Quarterly Financial Information as of September

30, 2016

IFRS - Regulated Information - Not Audited

Cegedim: robust revenue growth

continued in third quarter 2016, and the decline in EBITDA

slowed

-

Revenue up 4.9% like for like in Q3 2016

-

Margins temporarily pinched by investments and

the start of operations with BPO clients

-

Positive net income of €3.4 million compared

with a loss a year ago

-

2016 revenue target revised upward and 2016

EBITDA target maintained

|

Disclaimer: Pursuant to IAS 17 as it applies to

Cegelease's activities, leases are now classified as financial

leases, resulting in an adjustment to the quarterly 2015 figures

published in 2015. Readers should refer to the last annexes of this

press release for full details of the adjustments. All of the

figures in this press release reflect the adjustments. Furthermore,

the consolidated data presented in this press release relate to

continuing activities, unless otherwise mentioned. |

| Conference CALL ON November 29, 2016, at 6:15pm

cet |

| FR : +33 1 70 77 09 44 |

USA : +1 866 907 5928 |

UK : +44 (0)20 3367 9453 |

No access code required |

| |

|

|

|

Boulogne-Billancourt, November

29, 2016

Cegedim, an

innovative technology and services company, posted consolidated

first nine months of 2016 revenues of €318.3 million, up 3.7% on a

reported basis and 4.0% like for like compared with the same period

in 2015. EBITDA came to €40.6 million in first nine months of 2016,

down 22.4% year on year.

In the third quarter 2016, revenues came to €102.8

million, up 2.6% on a reported basis and 4.9% like for like. The Q3

2016 EBITDA came to €14.9 million, down 13.4% year on year.

The revamp of the business model

continues and will allow Cegedim to enjoy

greater customer loyalty, closer client relationships, simpler

operating processes, more robust offerings and stronger geographic

positions. The changes now under way will also boost the share of

recurring revenues, improve sales growth and predictability, and

enhance the Group's profitability. Profitability has been

negatively affected during this business model transition.

Cegedim expects to begin seeing the initial

positive impact of its investments, reorganizations and

transformations in 2017, with a full impact in 2018.

As proof that its clients see the

relevance of its new strategy, Cegedim is

revising its 2016 revenue target upward once again, and reiterates

its 2016 EBITDA target. However, there is a chance that recently

signed BPO contracts could negatively affect profitability in the

fourth quarter of 2016, since related revenues will not be

recognized until 2017.

Simplified income

statement

| |

9M 2016 |

9M 2015 |

Chg. |

| |

In €m |

In % |

In €m |

In % |

In % |

| Revenue |

318.3 |

100.0% |

306.9 |

100.0% |

+3.7% |

| EBITDA |

40.6 |

12.7% |

52.3 |

17.0% |

(22.4)% |

|

Depreciation |

(25.3) |

- |

(22.4) |

- |

+12.7% |

| EBIT before special items |

15.3 |

4.8% |

29.9 |

9.7% |

(48.9)% |

| Special

items |

(5.7) |

- |

(5.0) |

- |

+14.3% |

| EBIT |

9.6 |

3.0% |

24.8 |

8.1% |

(61.6)% |

| Cost of net

financial debt |

(25.2) |

- |

(32.7) |

- |

(22.9)% |

| Tax

expenses |

(1.4) |

- |

(2.5) |

- |

(42.8)% |

| Consolidated profit from continuing activities |

(15.5) |

(4.9)% |

(9.0) |

(2.9)% |

(72.9)% |

| Net

earnings from activities held for sale |

(1.2) |

- |

32.2 |

- |

n.m. |

| Profit

attributable to the owners of the parent |

(16.8) |

(5.3)% |

23.2 |

7.6% |

n.m. |

| EPS before

special items |

(0.7) |

- |

(0.3) |

- |

(146.4)% |

Over the third quarter of 2016,

Cegedim posted consolidated revenues of €102.8

million, up 2.6% on a reported basis. Excluding an unfavorable

currency translation effect of 2.3%, revenues rose 4.9%. There were

no disposals or acquisitions. In like-for-like terms the Health Insurance, HR and e-services division's revenues

rose by 9.5%, whereas the Healthcare professionals division's revenues fell by 0.7%.

In the first nine months of 2016,

Cegedim posted consolidated revenues of €318.3

million, up 3.7% on a reported basis. Excluding an unfavorable

currency translation effect of 1.4% and a 1.1% boost from

acquisitions, revenues rose 4.0%. In like-for-like terms the

Health Insurance,

HR and e-services

division's revenues rose by 9.5%, whereas the Healthcare professionals

division's revenues fell by 2.3%.

EBITDA

declined by €11.7 million, or 22.4%, to €40.6 million. The

first-nine month's margin fell to 12.7% from 17.0% a year earlier.

The EBITDA trend was attributable to investments made in human

resources and innovation in order to speed up the transition of

software products to cloud-based formats and swiftly roll out the

Group's new BPO offerings. It is worth noting that more than 80% of

this decline occurred during the first half of 2016.

Depreciation

charges rose €2.9 million, from €22.4 million for the first

nine months of 2015 to €25.3 million for the first nine months of

2016. Amortization of R&D expenses over the period amounted to

1.0 million.

EBIT from

recurring operations fell €14.6 million over the first nine

months of 2016, or 48.9%, to €15.3 million. The margin fell from

9.7% for the first nine months of 2015 to 4.8% for the first nine

months of 2016.

Special items

amounted to a €5.7 million charge over the first nine months of

2016 compared with a €5.0 million charge a year earlier. The

increase was chiefly due to the increase in restructuring costs due

to the implementation of new organizational structures.

The net cost of

financial debt amounted to €25.2 million over the first nine

months of 2016 compared to €32.7 million for the first months of

2015, a decrease of €7.5 million, or 22.9%. It represented 7.9% of

first nine months 2016 revenues, compared with 10.7% of first nine

months 2015 revenues. This decline reflects lower interest expenses

in the second and third quarters as a result of the debt

restructuring carried out in January and March 2016.

Tax amounted

to €1.4 million for the first nine months of 2016, compared with

€2.5 million for the first nine months of 2015, a decrease of €1.1

million, or 42.8%. This was chiefly due to the lack of corporate

income tax.

Thus, the consolidated net result from continuing activities came

to a loss of €15.5 million at end-September 2016, compared with a

loss of €9.0 million in the year-earlier period. Earnings per share before special items came to loss of

€0.7 at end of September 2016, compared with a €0.3 loss a year

earlier. Note that consolidated net result from

continuing activities came to €3.4million profit in the third

quarter, compared with a €0.7 million loss a year earlier.

Analysis of business trends by

division

| |

|

Revenue |

|

EBIT

before special items |

|

EBITDA |

| In €m |

|

9M 2016 |

9M 2015 |

|

9M 2016 |

9M 2015 |

|

9M 2016 |

9M 2015 |

| Health

Insurance, HR and e-services |

|

185.2 |

166.2 |

|

15.4 |

18.0 |

|

26.8 |

29.9 |

|

Healthcare Professionals |

|

130.8 |

138.0 |

|

2.3 |

13.3 |

|

12.1 |

21.8 |

|

Activities not allocated |

|

2.3 |

2.8 |

|

(2.4) |

(1.4) |

|

1.6 |

0.6 |

| Cegedim |

|

318.3 |

306.9 |

|

15.3 |

29.9 |

|

40.6 |

52.3 |

Over the first

nine months of 2016, division revenues came to €185.2 million, up

11.4% on a reported basis. The July 2015 acquisition of Activus in

the UK made a positive contribution of 2.0%. Currencies had

virtually no impact. Like-for-like revenues rose 9.5% over the

period.

The Health

insurance, HR and e-services division

represented 58.2% of consolidated revenues from continuing

activities, compared with 54.1% over the same period a year

earlier.

The division's Q3 2016 revenues came to €60.6

million, up 9.3% on a reported basis. There were no disposals or

acquisitions. Currencies had virtually no impact. Like-for-like

revenues rose 9.5% over the period:

This significant revenue growth

over the first nine months of 2016 was chiefly attributable to:

-

Cegedim Insurance

Solutions, driven by double-digit growth in its iGestion BPO activities and a brisk increase in

third-party payment processing. The start of operations with new

clients allowed the software and services business for the personal

insurance segment to more than offset the effects of switching over

to the cloud.

-

Double-digit growth at Cegedim

e-business following the start of operations with new clients

on its Global Information Services SaaS

platform for digital data exchanges, including payment

platforms.

-

The start of operations with numerous clients on

the Cegedim SRH SaaS platform for human

resources management, resulting in double-digit revenue

growth.

Over the first

nine months of 2016, division EBITDA came to €26.8 million, down

€3.1 million, or 10.4%. The EBITDA margin came to 14.5%, vs. 18.0%

a year earlier.

In the third quarter of 2016, division EBITDA came

€9.0 million, slightly down €0.2 million, or 2.1%. The EBITDA

margin came to 14.8%, vs. 16.6% a year earlier.

The decline in EBITDA took place

almost entirely in the first half of 2016, as third-quarter EBITDA

was virtually stable. The decline in the first half was chiefly the

result of:

-

The start of operations with BPO clients for

iGestion and Cegedim

e-business;

-

Cegedim Insurance Solutions

switching its core products over to SaaS format, the start of

operations with numerous new clients, and the start of new projects

for existing clients;

-

A difference in the timing of promotional

campaigns in the first half of 2016 compared to 2015 for RNP;

The impact was partially offset by

Cegedim SRH's fine performance in processing

third-party payment flows

Over the first

nine months of 2016, division revenues came to €130.8 million, down

5.2% on a reported basis. Currency effects made a negative

contribution of 2.9%. There was no impact from acquisitions or

divestments. Like-for-like revenues fell 2.3% over the

period.

The Healthcare professionals division

represented 41.1% of consolidated revenues from continuing

activities, compared with 45.0% over the same period a year

earlier.

The division's Q3 2016 revenues came to €41.5

million, down 5.6% on a reported basis. Currency effects made a

negative contribution of 4.9%. There was no impact from

acquisitions or divestments. Like-for-like revenues fell 0.7% over

the period.

The decline in revenues over the

first nine months of 2016 was mainly due to the following:

-

A slowing in the UK doctor computerization

business in anticipation of the early-2017 launch of a cloud-based

offering. Marketing for that offering should restore sales

momentum;

-

The September 2016 release in France of the new

Smart Rx offering - a comprehensive pharmacy

management solution built around a hybrid architecture that

combines local and cloud-based computing. The new solution allows

networks amongst individual pharmacies and links with healthcare

professionals. Thus, revenues at the French pharmacy business are

likely to resume their growth in the next few months.

-

The negative short-term impact of switching

Belgian doctors over to SaaS format.

These performances were offset

mainly by a double-digit growth:

-

At Pulse, driven by the RCM

and EHR activities.

-

In offerings for physical therapists and nurses

in France.

Over the first

nine months of 2016, division EBITDA came to €12.1 million, down

€9.6 million, or 44.3%. The EBITDA margin came to 9.3%, vs. 15.8% a

year earlier.

In the third quarter of 2016, division EBITDA came

€4.7 million, slightly down €2.9 million, or 38.2%. The EBITDA

margin came to 11.4%, vs. 17.3% a year earlier.

The decline in EBITDA was chiefly

attributable to investments made to ensure future growth. The Group

was chiefly penalized by the investments it made in:

-

France, to develop the new hybrid offering for

pharmacies;

-

The US, focusing on Revenue Cycle Management

(RCM) activities and SaaS electronic health records (EHR);

-

The UK, where it aims to have a cloud-based

offering for UK doctors in 2017

EBITDA felt a pinch in the short

term from efforts to switch Belgian doctors over to SaaS format and

reorganize the business in the US.

Over the first

nine months of 2016, division revenues came to €2.3 million, down 15.4% on a reported basis and like for

like. There were no currency effects and no acquisitions or

divestments.

The Activities not allocated division represented 0.7% of consolidated revenues from

continuing activities, compared with 0.9% over the same period a

year earlier.

The division's Q3

2016 revenues came to €0.8 million, down 8.7%

on a reported basis and like for like. There were no currency

effects and no acquisitions or divestments.

This trend reflects the return to

a normal level of billing.

Over the first

nine months of 2016, division EBITDA came to €1.6 million, up €1.0

million. In the third quarter of 2016, division EBITDA came €1.2

million, up €0.8 million.

Financial resources

Cegedim's

consolidated total balance sheet amounted to €659.9 million, at

September 30, 2016,

Acquisition

goodwill represented €183.8 million at September 30, 2016,

compared with €188.5 million at end-2015. The €4.7 million

decrease, equal to 2.5%, was mainly attributable to the euro's

appreciation against the British pound, for a total of €4.8

million. Acquisition goodwill represented 27.9% of the total

balance sheet at September 30, 2016, compared with 21.8% on

December 31, 2015.

Cash and

equivalents came to €9.1 million at September 30, 2016, a

decrease of €222.2 million compared with December 31, 2015. The

drop was principally due to the early redemption of the 2020 bond

for a nominal value of €340.1 million, payment of a €15.9 million

early redemption premium, and an €9.8 million deterioration in WCR,

partly offset by drawing €169.0 million from the €200 million

revolving credit facility. Cash and equivalents represented 1.4% of

the total balance sheet at September 30, 2016, compared with 26.8%

at December 31, 2015.

Shareholders'

equity fell by €32.7 million, i.e. 14.3%, to €195.4 million at

September 30, 2016, compared with €228.1 million at December

31, 2015. Shareholders' equity represented 29.6% of the total

balance sheet at end-September 2016, compared with 26.4% at

end-December 2015.

Net financial

debt amounted to €215.6 million at end-September 2016, up €48.0

million compared with end-December 2015. It represented 110.3%

of Group shareholders' equity at September 30, 2016.

Before the net

cost of financial debt and taxes, cash flow was €44.6 million

at September 30, 2016, compared with €51.5 million at

September 30, 2015.

Highlights

Apart from the items cited below,

to the best of the company's knowledge, there were no events or

changes during the period that would materially alter the Group's

financial situation.

In January 2016, the Group took

out a new five-year revolving credit facility (RCF) of €200

million. The applicable interest rate for this credit facility is

Euribor plus a margin. The Euribor rate can be the 1-, 3- or 6-

month rate; if Euribor is below zero, it will be deemed to be equal

to zero. The margin can range from 0.70% to 1.40% depending on the

leverage ratio calculated semi-annually in June and December (Refer

to point 2.4.1.1 on page 14 of the Q2-2016 Quarterly Financial

Report).

On April 1, 2016, Cegedim exercised its call option on the entire 6.75%

2020 bond with ISIN code XS0906984272 and XS0906984355, for a total

principal amount of €314,814,000.00 and a price of 105.0625%, i.e.

a total premium of €15,937,458.75. The company then cancelled these

securities. The transaction was financed by drawing a portion of

the RCF obtained in January 2016 and using the proceeds of the sale

to IMS Health. Following this transaction, the Group's debt

comprised the €45.1 million FCB subordinated loan, the partially

drawn €200 million RCF, and overdraft facilities.

After Cegedim

announced that it would redeem the entire 6.75% 2020 bond, rating

agency Standard and Poor's raised the company's rating on April 28,

2016, to BB with a positive outlook.

Significant post-closing

transactions and events

Apart from the items cited below,

to the best of the company's knowledge, there were no events or

changes during the period that would materially alter the Group's

financial situation.

Cegedim

announced on November 2, 2016, that it has signed a heads of

agreement to acquire Futuramedia Group. This

deal will strengthen the digital offerings of its subsidiary

RNP, which specializes in pharmacy displays in

France.

Last year Futuramedia Group generated revenues of around €5.4

million. It will have an accretive impact on Cegedim Group's margins and will begin contributing to

the Group's consolidation scope from December 1, 2016.

The Kadrige business was sold to

IMS Health on November 9, 2016.

Outlook

Cegedim is revising upward its

target for 2016 revenues and maintained it 2016 EBITDA target,

despite economic uncertainty and a challenging geopolitical

environment. Thus for the full year 2016, Cegedim expects:

-

Like-for-like revenue growth of 4% instead of at

least 3% before.

-

EBITDA down by €10 million relative to 2015.

However, the signing of a significant BPO contracts in third

quarter 2016 could have an impact on Group profitability in fourth

quarter 2016, because revenues related to the contract will not be

booked until 2017.

Cegedim expects to begin seeing

the initial positive impact of its investments, reorganizations and

transformations in 2017, with a full impact in 2018.

In 2016, the Group acquired

Futuramedia. It currently has no plans for further significant

acquisitions. Lastly, the Group does not communicate earnings

estimates or forecasts.

In 2015, the UK accounted for

15.1% of consolidated Group revenues and 19.2% of consolidated

Group EBIT.

Cegedim deals in local currency in

the UK, as it does in every country where it is present. Thus,

Brexit is unlikely to have a material impact on Group EBIT.

With regard to healthcare policy,

the Group has not identified any major European programs at work in

the UK and expects UK policy to be only marginally affected by

Brexit.

Starting in 2017, Cegedim will

only publish half-year and annual results. It will, however,

continue to publish quarterly revenues.

The figures cited above include

guidance on Cegedim's future financial performances. This

forward-looking information is based on the opinions and

assumptions of the Group's senior management at the time this press

release is issued and naturally entails risks and uncertainty. For

more information on the risks facing Cegedim, please refer to

points 2.4, "Risk factors and insurance", and 3.7, "Outlook", of

the 2015 Registration Document filed with the AMF on March 31,

2016, as well as point 2.4, "Risk factors", of the Interim

Financial Report of Q3 2016.

| |

December 14, 2016, at 1:30pm

January 26, 2017, after market

closing

March 22, 2017, after market closing

March 23, 2017, at 10:00am CET

April 27, 2017, after market closing |

7th Investor

Day

Full year 2016 revenue

Full year 2016 earnings

Analyst meeting (SFAF meeting)

Q1 2017 revenues |

Financial calendar

| November 29, 2016, at

6:15pm (Paris time) |

The Group

will hold a conference call hosted by Jan Eryk Umiastowski, Cegedim

Chief Investment Officer and Head of Investor Relations.

The Q3 2016 earnings presentation is available at:

The website:

http://www.cegedim.fr/finance/documentation/Pages/presentations.aspx

The Group's financial communications app, Cegedim IR. To download

the app, visit:

http://www.cegedim.fr/finance/profil/Pages/CegedimIR.aspx |

| Contact numbers: |

France: +33 1 70 77 09 44

United States: +1 866 907 5928

UK and others: +44 (0)20 3367 9453 |

No access code required |

Informations

additionnelles

| The Audit

Committee met on November 25, 2016, and the Board of Directors met

on November 29, 2016, to review the Q3 2016 consolidated financial

statements. |

| |

The interim financial report for Q3 2016 is

available:

In French:

http://www.cegedim.fr/finance/documentation/Pages/rapports.aspx

In English:

http://www.cegedim.com/finance/documentation/Pages/reports.aspx

To download the app, visit

http://www.cegedim.fr/finance/profil/Pages/CegedimIR.aspx. |

Appendices

Balance sheet as September 30,

2016

| In

thousands of euros |

09.30.2016 |

12.31.2015(1) |

| Goodwill on acquisition |

183,814 |

188,548 |

|

Development costs |

38,719 |

16,923 |

| Other

intangible fixed assets |

96,157 |

108,166 |

| Intangible fixed assets |

134,876 |

125,089 |

|

Property |

459 |

459 |

|

Buildings |

4,824 |

5,021 |

| Other

tangible fixed assets |

20,123 |

16,574 |

|

Construction work in progress |

684 |

51 |

| Tangible fixed assets |

26,090 |

22,107 |

| Equity

investments |

1,098 |

1,098 |

| Loans |

3,138 |

3,146 |

| Other

long-term investments |

5,719 |

5,730 |

| Long-term invetsments - excluding equity shares in equity

method companies |

9,956 |

9,973 |

| Equity

shares in equity method companies |

9,780 |

10,105 |

| Government

- Deferred tax |

29,672 |

28,722 |

| Accounts

receivable: Long-term portion |

26,916 |

26,544 |

| Other

receivables: Long-term portion |

407 |

1,132 |

| Non-current assets |

421,511 |

412,219 |

| Services

in progress |

- |

0 |

| Goods |

10,429 |

8,978 |

| Advances

and deposits received on orders |

1,012 |

218 |

| Accounts

receivables: Short-term portion |

155,039 |

161,923 |

| Other

receivables: Short-term portion |

48,929 |

32,209 |

| Cash

equivalents |

8,000 |

153,001 |

| Cash |

1,142 |

78,298 |

| Prepaid

expenses |

13,023 |

16,666 |

| Current Assets |

237,575 |

451,293 |

| Assets of

activities held for sale |

840 |

768 |

| Total Assets |

659,925 |

864,280 |

-

Restated see note "Correction

of the accounting treatment of the finance lease business in the

group consolidated financial statement.

| In

thousands of euros |

09.30.2016 |

12.31.2015(1) |

| Share

capital |

13,337 |

13,337 |

| Group

reserves |

202,113 |

139,287 |

| Group

exchange gains/losses |

(3,283) |

8,469 |

| Group

earnings |

(16,782) |

66,957 |

| Shareholders' equity, Group share |

195,384 |

228,051 |

| Minority

interests (reserves) |

9 |

39 |

| Minority

interests (earnings) |

10 |

41 |

| Minority interests |

19 |

79 |

| Shareholders' equity |

195,403 |

228,130 |

| Long-term

financial liabilities |

220,518 |

51,723 |

| Long-term

financial intruments |

2,517 |

3,877 |

| Deferred

tax liabilities |

6,131 |

6,731 |

|

Non-current provisions |

26,064 |

19,307 |

| Other

non-current liabilities |

13,208 |

14,376 |

| Non-current liabilities |

268,439 |

96,014 |

| Short-term

financial liabilities |

4,242 |

347,213 |

| Short-term

financial instruments |

5 |

5 |

| Accounts

payable and related accounts |

49,858 |

54,470 |

| Tax and

social liabilities |

60,623 |

70,632 |

|

Provisions |

2,930 |

2,333 |

| Other

current liabilities |

77,457 |

61,657 |

| Current liabilities |

195,116 |

536,311 |

|

Liabilities of activities held for sale |

968 |

3,823 |

| Total Liabilities |

659,925 |

864,280 |

(1) Restated see

note "Correction of the accounting treatment of the finance lease

business in the group consolidated financial statement".

· Income

statements as of September 30, 2016

| In

thousands of euros |

09.30.2016 |

09.30.2015(1) |

| Revenue |

318,345 |

306,889 |

| Other

operating activities revenue |

- |

- |

| Purchased

used |

(24,704) |

(26,600) |

| External

expenses |

(93,962) |

(81,696) |

| Taxes |

(5,469) |

(7,858) |

| Payroll

costs |

(150,447) |

(136,258) |

|

Allocations to and reversals of provisions |

(2,952) |

(2,739) |

| Change in

inventories of products in progress and finished products |

- |

- |

| Other

operating income and expenses |

(249) |

555 |

| EBITDA |

40,562 |

52,294 |

|

Depreciation expenses |

(25,295) |

(22,444) |

| Operating

income from recurring operations |

15,267 |

29,850 |

|

Depreciation of goodwill |

- |

- |

|

Non-recurrent income and expenses |

(5,717) |

(5,003) |

| Other exceptional operating income and expenses |

(5,517) |

(5,003) |

| Operating income |

9,550 |

24,847 |

| Income

from cash and cash equivalents |

1,056 |

1,202 |

| Gross cost

of financial debt |

(27,215) |

(32,775) |

| Other

financial income and expenses |

914 |

(1,153) |

| Cost of net financial debt |

(25,245) |

(32,726) |

| Income

taxes |

(579) |

(2,134) |

| Deferred

taxes |

(867) |

(394) |

| Total taxes |

(1,446) |

(2,528) |

| Share of

profit (loss) for the period of equity method companies |

1,613 |

1,428 |

| Profit

(loss) for the period from continuing activities |

(15,528) |

(8,979) |

| Profit

(loss) for the period from discontinued activities |

(1,244) |

32,186 |

|

Consolidated profit (loss) for the period |

(16,772) |

23,207 |

| Group share |

(16,782) |

23,217 |

| Minority

interests |

10 |

(10) |

| Average number of shares excluding treasury stock |

13,955,230 |

13,934,479 |

| Current Earnings Per Share (in euros) |

(0.7) |

(0.3) |

| Earnings Per Share (in euros) |

(1.2) |

1.7 |

| Dilutive

instruments |

None |

None |

| Earning for recurring operation per share (in

euros) |

(1.2) |

1.7 |

(1) Restated see

note "Correction of the accounting treatment of the finance lease

business in the group consolidated financial statement.

| In

thousands of euros |

09.30.2016 |

09.30.2015(1) |

|

Consolidated profit (loss) for the period |

(16,772) |

23,207 |

| Share of

earnings from equity method companies |

(1,613) |

(1,470) |

|

Depreciation and provisions |

36,395 |

22,929 |

| Capital

gains or losses on disposals |

(86) |

(30,687) |

| Cash flow after cost of net financial debt and

taxes |

17,925 |

13,979 |

| Cost of

net financial debt |

25,262 |

31,758 |

| Tax

expenses |

1,448 |

5,744 |

| Operating cash flow before cost of net financial debt and

taxes |

44,636 |

51,481 |

| Tax

paid |

(3,743) |

(9,877) |

| Change in

working capital requirements for operations: requirement |

(9,849) |

(23,097) |

| Cash flow generated from operating activities after tax

paid and change in working capital requirements (A) |

31,044 |

18,507 |

| Of which

net cash flows from operating activities of held for sales |

2,019 |

5,177 |

|

Acquisitions of intangible assets |

(33,667) |

(30,381) |

|

Acquisitions of tangible assets |

(10,496) |

(9,731) |

|

Acquisitions of long-term investments |

- |

- |

| Disposals

of tangible and intangible assets |

699 |

1,532 |

| Disposals

of long-term investments |

(265) |

1,604 |

| Impact of

changes in consolidation scope |

(1,448) |

319,370 |

| Dividends

received from equity method companies |

- |

81 |

| Net cash flows generated by investment operations

(B) |

(45,177) |

282,475 |

| Of which

net cash flows connected to investment operations of activities

held for sales |

(13) |

(7,482) |

| Dividends

paid to parent company shareholders |

- |

- |

| Dividends

paid to the minority interests of consolidated companies |

(87) |

(69) |

| Capital

increase through cash contribution |

- |

- |

| Loans

issued |

169,000 |

- |

| Loans

repaid |

(340,259) |

(144,457) |

| Interest

paid on loans |

(31,630) |

(41,530) |

| Other

financial income and expenses paid or received |

(995) |

(643) |

| Net cash flows generated by financing operations

(C) |

(203,971) |

(186,699) |

| Of which

net cash flows related to financing operations of activities held

for sales |

(16) |

(850) |

| Change In Cash without impact of change in foreign currency

exchange rates (A + B + C) |

(218,104) |

114,283 |

| Impact of

changes in foreign currency exchange rates |

(954) |

2,850 |

| Change in cash |

(219,057) |

117,133 |

| Opening

cash |

228,120 |

99,715 |

| Closing

cash |

9,062 |

216,848 |

(1) Restated see

note "Correction of the accounting treatment of the finance lease

business in the group consolidated financial statement"

Cegelease is

a wholly owned subsidiary of Cegedim which

offers since 2001 financing options through a variety of contracts

dedicated to pharmacies and healthcare professionals in

France.

Initially, these solutions were

aimed at serving the pharmacists, who preferred leasing instead of

paying up-front, the pharmacies management system software that

they bought from the Cegedim group.

As time passed, Cegelease diversified its activities. Starting as the

exclusive finance lease provider for Cegedim group products,

Cegelease converted to a broker proposing a

variety of leasing solutions (for group products as well as

products developed by third parties) offered to a variety of

clients (including clients who are not already in business with

other group entities).

After the sale of its CRM and strategic data business to IMS Health,

Cegedim investigated in depth these activities

and found that they had to be reclassified pursuant to IAS 17 on

March 23, 2016 when the 2015 accounts were published.

All the impacts on previous

accounts are indicated in the 2015 Registration Document filled

with the AMF on March 31, 2016 in Chapter 4.4 point 1.3 on page 89

to 94, as well as in the Q1 2016 Financial Interim Report in point

2.5.1 on page 17 to 19, in the Q2 2016 Financial Interim Report in

point 2.5.1 on page 17 and in the Q3 2016 Financial Interim Report

in point 2.5.1 on page 17.

Impacts for the first nine months

of 2015 consolidated financial statements are described below:

| In €

million |

09.30.2015

reported(1) |

Correction of leases |

09.30.2015

restated |

| Revenue |

365,270 |

(58,381) |

306,889 |

| Other

operating activities revenue |

- |

- |

- |

| Purchases

used |

(64,883) |

38,284 |

(26,600 |

| External

expenses |

(92,014) |

10,318 |

(81,696) |

| Taxes |

(7,858) |

|

(7,858) |

| Payroll

costs |

(136,258) |

- |

(136,258) |

|

Allocations to and reversals of provisions |

(2,739) |

- |

(2,739) |

| Change in

inventories of products in progress and finished products |

- |

- |

- |

| Other

operating income and expenses |

555 |

- |

555 |

| EBITDA |

62,073 |

(9,780) |

52,294 |

|

Depreciation expenses |

(32,047) |

9,603 |

(22,444) |

| Operating income from recurring operations |

30,026 |

(176) |

29,850 |

|

Depreciation of goodwill |

- |

- |

- |

|

Non-recurrent income and expenses |

(5,003) |

- |

(5,003) |

| Other exceptional operating income and expenses |

(5,003) |

- |

(5,003) |

| Operating income |

25,024 |

(176) |

24,847 |

| Income

from cash and cash equivalents |

1,202 |

- |

1,202 |

| Gross cost

of financial debt |

(32,775) |

- |

(32,775) |

| Other

financial income and expenses |

(1,153) |

- |

(1,153) |

| Cost of net financial debt |

(32,726) |

- |

(32,726) |

| Income

taxes |

(2,134) |

- |

(2,134) |

| Deferred

taxes |

(461) |

67 |

(394) |

| Total taxes |

(2,595) |

67 |

(2,528) |

| Share of

profit (loss) for the period of equity method companies |

1,428 |

- |

1,428 |

| Profit

(loss) for the period from continuing activities |

(8,869) |

(109) |

(8,979) |

| Profit

(loss) for the period discontinued activities |

32,185 |

- |

32,186 |

|

Consolidated profit (loss) for the period |

23,316 |

(109) |

23,207 |

| Group share |

23,326 |

(109) |

23,217 |

| Minority interests |

(10) |

|

(10) |

(1) Restated from the

IFRS 5 Cegedim Kadrige impact.

| In €

million |

09.30.2015

reported(1) |

Correction of leases |

09.30.2015

restated |

| Consolidated profit (loss) for the period |

23,316 |

(109) |

23,207 |

| Share of

earnings from equity method companies |

(1,470) |

- |

(1,470) |

|

Depreciation and provisions |

32,532 |

(9,603) |

22,929 |

| Capital

gains or losses on disposals |

(30,687) |

- |

(30,687) |

| Cash flow after cost of net financial debt and

taxes |

23,691 |

(9,712) |

13,979 |

| Cost of

net financial debt |

31,758 |

- |

31,758 |

| Tax

expenses |

5,811 |

(67) |

5,744 |

| Operating cash flow before cost of net financial debt and

taxes |

61,260 |

(9,779) |

51,481 |

| Tax

paid |

(9,877) |

- |

(9,877) |

| Change in

working capital requirements for operations: requirement |

(21,370) |

(1,727) |

(23,097) |

| Change in

working capital requirements for operations: surplus |

|

|

|

| Cash flow generated from operating activities after tax

paid and change in working capital requirements (A) |

30,013 |

(11,506) |

18,507 |

| Of which net cash flows from operating activities of held

for sales |

5,177 |

- |

5,177 |

|

Acquisitions of intangible assets |

(30,615) |

234 |

(30,381) |

|

Acquisitions of tangible assets |

(21,003) |

11,272 |

(9,731) |

|

Acquisitions of long-term investments |

- |

- |

- |

| Disposals

of tangible and intangible assets |

1,532 |

- |

1,532 |

| Disposals

of long-term investments |

1,604 |

- |

1,604 |

| Impact of

changes in consolidation scope (1) |

319,370 |

- |

319,370 |

| Dividends

received from equity method companies |

81 |

- |

81 |

| Net cash flows generated by investment operations

(B) |

270,969 |

11,506 |

282,475 |

| Of which net cash flows connected to investment operations

of activities held for sales |

(7,482) |

- |

(7,482) |

| Dividends

paid to parent company shareholders |

- |

- |

- |

| Dividends

paid to the minority interests of consolidated companies |

(69) |

- |

(69) |

| Capital

increase through cash contribution |

- |

- |

- |

| Loans

issued |

- |

- |

- |

| Loans

repaid |

(144,457) |

- |

(144,457) |

| Interest

paid on loans |

(41,530) |

- |

(41,530) |

| Other

financial income and expenses paid or received |

(643) |

- |

(643) |

| Net cash flows generated by financing operations

(C) |

(186,699) |

- |

(186,699) |

| Of which net cash flows related to financing operations of

activities held for sales |

(850) |

- |

(850) |

| Change In Cash without impact of change in foreign currency

exchange rates (A + B + C) |

114,283 |

- |

114,283 |

| Impact of

changes in foreign currency exchange rates |

2,850 |

- |

2,850 |

| Change in cash |

117,133 |

- |

117,133 |

| Opening

cash |

99,715 |

- |

99,715 |

| Closing

cash |

216,848 |

- |

216,848 |

(1) Restated from the

IFRS 5 Cegedim Kadrige impact.

| In € million |

|

09.30.2015

reported |

IFRS 5 impact Cegedim Kadrige |

Correction of leases |

Divisions aggregation |

09.30.2015

restated |

| |

|

|

(1) |

(2) |

(3) |

|

| Health Insurance H.R. & e-services |

|

167.5 |

(1.3) |

- |

- |

166.2 |

|

Healthcare Professionals |

|

113.0 |

- |

- |

24.9 |

137.9 |

|

Cegelease |

|

83.3 |

- |

(58.4) |

(24.9) |

- |

|

Activities not allocated |

|

2.8 |

- |

- |

- |

2.8 |

| Group Cegedim |

|

366.6 |

(1.3) |

(58.4) |

0 |

306.9 |

(1) The Cegedim Group

decided to sell the Kadrige activities. These activities are thus

isolated in separate lines of the profit and loss statement and

balance sheet, according to the IFRS 5 accounting standard.

(2) The correct

accounting treatment of the Cegelease finance lease business, for

all types of contracts (self-financed, sold except process

management, or backed against a bank) requires a correction over

the first nine months of 2015 consolidated revenue of €58.4m

downward.

(3) The finance lease

business accounts for less than 10% of the consolidated revenue or

EBITDA, and as such is not isolated anymore within the Group

internal reporting. These activities are reported into the «

Healthcare professionals » division, where they already belonged

until the 2014 annual closing.

Glossary

Activities not allocated: this

division encompasses the activities the Group performs as the

parent company of a listed entity, as well as the support it

provides to the three operating divisions.

EPS: Earnings Per Share is a specific

financial indicator defined by the Group as the net profit (loss)

for the period divided by the weighted average of the number of

shares in circulation.

Operating expenses: defined as purchases used,

external expenses and payroll costs.

Revenue at constant exchange rate: when

changes in revenue at constant exchange rate are referred to, it

means that the impact of exchange rate fluctuations has been

excluded. The term "at constant exchange rate" covers the

fluctuation resulting from applying the exchange rates for the

preceding period to the current fiscal year, all other factors

remaining equal.

Revenue on a like-for-like basis: the effect

of changes in scope is corrected by restating the sales for the

previous period as follows:

-

by removing the portion of sales originating in

the entity or the rights acquired for a period identical to the

period during which they were held to the current period;

-

similarly, when an entity is transferred, the

sales for the portion in question in the previous period are

eliminated.

Life-for-like data: at constant scope and

exchange rates.

Internal growth: internal growth covers growth

resulting from the development of an existing contract,

particularly due to an increase in rates and/or the volumes

distributed or processed, new contracts, acquisitions of assets

allocated to a contract or a specific project.

External growth: external growth covers

acquisitions during the current fiscal year, as well as those which

have had a partial impact on the previous fiscal year, net of sales

of entities and/or assets.

|

|

|

About Cegedim:

Founded in 1969, Cegedim is an innovative technology and services

company in the field of digital data flow management for healthcare

ecosystems and B2B, and a business software publisher for

healthcare and insurance professionals. Cegedim employs more than

4,000 people in 11 countries and generated revenue of €426 million

in 2015. Cegedim SA is listed in Paris (EURONEXT: CGM).

To learn more, please visit: www.cegedim.com

And follow Cegedim on Twitter: @CegedimGroup and LinkedIn

|

Aude Balleydier

Cegedim

Communications

Manager

and Media Relations

Tel.: +33 (0)1 49 09 68 81

aude.balleydier@cegedim.com |

Jan Eryk Umiastowski

Cegedim

Chief Investment Officer

and Head of Investor Relations

Tel.: +33 (0)1 49 09 33 36

janeryk.umiastowski@cegedim.com |

Guillaume de Chamisso

PRPA Agency

Media Relations

Tel.: +33 (0)1 77 35 60 99

guillaume.dechamisso@prpa.fr |

Follow Cegedim:

|

Cegedim_Results_3Q2016_ENG

This

announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: Cegedim SA via Globenewswire

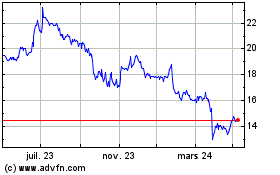

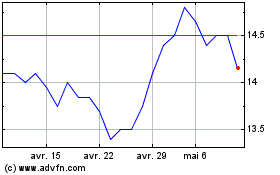

Cegedim (EU:CGM)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Cegedim (EU:CGM)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024