Regulated Information

4 May 2017 at 07:00 CEST

HIGHLIGHTS:

-

Group underlying EBITDA[1] of EUR 55 million for

Q1 2017, an increase of EUR 14 million on Q1 2016, primarily due to

a 66% increase in the average zinc price (USD 1,679/t to USD

2,780/t) and strengthening of the USD, partially offset by

reductions in treatment charge terms

-

Metals Processing underlying EBITDA of EUR 63

million, up EUR 12 million year-on-year, driven primarily by higher

commodity prices, partially offset by lower zinc treatment charges

and lead and by-product production; and

-

Improved Mining underlying EBITDA of EUR 3

million, up EUR 6 million year-on-year, driven by higher commodity

prices partially offset by lower Mine production and negative

EBITDA contribution from the restart of the Middle Tennessee

Mines

-

Net debt excluding zinc metal prepay and

perpetual securities of EUR 986 million at the end of Q1 2017, an

increase of EUR 121 million on 31 December 2016 driven

predominantly by working capital outflow due to higher commodity

prices. Net debt inclusive of zinc metal prepay and perpetual

securities of EUR 1.272 billion at the end of Q1 2017, an increase

of EUR 105 million on 31 December 2016

-

Successful placement of leverage neutral EUR

400m notes due 2024 to enhance credit, extend maturities and

improve liquidity

-

Port Pirie Redevelopment comprehensively

reviewed at the start of Q1 2017 with increased fully ramped-up

earnings uplift of approximately EUR 130 million per annum on 2016

macros. Construction has been optimised and hot commissioning

planned for September 2017 with total project cost of AUD 660

million

-

Restart of the Middle Tennessee Mines commenced

in December 2016 and progressing ahead of schedule; conditional

restart of Myra Falls approved; and Campo Morado mine sale

announced for USD 20 million

Commenting on the first quarter

2017 interim management statement, Hilmar Rode, Chief Executive

Officer said:

"We have continued to progress our strategic initiatives in Q1 2017

to position the business for a sustainable future as a top

performing zinc and lead business. We have completed a review of

our operations and identified three main streams that offer

opportunities for substantially increasing Nyrstar's

profitability:

- operating performance improvements across our

zinc smelter network;

- optimisation, de-risking and additional earnings

uplift from the Port Pirie Redevelopment; and

- extraction of maximum value from our now cash

flow positive North American mining portfolio.

In March 2017, our balance sheet

has been further strengthened by an additional USD 60 million

silver prepay agreement with a 6 month grace period followed by a 6

month amortisation and the issuance of EUR 400 million of senior

unsecured notes with a 7 year tenor which improved our liquidity

and extended our average bond maturity from 2.5 years to 4 years.

The balance sheet was further strengthened in April with the

upsizing of the Structured Commodity Trade Finance Facility from

EUR 400 million to EUR 500 million. We will continue to monitor the

market for additional opportunistic financings in order to further

strengthen the balance sheet and extend our existing maturity

profile.

For the remainder of 2017, we have

a clear focus on our strategic priorities to:

- reinforce our strong safety culture and improve

our visible safety leadership across the Company;

- deliver the commissioning and optimised ramp-up

of the Port Pirie Redevelopment in-line with the revised budget and

schedule announced in February 2017;

- extract maximum value from the mining portfolio

by concluding the sale of the Latin American mines and

optimising the North American mines, including the restart of

the Middle Tennessee and Myra Falls mines, to sell for value or

continue to operate for strong free cashflow if suitable offers are

not received;

- bring about a step change in operational

performance across all operations to unlock the full potential of

the existing asset base, including further corporate and

operational cost savings; and

- maintain a strong balance sheet and liquidity

profile utilising a diverse range of funding opportunities.

CONFERENCE

CALL

Management will discuss this statement in a conference call with

the investment community on 4 May 2017 at 9:00am Central European

Summer Time. The presentation will be webcast live and will also be

available in archive. The webcast can be accessed via

http://edge.media-server.com/m/p/qw853huk

KEY FIGURES

| EUR million |

|

|

|

| (unless otherwise indicated)[2] |

Q1 |

Q1 |

% |

| |

2016 |

2017 |

Change |

| Revenue |

|

|

|

| Metals

Processing |

638 |

931 |

46% |

|

Mining |

36 |

49 |

36% |

| Other |

(35) |

(48) |

(37%) |

| Group Revenue |

638 |

932 |

46% |

|

|

|

|

|

| Underlying EBITDA |

|

|

|

| Metals

Processing Underlying EBITDA |

51 |

63 |

24% |

| Mining

Underlying EBITDA |

(3) |

3 |

200% |

| Other and Eliminations Underlying EBITDA |

(7) |

(11) |

(57%) |

| Group Underlying EBITDA |

41 |

55 |

34% |

|

Underlying EBITDA margin |

6% |

6% |

0% |

|

|

|

|

|

| Capex |

|

|

|

| Metals

Processing |

58 |

56 |

(3%) |

| Mining |

3 |

8 |

167% |

| Group Capex |

61 |

65 |

7% |

|

|

|

|

|

| Loans and

borrowings, end of the period |

879 |

1,045 |

19% |

| Cash and

cash equivalents, end of period |

219 |

58 |

(74%) |

| Zinc

Prepay |

128 |

147 |

15% |

| Perpetual

Securities |

48 |

139 |

190% |

| |

|

|

|

| Net Debt Exclusive of Zinc Prepay and Perpetual

Securities |

660 |

986 |

49% |

|

|

|

|

|

| Net Debt Inclusive of Zinc Prepay and

Perpetual Securities |

837 |

1,272 |

52% |

|

|

|

|

|

| Metals Processing Production |

|

|

|

| Zinc

metal ('000 tonnes) |

255 |

261 |

2% |

| Lead

metal ('000 tonnes) |

47 |

35 |

(26%) |

|

|

|

|

|

| Mining Production |

|

|

|

| Zinc in

concentrate ('000 tonnes) |

26 |

23 |

(12%) |

| Copper in

concentrate ('000 tonnes) |

0.5 |

0.3 |

(40%) |

| Silver

('000 troy ounces) |

166 |

117 |

(30%) |

| Gold ('000 troy ounces) |

0.5 |

0.3 |

(40%) |

|

|

|

|

|

| Market[3] |

|

|

|

| Zinc

price (USD/t) |

1,679 |

2,780 |

66% |

| Lead

price (USD/t) |

1,744 |

2,278 |

31% |

| Silver

price (USD/t.oz) |

14.85 |

17.42 |

17% |

| Gold

price (USD/t.oz) |

1,183 |

1,219 |

3% |

| EUR/USD

average exchange rate |

1.10 |

1.06 |

(4%) |

| EUR/AUD

average exchange rate |

1.53 |

1.40 |

(8%) |

| |

|

|

|

GROUP FINANCIAL OVERVIEW

Revenue for Q1 2017 of EUR 932

million was up 46% on Q1 2016, driven by higher zinc, lead, silver

and gold prices which were up 66%, 31%, 17% and 3% respectively and

increased production volumes in zinc smelting which were partially

offset by deteriorating benchmark zinc treatment charge terms and a

higher average discount to benchmark achieved on Nyrstar's

concentrate book.

Group underlying EBITDA

(continuing operations) of EUR 55 million in Q1 2017, an increase

of 34% on Q1 2016, due to higher commodity prices and stronger US

dollar, partially offset by lower treatment charges and lower

production from lead smelting and Mining.

Capital expenditure (continuing

operations) was EUR 65 million in Q1 2017, representing an increase

of 7% year-on-year driven by a EUR 8 million capex increase in

Mining, partially offset by a 3% reduction in total capex spend in

Metals Processing compared to Q1 2016 at EUR 56 million.

Net debt at the end of Q1

2017, excluding the zinc metal prepay and perpetual securities, was

14% higher compared to the end of 2016 at EUR 986 million (EUR 865

million at the end of 2016). The net debt inclusive of the zinc

metal prepay and perpetual securities at the end of Q1 2017 was EUR

1,272 billion, up 9% compared to the end of 2016. Cash balance at

the end of Q1 2017 was EUR 58 million compared to EUR 127 million

at the end of 2016 with proforma liquidity at the end of Q1 2017 of

EUR 733 million which includes the upsize of the Structured

Commodity Trade Finance Facility completed at the end of April

2017.

ZINC CONCENTRATES

Zinc concentrate 2017 benchmark

treatment charges have been settled on the following terms:

- Base TC USD 172 per dmt (dry metric tonne) of

concentrate at basis price of USD 2,800 per tonne;

- Escalator of 0% from zinc price above USD 2,800

per tonne; and

- De-escalator of 0% from zinc price below USD

2,800 per tonne.

Nyrstar concluded its negotiations

with all benchmark and non-benchmark suppliers by April 2017. The

2017 benchmark zinc concentrate treatment charge represents a base

TC decrease of approximately 15% on the 2016 headline treatment

charge of USD 203 per dmt, basis price USD 2,000 per tonne.

The vast majority (90-95%) of

Nyrstar's concentrate requirements for 2017 are priced at benchmark

terms or by reference to the benchmark with a discount applied. The

average discount to the benchmark realized by Nyrstar in Q1 2017

has been slightly larger than in Q1 2016 and the past several

years. In Q1 2017, the average discount to the realized zinc

treatment charge achieved by Nyrstar's Metals Processing operations

was approximately USD 40-50 per tonne and was in-line with the

discount realized in Q2 to Q4 2016. The same discount is expected

to be realized over the course of 2017.

SAFETY, HEALTH AND

ENVIRONMENT

"Prevent Harm" is a core priority

of Nyrstar. The Company is committed to maintaining safe operations

and to proactively managing risks including with respect to people

and the environment. At Nyrstar, we work together to create a

workplace where all risks are effectively identified and controlled

and everyone goes home safe and healthy each day of their working

life.

The lost time injury rate (LTIR)

for the Company in Q1 2017 was 1.6, an improvement of 33% compared

to a rate of 2.4 in Q1 2016. The frequency rate of cases with time

lost or under restricted duties (DART) decreased by 10% compared to

Q1 2016 and the frequency rate of cases requiring at least a

medical treatment (RIR) slightly increased by 2% compared to Q1

2016. In Q1 2017 the Auby smelter reached the milestone of one

calendar year recordable injury free. This is the first time at

Nyrstar that an operational site has achieved such a milestone.

No environmental events with

material business consequences or long-term environmental impacts

occurred during the period.

OPERATIONS REVIEW: METALS

PROCESSING

| EUR million |

Q1 |

Q1 |

% |

| (unless otherwise indicated) |

2016 |

2017 |

Change |

| |

|

|

|

|

Revenue |

638 |

931 |

46% |

| |

|

|

|

| Underlying EBITDA |

51 |

63 |

24% |

|

|

|

|

|

|

Sustaining |

18 |

21 |

17% |

|

Growth |

5 |

6 |

20% |

| Port Pirie Redevelopment |

35 |

28 |

(20%) |

| Metal Processing

Capex |

58 |

56 |

(3%) |

Metals Processing delivered an

underlying EBITDA result of EUR 63 million in Q1 2017, an increase

of 24% over Q1 2016 due to higher commodity prices and a stronger

USD, partially offset by lower zinc treatment charges and reduced

lead and by-product production. In line with management

expectations, the sales performance for Metals Processing,

evidenced in premium gross profit, was seasonally weak due to the

de-stocking cycle of key customers over the Northern hemisphere

winter and Chinese new year.

Sustaining capital spend in Q1

2017 increased by 17% on Q1 2016, in-line with the higher

sustaining capital expenditure guidance provided for 2017 (EUR 100

million to EUR 135 million) compared to 2016 (EUR 97 million).

| |

Q1 |

Q1 |

% |

| |

2016 |

2017 |

Change |

| |

|

|

|

| Zinc metal ('000 tonnes) |

|

|

|

| Auby |

29 |

40 |

38% |

|

Balen/Overpelt |

65 |

64 |

(2%) |

|

Budel |

71 |

71 |

0% |

|

Clarksville |

28 |

29 |

4% |

|

Hobart |

62 |

57 |

(8%) |

| Total |

255 |

261 |

2% |

|

|

|

|

|

| Lead metal ('000 tonnes) |

|

|

|

| Port

Pirie |

47 |

35 |

(26%) |

|

|

|

|

|

| Other products |

|

|

|

| Copper

cathode ('000 tonnes) |

1.2 |

0.9 |

(25%) |

| Silver

(million troy ounces) |

3.8 |

2.8 |

(26%) |

| Gold

('000 troy ounces) |

10.9 |

17.6 |

61% |

| Indium

metal (tonnes) |

- |

2.7 |

100% |

| Sulphuric

acid ('000 tonnes) |

357 |

331 |

(7%) |

Metals Processing produced

approximately 261,000 tonnes of zinc metal in Q1 2017, in-line with

full year 2017 guidance, representing a 2% increase on Q1 2016. The

increase in zinc metal production year-over-year was primarily

driven by the planned maintenance shut at Auby in Q1 2016 which

negatively impacted production in the comparison period.

Production at Auby was up 38% as a

result of a planned cellhouse shutdown in Q1 2016; and Hobart was

down 8% due to an unplanned roaster outage caused by a refractory

failure and consequent bed de-fluidisation which impacted

production for the first 8 days of 2017 by constraining output due

to low calcine availability. Indium production at Auby recommenced

during Q1 2017 with production of 2.7 tonnes. The indium production

had ceased at Auby since November 2015 due to damage caused by a

fire in the indium plant.

Lead market metal production at

Port Pirie of 35kt was 26% lower compared to Q1 2016 due to a slow

blast furnace rate resulting from a heat exchanger failure in the

old acid plant that negatively affected sinter quality and a 12 day

blast furnace outage to repair leaking water jackets. Copper and

silver production was lower in Q1 2017 by 25% and 26% respectively

whilst gold production was up 61%. The variance in the production

of copper, silver and gold is mainly due to a different feed mix

consumed with lower copper and silver and higher gold

contained.

OPERATIONS REVIEW:

MINING

| EUR million |

Q1 |

Q1 |

% |

| (unless otherwise indicated) |

2016[4] |

2017 |

Change |

| |

|

|

|

| CONTINUING OPERATIONS |

|

|

|

|

|

|

|

|

|

Revenue |

36 |

49 |

36% |

| |

|

|

|

| Underlying EBITDA |

(3) |

3 |

200% |

|

|

|

|

|

|

Sustaining |

1 |

3 |

200% |

|

Exploration and development |

2 |

5 |

150% |

| Growth |

- |

- |

- |

| Mining Capex |

3 |

8 |

167% |

| |

|

|

|

| DISCONTINUED OPERATIONS (Contonga & Coricancha

only) |

|

|

|

|

Underlying EBITDA |

2 |

(2) |

(200%) |

|

Capex |

1 |

0 |

(100%) |

Mining underlying EBITDA of EUR 3

million in Q1 2017 was EUR 6 million higher than in Q1 2016 due to

the higher zinc price and lower zinc treatment charge and

operational improvements which reduced direct operating costs. The

Mining result excludes the underlying EBITDA impact of Contonga and

Coricancha, which have been eliminated as discontinued operations

due to their announced divestment. Myra Falls currently being on

suspension and the Middle Tennessee Mines which are currently being

re-started, contributed EBITDA of negative EUR 3 million and

negative EUR 4.4 million respectively in Q1 2017. As the Middle

Tennessee mines commence mill production in Q2 2017, the complex is

expected to begin contributing positive EBITDA.

Mining capital expenditure in Q1

2017 was EUR 8 million, up EUR 5 million year-on-year, due

primarily to the re-start of the Middle Tennessee mines which

commenced in December 2016. Mining capex excludes the Contonga and

Coricancha operations which have been eliminated from the results

as discontinued mining operations. During Q1 2017, the discontinued

mining operations did not incur capex.

| '000 tonnes |

Q1 |

Q1 |

% |

| unless otherwise indicated |

2016 |

2017 |

Change |

| |

|

|

|

| CONTINUING OPERATIONS |

|

|

|

| Total ore milled[5] |

603 |

586 |

(3%) |

|

|

|

|

|

| Zinc in Concentrate |

|

|

|

|

Langlois |

10 |

7 |

(30%) |

| Myra

Falls |

- |

- |

|

| East

Tennessee |

16 |

17 |

6% |

| Middle Tennessee |

- |

- |

|

| Total |

26 |

23 |

(12%) |

| |

|

|

|

| Other metals |

|

|

|

| Copper in

concentrate |

0.5 |

0.3 |

(40%) |

| Silver

('000 troy oz) |

166 |

117 |

(30%) |

| Gold

('000 troy oz) |

0.5 |

0.3 |

(40%) |

Nyrstar's continuing Mining

operations produced approximately 23kt of zinc in concentrate in Q1

2017, a decrease of 12% compared to Q1 2016. Production at Langlois

was impacted due to a lack of development which is currently being

addressed. In addition, the Middle Tennessee mine is re-starting

ahead of its previously communicated schedule with mill processing

operations to be commenced in Q2 2017 and full capacity of 50kt per

annum of zinc in concentrate to be reached by November 2017.

OTHER DEVELOPMENTS

Mining Divestment

Process

Over the course of Q1 2017, the Company has been progressing the

Mine divestment process by completing customary closing conditions

relating to the sales announced in December 2016 of the Contonga

mine in Peru and various mineral claims located in Quebec, Canada

to subsidiaries of Glencore plc and the Coricancha mine in Peru to

Great Panther Silver Limited. The closing conditions for the sale

of the minerals claims located in Quebec were completed in April

2017 and those for Coricancha and Contonga are expected to be

satisfied during the course of Q2 and Q3 2017 respectively.

At the end of April 2017, Nyrstar

entered a share purchase agreement to sell the Campo Morado mine in

Mexico to Telson Resources Inc. and Reynas Minas S.A. de C.V., a

Canadian based junior TSX Venture listed mining company and a

Mexican based mining company respectively, for a total

consideration of USD 20 million. Consideration of USD 0.8 million

was paid to Nyrstar upon signing the share purchase agreement, USD

2.7 million is payable in cash by the closing of the transaction

and USD 16.5 million payable in cash on or before the 12 month

anniversary of the closing of the transaction. Closing of the

transaction is subject to customary closing conditions and is

expected to occur by Q3 2017.

Nyrstar has conditionally approved

the restart of the Myra Falls mine and will continue to utilise

limited additional capex to prove up reserves and strengthen mine

plans to facilitate sales of its remaining North American mining

asset base. The Company remains committed to its strategy to divest

its Mining assets for value.

Port Pirie

Redevelopment

As at 31 March 2017, capex incurred at Port Pirie was AUD 551

million with AUD 572 million committed, AUD 220 million drawn under

the perpetual securities and AUD 73 million remaining to be

drawn.

As communicated by the Company on

9 February 2017, a comprehensive review of the Port Pirie

Redevelopment project has been undertaken and completed to ensure

that the scope, flow sheet and commissioning will provide Port

Pirie with industry leading performance.

Management's review has confirmed

that the Port Pirie Redevelopment is the right strategy for the

Company as it will have a significant positive long-term effect on

Nyrstar's operations and deliver a substantial earnings uplift.

However, the review also identified that rework is required to the

fabrication of key module components, delaying the start of hot

commissioning. Also as part of the review, a number of

engineering improvements have been identified that will unlock

additional value. Port Pirie is at a stage where the identified

improvements can still be implemented effectively ahead of the hot

commissioning milestone scheduled for September 2017.

In Q1 2017, the Port Pirie

Redevelopment has focused on completing the rework referred to

above and enhancing the slag tapping arrangements on the TSL

furnace whilst completing the modular construction and progressing

the commissioning of the new infrastructure and related control

systems. In addition, further advanced training of plant personnel

as well as improved start-up sequencing of the TSL furnace and

tie-in to the existing operations is continuing. To further reduce

ramp-up risk, the Company intends to continue operating the

existing sinter and acid plants in parallel with the ramp-up of the

TSL furnace and new acid plant. As previously communicated, the

total estimated cost to complete the project is expected to

increase by approximately EUR 70 million from AUD 563 million to

AUD 660 million.

The review completed in Q1 2017

has confirmed that the incremental EBITDA uplift from the

redevelopment, using 2016 as a basis, will increase from the

previous full ramp-up guidance of EUR 80 million per annum and is

expected to be in the region of EUR 40 million in 2018, EUR 100

million in 2019 and EUR 130 million per annum from 2020.

FORWARD-LOOKING

STATEMENTS

This release includes

forward-looking statements that reflect Nyrstar's intentions,

beliefs or current expectations concerning, among other things:

Nyrstar's results of operations, financial condition, liquidity,

performance, prospects, growth, strategies and the industry in

which Nyrstar operates. These forward-looking statements are

subject to risks, uncertainties and assumptions and other factors

that could cause Nyrstar's actual results of operations, financial

condition, liquidity, performance, prospects or opportunities, as

well as those of the markets it serves or intends to serve, to

differ materially from those expressed in, or suggested by, these

forward-looking statements. Nyrstar cautions you that

forward-looking statements are not guarantees of future performance

and that its actual results of operations, financial condition and

liquidity and the development of the industry in which Nyrstar

operates may differ materially from those made in or suggested by

the forward-looking statements contained in this news release. In

addition, even if Nyrstar's results of operations, financial

condition, liquidity and growth and the development of the industry

in which Nyrstar operates are consistent with the forward-looking

statements contained in this news release, those results or

developments may not be indicative of results or developments in

future periods. Nyrstar and each of its directors, officers and

employees expressly disclaim any obligation or undertaking to

review, update or release any update of or revisions to any

forward-looking statements in this report or any change in

Nyrstar's expectations or any change in events, conditions or

circumstances on which these forward-looking statements are based,

except as required by applicable law or regulation.

About

Nyrstar

Nyrstar is a global multi-metals business, with a market leading

position in zinc and lead, and growing positions in other base and

precious metals, which are essential resources that are fuelling

the rapid urbanisation and industrialisation of our changing world.

Nyrstar has mining, smelting and other operations located in

Europe, the Americas and Australia and employs approximately 4,300

people. Nyrstar is incorporated in Belgium and has its corporate

office in Switzerland. Nyrstar is listed on Euronext Brussels under

the symbol NYR. For further information please visit the Nyrstar

website: www.nyrstar.com.

Important

information

This announcement is for general information only. It does not

constitute, or form part of, an offer or invitation to sell or

issue, or any solicitation of an offer to purchase or subscribe

for, nor shall there be any sale or purchase of, the securities

referred to herein. In particular, this announcement is not

an offer of securities for sale in the United States. Any such

securities may not be sold in the United States absent registration

with the United States Securities and Exchange Commission or an

exemption from registration under the U.S. Securities Act of 1933,

as amended. The Company does not intend to register any part of any

offering in the United States or to conduct a public offering of

securities in the United States. Any offering of securities

will be made by means of an offering document that will contain

detailed information about the company and management as well as

financial statements. This announcement is not a prospectus within

the meaning of Directive 2003/71/EC of the European Parliament and

the Council of November 4th, 2003, as amended and as implemented

respectively in each member State of the European Economic Area

(the "Prospectus Directive"). This announcement does not, and shall

not, in any circumstances constitute a public offering nor an

invitation to the public in connection with any offer to buy or

subscribe for securities in any jurisdiction.

For further information

contact:

Anthony Simms Group Manager Investor

Relations T: +41 44 745 8157 M: +41 79 722

2152 anthony.simms@nyrstar.com

Franziska Morroni Group Manager Corporate

Communications T: +41 44 745 8295 M: +41 79

719 2342 franziska.morroni@nyrstar.com

[1] Underlying EBITDA is a non-IFRS measure of

earnings, which is used by management to assess the underlying

performance of Nyrstar's operations and is reported by Nyrstar to

provide additional understanding of the underlying business

performance of its operations. Nyrstar defines "Underlying EBITDA"

as profit or loss for the period adjusted to exclude loss from

discontinued operations (net of income tax), income tax

(expense)/benefit, share of loss of equity-accounted investees,

gain on the disposal of equity-accounted investees, net finance

expense, impairment losses and reversals, restructuring expense,

M&A related transaction expenses, depreciation, depletion and

amortization, income or expenses arising from embedded derivatives

recognised under IAS 39 "Financial Instruments: Recognition and

Measurement" and other items arising from events or transactions

clearly distinct from the ordinary activities of Nyrstar. For a

definition of other terms used in this press release, please see

Nyrstar's glossary of key terms available at:

http://www.nyrstar.com/investors/en/Pages/investorsmaterials.aspx

[2] Q1 2016 numbers were adjusted to exclude El Toqui, El Mochito,

Contonga and Coricancha as the mines are sold or reclassified as

discontinued operation

[3] Zinc, lead and copper prices are averages of LME daily cash

settlement prices. Silver/Gold price is average of LBMA daily

fixing / daily PM fixing, respectively

[4] Q1 2016 numbers were adjusted to exclude El Toqui, El Mochito,

Contango and Coricancha as the mines are sold or reclassified as

discontinued operation

[5] Mining production for both years was adjusted to exclude

Contonga production volumes as it has been reclassified as a

discontinued operation. For production at discontinued operations

refer to annex

The full press release can be downloaded from the

following link:

Press Release (Dutch)

Press Release (English)

This

announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: Nyrstar via Globenewswire

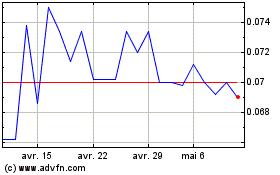

Nyrstar NV (EU:NYR)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Nyrstar NV (EU:NYR)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024