Canadian Dollar Climbs Amid Rising Oil Prices

02 Octobre 2015 - 6:43AM

RTTF2

The Canadian dollar drifted higher against most major rivals in

European deals on Friday, as oil prices rebounded ahead of U.S.

jobs data for September later in the day, while air strikes in

Syria weighed.

Crude for November delivery rose $0.70 to $45.44 a barrel.

The U.S. Labor Department report is expected to show an increase

of about 203,000 jobs in September following the addition of

173,000 jobs in August. The rate of unemployment is expected to

remain at 5.1 percent.

The jobs data is likely to offer more clues about the strength

of labour, as well as a potential rate hike in U.S.

In Syria, U.S. and Russia are conducting air strikes, with the

White House alleging Russian interference as "indiscriminate." Iran

officially announced its support for the Russian military campaign

in Syria with the foreign ministry saying Moscow is "fighting

terrorism" there. French President Francois Hollande will meet his

Russian counterpart, Vladimir Putin, in Paris today.

The currency has been trading in a positive territory in the

Asian session.

In early European deals, the loonie edged up to 1.3225 against

the greenback, up by 0.31 percent from Thursday's closing value of

1.3266. The loonie is likely to target 1.30 as next resistance

level.

The loonie appreciated by 0.55 percent to a weekly high of 90.84

versus the yen, compared to 90.37 hit late New York Thursday. If

the loonie continues rise, it may locate resistance around the

92.00 region.

The loonie advanced to a session's high of 1.4762 against the

euro, from yesterday's closing value of 1.4850. The loonie is seen

finding resistance around the 1.46 mark.

On the flip side, the loonie reversed from an early 8-day high

of 0.9283 against the aussie, easing to 0.9329 around 2:30 am ET.

The pair was steady since then.

Looking ahead, Eurozone PPI for August is due to be released

shortly.

In the New York session, U.S. jobs data for September and

factory orders for August are slated for release.

At 8:45 am ET, Federal Reserve Bank of Philadelphia President

Patrick Harker is scheduled to give opening remarks before the "New

Perspectives on Consumer Behavior in Credit and Payments Markets"

conference hosted by the Federal Reserve Bank of Philadelphia.

Half-an-hour later, Federal Reserve Bank of St. Louis President

James Bullard is expected to speak on the economy and monetary

policy before a Shadow Open Market Committee meeting hosted by the

Manhattan Institute for Policy Research, in New York.

At 1:30 pm ET, Federal Reserve Bank of Boston President Eric

Rosengren will give welcome and opening remarks before the "Macro

Prudential Monetary Policy" conference hosted by the Federal

Reserve Bank of Boston. Additionally, Federal Reserve Governor

Stanley Fischer is expected to speak at the conference.

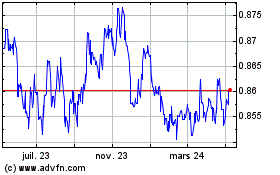

Euro vs Sterling (FX:EURGBP)

Graphique Historique de la Devise

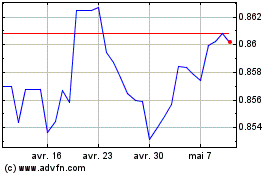

De Mar 2024 à Avr 2024

Euro vs Sterling (FX:EURGBP)

Graphique Historique de la Devise

De Avr 2023 à Avr 2024