Canadian Dollar Declines As Oil Prices Fall

21 Avril 2015 - 4:40PM

RTTF2

The Canadian dollar slipped against its major rivals in New York

deals on Tuesday, as oil prices fell on profit taking.

Crude for June delivery declined $0.37 to $57.53 a barrel.

The American Petroleum Institute, an industry group, will

release its weekly inventory data later Tuesday. Official data from

the U.S. Energy Information Administration is due Wednesday.

Meanwhile, escalation of civil war in Yemen arose concerns about

possible supply disruption from the Persian Gulf. Saudi has been

conducting air strikes against Iran-allied Houthi rebels in

neighbouring Yemen since March 26, in order to reinstate Hadi's

government into power.

In economic news, data from Statistics Canada showed that

Canada's wholesale sales declined for a second consecutive month in

February, decreasing 0.4 percent to C$53.6 billion, their lowest

level in six months. The January reading was revised up to -2.9

percent.

Economists were expecting an increase of 0.5 percent.

The loonie was higher against the yen, greenback and the euro in

European trading. Against the aussie, the loonie extended fall.

The loonie fell back to a 5-day low of 1.2296 against the

greenback, reversing from an early high of 1.2213. The next

possible support for the loonie may be located around the 1.25

mark.

The loonie dropped to 0.9488 against the aussie, off early high

of 0.9417. If the loonie continues decline, 0.97 is possibly seen

as its next support level.

After climbing to a 4-day high of 1.3056 against the euro at

5:00 am ET, the loonie reversed direction with pair trading at

1.3120. The loonie is likely to find support near the 1.35

area.

The loonie pared gains to 97.34 against the yen, from an early

high of 97.74. Further weakness may take the loonie to a support

around the 95.00 region.

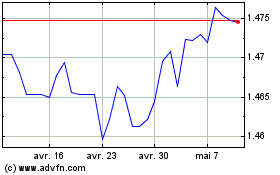

Euro vs CAD (FX:EURCAD)

Graphique Historique de la Devise

De Mar 2024 à Avr 2024

Euro vs CAD (FX:EURCAD)

Graphique Historique de la Devise

De Avr 2023 à Avr 2024