Dollar Paring Losses After Initial Drop Following Fed Rate Hike

14 Juin 2017 - 4:31PM

RTTF2

The dollar briefly spiked lower against all of its major rivals

Wednesday afternoon, but has since pared its losses. The sharp move

followed today's announcement from the Federal Reserve, which

raised its benchmark interest rate for the third time in three

months despite signs the U.S. economy has cooled off in 2017.

The Federal Open Market Committee voted to raise fed funds to

between 1% and 1.25% and will start "gradual" shrinking of its $4.5

trillion balance sheet "this year."

Their so-called 'dot plot' shows one more rate hike in 2017 and

three more in 2018, but the Fed's accompanying statement offered

little indication they plan to raise interest rates again this

summer.

Policy makers say they are "monitoring developments closely,"

meaning they are likely wait for confirmation that recent economic

weakness is "transitory."

Retail sales in the U.S. unexpectedly decreased in the month of

May, according to a report released by the Commerce Department on

Wednesday. The Commerce Department said retail sales fell by 0.3

percent in May after climbing by an upwardly revised 0.4 percent in

April.

The drop in sales surprised economists, who had expected sales

to inch up by 0.1 percent compared to the 0.3 percent increase

originally reported for the previous month.

Reflecting a steep drop in energy prices, the Labor Department

released a report on Wednesday showing a modest decrease in U.S.

consumer prices in the month of May. The report said the consumer

price index edged down by 0.1 percent in May after rising by 0.2

percent in April. Economists had expected prices to come in

unchanged.

The dollar briefly dropped to a low of $1.1294 against the Euro

Wednesday afternoon, but has since bounced back to around

$1.1250.

Eurozone industrial production increased for the second straight

month in April, in line with expectations, data from Eurostat

showed Wednesday.

Industrial production climbed a seasonally adjusted 0.5 percent

month-over-month in April, faster than the 0.2 percent rise in

March, which was revised from a 0.2 percent drop reported earlier.

The figure also matched consensus estimate.

Employment hit a record high in both the euro area and the EU28

in the first quarter of the year amid sustained growth in the

figures, preliminary data from Eurostat showed Wednesday. The

number of employed totaled a seasonally adjusted 154.8 million for

the Eurozone and 234.2 million for the EU28 during the first

quarter. Both figures were the highest ever.

Germany's consumer price inflation slowed to a six-month low in

May, as initially estimated, data from the statistical office

Destatis showed Wednesday. Inflation eased to 1.5 percent in May

from 2 percent in April. This was the lowest since November, when

the rate was 0.8 percent.

The buck slipped to a low of $1.2817 against the pound sterling

Wednesday afternoon, but has since rebounded to around $1.2775.

The UK unemployment rate remained unchanged at the lowest level

since 1975, but wage growth remained subdued squeezing household

spending.

The ILO jobless rate came in at 4.6 percent in the three months

to April, the same rate as seen in the three months to March, data

from the Office for National Statistics showed Wednesday. The rate

came in line with economists' expectations.

The greenback briefly sank to over a month and a half low of

Y108.685 against the Japanese Yen this afternoon, but has since

bounced back to around Y109.325.

Japan's industrial production expanded as initially estimated in

April, final data from the Ministry of Economy, Trade and Industry

showed Wednesday. Industrial output grew 4 percent month-on-month

in April, in line with the preliminary estimate published on May

31. Production had declined 1.9 percent in March.

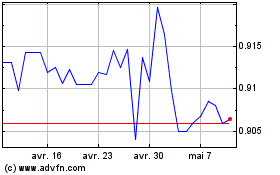

US Dollar vs CHF (FX:USDCHF)

Graphique Historique de la Devise

De Mar 2024 à Avr 2024

US Dollar vs CHF (FX:USDCHF)

Graphique Historique de la Devise

De Avr 2023 à Avr 2024