Dollar Mixed After ADP Private Payrolls Data

04 Janvier 2018 - 10:10AM

RTTF2

The U.S. dollar came in mixed against its key counterparts in

the European session on Thursday, following a data showing better

than expected U.S. private sector employment growth in

December.

Data from payroll processor ADP showed that employment in the

private sector surged up by 250,000 jobs in December after climbing

by a downwardly revised 185,000 jobs in November.

Economists had expected an increase of about 190,000 jobs,

matching the job growth originally reported for the previous

month.

Separate report from the Labor Department showed that initial

jobless claims unexpectedly inched higher in the week ended

December 30th.

The report said initial jobless claims edged up to 250,000, an

increase of 3,000 from the previous week's revised level of

247,000.

Economists had expected jobless claims to drop to 240,000 from

the 245,000 originally reported for the previous week.

Investors await non-farm payrolls report due tomorrow for more

clues about the health of the labour market.

The economy is forecast to have added 188,000 jobs in December,

compared to 228,000 in November. The jobless rate is forecast to

remain at 4.1 percent.

The greenback fell against its European major counterparts early

in the European session, as the latest FOMC meeting minutes

revealed that the Fed would continue a gradual path of tightening

as policy makers wrangle over the inflation outlook.

The currency showed mixed performance in the Asian session.

While it dropped against the euro and the pound, it held steady

against the franc. Against the yen, the currency rose.

The greenback weakened to 0.9745 against the franc, compared to

0.9770 hit late New York Wednesday. The greenback may challenge

support around the 0.96 mark.

The greenback resumed its early gains against the yen, touching

a 6-day high of 112.84. The greenback is seen finding resistance

around the 114.00 level.

Survey from Nikkei showed that Japan's manufacturing sector

continued to expand in December, and at an accelerated pace, with a

manufacturing PMI score of 54.0.

That's up from 53.6 in November, and it moves further above the

boom-or-bust line of 50 that separates expansion from

contraction.

The greenback reclaimed some of its lost ground against the

pound, trading at 1.3542. This may be compared to a low of 1.3560

hit at 7:15 am ET. If the greenback extends rally, 1.34 is likely

seen as its next resistance level.

Survey data from IHS Markit showed that British service sector

growth accelerated at a faster-than-expected pace in December.

The IHS Markit/Chartered Institute of Procurement & Supply

Purchasing Managers' Index, rose to 54.2 in December from 53.8 in

November. Economists had expected the index to rise to 54.0.

The greenback fell further to a 2-day low of 1.2075 against the

euro, off its early high of 1.2005. The next possible support for

the greenback is seen around the 1.23 area.

Final data from IHS Markit showed that Eurozone private sector

expanded the most since early 2011 driven by a near-record

expansion of manufacturing and the steepest rise in service sector

for over six-and-a-half years.

The composite output index rose to 58.1 in December from 57.5 in

November. This was the highest score since February 2011.

Markit's U.S. final services PMI data for December is due

shortly.

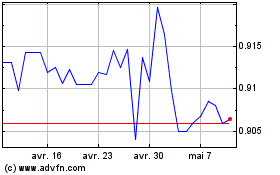

US Dollar vs CHF (FX:USDCHF)

Graphique Historique de la Devise

De Mar 2024 à Avr 2024

US Dollar vs CHF (FX:USDCHF)

Graphique Historique de la Devise

De Avr 2023 à Avr 2024