Press release

Paris, July 11, 2017

Results for the 1st HALF OF

2017

-

Strong sales and financial

results in a market that remains favorable

-

Marked improvement in the

quality of the financial structure

-

Upgrade of the prospects for

annual revenues

(H1 2017 compared with H1 2016)

Volume: 4,100 housing units (+16.6%)

Value: €784.8 million including VAT (+16.5 %)

6.3 months compared with 7.8 months in H1 2016

Key financial data

(H1 2017 compared with H1 2016)

Of which Housing Units: €537.9 million (+19.1%)

- Gross margin:

€119.9 million compared with €109.0 million in H1 2016

- Adjusted EBIT:

€52.1 million compared with €49.4 million in H1 2016

- Attributable net

income

€20.2 million compared with €18.1 million in H1 2016

- Net financial debt:

€59.4 million compared with €85.1 million at the end of

2016

Of which Housing Units:

€1,487.9 million (+21.9% compared with H1 2016)

|

Kaufman & Broad SA announced its results for the 1st half of the

2017 financial year (from December 1, 2016 to May 31, 2017)

today.

Nordine Hachemi, Chairman and Chief Executive Officer of Kaufman

& Broad, made the following comments:

The results for the 1st half of 2017

confirm the strength of Kaufman & Broad's business model, which

generated balanced and sustained growth across all of its sales and

financial indicators.

Housing unit orders increased by around 17% in

both volume and value terms. Their rise was driven by all of our

customer segments. Furthermore, the marketing period was shortened

by 1.5 months between one first half and the next.

The increases of 18% in the land bank and of 22%

in the backlog confirm the ongoing strong growth

momentum.

Kaufman & Broad remained very active in the

Commercial Property segment. Projects on the market represent a

potential order volume of between €150 and €200 million over the

next six to nine months.

The Group's financial structure has been

significantly strengthened. On the one hand, the economic

performance of our activities resulted in a good profitability

combined with the control of working capital requirements.

Secondly, the success of the € 150 million Euro-bonds has allowed

the average maturity of the debt to be extended by 2 years.

Finally, the share dividend payment option was widely chosen by our

shareholders, with a 74% success rate, allowing the Group to

reinforce its equity. All of these factors led to an increase in

financial capacity, which stood at nearly € 290 million at the end

of May 2017.

Kaufman & Broad matches its customers'

purchasing power very closely when developing its projects, in a

New Housing market that remains very buoyant, and is driven by

balanced tax arrangements as well as by interest rates that are

still very low.

Barring any change to the tax arrangements in

effect, and based on a moderate increase in interest rates, the

strong momentum in the housing market observed in the 1st half now

leads us to expect that market to grow by around 5% of the year as

a whole.

Against this backdrop, the Group believes that the

increase in its revenues over the 2017 financial year as a whole

should be at least 10%, while the gross margin and adjusted EBIT

ratios will remain around 19% and 8.5% respectively. Furthermore,

net financial debt should amount less than €80

million" . |

Sales

activities

Housing unit orders in volume

terms amounted to 4,100 housing units in the 1st half

of 2017, i.e. an increase of 16.6% compared with the 1st half of

2016.

In value terms, housing unit orders amounted to €784.8 million

(including VAT) an increase of 16.5% compared with the same period

in 2016.

4,005 apartments with a value of

€764.2 million (including VAT) were ordered during the 1st half, i.e.

an increase of 17.5% in volume terms and of 18.4% in value terms.

Orders of single-family homes in communities represented 95 units,

compared with 108 units in the 1st half of 2016

(€20.6 million (including VAT) compared with €28.0 million

(including VAT) in the 1st half of

2016).

Breakdown of the

customer base

Orders by first-time buyers

increased by 13.8% in value terms (excluding VAT) over the

1st half of 2017

as a whole, while orders from second home purchasers increased by

20.1%. Orders by investors increased by 19.2% (growth of 7.8% for

the Pinel Scheme on a stand-alone basis, where the percentage of

total orders decreased by around 5 points from one first half to

the next, and amounted to 35.3%). Block sales increased by

32.6%.

The marketing period for projects

was 6.3 months in the 1st half of

2017, a decrease of 1.5 months compared with the 1st half of 2016

(7.8 months).

The Commercial Property segment

generated revenues of €87.0 million in the 1st half

of 2017.

In February, Kaufman & Broad

won the tender organized by the Bordeaux Euratlantique EPA with a

view to building a 26,000 m² office building at the foot of the

future TGV station. Furthermore, the Group won a consultation

process in Lille involving a 7,000 m² project in the Eurasanté

Complex. In the Logistics segment, Kaufman & Broad signed three

off-plan leases covering a total surface area of around 150,000

m2.

All of the projects on the market

represent a potential order volume of between €150 and €200 million

over the next six to nine months.

The Commercial Property backlog

amounted to €144.5 million (excluding VAT) at the end of May

2017.

The Housing backlog amounted to

€1487.9 million (excluding VAT), i.e. 15.6 months of business at

May 31, 2017. Kaufman and Broad had 225 housing programs on the

market at the same date, which represent 4,294 housing units,

compared with 200 programs representing 4,577 housing units at the

end of May 2016.

The Housing property portfolio

amounted to 27,296 units, and was up 18% compared with the

portfolio at the end of May 2016. This portfolio represents

potential revenues equivalent to almost four years of business,

Stable compared to November 30, 2016 (4.1 years) and ona one year

basis (3.9 years).

The Group is planning to launch 92

new programs in the 2nd half of

2017, including 32 programs in the Ile-de-France Region, which

represent 2,917 units, and 60 programs in the French Regions, which

represent 4,035 units.

Total revenues amounted to €627.7

million (excluding VAT), an increase of 9.2% compared with the

1st half of

2016.

Housing revenues amounted to

€537.9 million (excluding VAT), compared with €451.6 million

(excluding VAT) in the 1st half of

2016. They accounted for 85.7% of the Group's revenues

Revenues from the Apartments

business were up 20.6% compared with the 1st half of

2016, and amounted to €520.0 million (excluding VAT). Revenues from

Single-Family Homes in communities amounted to €18.0 million

(excluding VAT) compared with €20.6 million (excluding VAT) in the

1st half of

2016.

The Commercial Property segment's

revenues amounted to €87.0 million (excluding VAT) in the

1st half of

2017. The other businesses generated revenues of €2.7 million

(excluding VAT).

The gross margin amounted to

€119.9 million compared with €109.0 million in the 1st half of

2016. The gross margin ratio was 19.1%, or slightly higher than the

level in the 1st half of 2016

(19.0%).

Current operating expenses

amounted to €71.2 million (11.3% of revenues), compared with

€63.3 million[1] in the

1st half of 2016

(11.0% of revenues).

Income from current operations

amounted to €48.8 million, compared with €45.6 million in the

1st half of

2016. The current operating margin was 7.8%, compared with 7.9% in

the 1st half of

2016.

The Group's adjusted EBIT amounted

to €52.1 million in the 1st half of 2017

(compared with €49.4 million in the 1st half of

2016). The adjusted EBIT was 8.3% (compared with 8.6% in the

1st half of

2016).

Attributable net income amounted

to €20.2 million (compared with €18.1 million in the 1st half of

2016).

Kaufman and Broad issued its first

"Euro PP" bond placement amounting to €150 million in May, as part

of a private placement with institutional investors in Europe. This

private placement broke down between a €50 million 7-year tranche

and a €100 million 8-year tranche.

This loan, which was arranged

under favorable market conditions, gives the Group new financial

resources to support its growth. It also provides €100 million to

refinance the existing bank debt, and significantly extends the

maturity of that debt, which increased from 4.3 years at the end of

2016 to 6.2 years at the end of May 2017.

This strengthening of the Group's

financial structure was compounded by the positive impact on the

shareholders' equity of the high number (74% success rate) of

shareholders who opted to receive the 2016 dividend in Kaufman

& Broad shares.

Following these transactions, net

financial debt amounted to €59.4 million on May 31, 2017. Cash

assets (available cash and investment securities) amounted to

€189.4 million, compared with €118.1 million on November 30,

2016.

Working capital amounted to €131.5

million (10.2% of revenues on a 12-month rolling basis), compared

with €129.2 million on November 30, 2016 (10.4% of revenues). The

tight control on working capital primarily relies on the very short

marketing period for the Group's programs.

Kaufman & Broad paid out a

dividend of €1.85 per share in respect of the financial year ended

November 30, 2016, including a share-based dividend option, on June

2, 2017. The issue price for these new shares was set at €30.13,

which corresponds to 90% of the average prices quoted for Kaufman

& Broad shares on the Euronext Paris regulated market during

the 20 trading sessions prior to the day of said General Meeting,

minus the net amount of the dividend of €1.85 per share, rounded up

to the next euro cent.

The option period was opened

between May 16 and May 26, 2017 inclusive. At the close of the

period, shareholders who had opted for payment of the dividend in

shares represented 74% of

Kaufman & Broad S.A.'s shares. 947,136 new shares were issued

in order to pay the share-based dividend, which represents 4.55% of

the share capital, and 4.57% of the voting rights on the basis of

Kaufman & Broad S.A.'s share capital and voting rights on May

31, 2017. Settlement & delivery of the shares, and their

admission to trading on the Euronext Paris regulated market

occurred on June 2, 2017.

Following this transaction, and in

order to keep the number of shares unchanged on a fully-diluted

basis, Kaufman & Broad canceled 947,136 treasury shares. The

overall cash dividend payable to shareholders who did not choose to

have their dividends paid in shares amounted to €7.6 million, and

was paid on June 2, 2017.

The Group believes that the

increase in its revenues over the 2017 financial year should be at

least 10%, while the gross margin and adjusted EBIT ratios will

remain around 19% and 8.5%, respectively. Furthermore, net

financial debt should amount less than €80 million".

This release is

available on the www.kaufmanbroad.fr website

Contacts

Executive Vice-President,

Finance

Bruno Coche

01.41.43.44 73

Infos-invest@ketb.com |

Press Relations |

Camille Petit

Burson-Marsteller

01 56 03 12 80

contact.presse@ketb.com |

About Kaufman

& Broad - Kaufman & Broad has been designing,

building and selling single-family homes in communities,

apartments, and offices on behalf of third parties for almost 50

years. Kaufman & Broad is one of the leading French

Property Development & Construction companies due to the

combination of its size and profitability, and the strength of its

brand.

The Kaufman &

Broad Registration Document was filed with the French Financial

Markets Authority ("AMF") under No. D.17.0286 on March 31, 2017. It

is available on the AMF (www.amf-france.org)

and Kaufman & Broad (www.kaufmanbroad.fr)

websites. It contains a detailed description of Kaufman &

Broad's business activities, results, and prospects, as well as of

the related risks factors. Kaufman & Broad specifically draws

attention to the risk factors set out in Chapter 1.2 of the

Registration Document. The materialization of one or several of

these risks may have a material adverse impact on the Kaufman &

Broad Group's business activities, net assets, financial position,

results, and outlook, as well as on the price of Kaufman &

Broad's shares.

This press release does not amount to, and cannot

be construed as amounting to a public offering, a sale offer or a

subscription offer, or as intended to seek a purchase or

subscription order in any country.

Adjusted

EBIT: corresponds to income from current operations restated

for capitalized "IAS 23 revised" borrowing costs, which are

deducted from the gross margin.

Backlog:

Covers, for sales before completion (VEFA): ordered but undelivered

housing units; sales for which a notarized deed of sale has not yet

been signed; and the incomplete portion of undelivered housing

units for which a notarized deed of sale has been signed (for a

program that is 30% complete, 30% is accounted for as sales, and

70% remains in the backlog). The backlog is a summary at any given

point in time that can be used to estimate the revenue remaining to

be recognized in coming months and to confirm group forecasts - it

being understood that translating the backlog into revenues

involves uncertainties, especially for orders that have not yet

been officially notarized.

Commercial

offer: is represented by the total inventory of housing units

available for sale at the relevant date, i.e. all housing units

that have not been ordered on that (minus the sales tranches that

have not been released for marketing).

EHU: The EHUs

(Equivalent Housing Units) delivered are a direct reflection of

business volumes. The number of EHUs is obtained by multiplying (i)

the number of housing units in a given program for which notarized

sale deeds have been signed by (ii) the ratio between the Group's

property expenses and construction expenses incurred on said

program and the total expense budget for said program.

Gross margin:

Gross margin corresponds to revenues less cost of sales. The cost

of sales consists of the price of land parcels, the related

property costs (taxes, etc.), commissions paid to developers and to

Kaufman & Broad sales staff, as well as fees and commissions

provided for in the agency agreements executed by Kaufman &

Broad in order to sell its real estate programs, construction costs

and borrowing costs that may be directly attributed to program

development.

Land reserve:

This includes land for development (otherwise called the land

portfolio), i.e., the land for which an act or promise of sale was

signed, as well as land under consideration, i.e., the land for

which an act or promise of sale has not yet been signed

Off-plan lease

(BEFA): an off-plan lease involves a customer leasing a

building before it is even built or redeveloped.

Off-plan sale

(VEFA): an off-plan sale is an agreement via which the vendor

transfers their rights to the land and their ownership of the

existing buildings to the purchaser immediately. The future

structures will become the purchaser's property as they are

completed: the purchaser is required to pay the price of these

structures as the works progress. The vendor retains Project

Management powers until the works are accepted.

Orders:

measured in volume (Units) and in value terms; orders reflect the

Group's sales activity. Their inclusion in revenues is conditional

on the time required to turn an order into a signed and notarized

deed, which is the triggering event for booking the income. In

addition, in the case of multiple-dwelling programs that include

mixed-use buildings (apartments, business premises, retail space,

and offices), all of the floor space is converted into housing

equivalents.

Property

portfolio: represents all of the land for which any commitment

(contract for sale, etc.) has been signed.

Program, i.e. the marketing period. For instance, a 4.0% marketing

period corresponds to an estimated marketing period of 25 months,

which represents the number of orders compared with the average

commercial offer for the period.

Take-up

period: The inventory take-up period is the number of months

required for the available housing units to be sold if sales are

maintained at the same pace as in previous months, i.e., housing

units outstanding (offer available) per quarter divided by the

number of orders per quarter ended and with orders in turn divided

by three.

Take-up rate

(Te): The take-up rate (Te) represents the percentage of

initial inventory sold per month in a real estate program

(sales/month divided by initial inventory); i.e., net monthly

orders divided by the beginning of the period inventory ratio plus

the end of period inventory divided by two. NB: The reverse of the

take-up ratio (1/Te) gives the projected duration (in months) of a

program's promotion and marketing, in other words the take-up

period. For example, a 4.0% take-up ratio corresponds to a

projected promotion and marketing of 25 months.

Units: units

are used to define the number of housing units or equivalent

housing units (for mixed programs) in a given program. The number

of equivalent housing units is calculated as a ratio between the

surface area by type (business premises, retail space, or offices)

and the average surface area of the housing units previously

obtained.

APPENDICES

Key consolidated

data

| € '000s |

H1 2017 |

H1 2016 |

|

Revenues |

627,676 |

574,799 |

|

|

537,935 |

451,568 |

|

|

87,016 |

120,239 |

|

|

2,725 |

2,992 |

| |

|

|

| Gross margin |

119,903 |

108,966 |

| Gross

margin ratio (%) |

19.1% |

19.0% |

| Income from current

operations |

48,750 |

45,630 |

| Current operating margin (%) |

7.8% |

7.9% |

| Adjusted EBIT* |

52,099 |

49,437 |

| Adjusted EBIT margin (%) |

8.3% |

8.6% |

| Attributable net

income |

20,151 |

18,147 |

|

Attributable net earnings per share (€/share)** |

€ 0.97 |

€ 0.87 |

-

Based on the number of shares

that make up Kaufman & Broad S.A.'s share capital, i.e.

20,839,037 shares.

Consolidated

income statement

| € '000s |

S1 2017* |

H1 2016 |

| Revenues |

627,676 |

574,799 |

| Cost of sales |

-507,773 |

-465,833 |

| Gross

margin |

119,903 |

108,966 |

| Selling expenses |

-17,886 |

-16,098 |

| Administrative

expenses |

-32,541 |

-27,439 |

| Technical and

after-sales service expenses |

-10,590 |

-9,793 |

| Development and

program expenses |

-10,135 |

-10,006 |

| Income from current operations |

48,750 |

45,630 |

| Other non-recurring

income and expenses |

- |

- |

| Operating income |

48,750 |

45,630 |

| Cost of net financial

debt |

-2,131 |

-1,394 |

| Other financial income

and expense |

- |

- |

| Income tax |

-13,366 |

-14,906 |

Share of income

(loss)

of equity affiliates and joint ventures |

-202 |

-121 |

| Net

income of the consolidated entity |

33,051 |

29,209 |

|

Non-controlling interests |

12,900 |

11,062 |

| Attributable net income |

20,151 |

18,147 |

Consolidated

balance sheet

| € '000s |

May 31, 2017* |

30 Nov 2016 |

| ASSETS |

|

|

|

Goodwill |

68,661 |

68,661 |

| Intangible assets |

88,532 |

87,570 |

| Property, plant and

equipment |

7,667 |

7,449 |

| Equity affiliates and

joint ventures |

12,132 |

5,634 |

| Other non-current

financial investments |

1,790 |

2,504 |

| Non-current assets |

178,782 |

171,818 |

| Inventory |

373,926 |

371,381 |

| Trade receivables |

352,798 |

375,669 |

| Other receivables |

161,723 |

159,772 |

| Cash and cash

equivalents |

189,364 |

118,108 |

| Prepaid expenses |

1,424 |

1,345 |

| Current assets |

1,079,235 |

1,026,275 |

| TOTAL ASSETS |

1,258,017 |

1,198,093 |

| |

|

| LIABILITIES |

|

|

| Share capital |

5,418 |

5,418 |

| Additional paid-in

capital |

124,043 |

79,119 |

| Attributable net

income |

20,151 |

46,035 |

| Attributable equity capital |

149,612 |

130,571 |

| Non-controlling

interests |

21,619 |

15,196 |

| Equity capital |

171,231 |

145,767 |

| Non-current

provisions |

23,092 |

23,229 |

Borrowings and other

non-current financial liabilities

(portion maturing in > 1 year) |

248,182 |

191,362 |

| Deferred tax

liabilities |

54,949 |

45,471 |

| Non-current liabilities |

326,223 |

260,062 |

| Current

provisions |

1,696 |

1,499 |

| Other current

financial liabilities (portion maturing in < 1 year) |

541 |

11,841 |

| Trade payables |

658,536 |

675,146 |

| Other payables |

98,239 |

97,382 |

| Current tax |

1,082 |

5,858 |

| Prepaid

income |

469 |

539 |

| Current liabilities |

760,563 |

792,264 |

| TOTAL EQUITY AND LIABILITIES |

1,258,017 |

1,198,093 |

| Housing |

1st half of 2017 |

1st half of 2016 |

| |

|

|

| Revenues (€ million,

excluding VAT) |

537.9 |

451.6 |

|

|

520.0 |

431.0 |

|

|

18.0 |

20.6 |

| |

|

|

| Deliveries (EHUs) |

3,471 |

2,798 |

|

|

3,389 |

2,709 |

|

|

82 |

89 |

| |

|

|

| Net orders

(number) |

4,100 |

3,517 |

|

|

4,005 |

3,409 |

|

|

95 |

108 |

| |

|

|

| Net orders (€ million,

including VAT) |

784.8 |

673.5 |

|

|

764.2 |

645.5 |

|

|

20.6 |

28.0 |

| |

|

|

| End-of-period

commercial offer (number) |

4,294 |

4,577 |

| |

|

|

| End-of-period

backlog |

|

|

|

|

1,487.9 |

1,220.3 |

|

|

1,440.9 |

1,177.7 |

|

|

46.9 |

42.6 |

|

|

15.6 |

14.6 |

| |

|

|

|

End-of-period land bank (number) |

27,296 |

23,122 |

| Commercial property |

1st half of 2017 |

1st half of 2016 |

| |

|

|

| Revenues (€ million,

excluding VAT) |

87.0 |

120.2 |

| Net orders (€ million,

including VAT) |

0.6 |

221.6 |

|

End-of-period backlog (€ million, excluding VAT) |

144.5 |

238.3 |

[1] Of which expenses €1.1 million relating to the re-IPO

transaction performed in the 1st half of

2016.

KB SA Half year Result

2017

This

announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: Kaufman & Broad SA via Globenewswire

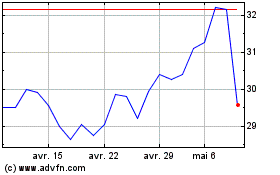

Kaufman and Broad (EU:KOF)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Kaufman and Broad (EU:KOF)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024