Regulated Information - Inside

Information

THIS ANNOUNCEMENT

IS NOT FOR DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN THE UNITED

STATES OF AMERICA, AUSTRALIA, CANADA, JAPAN, SOUTH AFRICA OR ANY

OTHER JURISDICTION WHERE TO DO SO WOULD BE PROHIBITED BY APPLICABLE

LAW NOR FOR DISTRIBUTION TO ANY U.S. PERSON.

9 March 2017 at 7am CET

Nyrstar Netherlands (Holdings)

B.V. (the "Offeror"), a subsidiary of Nyrstar NV (the "Company" or

"Nyrstar"), announced today the results of its voluntary tender

offer (the "Tender Offer") to purchase for cash any and all of the

outstanding 4.25% convertible bonds due 2018 issued by Nyrstar in

an original aggregate principal amount of €120 million (ISIN Code:

BE6258011566) (Common Code: 097373388) (the "2018 Convertible

Bonds").

The Tender Offer was launched on

27 February 2017, and (following an extension) the acceptance

period during which holders of the outstanding 2018 Convertible

Bonds could tender their bonds ran from 27 February 2017 to 8 March

2017 at 4.00 p.m. CET (the "Expiration Date").

As at the Expiration Date, €

29,500,000 in aggregate principal amount of 2018 Convertible Bonds

were validly tendered pursuant to the Tender Offer. The Offeror has

decided to accept for repurchase all 2018 Convertible Bonds validly

tendered in full, subject to the conditions set forth in the

memorandum regarding the Tender Offer (the "Tender Offer

Memorandum"), including satisfaction of the completion of the issue

of €400 million new senior unsecured notes due 2024 (the

"Notes").

Description

of the

Convertible

Bonds |

|

Original

Aggregate

Principal

Amount |

|

Aggregate

Principal

Amount

Tendered

and

Accepted |

|

Aggregate

Principal

Amount

Outstanding

Following

Completion

of the

Tender

Offer |

|

Purchase

Price |

4.25%

Convertible Bonds

due 2018

BE6258011566 /

097373388 |

|

€120,000,000 |

|

€ 29,500,000 |

|

€ 90,500,000 |

|

100 per cent. |

Subject to the satisfaction of

certain conditions, the Offeror will pay the purchase price and

accrued interest on the 2018 Convertible Bonds, and ownership of

the tendered 2018 Convertible Bonds will be transferred on or

around 10 March 2017 (the "Payment Date"). The Tender Offer is

expected to settle on the Payment Date, and all payments for 2018

Convertible Bonds validly tendered on or prior to the Expiration

Date and accepted for repurchase will be made on the Payment Date.

The Tender Offer is subject to conditions set forth in the Tender

Offer Memorandum, including satisfaction of the completion of the

issue of the Notes. Subject to applicable law, the Offeror reserves

the right, in its sole discretion, to waive any and all conditions

of the Tender Offer.

About

Nyrstar

Nyrstar is a global multi-metals business, with a market leading

position in zinc and lead, and growing positions in other base and

precious metals, which are essential resources that are fuelling

the rapid urbanisation and industrialisation of our changing world.

Nyrstar has mining, smelting, and other operations located in

Europe, the Americas and Australia and employs approximately 4,300

people. Nyrstar is incorporated in Belgium and has its corporate

office in Switzerland. Nyrstar is listed on Euronext Brussels under

the symbol NYR. For further information please visit the Nyrstar

website: www.nyrstar.com

For further information

Anthony Simms - Group

Manager Investor Relations T: +41 44 745

8157 M: +41 79 722 2152 anthony.simms@nyrstar.com

Franziska Morroni - Group Manager

Corporate Communications T: +41 44 745 8295 M: +41 79 719

2342 franziska.morroni@nyrstar.com

IMPORTANT NOTICE

The

information contained in this announcement is for general

information only and does not purport to be full or complete. This

announcement does not constitute, or form part of, an offer or

invitation to sell or issue, or any solicitation of an offer to

purchase or subscribe for, nor shall there be any sale or purchase

of, the securities referred to herein, in any jurisdiction in which

such offer, invitation, solicitation, sale, issue, purchase or

subscription would be unlawful under the securities laws of any

such jurisdiction. This announcement is not for distribution,

directly or indirectly, in the United States of America, Australia,

Canada, Japan, South Africa or any other jurisdiction where to do

so would be prohibited by applicable law, nor to any U.S. person.

Any persons reading this announcement should inform themselves of

and observe any such restrictions.

No

communication and no information in respect of the Tender Offer may

be distributed to the public in any jurisdiction where a

registration or approval is required. No steps have been or will be

taken in any jurisdiction where such steps would be required. The

participation in the Tender Offer may be subject to specific legal

or regulatory restrictions in certain jurisdictions. The Offeror

takes no responsibility for any violation of any such restrictions

by any person.

These

materials are not an offer for sale of securities. The distribution

of this announcement in certain jurisdictions (in particular the

United States and the United Kingdom) may be restricted by law.

Persons into whose possession this announcement comes are required

by each of the Offeror, and the dealer managers and the tender

agent for the Tender Offer to inform themselves about, and to

observe, any such restrictions. If you are in any doubt as to the

contents of this announcement or the action you should take, you

are recommended to immediately seek your own financial and legal

advice, including as to any tax consequences resulting from the

Tender Offer, from your stockbroker, bank manager, solicitor,

accountant or other independent financial or legal adviser.

The

Tender Offer has not been made, directly or indirectly in or into,

or by use of the mail of, or by any means or instrumentality of

interstate or foreign commerce of, or of any facilities of a

national securities exchange of, the United States. This includes,

but is not limited to, facsimile transmission, electronic mail,

telephone and the internet and other forms of electronic

communication. Copies of this announcement are not being, and must

not be, directly or indirectly mailed or otherwise transmitted,

distributed or forwarded (including, without limitation, by

custodians, nominees or trustees) in or into the United States. Any

purported tender of 2018 Convertible Bonds in the Tender Offer

resulting directly or indirectly from a violation of these

restrictions will be invalid and any purported tender of 2018

Convertible Bonds made by a person located in the United States or

any agent, fiduciary or other intermediary acting on a

non-discretionary basis for a principal giving instructions from

within the United States will be invalid and will not be accepted.

Each person participating in the Tender Offer has represented that

it or any beneficial owner of the 2018 Convertible Bonds or any

person on whose behalf such person is acting is not a U.S. person

(as defined under the U.S. Securities Act of 1933, as amended) or a

resident and/or located in the United States. For the purposes of

this and the above paragraph, "United States" means the United

States of America, its territories and possessions, any state of

the United States of America and the District of Columbia.

This

announcement has not been, and will not be, submitted for approval

or recognition to the Financial Services and Markets Authority

(Autorité des Services et Marchés Financiers /

Autoriteit voor Financiële Diensten en Markten). The Tender

Offer was made under Article 6, §3, 3° of the Belgian Act of 1

April 2007 on public takeover bids (as amended from time to time)

(the "Belgian Takeover Act"). Accordingly, the Tender Offer does

not constitute a public offering as defined in Articles 3, §1, 1°

and 6, §1 of the Belgian Takeover Act. This announcement has been

issued exclusively for the purpose of the Tender Offer.

Accordingly, the information contained in this announcement may not

be used for any other purpose or disclosed to any other person in

Belgium.

The

Tender Offer has not been made, directly or indirectly, to the

public in the Republic of France ("France"). This announcement has

not been, or will not be, distributed to the public in France, and

only (i) providers of investment services relating to portfolio

management for the account of third parties (personnes fournissant le service d'investissement de

gestion de portefeuille pour compte de tiers) and/or (ii)

qualified investors (investisseurs qualifiés),

other than individuals, acting for their own account, all as

defined in, and in accordance with, Articles L.411-1, L.411-2 and

D.411-1 to D.411-3 of the French Code monétaire et

financier, are eligible to participate in the Tender Offer.

This announcement has not been, or will not be, submitted for

clearance to or approved by the Autorité des

Marchés Financiers.

This

announcement has not been, or will not be, submitted to the

clearance procedures of the Commissione Nazionale

per le Società e la Borsa ("CONSOB") pursuant to applicable

Italian laws and regulations. The Tender Offer was conducted in the

Republic of Italy ("Italy") as an exempted offer pursuant to

Article 101-bis, paragraph 3-bis of the Legislative Decree No. 58

of 24 February 1998, as amended (the "Financial Services Act") and

Article 35-bis, paragraph 4, of CONSOB Regulation No. 11971 of 14

May 1999, as amended (the "Issuer's Regulation") and, therefore, is

intended for, and directed only at qualified investors (investitori qualificati) (the "Italian Qualified

Investors"), as defined pursuant to Article 100, paragraph 1,

letter (a) of the Financial Services Act and Article 34-ter, paragraph 1, letter (b) of the Issuers'

Regulation. Accordingly, the Tender Offer cannot be promoted,

nor may copies of any document related thereto be distributed,

mailed or otherwise forwarded, or sent in Italy other than to

Italian Qualified Investors. Holders or beneficial owners of the

2018 Convertible Bonds who are Italian Qualified Investors resident

and/or located in Italy could only tender the 2018 Convertible

Bonds for purchase through authorised persons (such as investment

firms, banks or financial intermediaries permitted to conduct such

activities in Italy in accordance with the Financial Services Act,

CONSOB Regulation No. 16190 of 29 October 2007, as amended from

time to time, and Legislative Decree No. 385 of 1 September

1993, as amended from time to time) and in compliance with any

other applicable laws and regulations and with any requirements

imposed by CONSOB or any other Italian authority.

This

announcement may not be distributed or circulated in The

Netherlands, other than to persons or entities which are "qualified

investors" (gekwalificeerde beleggers) as

defined in Article 1:1 of the Dutch Financial Supervision Act

(Wet op het financieel toezicht).

The

communication of this announcement is not being made, and has not

been approved, by an "authorised person" within the meaning of

Section 21 of the U.K. Financial Services and Markets Act 2000.

Accordingly, this announcement is not being distributed to, and

must not be passed on to, the general public in the United Kingdom.

The communication of this announcement is only being made to those

persons in the United Kingdom falling within the definition of

investment professionals (as defined in Article 19(5) of the

Financial Services and Markets Act 2000 (Financial Promotion) Order

2005 (the "Financial Promotion Order")) or persons who are within

Article 43 of the Financial Promotion Order or any other persons to

whom it may otherwise lawfully be made under the Financial

Promotion Order. This announcement must not be acted on or relied

on by persons who are not relevant persons. The Tender Offer to

which this announcement relates was made only to relevant persons

and was engaged in only with relevant persons. Any person who is

not a relevant person should not act or rely on this announcement

or any of its content. This announcement must not be distributed,

published, reproduced or disclosed (in whole or in part) by

recipients to any other person.

The full press release can be

downloaded from the following link:

Press Release (Dutch)

Press Release (English)

This

announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: Nyrstar via Globenewswire

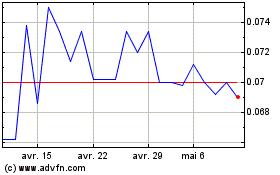

Nyrstar NV (EU:NYR)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Nyrstar NV (EU:NYR)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024