CREDIT AGRICOLE SA : Indosuez WM signs agreement for acquisition of CIC's private banking operations in Singapore and Hong K...

13 Juillet 2017 - 8:00AM

Paris, July 13th, 2017

Indosuez Wealth

Management signs agreement

for acquisition of Crédit Industriel et

Commercial's

private banking operations in Singapore and Hong Kong

Indosuez Wealth Management today

announced that it reached an agreement with Crédit Industriel et

Commercial to acquire the latter's private banking operations in

Singapore and Hong Kong after the parties entered exclusive

negotiations on 16th June

2017.

As part of the transaction,

Indosuez Wealth Management in Asia, chaired by Pierre Masclet, will

welcome CIC's private banking teams in Singapore and Hong Kong,

adding to the staff the group currently employs in Asia. After

completion of the transaction, Indosuez will have AUM of 14 billion

US dollars in Asia.

The acquisition is expected to

close by the end of this year and remains subject to both

regulatory approvals. Both parties are committed to ensuring a

smooth transition for colleagues, clients and partners.

The transaction is fully in line

with Crédit Agricole's Medium Term Plan "Strategic Ambition 2020",

which included targeted add-on acquisitions in Wealth management.

It will have a very limited impact on Crédit Agricole S.A.'s and

Crédit Agricole Group's Common Equity Tier 1 ratio, of less than 2

basis points.

The acquisition marks an important

step for Indosuez Wealth Management and its "Shaping Indosuez 2020"

corporate project as it enhances the firm's global footprint by

adding a well-respected business in a strategically important

market. Asia is the fastest growing region in the world for wealth

management with an expected 10% annual growth in the coming years.

In 5 years, Asia's weight in global private banking AUM worldwide

will be above Europe's and probably constitute the largest pool of

wealth globally.

Paul de Leusse, Chief Executive

Officer of Indosuez Wealth Management, commented: "We are delighted

that we were able to reach an agreement with Crédit Industriel et

Commercial to acquire its highly-rated private banking business in

a market that is one of our core growth regions. On behalf of

Indosuez I would like to welcome our new colleagues and I look

forward to working closely with them to continue to deliver

best-in-class services and meeting the highest compliance standards

for the benefit of our clients."

Pierre Masclet, Chief Executive

Officer of Indosuez Wealth Management Asia, added: "Indosuez has a

long-standing presence in this market, having set up in Hong Kong

in 1894 and in Singapore in 1905. The addition of CIC's private

banking operations in these markets further cements our commitment

for the future in the region."

For further

information, please contact:

Indosuez Wealth

Management Group

Julie de La Palme, Acting as Communication

Director

julie.delapalme@ca-indosuez.fr

+33 1 4075 6570

Melinda Raverdy, Media Relations

melinda.raverdy@ca-indosuez.ch

+41 58 321 9597

PR agency,

FinElk

Teresa Wincrantz,

FinElk

teresa.wincrantz@finelk.eu

+44 759 505 5877

About Indosuez

Wealth Management in Asia

Indosuez Wealth Management has a solid foundation in Asia as a

pioneering bank with more than a century old heritage, when Banque

de l'Indochine opened its historic offices in Hong Kong and

Singapore. From these two locations, branches of

CA Indosuez (Switzerland) SA, almost 220 highly specialised wealth

managers combine their knowledge of the region with the vast

opportunities provided by the global network of Indosuez Wealth

Management and the Crédit Agricole Group.

About Indosuez

Wealth Management group

Indosuez Wealth Management is the global wealth management brand of

Crédit Agricole Group, ranked 11th in the world based on Tier 1

capital (source: The Banker, July 2016). Shaped by 140 years of

experience helping families and entrepreneurs around the globe,

Indosuez Wealth Management offers a tailored approach that enables

clients to manage, protect and pass on their wealth according to

their specific needs. Its teams take a comprehensive view and

provide expert advice and exceptional service, offering a wide

range of services for the management of both personal and business

assets. Renowned for its international reach combined with a human

scale, Indosuez Wealth Management has 2,800 employees in 14

countries around the world, in Europe (France, Belgium, Spain,

Italy, Luxembourg, Monaco and Switzerland), Asia-Pacific (Hong

Kong, Singapore and New Caledonia), the Middle East (Abu Dhabi,

Dubai and Lebanon) and the Americas (Brazil, Uruguay and Miami).

With €110 billion in assets under management (as at 31/12/2016),

Indosuez Wealth Management group is one of the global leaders in

wealth management.

www.ca-indosuez.com

PR Indosuez acquisition 13 07

2017

This

announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: CREDIT AGRICOLE SA via Globenewswire

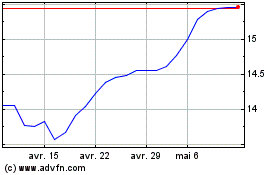

Credit Agricole (EU:ACA)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

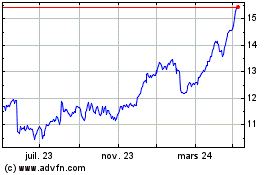

Credit Agricole (EU:ACA)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024