THIS ANNOUNCEMENT

IS FOR INFORMATION ONLY AND IS NOT AN OFFER TO PURCHASE OR A

SOLICITATION OF OFFERS TO SELL ANY SECURITIES.

Montrouge 22 May

2017

Crédit Agricole

S.A. Announces Results of its Any and All Offers and

the Maximum Tender Amount for its Waterfall Offers

____________________

On 15 May 2017, Crédit Agricole

S.A. announced the launch of offers to purchase any and all of its

two series of outstanding perpetual notes listed in the table below

(the "Any and All Offers", in respect of the

"Any and All Notes"). The Any and All

Offers were made upon the terms and subject to the conditions set

forth in the Offer to Purchase dated 15 May 2017 relating to the

Any and All Offers (the "Any and All Offer to

Purchase"). Capitalised terms used in this announcement

but not defined herein have the meanings given to them in the

related Offers to Purchase.

Results of the Any and All Offers

The Any and All Offers expired at

5:00 p.m., New York City time/11:00 p.m., Central European time, on

19 May 2017 (the "Any and All Expiration Time").

The table below sets forth

information with respect to the aggregate principal amount of Any

and All Notes that were validly tendered (including using the

guaranteed delivery procedures set forth in the Any and All Offer

to Purchase) and not validly withdrawn at or prior to 5:00 p.m.,

New York City time/11:00 p.m., Central European time, on

19 May 2017.

|

Title of Notes |

CUSIP / ISIN No. |

Principal Amount Tendered(1) |

Offer Price(2) |

Principal Amount Outstanding after the Any

and All Offers |

| USD

6.637% Undated Deeply Subordinated Notes |

CUSIP:

225313AA3 (Rule 144A) / F22797FJ2 (Reg S)

ISIN:

US225313AA37 (Rule 144A) / USF22797FJ25 (Reg S) |

USD782,972,000 |

USD950.00 |

USD106,956,000 |

| EUR CMS

Floater Undated Deeply Subordinated Notes |

ISIN:

FR0010161026 |

EUR120,456,000 |

EUR780.00 |

EUR250,776,000 |

(1) Including

USD1,710,000 in principal amount of Any and All Notes tendered

pursuant to the guaranteed delivery procedures, for which the

delivery of Any and All Notes must be made no later than 5:00 p.m.,

New York City time/11:00 p.m., Central European time, on 23 May

2017.

(2) Per

USD1,000 or EUR1,000, as applicable, in principal amount of Any and

All Notes purchased pursuant to the Any and All Offers

Payment of the aggregate

consideration for Any and All Notes accepted for purchase is

expected to be made on 24 May 2017, on which date Crédit Agricole

S.A. will deposit with CACEIS Corporate Trust S.A., as Tender Agent

(for tendering holders that hold their Any and All Notes through

Euroclear, Clearstream or Euroclear France), or with DTC, the

amount of cash necessary to pay the Offer Price plus Accrued

Interest in respect of the Any and All Notes accepted for purchase

in the Any and All Offers.

Maximum Tender Amount of the Waterfall

Offers

Concurrently with the announcement

of the Any and All Offers, Crédit Agricole S.A. also announced an

offer to purchase up to EUR1.5bn euro equivalent (less the euro

equivalent of the amount purchased in the Any and All Offers) (the

"Maximum Waterfall Tender Amount") in nominal

amount of four other series of notes described in the press release

dated 15 May 2017, subject to the Acceptance Priority Levels

described in the related offer to purchase dated 15 May 2017 (such

offer, the "Waterfall Offers" and together

with the Any and All Offers, the "Tender

Offers", and such offer to purchase the "Waterfall Offer to Purchase"). The aggregate

principal amount of notes subject to the Waterfall Offers which

Crédit Agricole S.A. will purchase is limited to the Maximum

Waterfall Tender Amount (as defined above).

On the basis of the results of the

Any and All Offers, the Maximum Waterfall Tender Amount will be

EUR679,211,262. For purposes of determining the Maximum Waterfall

Tender Amount, the euro equivalent of the aggregate principal

amount accepted for purchase pursuant to the Any and All Offers was

calculated as of 9:00 a.m., New York City time/3:00 p.m. Central

European time on 19 May 2017, based on the applicable EUR/USD

exchange rate of 1.118 as reported on Bloomberg screen page "FXIP"

under the heading "FX Rate vs. USD". Crédit Agricole S.A. may

increase or decrease the Maximum Waterfall Tender Amount in its

sole discretion, subject to applicable law.

The Waterfall Offers are being

made upon and are subject to the terms and conditions set forth in

the Waterfall Offer to Purchase. The early participation date

for the Waterfall Offers is 8:00 a.m., New York City time/2:00

p.m., Central European time, on 30 May 2017 and the expiration date

for the Waterfall Offers is 11:59 p.m., New York City time, on 13

June 2017/5:59 a.m., Central European time, on 14 June 2017 (in

each case, subject to extension).

Tenders of notes pursuant to the Waterfall Offers may be validly

withdrawn at any time on or prior to 8:00 a.m., New York City

time/2:00 p.m. Central European time, on 30 May 2017 (subject to

extension).

For further details about the

terms and conditions of the Waterfall Offers and the procedures for

tendering notes in the Waterfall Offers, please refer to the

Waterfall Offer To Purchase.

Further

Information

Copies of the Any and All Offer to

Purchase, the Waterfall Offer to Purchase and other documentation

are available at http://gbsc-usa.com/Credit-Agricole/.

Questions and requests for assistance in

connection with the Offers may be directed to:

The Sole Structuring Bank and Sole Dealer Manager for the

Tender Offers

Crédit Agricole

Corporate and Investment Bank

12, place des Etats-Unis, CS

70052

92547 Montrouge Cedex

France

Attn: Liability Management

Tel: +44 207 214 5733

Email: liability.management@ca-cib.com

Credit Agricole Securities (USA)

Inc.

Attn: Debt Capital Markets/Liability Management

1301 Avenue of the Americas

New York, New York 10019

Collect: 212-261-7802

U.S. Toll Free: (866) 807-6030

Questions and requests for assistance

in connection with the tenders of Notes including requests for a

copy of the relevant Offer to Purchase may be directed to:

The Tender Agents and the Information Agents for the Tender

Offers

In respect of USD Notes

Global Bondholder Services

Corporation

65 Broadway - Suite 404

New York, New York 10006

Attn: Corporate Actions

Banks and Brokers call: (212) 430-3774

Toll free (866)-794-2200

By facsimile:

(For Eligible Institutions only):

(212) 430-3775/3779

Confirmation:

(212) 430-3774 |

In respect of GBP or EUR Notes

CACEIS Corporate Trust S.A.

1-3, Place Valhubert

75013 Paris

Attn: Charlotte HUGO

Tel: +33 (1) 57 78 34 10

Email: charlotte.hugo@caceis.com /

LD-F-CT-OST-MARCHE-PRIMAIR@caceis.com

|

Disclaimer

Holders must make

their own decision as to whether to tender any of their Notes

pursuant to the Tender Offers, and if so, the principal amount of

Notes to tender. Holders should consult their own tax,

accounting, financial and legal advisors as they deem appropriate

regarding the suitability of the tax, accounting, financial and

legal consequences of participating or declining to participate in

the Tender Offers.

This announcement

is not an offer to purchase or a solicitation of offers to sell any

securities.

This announcement

is not an invitation to participate in the Tender Offers. Such an

invitation will only be extended by means of documents (the Offers

to Purchase) that will be provided only to those investors to whom

such an invitation may be legally addressed. The distribution of

this announcement in certain countries may be prohibited by

law.

Offer

Restrictions

United Kingdom.

The communication of this announcement, the Offers

to Purchase and any other documents or materials relating to the

Tender Offers are not being made, and such documents and/or

materials have not been approved, by an authorised person for the

purposes of section 21 of the Financial Services and Markets Act

2000 (the "FSMA"). Accordingly, such documents

and/or materials are not being distributed to, and must not be

passed on to, the general public in the United Kingdom. The

communication of such documents and/or materials is exempt from the

restriction on financial promotions under section 21 of the FSMA on

the basis that it is only directed at and may be communicated to

(1) persons who have professional experience in matters relating to

investments, being investment professionals as defined in Article

19(5) of the Financial Services and Markets Act 2000 (Financial

Promotion) Order 2005 (the "FPO"); (2) persons

who fall within Article 49(2)(a) to (d) of the FPO ("high net worth

companies, unincorporated associations etc."); or (3) any other

persons to whom these documents and/or materials may lawfully be

communicated. Any investment or investment activity to which the

Offers to Purchase relate is available only to such persons or will

be engaged only with such persons and other persons should not rely

on it.

France. The Tender Offers are not

being made, directly or indirectly, to the public in the Republic

of France. Neither this announcement, the Offers to Purchase nor

any other documents or offering materials relating to the Tender

Offers have been or shall be distributed to the public in the

Republic of France and only (i) providers of investment services

relating to portfolio management for the account of third parties

(personnes fournissant le service d'investissement de gestion de

portefeuille pour compte de tiers) and/or (ii) qualified investors

(investisseurs qualifiés) acting for their own account, with the

exception of individuals, within the meaning ascribed to them in,

and in accordance with, Articles L.411-1, L.411-2 and D.411-1 of

the French Code monétaire et financier and applicable regulations

thereunder, are eligible to participate in the Tender Offers.

Neither this announcement, the Offers to Purchase nor any other

such offering material has been submitted for clearance to the

Autorité des marchés financiers.

Italy. None of the Tender

Offers, this announcement, the Offers to Purchase or any other

documents or materials relating to the Tender Offers have been or

will be submitted to the clearance procedure of the Commissione

Nazionale per le Società e la Borsa ("CONSOB")

pursuant to applicable Italian laws and regulations.

The Tender Offers

are being carried out in the Republic of Italy ("Italy") as exempted offers pursuant to Article 101-bis,

paragraph 3-bis of Legislative Decree No. 58 of February 24, 1998,

as amended (the "Consolidated Financial Act")

and article 35-bis, paragraph 4 of CONSOB Regulation No. 11971 of

May 14, 1999, as amended.

Holders or

beneficial owners of the Notes (as defined in the Offers to

Purchase) that are resident and/or located in Italy can tender the

Notes for purchase through authorized persons (such as investment

firms, banks or financial intermediaries permitted to conduct such

activities in Italy in accordance with the Consolidated Financial

Act, CONSOB Regulation No. 16190 of October 29, 2007, as amended,

and Legislative Decree No. 385 of September 1, 1993, as amended)

and in compliance with any other applicable laws and regulations

and with any requirements imposed by CONSOB or any other Italian

authority. Each intermediary must comply with the applicable

laws and regulations concerning information duties vis-à-vis its

clients in connection with the Notes or the Offers.

European Economic Area. In

any European Economic Area ("EEA") Member

State, this announcement and the Offers to Purchase are only

addressed to and is only directed at qualified investors in that

Member State within the meaning of Directive 2010/73/EU, together

with any applicable implementing measures in any Member State, the

"Prospectus Directive."

Press release ENG

This

announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: CREDIT AGRICOLE SA via Globenewswire

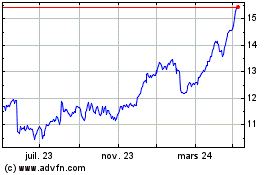

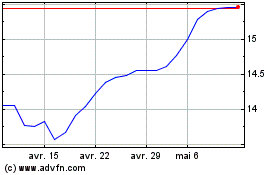

Credit Agricole (EU:ACA)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Credit Agricole (EU:ACA)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024