Gucci Adds Sparkle to Kering Results -- 2nd Update

10 Février 2017 - 6:01PM

Dow Jones News

By Matthew Dalton

PARIS--The runaway success of Gucci shows no sign of

slowing.

Sales at the Italian fashion house rose 13% last year to EUR4.38

billion ($4.68 billion), luxury conglomerate Kering SA, which owns

Gucci, said Friday. Growth accelerated in the fourth quarter, when

sales surged 22%.

Gucci's performance fueled a 17% increase in Kering's net profit

last year, the company said.

Kering Chief Executive François-Henri Pinault, whose family is

the company's controlling shareholder, says Gucci has plenty of

room to grow. Kering is making investments to raise the

productivity of Gucci stores to rival the luxury industry's most

productive retailers, Mr. Pinault said. Hitting that target by

itself would boost Gucci's sales 50%, he said.

"That's enormous, when you consider the size of Gucci," Mr.

Pinault told reporters Friday.

The results reflect enduring momentum at Gucci under its

creative director Alessandro Michele , who was named to the job in

January 2015. Since then, Mr. Michele has revamped the brand with a

mix of extravagant prints, and retro flourishes such as embroidery.

His designs have earned praise from critics and drawn droves of

customers back to a brand that had fallen out of fashion.

The full impact of Mr. Michele on Gucci's sales has yet to be

felt: His designs are still being incorporated into the brand's

collections.

"This is an excellent performance for Gucci and Kering overall,"

Mario Ortelli, an analyst at Sanford C. Bernstein, wrote in a note

to clients. The brand's strong performance should continue, he

said, as "Alessandro Michele-designed merchandise continues to be

phased in and as the brand momentum continues to trickle from the

fashion elite to the broader luxury consumer."

Gucci managed to flourish in a tough environment for the luxury

industry, which has seen spending growth stall amid terror fears in

Europe and a slowdown in consumption by globe-trotting Chinese

shoppers. But Kering now faces the challenge of ensuring Gucci

doesn't fall out of a favor as quickly as it was embraced.

Mr. Pinault argued that the brand is developing an enduring

aesthetic under Mr. Michele that should insulate it from quickly

changing tastes in ready-to-wear fashion.

"Gucci's desirability should last over time," Mr. Pinault said.

"When you say, 'All this is fragile, because it's ready-to-wear.'

No, it's not ready-to-wear. It's a creative universe that expresses

itself in ready-to-wear."

Saint Laurent, another of Kering's flagship brands, also

delivered strong results, with annual sales rising 25% to EUR1.22

billion. Kering's earnings beat analyst expectations, pushing its

shares up more than 2.6% in afternoon trading.

The company said revenue for the year was EUR12.4 billion, up

6.9%. Sales growth accelerated in the fourth quarter, rising 10% to

EUR3.5 billion.

Net profit for the year was EUR814 million.

Strong sales at Gucci and Saint Laurent offset problems at some

of Kering's other brands, in particular at high-end leather goods

maker Bottega Veneta. Sales at the Italian fashion house fell 8.7%

to EUR1.17 billion. Revenue at the company was particularly hard

hit by the terror attacks in Europe, which kept shoppers away from

its stores on the continent.

Kering said it is preparing a communications campaign to attract

new customers to the decades-old brand, best known for its woven

leather handbags.

Write to Matthew Dalton at Matthew.Dalton@wsj.com

(END) Dow Jones Newswires

February 10, 2017 11:46 ET (16:46 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

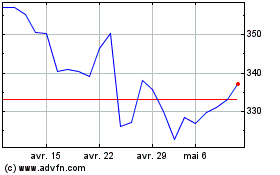

Kering (EU:KER)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Kering (EU:KER)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024