EU Demand Adds to Challenges for CEO -- WSJ

31 Août 2016 - 9:03AM

Dow Jones News

Disputed tax bill comes as company is readying new products

after sales slowdown

By Robert McMillan

A $14.5 billion European tax bill is the latest headache for

Apple Inc. Chief Executive Tim Cook, who is facing his toughest set

of challenges since taking the company's helm five years ago.

On Tuesday, the European Union's antitrust regulator ordered

Ireland to recoup about EUR13 billion in taxes from Apple, ruling

that tax arrangements Ireland offered to Apple in 1991 and in 2007

amounted to illegal benefits. Between 2003 and 2014, Apple paid

less than 1% tax on its European profits, the Commission said.

Apple and Ireland both said they plan to appeal the decision,

which comes as sales of Apple's flagship product, the iPhone, are

declining for the first time in its history. Concerns about sales

of the iPhone, which accounts for roughly two-thirds of Apple's

revenue, have pushed Apple shares down 6% in the past year.

Shares fell 1% in recent trading Tuesday following the European

Commission ruling, which Apple sharply criticized.

In an open letter posted on Apple's website, Mr. Cook said the

company pays "all the taxes we owe." He blasted the Commission as a

challenge to the sovereignty to EU members. "At its root, the

Commission's case is not about how much Apple pays in taxes," he

wrote. "It is about which government collects the money."

Apple said Tuesday that it expects to set aside an undetermined

amount of cash in an escrow account. This cash will be recorded as

restricted cash, pending the company's appeal. The company said it

has paid more taxes than the Commission represented, noting that

its 2014 Irish tax bill was $400 million.

Even if Apple is forced to pay the full penalty, it would make

only a small dent in the company's $231 billion cash hoard as of

June 25. Apple said the ruling wouldn't affect its future tax rate.

The European Commission noted that Apple's Irish tax deals no

longer were in effect after Apple made structural changes to its

Irish operations in 2015.

Despite the big bill, analysts generally played down the

potential impact. UBS Group AG analyst Steven Milunovich said the

$14.5 billion total was "toward the high end of expectations," and

could translate to as much as a $5 hit to Apple's share price. But,

he said it is "too soon to make any adjustments" to his Apple

forecasts.

The ruling comes at an awkward time for Apple, which is

preparing to introduce its latest iPhones next week. Revenue from

the iPhone fell 23% in the quarter ended June 25, compared with a

year earlier. Meanwhile, sales of established products such as the

Macintosh and iPad have slowed recently, and new products such as

the Apple Watch haven't yet had an appreciable impact on Apple's

finances.

"Right now, Apple goes as the iPhone goes, and it's a much more

mature market than it was two years ago," said Crawford del Prete,

chief research officer with the International Data Corp.

technology-research firm.

At next week's event, Mr. del Prete said in addition to

refreshing its iPhone line, Apple may seek to break into new

product areas building virtual-reality headsets or

personal-assistant devices such as Amazon.com Inc.'s Alexa. Apple

also has the automobile in its sights. It recently named veteran

executive Bob Mansfield to oversee its secret autonomous-vehicle

initiative, code-named Project Titan. Earlier this year, the

company invested $1 billion in Chinese ride-sharing company Didi

Chuxing Technology Co.

In a conference call with analysts last month, Mr. Cook said

that he was optimistic about the company's prospects in China and

India, two countries that have experienced rapid iPhone growth.

--Natalia Drozdiak contributed to this article.

Write to Robert McMillan at Robert.Mcmillan@wsj.com

(END) Dow Jones Newswires

August 31, 2016 02:48 ET (06:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

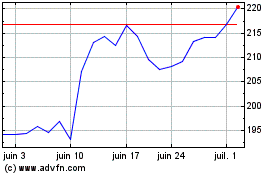

Apple (NASDAQ:AAPL)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

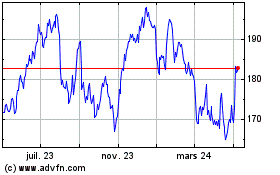

Apple (NASDAQ:AAPL)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024