THIS ANNOUNCEMENT

IS FOR INFORMATION ONLY AND IS NOT AN OFFER TO PURCHASE OR A

SOLICITATION OF OFFERS TO SELL ANY SECURITIES.

Montrouge 15 May

2017

Crédit Agricole

S.A. Launches Tender Offers for Perpetual Notes

____________________

Crédit Agricole S.A. today

announced the launch of simultaneous tender offers to purchase for

cash six series of its outstanding perpetual notes:

-

An offer to purchase any and all of its two

series of outstanding notes listed in Table I below (the "Any and All Offers"); and

-

An offer to purchase up to EUR1.5bn euro

equivalent (less the euro equivalent of the amount purchased in the

Any and All Offers) (the "Maximum Waterfall Tender

Amount") in nominal amount of its four series of notes listed

in Table II below, subject to the Acceptance Priority Levels set

forth in Table II below (such offer, the "Waterfall Offers" and together with the Any and All

Offers, the "Tender Offers").

The Tender Offers are made upon

the terms and subject to the conditions set forth in the Offer to

Purchase dated 15 May 2017 relating to the Any and All Offers (the

"Any and All Offer to Purchase") and the Offer

to Purchase dated 15 May 2017 relating to the Waterfall Offers (the

"Waterfall Offer to Purchase" and together

with the Any and All Offer to Purchase, the "Offers to Purchase"). Capitalized terms

used in this announcement but not defined herein have the meanings

given to them in the related Offers to Purchase.

Copies of the Offers to Purchase

and other documentation are available at

http://gbsc-usa.com/Credit-Agricole/.

Context and rationale of the Offers

The purpose of the Tender Offers

is to allow Crédit Agricole S.A. and the Crédit Agricole Group to

optimize its capital base and debt management while offering

liquidity to investors, as described in the press release of 17

March 2017 announcing the contemplated Tender Offers.

Description of the Any and All Offers

Table I: Notes

subject to the Any and All Offers (the "Any and All Notes")

|

Title of Notes |

CUSIP / ISIN No. |

Principal Amount Outstanding |

Offer Price(1) |

| USD

6.637% Undated Deeply Subordinated Notes |

CUSIP:

225313AA3 (Rule 144A) / F22797FJ2 (Reg S)

ISIN:

US225313AA37 (Rule 144A) / USF22797FJ25 (Reg S) |

USD889,928,000 |

USD950.00 |

| EUR CMS

Floater Undated Deeply Subordinated Notes |

ISIN:

FR0010161026 |

EUR371,232,000 |

EUR780.00 |

(1) Per

USD1,000 or EUR1,000, as applicable, in principal amount of Any and

All Notes purchased pursuant to the Any and All Offers.

The Any and All Offers are being

made upon and are subject to the terms and conditions set forth in

the Any and All Offer to Purchase. The expiration date for

the Any and All Offers is 5:00 p.m., New York City time/11:00 p.m.,

Central European time, on 19 May 2017 (the "Any

and All Expiration Date") and the deadline for withdrawing

tenders in the Any and All Offers is 5:00 p.m., New York City

time/11:00 p.m., Central European time, on 19 May 2017 (in each

case subject to extension).

Subject to the terms of the Any

and All Offers and upon satisfaction or waiver of the conditions

set forth in the Any and All Offer To Purchase, Crédit Agricole

S.A. will purchase all Any and All Notes validly tendered and not

validly withdrawn.

The Offer Price for each series of

Any and All Notes subject to the Any and All Offers is set forth in

Table I above. In addition to the Offer Price, holders whose Any

and All Notes are accepted for purchase will also be eligible to

receive a cash payment representing accrued and unpaid interest

from, and including, the last interest payment date for the Any and

All Notes up to, but excluding, the Any and All Settlement Date (as

defined below). The "Any and All

Settlement Date" will occur promptly

following the Any and All Expiration Date and is expected to be on

or about 24 May 2017 (subject to extension). The Guaranteed

Delivery Settlement Date for Any and All Notes tendered using

guaranteed delivery procedures is expected to be on or about 24 May

2017 (subject to extension).

Crédit Agricole S.A.'s obligation

to accept for purchase and pay for validly tendered Any and All

Notes is subject to, and conditioned upon, satisfaction or waiver

of certain customary conditions described in the Any and All Offer

To Purchase.

For further details about the

terms and conditions of the Any and All Offers and the procedures

for tendering the Any and All Notes, please refer to the Any and

All Offer To Purchase.

Description of the Waterfall Offers

Table II: Notes

subject to the Waterfall Offers (the "Waterfall Notes")

|

Title of Notes |

CUSIP / ISIN No. |

Principal Amount Outstanding |

Acceptance Priority

Level |

Early Participation Amount(1) |

Reference Benchmark |

Bloomberg Reference Page/Screen |

Fixed Spread |

| GBP

7.589% Undated Deeply Subordinated Notes |

ISIN:

FR0010575654 |

GBP171,850,000 |

1 |

GBP30.00 |

4.75%

UK Treasury due 7 March 2020 |

DM02 |

+300bps |

GBP

8.125% Undated Deeply Subordinated Notes

|

ISIN:

FR0010814418 |

GBP291,050,000 |

2 |

GBP30.00 |

3.75%

UK Treasury due 7 September 2019 |

DM02 |

+235bps |

| USD

8.375% Undated Deeply Subordinated Notes |

CUSIP:

225313AB1 (Rule 144A) / F22797FK9 (Reg S)

ISIN:

US225313AB10 (Rule 144A) / USF22797FK97 (Reg S) |

USD1,000,000,000 |

3 |

USD30.00 |

1.250%

U.S. Treasury due 30 April 2019 |

FIT1 |

+200bps |

| EUR

7.875% Undated Deeply Subordinated Notes |

ISIN:

FR0010814434 |

EUR450,000,000 |

4 |

EUR30.00 |

Interpolated Mid-swap Rate |

ICAE1 |

+100bps |

(1) The

Waterfall Total Consideration (as defined below) payable for each

Waterfall Note will be a price per GBP1,000, USD1,000 or EUR1,000,

as applicable, in principal amount of such Waterfall Note validly

tendered at or prior to the Early Participation Date (as defined

below) and accepted for purchase by Crédit Agricole S.A., and will

include the Early Participation Amount.

The Waterfall Offers are being

made upon and are subject to the terms and conditions set forth in

the Waterfall Offer to Purchase. The early participation date

for the Waterfall Offers is 8:00 a.m., New York City time/2:00

p.m., Central European time, on 30 May 2017 (the "Early Participation Date") and the expiration date for

the Waterfall Offers is 11:59 p.m., New York City time, on 13 June

2017/5:59 a.m., Central European time, on 14 June 2017 (the

"Waterfall Expiration Date") (in each case,

subject to extension). Tenders of

Waterfall Notes pursuant to the Waterfall Offers may be validly

withdrawn at any time on or prior to 8:00 a.m., New York City

time/2:00 p.m. Central European time, on 30 May 2017 (subject to

extension).

Subject to the Maximum Waterfall

Tender Amount, the Acceptance Priority Levels set forth in Table II

above and proration, and other terms and conditions of the

Waterfall Offers and upon satisfaction or waiver of the conditions

set forth in the Waterfall Offer To Purchase, Crédit Agricole S.A.

will purchase all Waterfall Notes validly tendered and not validly

withdrawn. If the Waterfall Offers are oversubscribed, Waterfall

Notes will be accepted in accordance with their Acceptance Priority

Levels as set forth in Table II above, with 1 being the highest

Acceptance Priority Level and 4 being the lowest.

All Waterfall Notes validly

tendered and not validly withdrawn before the Early Participation

Date having a higher Acceptance Priority Level will be accepted

before any tendered Waterfall Notes having a lower Acceptance

Priority Level, and all Waterfall Notes validly tendered after the

Early Participation Date having a higher Acceptance Priority Level

will be accepted before any Waterfall Notes tendered after the

Early Participation Date having a lower Acceptance Priority Level.

However, Waterfall Notes validly tendered and not validly withdrawn

on or before the Early Participation Date will be accepted for

purchase in priority to other Waterfall Notes tendered after the

Early Participation Date even if such Waterfall Notes tendered

after the Early Participation Date have a higher Acceptance

Priority Level than Waterfall Notes tendered prior to the Early

Participation Date.

Holders of Waterfall Notes

accepted for purchase that are validly tendered and not validly

withdrawn at or prior to the Early Participation Date will be

eligible to receive the Waterfall Total Consideration (as defined

below) for their Waterfall Notes. Holders of Waterfall Notes

accepted for purchase that are validly tendered after the Early

Participation Date but at or prior to the Waterfall Expiration Date

will be eligible to receive an amount equal to the Waterfall Total

Consideration (as defined below) less the applicable Early

Participation Amount (the "Waterfall Tender

Consideration").

The "Waterfall Total Consideration" for

Waterfall Notes will be equal to an amount in the currency in which

the applicable Waterfall Notes are denominated that would reflect,

as of the Early Settlement Date, a yield to the applicable first

call date of such Waterfall Notes equal to the sum (annualized

where applicable) of the applicable reference yield plus the

applicable Fixed Spread as described in Table II and as described

more fully in the Waterfall Offer to Purchase. The Waterfall

Total Consideration also includes the Early Participation Amount

for the applicable series of Waterfall Notes shown in Table

II. The reference yields will be determined at 9:00 a.m., New

York City time/3:00 p.m., Central European time, on 31 May 2017,

subject to extension.

In addition to the Waterfall Total

Consideration or the Waterfall Tender Consideration, as applicable,

holders whose Waterfall Notes are accepted for purchase pursuant to

the Waterfall Offers will also be eligible to receive a cash

payment representing accrued and unpaid interest from, and

including, the last interest payment date for the Waterfall Notes

to, but excluding, the applicable settlement date.

The "Early

Settlement Date" for Waterfall Notes tendered on or prior to

the Early Participation Date is expected to be 2 June 2017.

The Final Settlement Date for the Waterfall Notes tendered after

the Early Participation Date and prior to the Waterfall Expiration

Date is expected to be on or about 16 June 2017.

For further details about the

terms and conditions of the Waterfall Offers and the procedures for

tendering Notes in the Waterfall Offers, please refer to the

Waterfall Offer To Purchase.

Further

Information

Questions and requests for assistance in

connection with the Offers may be directed to:

The Sole Structuring Bank and Sole Dealer Manager for the

Tender Offers

Crédit Agricole

Corporate and Investment Bank

12, place des Etats-Unis, CS

70052

92547 Montrouge Cedex

France

Attn: Liability Management

Tel: +44 207 214 5733

Email: liability.management@ca-cib.com

Credit Agricole Securities (USA)

Inc.

Attn: Debt Capital Markets/Liability Management

1301 Avenue of the Americas

New York, New York 10019

Collect: 212-261-7802

U.S. Toll Free: (866) 807-6030

Questions and requests for assistance

in connection with the tenders of Notes including requests for a

copy of the relevant Offer to Purchase may be directed to:

The Tender Agents and the Information Agents for the Tender

Offers

In respect of USD Notes

Global Bondholder Services

Corporation

65 Broadway - Suite 404

New York, New York 10006

Attn: Corporate Actions

Banks and Brokers call: (212) 430-3774

Toll free (866)-794-2200

By facsimile:

(For Eligible Institutions only):

(212) 430-3775/3779

Confirmation:

(212) 430-3774 |

In respect of GBP or EUR Notes

CACEIS Corporate Trust S.A.

1-3, Place Valhubert

75013 Paris

Attn: Charlotte HUGO

Tel: +33 (1) 57 78 34 10

Email: charlotte.hugo@caceis.com /

LD-F-CT-OST-MARCHE-PRIMAIR@caceis.com

|

Disclaimer

Holders must make

their own decision as to whether to tender any of their Notes

pursuant to the Tender Offers, and if so, the principal amount of

Notes to tender. Holders should consult their own tax,

accounting, financial and legal advisors as they deem appropriate

regarding the suitability of the tax, accounting, financial and

legal consequences of participating or declining to participate in

the Tender Offers.

This announcement

is not an offer to purchase or a solicitation of offers to sell any

securities.

This announcement

is not an invitation to participate in the Tender Offers. Such an

invitation will only be extended by means of documents (the Offers

to Purchase) that will be provided only to those investors to whom

such an invitation may be legally addressed. The distribution of

this announcement in certain countries may be prohibited by

law.

Offer

Restrictions

United Kingdom.

The communication of this announcement, the Offers

to Purchase and any other documents or materials relating to the

Tender Offers are not being made, and such documents and/or

materials have not been approved, by an authorised person for the

purposes of section 21 of the Financial Services and Markets Act

2000 (the "FSMA"). Accordingly, such documents

and/or materials are not being distributed to, and must not be

passed on to, the general public in the United Kingdom. The

communication of such documents and/or materials is exempt from the

restriction on financial promotions under section 21 of the FSMA on

the basis that it is only directed at and may be communicated to

(1) persons who have professional experience in matters relating to

investments, being investment professionals as defined in Article

19(5) of the Financial Services and Markets Act 2000 (Financial

Promotion) Order 2005 (the "FPO"); (2) persons

who fall within Article 49(2)(a) to (d) of the FPO ("high net worth

companies, unincorporated associations etc."); or (3) any other

persons to whom these documents and/or materials may lawfully be

communicated. Any investment or investment activity to which the

Offers to Purchase relate is available only to such persons or will

be engaged only with such persons and other persons should not rely

on it.

France. The Tender Offers are not

being made, directly or indirectly, to the public in the Republic

of France. Neither this announcement, the Offers to Purchase nor

any other documents or offering materials relating to the Tender

Offers have been or shall be distributed to the public in the

Republic of France and only (i) providers of investment services

relating to portfolio management for the account of third parties

(personnes fournissant le service d'investissement de gestion de

portefeuille pour compte de tiers) and/or (ii) qualified investors

(investisseurs qualifiés) acting for their own account, with the

exception of individuals, within the meaning ascribed to them in,

and in accordance with, Articles L.411-1, L.411-2 and D.411-1 of

the French Code monétaire et financier and applicable regulations

thereunder, are eligible to participate in the Tender Offers.

Neither this announcement, the Offers to Purchase nor any other

such offering material has been submitted for clearance to the

Autorité des marchés financiers.

Italy. None of the Tender

Offers, this announcement, the Offers to Purchase or any other

documents or materials relating to the Tender Offers have been or

will be submitted to the clearance procedure of the Commissione

Nazionale per le Società e la Borsa ("CONSOB")

pursuant to applicable Italian laws and regulations.

The Tender Offers

are being carried out in the Republic of Italy ("Italy") as exempted offers pursuant to Article 101-bis,

paragraph 3-bis of Legislative Decree No. 58 of February 24, 1998,

as amended (the "Consolidated Financial Act")

and article 35-bis, paragraph 4 of CONSOB Regulation No. 11971 of

May 14, 1999, as amended.

Holders or

beneficial owners of the Notes (as defined in the Offers to

Purchase) that are resident and/or located in Italy can tender the

Notes for purchase through authorized persons (such as investment

firms, banks or financial intermediaries permitted to conduct such

activities in Italy in accordance with the Consolidated Financial

Act, CONSOB Regulation No. 16190 of October 29, 2007, as amended,

and Legislative Decree No. 385 of September 1, 1993, as amended)

and in compliance with any other applicable laws and regulations

and with any requirements imposed by CONSOB or any other Italian

authority. Each intermediary must comply with the applicable

laws and regulations concerning information duties vis-à-vis its

clients in connection with the Notes or the Offers.

European Economic Area. In

any European Economic Area ("EEA") Member

State, this announcement and the Offers to Purchase are only

addressed to and is only directed at qualified investors in that

Member State within the meaning of Directive 2010/73/EU, together

with any applicable implementing measures in any Member State, the

"Prospectus Directive."

Press release ENG

This

announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: CREDIT AGRICOLE SA via Globenewswire

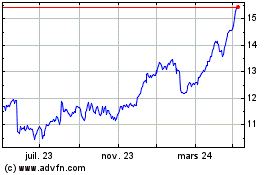

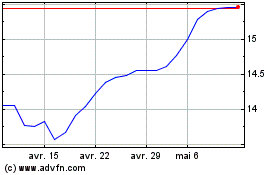

Credit Agricole (EU:ACA)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Credit Agricole (EU:ACA)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024