Euro Retreats Amid French Election Worries

19 Avril 2017 - 9:17AM

RTTF2

The euro retreated from early highs against its major

counterparts in the European session on Wednesday, as latest polls

showed a tight race between the far-right leader Marine Le Pen and

independent candidate Emmanuel Macron in the first round of French

Presidential election taking place on Sunday.

A poll released by Cevipof for Le Monde newspaper showed that

front runners Le pen and Macron are running neck and neck in the

first round of voting, with 22.5 percent and 23 percent of votes,

respectively. Far-left firebrand Jean-Luc Melenchon scored 19

percent, followed by conservative leader Francois Fillon with 19.5

percent.

The Cevipof poll also showed that Le Pen would lose to Macron in

the second round run-off vote on May 7.

Meanwhile, recent opinion polls showing a surge in support to

Melenchon makes election a four-way contest, with the outcome hard

to predict.

Adding to worries, two men linked to Islamic State have been

arrested on suspicion of planning an "imminent terrorist attack" in

France ahead of the first round of presidential election on

Sunday.

Latest data from Eurostat showed that Eurozone inflation slowed

as estimated initially to a three-month low in March.

The harmonized consumer price index rose 1.5 percent

year-on-year after 2 percent increase in February, which was the

highest since January 2013.

Separate data from Eurostat showed that Eurozone trade surplus

increased more-than-expected in February, as exports rose and

imports fell.

The seasonally adjusted trade surplus climbed to EUR 19.2

billion in February from EUR 15.7 billion in the previous month.

Economists had expected the surplus to rise to EUR 18.5

billion.

The euro showed mixed performance in the Asian session. While

the currency fell against the franc and the dollar, it held steady

against the franc. Against the yen, it was higher.

Pulling away from an early 6-day high of 1.0698 against the

franc, the euro eased to 1.0677. The euro is on track to pierce its

early 2-day low of 1.0673. Continuation of the euro's downtrend may

see it challenging support around the 1.05 zone.

The euro edged down to 1.0708 against the greenback, from near a

3-week high of 1.0737 hit at 3:30 am ET. The next possible support

for the euro-greenback pair is seen around the 1.06 level.

The single currency retreated to 0.8347 against the pound, from

an early high of 0.8374.If the euro extends decline, 0.82 is

possibly seen as its next support level.

Survey by IHS Markit and market research company Ipsos Mori

showed that British households' current financial pressures

intensified in April, as rising inflation and subdued pay growth

have created a renewed squeeze on cash available to spend.

The seasonally adjusted Household Finance Index, of HFI, dropped

42.5 in April from 43.1 in March. This was one of the lowest

readings seen since the summer of 2014.

On the flip side, the euro held firm against the yen, following

an 8-day high of 116.85 hit at 3:10 am ET. The euro is seen finding

resistance around the 118.00 mark.

Looking ahead, the European Central Bank board member Benoit

Coeure speaks at C. Peter McColough Roundtable Series on

International Economics in New York at 9:00 am ET.

European Central Bank board member Peter Praet will give a

speech at the "Levy Economics Institute's 26th annual Hyman P.

Minsky conference" at 10:30 am ET.

At 12:00 pm ET, the Fed releases Beige book report on economic

conditions.

At 1:00 pm ET, the Bank of Canada Senior Deputy Governor Carolyn

Wilkins participates in a panel discussion titled "FinTech and the

Transformation of Financial Services" at the International Monetary

Fund, in Washington DC.

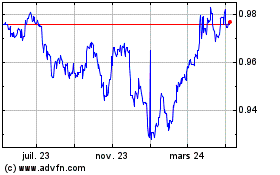

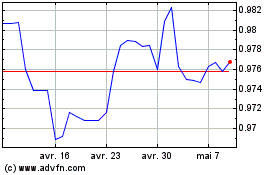

Euro vs CHF (FX:EURCHF)

Graphique Historique de la Devise

De Mar 2024 à Avr 2024

Euro vs CHF (FX:EURCHF)

Graphique Historique de la Devise

De Avr 2023 à Avr 2024