ING 3Q16 underlying net result EUR 1,336 million

03 Novembre 2016 - 7:35AM

|

ING Bank 3Q16 underlying net result EUR

1,336 million, up 22.3% year-on-year, reflecting solid commercial

momentum |

| · |

ING Bank recorded EUR 3.6

billion of net core lending growth and attracted EUR 2.0 billion of

net customer deposits in 3Q16 |

| · |

Performance reflects

continued loan growth at healthy margins, as well as higher

commission and fee income |

| · |

Operating expenses

declined slightly year-on-year and sequentially; risk costs

remained relatively low at 34 bps of average RWA |

|

|

| ING

Group 3Q16 net result EUR 1,349 million (or EUR 0.35 per share);

robust ING Group CET1 ratio and ING Bank ROE |

| · |

ING Group fully-loaded

CET1 ratio rose to 13.5%; ING Bank underlying ROE of 11.3% for the

first nine months of 2016 |

|

|

|

|

| CEO statement

"ING delivered another quarterly result that exemplifies our Think

Forward strategy in action," said Ralph Hamers, CEO of ING Group.

"We again recorded solid commercial growth and introduced several

new innovations. Year-to-date, we have established over 400,000 new

primary customer relationships. To foster further growth and

maintain our standing as a leading European bank, we strive to keep

getting better every day, while managing the pressure on returns

from the continuous regulatory burden and the low interest rate

environment. In this context, I am convinced that our recently

announced investment programme and intention to converge towards a

single digital banking platform are necessary steps to enable ING

to evolve with changing customer expectations and to increase

operational efficiency.""ING Bank recorded EUR 3.6 billion of net

core lending growth and attracted EUR 2.0 billion of net customer

deposits in the third quarter. Lending growth was well diversified

across Retail and Wholesale Banking. We also continued to

facilitate our clients' sustainable transitions through deals that

support recycling, the circular economy and renewable energy. We

are proud that our integrated sustainability approach earned ING

the number-one ranking among global listed banks by Sustainalytics

in August. We also achieved a significant year-on-year improvement

in our Dow Jones Sustainability Index ranking, and received the

highest possible score in CDP's annual review for our performance

and disclosure related to our climate change strategy.""During the

third quarter, we introduced another wave of innovative and

insightful financial tools that empower customers. In Spain, the

launch of Twyp Cash provides customers with greater convenience by

enabling them to withdraw cash using their smartphones when making

purchases at more than 3,500 supermarkets and petrol stations. In

Wholesale Banking, we developed Virtual Cash Management, an

advanced application that allows companies to manage their cash

across banks and borders. It provides corporate treasurers with

enhanced cash visibility, access and control, anytime and

anywhere.""More recently, we created and launched the money

management platform Yolt as a next step in digitalisation and in

preparation for upcoming European regulation that will open the

payment services market to new players in 2018. Yolt gives users

insight into their account information from different banks in one

easy overview, helping customers stay on top of their finances. The

app is currently being tested only in the United Kingdom, but we

will explore opportunities for expansion.""ING's third-quarter

underlying result before tax was EUR 1,878 million, reflecting

continued loan growth at healthy margins, effective cost control

and a relatively low level of risk costs. Challengers & Growth

Markets delivered another record quarterly result on the back of

further organic growth. Retail Benelux showed resilience, as the

performance of the Netherlands compensated for the decline in

results at Retail Belgium, which were down 16.5% year-on-year. ING

Group's fully-loaded CET1 ratio rose to 13.5%. ING Bank's

underlying ROE was 11.3% for the first nine months of 2016.""As

announced on 3 October, we intend to invest EUR 800 million over

the next five years to create a scalable banking platform to cater

for continued commercial growth, an improved customer experience

and a quicker delivery of products. Regrettably, our intended

transformation will impact many of our employees, particularly in

Belgium and the Netherlands. We will do our utmost to build on our

track record of helping colleagues who are or could be affected to

find new job opportunities. All of those affected will be treated

with respect and care.""I fully appreciate the hard work of our

employees that is reflected in our quarterly results. While change

is not easy, it is essential to build on our position of strength.

I have complete confidence in our ability to execute on our

strategy and truly believe that the measures we intend to implement

will ensure that we continue to empower customers to stay a step

ahead." |

| Further

information All publications related to ING's 2016 Third

Quarter can be found at www.ing.com/3q16, including a video with

Ralph Hamers, which is also available at YouTube. Additional

financial information is available at www.ing.com/qr: - ING Group

historical trend data - ING Group analyst presentation (also

available via SlideShare) For further information on ING, please

visit www.ing.com. Frequent news updates can be found in the

Newsroom or via the @ING_news Twitter feed. Photos of ING

operations, buildings and its executives are available for download

at Flickr. Video is available on YouTube. Footage (B-roll) of ING

is available via videobankonline.com, or can be requested by

emailing info@videobankonline.com. ING presentations are available

at SlideShare. |

| Investor

conference call, Media conference call and webcasts Ralph Hamers,

Patrick Flynn and Wilfred Nagel will discuss the results in an

Investor conference call on 3 November 2016 at 9:00 a.m. CET.

Members of the investment community can join the conference call at

+31 20 703 8261 (NL), +44 20 3043 2026 (UK) or +1 719 325 2213 (US)

and via live audio webcast at www.ing.com. Ralph Hamers, Patrick

Flynn and Wilfred Nagel will also discuss the results in a Media

conference call conference on 3 November 2016 at 11:00 a.m.

CET. Journalists are welcome to join the conference call via

+31 20 531 5871 (NL) or

+44 203 365 3210 (UK). The Media conference call can

also be followed via live audio webcast at www.ing.com. |

| Investor

enquiries T: +31 20 576 6396 E: investor.relations@ing.com Press

enquiries T: +31 20 576 5000 E: media.relations@ing.com |

| |

| ING PROFILE ING is a global financial

institution with a strong European base, offering banking services

through its operating company ING Bank. The purpose of ING Bank is

empowering people to stay a step ahead in life and in business. ING

Bank's 52,000 employees offer retail and wholesale banking services

to customers in over 40 countries. ING Group shares are listed on

the exchanges of Amsterdam (INGA NA, INGA.AS), Brussels and on the

New York Stock Exchange (ADRs: ING US, ING.N). Sustainability forms

an integral part of ING's strategy, which is evidenced by the

number one position among 395 banks ranked by Sustainalytics. ING

Group shares are being included in the FTSE4Good index and in the

Dow Jones Sustainability Index (Europe and World) where ING is

among the leaders in the Banks industry group. |

| IMPORTANT LEGAL INFORMATION Elements of this

press release contain or may contain information about ING Groep

N.V. and/or ING Bank N.V. within the meaning of Article 7(1) to (4)

of EU Regulation No 596/ 2014. Projects may be subject to

regulatory approvals. Insofar as they could have an impact in

Belgium, all projects described are proposed intentions of the

bank. No formal decisions will be taken until the information and

consultation phases with the Work Council have been properly

finalised. ING Group's annual accounts are prepared in accordance

with International Financial Reporting Standards as adopted by the

European Union ('IFRS-EU'). In preparing the financial information

in this document, except as described otherwise, the same

accounting principles are applied as in the 2015 ING Group

consolidated annual accounts. All figures in this document are

unaudited. Small differences are possible in the tables due to

rounding. Certain of the statements contained herein are not

historical facts, including, without limitation, certain statements

made of future expectations and other forward-looking statements

that are based on management's current views and assumptions and

involve known and unknown risks and uncertainties that could cause

actual results, performance or events to differ materially from

those expressed or implied in such statements. Actual results,

performance or events may differ materially from those in such

statements due to, without limitation: (1) changes in general

economic conditions, in particular economic conditions in ING's

core markets, (2) changes in performance of financial markets,

including developing markets, (3) consequences of a potential

(partial) break-up of the euro, (4) potential consequences of

European Union countries leaving the European Union, (5) changes in

the availability of, and costs associated with, sources of

liquidity such as interbank funding, as well as conditions in the

credit markets generally, including changes in borrower and

counterparty creditworthiness, (6) changes affecting interest rate

levels, (7) changes affecting currency exchange rates, (8) changes

in investor and customer behaviour, (9) changes in general

competitive factors, (10) changes in laws and regulations, (11)

changes in the policies of governments and/or regulatory

authorities, (12) conclusions with regard to purchase accounting

assumptions and methodologies, (13) changes in ownership that could

affect the future availability to us of net operating loss, net

capital and built-in loss carry forwards, (14) changes in credit

ratings, (15) ING's ability to achieve projected operational

synergies and (16) the other risks and uncertainties detailed in

the most recent annual report of ING Groep N.V. (including the Risk

Factors contained therein) and ING's more recent disclosures,

including press releases, which are available on www.ING.com. Any

forward looking statements made by or on behalf of ING speak only

as of the date they are made, and, ING assumes no obligation to

publicly update or revise any forward-looking statements, whether

as a result of new information or for any other reason. This

document does not constitute an offer to sell, or a solicitation of

an offer to purchase, any securities in the United States or any

other jurisdiction. |

ING 3Q16 results full Press Release (PDF):

http://hugin.info/130668/R/2053879/768769.pdf

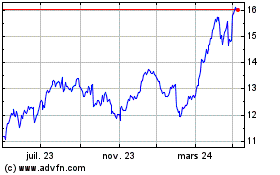

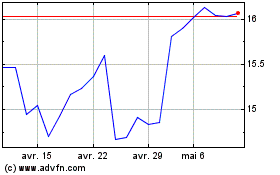

ING Groep NV (EU:INGA)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

ING Groep NV (EU:INGA)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024