IBA SA : IBA Trading Update - Third Quarter 2016

16 Novembre 2016 - 7:00AM

IBA Trading Update

- Third Quarter 2016

-

Group revenue up 19.3%, full year 2016 revenue

growth guidance of approximately 20%

-

Continued strong growth in Proton Therapy, with

Proton Therapy and Other Accelerators setting a new record backlog

of EUR 362.6 million

-

FY operating margin expected to be around 10%

due to slower Dosimetry business

Louvain-La-Neuve,

Belgium, 16 November 2016 - IBA (Ion Beam Applications S.A.,

EURONEXT), the world's leading provider of proton therapy solutions

for the treatment of cancer, today announces its trading update for

the third quarter ending 30 September 2016.

Group

Highlights

-

Q3 2016 year to date Group revenues of EUR 225.3

million, up 19.3% year-on-year, driven by excellent revenue

recognition of Proton Therapy projects (+43.7% versus last year),

more than offsetting declining Dosimetry (-12.8% versus last year)

and flat revenues of Other Accelerators division

-

Strong growth in Proton Therapy and Other

Accelerators orders - orders at end of Q3 totalling EUR 206.2

million, up 39.5% from Q3 2015, comprising three Proteus®One*, three Proteus®PLUS* (15 proton therapy rooms in total), and ten other

accelerators. This order intake also includes upgrades for EUR 16.9

million.

-

Proton Therapy and Other Accelerators service

revenue up 16.9% to EUR 57.7 million, in line with

expectations

-

Proton Therapy and Other Accelerators backlog at

an all-time record of EUR 362.6 million, following downpayment by

Medstar (Shanghai) Leasing Co, for a previously announced four-room

Proteus®PLUS* solution. Backlog conservatively excludes the

previously announced contract with Qingdao Zhong Jia Lian He

Healthcare Management Company Limited (five-room solution) that is

a firm contract but awaiting down payment

-

Record Dosimetry backlog of EUR 19.4 million, up

from EUR 18.0 million in Q3 2015

-

Healthy gross cash position of EUR 66.4 million

at the end of Q3 2016, compared with EUR 64.7 million at the end of

Q3 2015

-

Revenues for the full-year expected to be around

20% higher than in 2015, reflecting strong PT growth and more than

offsetting Dosimetry weakness; operating margin expected to be

around 10%, slightly below previous expectations of 11% due to the

weak Dosimetry market; the Company expects operating margins to

rise to 13-15% by 2018

Olivier Legrain,

Chief Executive Officer of IBA commented: "This has been another positive quarter of growth, driven

by continued robust demand in the global proton therapy market and

timely execution of the backlog. With a growing order book from

markets as diverse as Europe, US, China and the UAE, we are

confident about the outlook of the Company, despite challenges in

the dosimetry market which has further decreased as a proportion of

our overall business. We are continuing to make targeted strategic

investments in our business to ensure that we can maintain and grow

our clear leadership in proton therapy, expanding our product

offering to provide greater choice to customers and investing in

our commercial, manufacturing and service capabilities."

Key Figures and

Events at Segment Level

IBA reported the following

segmental trends and news during the third quarter of 2016:

Proton Therapy

and Other Accelerators

-

Q3 year to date revenues totaled EUR 190.9

million compared to EUR 149.4 million for the same period in 2015,

up 27.8%; revenue growth came mostly from equipment revenue

recognition which grew 33.1% compared to Q3 2015

-

Two proton therapy centers were sold in

Q3:

-

Contract signed with Proton Partners

International (PPI) to install a Proteus®ONE

compact proton therapy solution in a private clinic in Abu Dhabi,

UAE

-

Contract signed with Medstar (Shanghai) Leasing

Co., Ltd, a subsidiary of Concord Medical Services Holdings

Limited, for the installation and maintenance of a proton therapy

system in Beijing, China.

-

Total of six systems sold comprising 15 proton

therapy rooms in the first nine months of 2016, (seven systems

comprising 12 rooms were sold at end of Q3 2015), confirming IBA's

global leadership

-

New milestones achieved for

Proteus®ONE:

-

All features of Proteus®ONE now

FDA (Food and Drug Administration) cleared

-

First patient treated in Europe at Centre

Antoine Lacassagne in Nice, France

-

Investment in HIL Applied Medical Ltd to develop

laser-based proton therapy solution with the potential to enable a

meaningful reduction in the size and cost of proton therapy systems

without compromising clinical utility

-

At the American Society for Radiation Oncology

(ASTRO) annual meeting, IBA announced initiatives with prestigious

partners including Philips and RaySearch to co-develop integrated

comprehensive solutions for adaptive proton radiation therapy

-

Growth strategy on track, including staff

recruitment and production capacity scale-up to meet high proton

therapy demand; more than 300 of the planned 400 engineers have now

been recruited by the end of Q3

-

Post quarter end, IBA RadioPharma Solutions

presented two new products at the European Association of Nuclear

Medicine (EANM) congress in October - the compact and powerful

Cyclone®KIUBE

cyclotron and the new Synthera®+

chemistry modules. IBA Industrial Solutions introduced the Second

Generation Rhodotron® at the

International Meeting on Radiation Processing (IMRP) in Vancouver,

Canada, offering improved performances including lower power

consumption and a new modular design; the current Rhodotron® product

portfolio has been extended with the TT50, a new compact and

cost-efficient 10 MeV Rhodotron®

Dosimetry

-

Despite strong activity in Dosimetry for PT,

Dosimetry revenue declined 12.8% to EUR 34.4 million versus EUR

39.5 million in Q3 2015 due to strong a comparator period, a slower

conversion rate in 2016 on long-term orders and a difficult LINAC

market in conventional radiotherapy

-

Dosimetry has been impacted in 2016 by revenue

conversion but the backlog remains strong at EUR 19.4 million

compared with EUR 18.0 million at the end of Q3 2015

-

First worldwide clinical implementation of newly

released Dolphin Online Ready Patient QA and Monitoring

Outlook

IBA currently anticipates

full-year revenue growth of around 20%, with continued strong PT

performance more than offsetting current weakness in the Dosimetry

market. Due to a lower than expected Dosimetry profit margin for

the year, the operating margin is expected to be around 10%,

slightly below previous expectations of around 11%, before rising

to between 13% and 15% by 2018. Achievement of these targets

depends on the timing of a small number of outstanding additional

PT contracts.

The Company is making a number of

strategic investments in order to build on and expand its

leadership in the global PT market. This includes scaling up

production capacity including a new Proteus®ONE

accelerator (S2C2) assembly line, plus additional investment in

R&D and commercial infrastructure. Total CAPEX is expected to

be around EUR 15 million, of which about EUR 2.5 million will be in

2016, with the remainder in 2017 and 2018.

The Company is also focusing on

additional skilled recruitment to meet growing market demand, with

the remainder of the additional 400 engineers and other qualified

staff expected to take the total headcount to around 1,600 by the

end of 2016. This additional recruitment is expected to be largely

self-financing through rapid revenue generation.

IBA expects to maintain the

dividend pay-out ratio at 30%.

Shareholder's

Agenda

Year End results 2016 : 23 March

2017

First Quarter 2017 results : 10 May 2017

Directors'

Declarations

In accordance with the Royal

Decree of 14 November 2007, IBA indicates that this Trading Update

has been prepared by the Chief Executive Officer (CEO) and the

Chief Financial Officer (CFO).

About IBA

IBA (Ion Beam Applications S.A.) is a global medical technology

company focused on bringing integrated and innovative solutions for

the diagnosis and treatment of cancer. The company is the worldwide

technology leader in the field of proton therapy, considered to be

the most advanced form of radiation therapy available today. IBA's

proton therapy solutions are flexible and adaptable, allowing

customers to choose from universal full-scale proton therapy

centers as well as compact, single room solutions. In addition, IBA

also has a radiation dosimetry business and develops particle

accelerators for the medical world and industry. Headquartered in

Belgium and employing about 1,400 people worldwide, IBA has

installed systems across the world.

IBA is listed on the pan-European

stock exchange NYSE EURONEXT (IBA: Reuters IBAB.BR and Bloomberg

IBAB.BB).

More information can be found at:

www.iba-worldwide.com

*Proteus®ONE and

Proteus®PLUS are the

brand names of new configurations of the Proteus®235.

For further

information, please contact:

IBA

Jean-Marc Bothy

Chief Strategy Officer

Soumya Chandramouli

Chief Financial Officer

+32 10 475 890

Investorrelations@iba-group.com

Thomas

Ralet

Vice-President Corporate Communication

+32 10 475 890

communication@iba-group.com

For media and

investor enquiries:

Consilium

Strategic Communications

Jonathan Birt, Matthew Neal, Ivar Milligan

+44 (0) 20 3709 5700

IBA@consilium-comms.com

pdf-IBA_3Q_Trading-update-EN-20161116

This

announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: IBA SA via Globenewswire

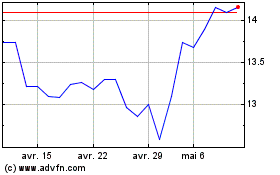

Ion Beam Applications (EU:IBAB)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

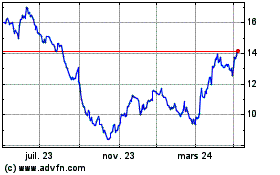

Ion Beam Applications (EU:IBAB)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024