CREDIT AGRICOLE SA : Press Release / Montrouge, 1st august 2017

01 Août 2017 - 7:30PM

| Montrouge, 1st august

2017 |

With reference to the preliminary

discussions started at the end of April 2017 concerning the

possible acquisition of Cassa di Risparmio di Cesena, Cassa di

Risparmio di Rimini and Cassa di Risparmio di San Miniato, Crédit

Agricole S.A. informs that on the date hereof its Italian

subsidiary Crédit Agricole Cariparma S.p.A. («CA Cariparma»), at

the expiry of the term set up for the conclusion of such

preliminary discussions and following the due diligence activities

carried out by the same, confirmed to the Fondo Interbancario di

Tutela dei Depositi - sezione Schema Volontario («FITD») its

interest in the transaction and the strategic rationale that it has

in order to achieve the targets of growth of the Crédit Agricole

Group in Italy.

The profitable discussions held

during these months of intense work with the FITD, the target banks

and all the institutions involved, in a context of constructive

spirit and full cooperation and mutual commitment, allowed to

identify a transaction structure aimed at preserving the

prerequisites and conditions that Crédit Agricole Cariparma has

indicated, since the beginning, as essential to render the

transaction sustainable from an equity and economic standpoint for

the Crédit Agricole Group.

In this context, Crédit Agricole

has renewed through its subsidiary CA Cariparma and until 15

September 2017 its interest in pursuing the transaction. The above

prerequisites and conditions will have to be confirmed by such

date, in particular with reference to the securitization of the

target banks' non performing exposures and the approval by the

General Assembly meeting of the members of the FITD of the increase

of resources necessary to carry out the proposed transaction.

Crédit Agricole S.A. believes in

the positive outcome of such plan and, therefore, in the favorable

conclusion of the transaction, reminding that it will, inter alia,

allow the target banks to protect the depositors and to benefit

from the integration in an international banking group, with

significant impacts on the economic situation of the relevant

territories and of the different stakeholders involved.

The transaction will be anyway

subject to the authorization by the competent regulatory and

antitrust authorities.

CRÉDIT

AGRICOLE S.A. PRESS CONTACT

Charlotte de

Chavagnac + 33 1 57

72 11

17

charlotte.dechavagnac@credit-agricole-sa.fr

Alexandre

Barat

+ 33 1 43 23 07

31

alexandre.barat@credit-agricole-sa.fr

Find our press release on: www.credit-agricole.com

- www.creditagricole.info

| |

Crédit_Agricole |

|

Groupe Crédit

Agricole |

|

créditagricole_sa |

UK 01 08 17 Press

release.pdf

This

announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: CREDIT AGRICOLE SA via Globenewswire

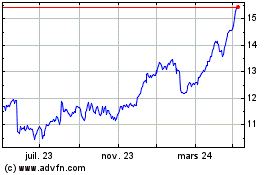

Credit Agricole (EU:ACA)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

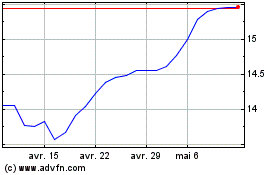

Credit Agricole (EU:ACA)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024