Euro Rises Amid Hopes Of Greece Tensions Easing

27 Mai 2015 - 11:22AM

RTTF2

The euro strengthened against most major currencies in the early

European session on Wednesday, as hopes concerning Greece's ability

to fulfill its next IMF repayment bolstered sentiment.

Greece's outspoken Finance Minister Yanis Varoufakis said on

Tuesday that the country expects to finalize a deal with creditors

by June 5, when the first IMF payment is due. However, he urged the

international creditors to come to an agreement with Greece before

the country runs out of money.

Greek officials are set to resume debt talks between Greece and

its EU creditors in Brussels, due later in the day, to discuss

about the country's loan program.

Finance ministers and central bankers from 7 industrialized

nations will begin a three-day meeting in Dresden, Germany today to

discuss the health of the global economy and financial

regulation.

In other economic news, data from market research group GfK

showed that German consumer sentiment is set to improve to its

highest level since October 2001.The forward-looking consumer

sentiment rose to 10.2 in June from 10.1 in May. This was the

highest score since October 2001.

In the Asian trading today, the euro held steady against its

major rivals.

In the European trading today, the euro advanced to 5-day highs

of 1.4107 against the Australian dollar and 1.3569 against the

Canadian dollar, from early lows of 1.4028 and 1.3510,

respectively. If the euro extends its uptrend, it is likely to find

resistance around 1.44 against the aussie and 1.40 against the

loonie.

The euro rose to 0.7089 against the pound and 134.39 against the

yen, from early lows of 0.7062 and 133.76, respectively. On the

upside, 0.73 against the pound and 137.50 against the yen are seen

as the next resistance levels for the euro.

Against the U.S. and the New Zealand dollars, the euro edged up

to 1.0928 and 1.5077 from early lows of 1.0864 and 1.4988

respectively. The euro may test resistance near 1.12 against the

greenback and 1.55 against the kiwi.

Looking ahead, the Bank of Canada will announce its interest

rate decision at 10:00 am ET. Economists expect the bank to retain

interest rates unchanged at 0.75 percent.

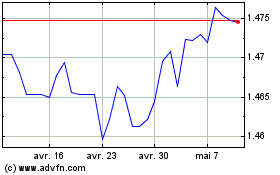

Euro vs CAD (FX:EURCAD)

Graphique Historique de la Devise

De Mar 2024 à Avr 2024

Euro vs CAD (FX:EURCAD)

Graphique Historique de la Devise

De Avr 2023 à Avr 2024