Dollar Climbs Ahead Of U.S. Jobs Data

05 Janvier 2018 - 6:59AM

RTTF2

The U.S. dollar strengthened against its major rivals in early

European deals on Friday, ahead of the all-important U.S. nonfarm

payrolls data due later in the day, which would shed more clues

about economic growth in the world's largest economy.

Data from the Labor Department is expected to show that the

economy may have added 190,000 jobs in December following the jump

of 228,000 jobs in November. The unemployment rate is expected to

hold at 4.1 percent.

The data plays a vital role in helping shape expectations for

next rate hike action from the Federal Reserve.

U.S. factory orders, international trade and the ISM

non-manufacturing index are also set to be released today.

Investor sentiment remained buoyant following the release of

strong economic indicators across the currency bloc. While German

retail sales data beat estimates, French consumer inflation and

consumer confidence painted a positive picture of the economy.

The currency has been trading higher against its key

counterparts in the Asian session, with the exception of the

pound.

The greenback extended rise to an 8-day high of 113.20 against

the yen, off its early low of 112.72. The next possible resistance

for the greenback is seen around the 114.5 region.

The latest survey from Nikkei showed that Japan's services

sector continued to expand in December, although at a marginally

slower rate, with a Services PMI score of 51.1.

That's down from 51.2 in November, although it remains above the

boom-or-bust line of 50 that separates expansion from

contraction.

The greenback edged up to 0.9773 against the franc and 1.2042

against the euro, from its previous lows of 0.9733 and 1.2080,

respectively. On the upside, 0.99 and 1.19 are likely seen as the

next resistance levels for the greenback against the franc and the

euro, respectively.

Reversing from an early 2-day low of 1.3577 against the pound,

the greenback rose to 1.3523. The greenback is seen finding

resistance around the 1.34 area.

Data from the the British Retail Consortium showed that the U.K.

shop prices fell 0.6 percent on year in December.

That missed expectations for a flat reading following the 0.1

percent contraction in November.

The greenback advanced to 0.7835 against the aussie and 1.2512

against the loonie, reversing from its early 2-1/2-month lows of

0.7870 and 1.2482, respectively. If the greenback extends rise, it

may find resistance around 0.77 against the aussie and 1.26 against

the loonie.

Apart from the U.S. data, Canada jobs data and Ivey PMI for

December are set for release in the New York session.

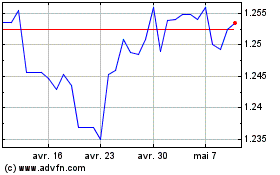

Sterling vs US Dollar (FX:GBPUSD)

Graphique Historique de la Devise

De Mar 2024 à Avr 2024

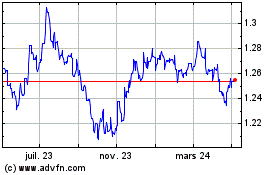

Sterling vs US Dollar (FX:GBPUSD)

Graphique Historique de la Devise

De Avr 2023 à Avr 2024