Euro Recovers As Eurozone Inflation Confirmed At 4-month

18 Septembre 2017 - 8:18AM

RTTF2

The euro recouped its early losses against its key counterparts

in the European session on Monday, after data showed that Eurozone

inflation climbed to a four-month high in August, as initially

estimated.

Final data from Eurostat showed that consumer prices advanced

1.5 percent year-on-year in August, faster than the 1.3 percent

increase seen in July. This was the highest since April and in line

with the estimate published on August 31.

Nonetheless, inflation continues to stay well below the European

Central Bank's target of 'below, but close to 2 percent'.

On a monthly basis, consumer prices rose 0.3 percent in

August.

Further underpinning the currency was dovish comments by the ECB

Chief Economist and Executive Board member Peter Praet, who said in

an interview over the weekend that substantial stimulus is still

needed to ensure price stability target.

"This autumn we will decide on our policy next year," he

added.

Risk sentiment prevailed on easing geopolitical tensions and as

S&P Global Ratings raised Portugal's credit rating to

investment grade with a stable outlook, helping spur a rally in

euro-area peripheral bonds.

Investors await the crucial Fed meeting on Tuesday and Wednesday

for clues to the likelihood of a rate hike in December.

The single currency climbed against its major rivals in the

Asian session, with the exception of the pound.

The euro that edged down to 1.1915 against the greenback at 3:20

am ET bounced off to 1.1954. The pair ended last week's deals at

1.1919. The next possible resistance for the euro-greenback pair is

seen around the 1.23 region.

The single currency recovered to 133.07 against the yen, heading

to pierce its early 1-1/2-year high of 133.11. On the upside,

136.00 is possibly seen as the next resistance for the euro-yen

pair.

The euro, having fallen to a 2-month low of 0.8779 against the

pound at 2:30 am ET, reversed direction and climbed to 0.8830. If

the euro-pound pair extends gain, 0.90 is likely seen as its next

resistance level.

Data from property tracking website Rightmove showed that U.K.

house prices fell 1.2 percent on month in September

That follows the 0.9 percent decline in August, and it marks the

third monthly drop in four months.

The euro recovered to 1.4920 against the aussie, 1.4580 against

the loonie and 1.6355 against the kiwi, from its early lows of

1.4872 and 1.4513, and near a 4-week low of 1.6270, respectively.

The euro is poised to locate resistance around 1.51 against the

aussie, 1.48 against the loonie and 1.65 against the kiwi.

On the flip side, the 19-nation currency eased to 1.1451 against

the Swiss franc, from a high of 1.1485 hit at 2:45 am ET. If the

euro-franc pair extends drop, 1.135 is possibly seen as its next

support level.

Looking ahead, U.S. NAHB housing market index for September is

slated for release in the New York session.

At 10:30 am ET, ECB Board member Sabine Lautenschlager will

participate in Panel II "Policy challenges in the banking sector"

at conference "Supervisory policy implementation in the current

macro-financial environment: a cross-sectoral journey," organised

by BIS in Basel, Switzerland.

At 11:00 am ET, Bank of England Governor Mark Carney gives a

lecture at the International Monetary Fund (IMF) in Washington

D.C.

At 2:15 pm ET, Bank of Canada Deputy Governor Timothy Lane is

expected to speak at the Saskatoon Regional Economic Development

Authority in Saskatchewan, Canada.

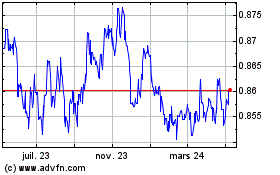

Euro vs Sterling (FX:EURGBP)

Graphique Historique de la Devise

De Mar 2024 à Avr 2024

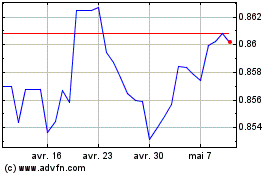

Euro vs Sterling (FX:EURGBP)

Graphique Historique de la Devise

De Avr 2023 à Avr 2024