Libya to Reopen Oil Sector to New Foreign Investments -- Oil Chief

24 Janvier 2017 - 12:54PM

Dow Jones News

By Benoit Faucon

Libya intends to reopen its oil sector to new foreign

investments as it seeks to double its output, its oil chief said

Tuesday.

Production in the North African nation has tripled since this

summer to about 700,000 barrels a day. The ramp-up came as the

country's militias agreed to let key oil ports and fields to reopen

following the appointment of a unified government.

But speaking at the Chatham House think-tank in London, Mustafa

Sanallah, chairman of the state-run National Oil Co., said he

wanted to step up the revival of his country's oil industry by

bringing back investment from foreign companies.

"We intend in the coming months to lift our self-imposed

moratorium on foreign investment in new projects," he said.

International oil companies such as Italy's Eni SpA, France's

Total SA and Spain's Repsol SA have continued operating in Libya

following the civil war that toppled strongman Moammar Gadhafi in

2011. But after unrest continued, NOC decided to freeze new foreign

investments in the country.

Mr Sanallah said studies before the civil war had estimated

Libya's oil industry needed investment of $100 billion to $120

billion. With investments expected to flow again, Libya now expects

to boost its output to 1.25 million barrels a day by the end of

this year and return to its prewar production level of 1.6 million

barrels a day by 2022.

Write to Benoit faucon at Benoit.Faucon@wsj.com

(END) Dow Jones Newswires

January 24, 2017 06:39 ET (11:39 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

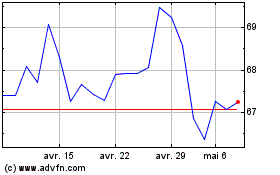

TotalEnergies (EU:TTE)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

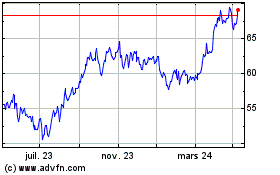

TotalEnergies (EU:TTE)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024