Euro Falls Amid Risk Aversion

27 Septembre 2016 - 12:19PM

RTTF2

The euro slipped against its major counterparts in early New

York trading on Tuesday amid risk aversion, as European shares

declined on worries about the strength of European banks.

Rival Deutsche Bank fell about 2.7 percent in Germany to extend

Monday's 7 percent loss after a German magazine reported that

Chancellor Angela Merkel had ruled out providing government aid to

the bank.

Commerzbank lost 3 percent on a report that the German lender

plans to slash around 9,000 jobs over the coming years as part of a

restructuring plan.

Falling oil prices also weighed, with the crude oil tumbling

below $45 after Saudi Arabia and Iran downplayed expectations of a

deal with Russia to curb oil supplies.

Traders digested last night's highly anticipated presidential

debate between Hillary Clinton and Donald Trump in Hofstra

University in New York.

While some pundits have given the edge to Clinton, the debate

did not seem to feature any substantial blows that will lead to a

significant shakeup in the race for the White House.

Recent polls have shown Clinton and Trump running neck-and-neck,

suggesting that uncertainty about the outcome of the race could

prevail for the next several weeks.

In economic front, data from the European Central Bank showed

that Eurozone money supply growth accelerated in August and loans

to households increased at a steady pace.

The broad monetary aggregate M3 climbed 5.1 percent year-on-year

in August, faster than the 4.9 percent increase seen in July.

The currency has been trading in a negative territory during the

European session.

The euro slipped to a 5-day low of 112.25 against the yen, off

its early high of 113.57. The euro may locate support around the

111.5 mark.

The minutes from the Bank of Japan's July 28-29 meeting showed

that the members of the board judged that the county's economic

recovery is on track, with the inflation outlook remaining slightly

negative due to soft energy prices.

At the meeting, board decided to hold its target of raising the

monetary base at an annual pace of about JPY 80 trillion. Also, the

board voted to maintain a negative interest rate of -0.1

percent.

The euro dropped to a 4-day low of 1.1198 against the greenback,

after having advanced to 1.1259 at 3:30 am ET. On the downside,

1.10 is likely seen as the next support level for the

euro-greenback pair.

Data from Standard & Poor's showed that U.S. home price

growth in major metropolitan areas continued to slow in the month

of July.

The report said the S&P/Case-Shiller 20-city composite home

price index was up 5.0 percent year-over-year in July compared to

the 5.1 percent increase seen in June. Economists had expected the

rate of growth to hold unchanged.

After advancing to 0.8693 against the pound at 5:45 am ET, the

euro retreated to a 4-day low of 0.8627. Continuation of the euro's

downtrend may see it challenging support around the 0.85

region.

The single currency slid to a 4-day low of 1.0870 against the

Swiss franc, reversing from a 4-day peak of 1.0912 hit at 3:00 am

ET. The euro is likely to find support around 1.06 against the

franc.

The euro held steady against the aussie, after touching a

multi-week low of 1.4615 at 3:15 am ET. The next possible support

for the euro-aussie pair is seen around the 1.45 region.

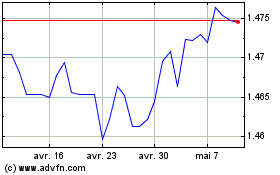

The euro retreated from an early 5-1/2-month high of 1.4925

against the loonie in European morning trading and held steady

since then. The pair was valued at 1.4883 when it finished Monday's

deals.

The common currency that slid to a 4-day low of 1.5341 against

the kiwi at 4:30 am ET moved sideways in subsequent part of the

deals. The kiwi-greenback pair ended yesterday's trading at

1.5465.

Looking ahead, at 11:15 am ET, Federal Reserve Governor Stanley

Fischer will deliver a speech titled "Why Study Economics?" at the

Howard University Economic Convocation in Washington DC.

Euro vs CAD (FX:EURCAD)

Graphique Historique de la Devise

De Mar 2024 à Avr 2024

Euro vs CAD (FX:EURCAD)

Graphique Historique de la Devise

De Avr 2023 à Avr 2024