Canadian Dollar Drops Amid Falling Oil Prices

24 Octobre 2016 - 10:29AM

RTTF2

The Canadian dollar traded lower against its major counterparts

in European deals on Monday, as oil prices declined after Iraq

refused to join the OPEC's proposed plan to slash oil production

and the U.S. oil rig count increased for the fifth-straight

week.

Crude for December delivery fell $0.36 to $50.49 per barrel.

Iraqi oil minister Jabber Al-Luaibi on Sunday asked OPEC for an

exemption from contributing to production cuts, as the nation is

waging war against Islamic militants.

OPEC will meet later this month to find out the details of

market share of crude oil to be allowed to pump by members, in

order to implement an accord at meeting in November.

Data from the industry provider Baker Hughes showed that the

number of active U.S. oil rigs totaled 443 in the week ended

October 21, up by 11 from the prior week.

Canada's consumer prices in grew less than expected last month

and retail sales fell unexpectedly in August, separate reports

showed last week, raising expectations for a rate cut by the Bank

of Canada.

The currency has been trading lower against its key

counterparts, except the Japanese yen, in the Asian session.

The loonie pared gains to 77.84 against the Japanese yen, from

an early high of 77.98. Continuation of the loonie's downtrend may

see it challenging support around the 75.5 mark.

Survey figures from IHS Markit showed Japan's manufacturing

activity expanded at the fastest pace in nine months in

October.

The Nikkei Flash Manufacturing Purchasing Managers' Index, or

PMI, rose to 51.7 in October from 50.4 in September.

The loonie fell back to 1.3356 against the greenback, heading to

violate its early more than 7-month low of 1.3360. If the loonie

extends slide, 1.35 is likely seen as its next support level.

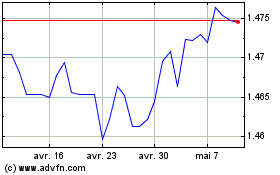

The loonie slipped to a 4-day low of 1.4544 against the euro,

off its previous high of 1.4492. The loonie is seen finding support

around the 1.465 region.

Flash survey from IHS Markit showed Eurozone private sector

expanded at the fastest pace in ten months in October

The composite output index climbed to 53.7 in October from 52.6

in September. It was forecast to increase slightly to 52.8.

The loonie held steady against the aussie, after sliding to more

than a 2-year low of 1.0192 at 4:30 am ET. Further downtrend may

take the loonie to a support near the 1.03 region.

Looking ahead, Canada wholesale sales for August are set for

release at 8:30 am ET.

At 9:00 am ET, the Federal Reserve Bank of New York President

William Dudley will deliver opening remarks at the Federal Bank of

New York Annual Conference.

Subsequently, Federal Reserve Bank of St. Louis President James

Bullard speaks about the economy and monetary policy at the

Association for University Business and Economic Research in

Arkansas.

Markit's U.S. flash manufacturing PMI for October will be out at

9:45 am ET.

The Bank of Canada Governor Stephen Poloz, will testify along

with Senior Deputy Governor Carolyn Wilkins before the House of

Commons Standing Committee on Finance in Ottawa at 3:30 pm ET.

Euro vs CAD (FX:EURCAD)

Graphique Historique de la Devise

De Mar 2024 à Avr 2024

Euro vs CAD (FX:EURCAD)

Graphique Historique de la Devise

De Avr 2023 à Avr 2024