) |

- |

(239) |

+14.8% |

| Gross operating income |

2,769 |

(86) |

2,855 |

1,799 |

(651) |

2,450 |

+16.5% |

| Cost of credit

risk |

(478) |

- |

(478) |

(554) |

- |

(554) |

(13.7%) |

| Cost of legal

risk |

(40) |

- |

(40) |

|

- |

- |

n.m. |

| Equity-accounted

entities |

218 |

- |

218 |

126 |

- |

126 |

+72.5% |

| Net income on other

assets |

(0) |

- |

(0) |

25 |

- |

25 |

n.m. |

| Change in value of

goodwill |

- |

- |

- |

- |

- |

- |

n.m. |

| Income before tax |

2,469 |

(86) |

2,554 |

1,396 |

(651) |

2,047 |

+24.8% |

| Tax |

(789) |

33 |

(822) |

(488) |

226 |

(714) |

+15.2% |

| Net income from

discontinued operations |

15 |

- |

15 |

- |

- |

- |

n.m. |

| Net income |

1,695 |

(52) |

1,747 |

908 |

(425) |

1,333 |

+31.1% |

| Non

controlling interests |

(95) |

(2) |

(93) |

(90) |

2 |

(92) |

+1.0% |

| Net income Group share |

1,600 |

(54) |

1,654 |

818 |

(423) |

1,241 |

+33.3% |

|

Cost income ratio excl. SRF (%) |

63.1% |

|

62.5% |

71.5% |

|

65.6% |

-3.1 pp |

Appendix 3 - Crédit Agricole Group: Consolidated income

statement by business line

Table 4. Crédit Agricole Group - Income statement by

business line

| €m |

Retail

banking

in

France

(RBs) |

French

retail

banking

(LCL) |

Inter-

national

retail

banking |

Asset

gathering |

Specialised

financial

services |

Large

customers |

Corporate

centre |

Total |

Q1-17

Sta-

ted |

Q1-16

Sta-

ted |

Q1-17

Sta-

ted |

Q1-16

Sta-

ted |

Q1-17

Sta-

ted |

Q1-16

Sta-

ted |

Q1-17

Sta-

ted |

Q1-16

Sta-

ted |

Q1-17

Sta-

ted |

Q1-16

Sta-

ted |

Q1-17

Sta-

ted |

Q1-16

Sta-

ted |

Q1-17

Sta-

ted |

Q1-16

Sta-

ted |

Q1-17

Sta-

ted |

Q1-16

Sta-

ted |

Rev-

enues |

3,529 |

3,563 |

904 |

835 |

634 |

650 |

1,248 |

1,175 |

685 |

647 |

1,421 |

1,220 |

(171) |

(931) |

8,249 |

7,159 |

Oper-

ating

ex-

penses

excl.

SRF |

(2,178) |

(2,109) |

(628) |

(654) |

(380) |

(383) |

(626) |

(591) |

(352) |

(348) |

(813) |

(786) |

(230) |

(251) |

(5,206) |

(5,122) |

|

SRF |

(41) |

(38) |

(16) |

(16) |

(10) |

(8) |

(2) |

(2) |

(14) |

(10) |

(133) |

(125) |

(57) |

(40) |

(274) |

(239) |

Gross

oper-

ating

income |

1,310 |

1,417 |

260 |

165 |

244 |

259 |

620 |

582 |

320 |

289 |

475 |

309 |

(459) |

(1,222) |

2,769 |

1,799 |

Cost

of

credit

risk |

(116) |

(148) |

(48) |

(22) |

(106) |

(131) |

1 |

(2) |

(92) |

(119) |

(106) |

(122) |

(9) |

(10) |

(478) |

(554) |

Cost

of

legal

risk |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

(40) |

- |

- |

- |

(40) |

- |

Equity-

ac-

counted

entities |

3 |

3 |

- |

- |

- |

- |

8 |

7 |

66 |

46 |

69 |

62 |

72 |

8 |

218 |

126 |

Net

income

on

other

assets |

1 |

25 |

(0) |

- |

0 |

- |

(0) |

- |

(0) |

- |

(0) |

- |

(1) |

- |

(0) |

25 |

Change

in

value

of

good-

will |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

In-

come

before

tax |

1,198 |

1,297 |

211 |

143 |

138 |

128 |

628 |

587 |

293 |

216 |

398 |

249 |

(397) |

(1,224) |

2,469 |

1,396 |

|

Tax |

(442) |

(470) |

(64) |

(53) |

(46) |

(44) |

(192) |

(172) |

(74) |

(57) |

(84) |

(80) |

113 |

388 |

(789) |

(488) |

Net

in-

come

from

discon-

tinued

opera-

tions |

- |

- |

- |

- |

0 |

- |

(0) |

- |

15 |

- |

- |

- |

- |

- |

15 |

- |

Net

income |

756 |

827 |

147 |

90 |

92 |

84 |

436 |

415 |

234 |

159 |

314 |

169 |

(284) |

(836) |

1,695 |

908 |

Non

controlling

interests |

(0) |

(1) |

(0) |

- |

(21) |

(22) |

(38) |

(37) |

(33) |

(30) |

(4) |

(3) |

1 |

3 |

(95) |

(90) |

Net

income

Group

share |

755 |

826 |

147 |

90 |

71 |

62 |

398 |

378 |

201 |

129 |

310 |

166 |

(283) |

(833) |

1,600 |

818 |

Appendix 4 - Crédit Agricole S.A.: stated and underlying

income statement

Table 5.

Crédit Agricole S.A. - Reconciliation

between the stated and the underlying results

|

€m |

Q1-17

stated |

Specific items |

Q1-17

underlying |

Q1-16

stated |

Specific items |

Q1-16

underlying |

Var. Q1/Q1

underlying |

| |

|

|

|

|

|

|

|

| Revenues |

4,700 |

(81) |

4,781 |

3,799 |

(395) |

4,194 |

+14.0% |

| Operating expenses

excl. SRF |

(2,996) |

- |

(2,996) |

(2,975) |

- |

(2,975) |

+0.7% |

| Contribution to Single

Resolution Funds (SRF) |

(232) |

- |

(232) |

(201) |

- |

(201) |

+15.6% |

| Gross operating income |

1,472 |

(81) |

1,553 |

623 |

(395) |

1,018 |

+52.5% |

| Cost of credit

risk |

(359) |

- |

(359) |

(402) |

- |

(402) |

(10.6%) |

| Cost of legal

risk |

(40) |

- |

(40) |

- |

- |

- |

n.m. |

| Equity-accounted

entities |

215 |

- |

215 |

123 |

- |

123 |

+75.1% |

| Net income on other

assets |

(1) |

- |

(1) |

- |

- |

- |

n.m. |

| Change in value of

goodwill |

- |

- |

- |

- |

- |

- |

n.m. |

| Income before tax |

1,287 |

(81) |

1,368 |

344 |

(395) |

739 |

+85.1% |

| Tax |

(343) |

31 |

(373) |

(12) |

226 |

(238) |

+57.1% |

| Net income from

discontinued or held-for-sale operations |

15 |

- |

15 |

- |

- |

- |

n.m. |

| Net income |

959 |

(50) |

1,009 |

332 |

(169) |

501 |

x 2 |

| Non

controlling interests |

(114) |

0 |

(114) |

(105) |

2 |

(107) |

+6.8% |

| Net income Group share |

845 |

(50) |

895 |

227 |

(167) |

394 |

x 2.3 |

| Net earnings per share (€) |

0.25 |

|

0.27 |

0.03 |

|

0.10 |

+0.17 |

|

Cost/income ratio excl.SRF (%) |

63.7% |

|

62.7% |

78.3% |

|

70.9% |

-8.3 pp |

Appendix 5 - Crédit Agricole S.A. : Consolidated

income statement by business line

Table 6.

Crédit Agricole S.A. - Income

statement by business line

| €m |

Asset

gathering |

French retail banking

(LCL) |

International retail

banking |

Specialised financial

services |

Large

customers |

Corporate

centre |

Total |

|

Q1-17

Stated |

Q1-16

Stated |

Q1-17

Stated |

Q1-16

Stated |

Q1-17

Stated |

Q1-16

Stated |

Q1-17

Stated |

Q1-16

Stated |

Q1-17

Stated |

Q1-16

Stated |

Q1-17

Stated |

Q1-16

Stated |

Q1-17

Stated |

Q1-16

Stated |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenues |

1,250 |

1,178 |

904 |

835 |

607 |

625 |

685 |

647 |

1,421 |

1,220 |

(166) |

(706) |

4,700 |

3,799 |

| Operating expenses

excl. SRF |

(626) |

(591) |

(628) |

(654) |

(362) |

(367) |

(352) |

(348) |

(813) |

(786) |

(216) |

(229) |

(2,996) |

(2,975) |

| Contribution of Single

Resolution Funds (SRF) |

(2) |

(2) |

(16) |

(16) |

(10) |

(8) |

(14) |

(10) |

(133) |

(125) |

(58) |

(40) |

(232) |

(201) |

| Gross operating income |

623 |

585 |

260 |

165 |

235 |

250 |

320 |

289 |

475 |

309 |

(440) |

(975) |

1,472 |

623 |

| Cost of credit

risk |

1 |

(2) |

(48) |

(22) |

(104) |

(127) |

(92) |

(119) |

(106) |

(122) |

(9) |

(10) |

(359) |

(402) |

| Cost of legal

risk |

- |

- |

- |

- |

- |

- |

- |

- |

(40) |

- |

- |

- |

(40) |

- |

| Equity-accounted

entities |

8 |

7 |

- |

- |

- |

- |

66 |

46 |

69 |

62 |

73 |

8 |

215 |

123 |

| Net income on other

assets |

(0) |

- |

(0) |

- |

0 |

- |

(0) |

- |

(0) |

- |

(0) |

- |

(1) |

- |

| Change in value of

goodwill |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

| Income before tax |

631 |

590 |

211 |

143 |

131 |

123 |

293 |

216 |

398 |

249 |

(376) |

(977) |

1,287 |

344 |

| Tax |

(192) |

(172) |

(64) |

(53) |

(44) |

(43) |

(74) |

(57) |

(84) |

(80) |

116 |

393 |

(343) |

(12) |

| Net income from

discontinued or held-for-sale operations |

(0) |

- |

- |

- |

0 |

- |

15 |

- |

- |

- |

- |

- |

15 |

- |

| Net income |

439 |

418 |

147 |

90 |

87 |

80 |

234 |

159 |

314 |

169 |

(261) |

(584) |

959 |

332 |

| Non controlling

interests |

(41) |

(39) |

(7) |

(5) |

(26) |

(27) |

(33) |

(30) |

(10) |

(6) |

3 |

2 |

(114) |

(105) |

| Net income Group share |

398 |

379 |

140 |

85 |

61 |

53 |

201 |

129 |

304 |

163 |

(258) |

(582) |

845 |

227 |

Disclaimer

The financial

information for the first quarter of 2017 for Crédit Agricole S.A.

and the Crédit Agricole Group comprises this press release and the

attached quarterly financial report and presentation, available at

https://www.credit-agricole.com/en/finance/finance/financial-publications.

This press

release may include prospective information on the Group, supplied

as information on trends. This data does not represent forecasts

within the meaning of European Regulation 809/2004 of 29 April 2004

(chapter 1, article 2, §10).

This information

was compiled from scenarios based on a number of economic

assumptions for a given competitive and regulatory environment.

Therefore, these assumptions are by nature subject to random

factors that could cause actual results to differ from

projections.

Likewise, the

financial statements are based on estimates, particularly for the

calculation of market values and asset impairments.

Readers must take

all of these risk factors and uncertainties into consideration

before making their own judgement.

The figures

presented for the three-month period ended 31 March 2017 have been

prepared in accordance with IFRS as adopted in the European Union

and applicable at that date, and with prudential regulations

currently in force. This financial information does not constitute

a set of financial statements for an interim period as defined by

IAS 34 "Interim Financial Reporting" and has not been

audited.

N.B. The scope of

consolidation of Crédit Agricole S.A. group and Crédit Agricole

Group has not changed materially since the filing with the AMF of

Crédit Agricole S.A.'s 2016 Registration Document on 21 March 2017

under number D.17-0197 and update A.01 of the 2016 Registration

Document containing the regulated information for Crédit Agricole

Group.

The sum of the

values contained in the tables and analyses may differ slightly

from the totals due to rounding effects.

Unlike

publications for previous quarters, the income statements contained

in this press release show non-controlling interests with a minus

sign such that the line item "net income Group share" is the

mathematical addition of the line item "net income" and the line

item "non-controlling interests".

On 1 January

2017, Calit was transferred from Specialised financial services

(Crédit Agricole Leasing & Factoring) to Retail banking in

Italy. Historical data have not been restated on a pro forma

basis.

Contacts

Crédit

Agricole press contacts

Charlotte de

Chavagnac + 33 1 57

72 11

17

charlotte.dechavagnac@credit-agricole-sa.fr

Alexandre

Barat

+ 33 1 57 43 23

07

alexandre.barat@credit-agricole-sa.fr

Caroline de

Cassagne

+ 33 1 49 53 39

72

Caroline.decassagne@ca-fnca.fr

Crédit

Agricole S.A. investor relations contacts

Institutional

investors

+ 33 1 43 23 04

31

investor.relations@credit-agricole-sa.fr

Individual

shareholders

+ 33 800

000 777

credit-agricole-sa@relations-actionnaires.com

(toll-free number France only)

Cyril Meilland,

CFA

+ 33 1 43 23 53

82

cyril.meilland@credit-agricole-sa.fr

Céline de

Beaumont

+ 33 1 57 72 41

87

celine.debeaumont@credit-agricole-sa.fr

Letteria

Barbaro-Bour

+ 33 1 43 23 48

33

letteria.barbaro-bour@credit-agricole-sa.fr

Oriane

Cante

+ 33 1 43 23 03

07

oriane.cante@credit-agricole-sa.fr

Emilie

Gasnier

+ 33 1 43 23 15

67

emilie.gasnier@credit-agricole-sa.fr

Fabienne

Heureux

+ 33 1 43 23 06

38

fabienne.heureux@credit-agricole-sa.fr

Vincent

Liscia

+ 33 1 57 72 38

48

vincent.liscia@credit-agricole-sa.fr

All our press releases are available at:

www.credit-agricole.com - www.creditagricole.info

| |

Crédit_Agricole |

|

Groupe Crédit

Agricole |

|

créditagricole_sa |

[1] Pro forma P2R for 2019 as notified by

the ECB

[2] See p. 11 for further details on specific items

[3] Calculated on an average annualised basis over four rolling

quarters

[4] See p. 11 for further details on specific items

[5] Pro forma P2R for 2019 as notified by the ECB: 9.50% as of

1 January 2019

[6] See p. 11 for further details on

Crédit Agricole Group's specific items

[7] See p. 11 for further details on

Crédit Agricole Group's specific items

[8] Average over last 4 rolling quarters annualised

[9] Impact of operation to simplify the Group's structure

(Q1-17 impact unwinding of Switch guarantee - €115m and loan -€59m,

making a total of -€174 million euros before tax, deductible

at the standard rate in France)

[10] See p. 11 for

further details on Crédit Agricole S.A.'s specific items

[11] Average over last 4 rolling quarters, annualised

[12] Not allocated to a specific matter

[13] See p. 11 for

further details on Crédit Agricole S.A.'s specific items

[14] Contribution to Single Resolution Fund

[15] Calculated on an average annualised basis over four rolling

quarters

[16] See p. 11 for

further details on Crédit Agricole S.A.'s specific items

[17] Calculated on an average annualised basis over four rolling

quarters

Press release (PDF)

This

announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: CREDIT AGRICOLE SA via Globenewswire

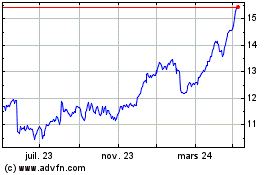

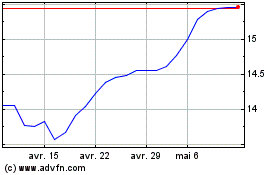

Credit Agricole (EU:ACA)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Credit Agricole (EU:ACA)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024