Regulated Information - Inside

Information

THIS ANNOUNCEMENT

IS NOT FOR DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN THE UNITED

STATES OF AMERICA, AUSTRALIA, CANADA, JAPAN, SOUTH AFRICA OR ANY

OTHER JURISDICTION WHERE TO DO SO WOULD BE PROHIBITED BY APPLICABLE

LAW

14 November 2017

at 5:45 p.m. CET

Nyrstar

NV (the "Company") announces today the launch of an equity offering

of approximately EUR 100 million worth of new shares through an

accelerated book build offering (the "Placement") conducted under

private placement exemptions.

Nyrstar intends to use

the net proceeds of the Placement:

-

to fund EUR 30 million of the capital investment

announced in August 2017 to restart the Myra Falls mine;

-

to fund the additional EUR 70 million of

capital investment announced in February 2017 to complete the Port

Pirie Redevelopment, which is now being ramped up and expected to

deliver a substantial earnings uplift from 2018 onwards; and

-

to accelerate its strategy to further strengthen

and start deleveraging the balance sheet.

Commenting on the Placement, Hilmar Rode, Chief Executive Officer

said:

"By

providing an immediate capital structure improvement, the Placement

enables Nyrstar and its stakeholders to accelerate the delivery of

the Company's clear strategic priorities, which are expected to

result in a material uplift in earnings and a substantial

deleveraging from 2018 onwards."

The

issue price per new share and the number of new shares effectively

placed will be announced after completion of the Placement,

expected before opening of trading on Euronext Brussels on 15

November 2017, subject to acceleration.

If the

Placement is not completed before opening of trading on 15 November

2017, trading in Nyrstar shares on Euronext Brussels will be

suspended and resume following the publication of the results of

the Placement.

J.P.

Morgan Securities plc. and KBC Securities NV are acting as Joint

Bookrunners in the Placement.

Urion Holdings (Malta) Ltd., a

subsidiary of Trafigura Group Pte. Ltd. and shareholder of the

Company, is fully supportive of the Placement and intends to,

directly or indirectly through one or more of its affiliates,

submit an order for an amount of at least EUR 25 million to the

Joint Bookrunners. In addition, Hilmar Rode, Chief Executive

Officer of the Company, is supporting the Placement and intends to

submit an order (through one or more private banks). The Placement

is open to institutional investors and such other investors as

permitted under applicable private placement exceptions, as

aforementioned, and any final allocation to investors, as the case

may be, will be made based on customary objective and

pre-identified criteria. No guarantee has been given as to the

final allocation to Urion Holdings (Malta) Ltd. or any of its

affiliates, Mr. Rode, or any private banking entities through which

Mr. Rode's order is placed, that any allocation will be made to

them or as to the size of any such allocation.

In relation to the Placement, the

Company has agreed with the Joint Bookrunners a lock-up undertaking

for a period of 180 calendar days, subject to certain

exceptions.

- END -

About Nyrstar

Nyrstar is a global multi-metals business, with a market leading

position in zinc and lead, and growing positions in other base and

precious metals, which are essential resources that are fuelling

the rapid urbanisation and industrialisation of our changing world.

Nyrstar has mining, smelting and other operations located in

Europe, the Americas and Australia and employs approximately 4,300

people. Nyrstar is incorporated in Belgium and has its corporate

office in Switzerland. Nyrstar is listed on Euronext Brussels under

the symbol NYR. For further information please visit the Nyrstar

website: www.nyrstar.com.

For further information

contact:

Anthony Simms Group Manager Investor Relations T:

+41 44 745 8157 M: +41 79 722 2152 E:

anthony.simms@nyrstar.com

Franziska Morroni Group Manager Corporate Communications T: +41 44

745 8295 M: +41 79 719 2342 E: franziska.morroni@nyrstar.com

IMPORTANT INFORMATION

This

communication is not a prospectus for the purposes of the

Prospectus Directive (Directive 2003/71/EC and amendments thereto,

including Directive 2010/73/EU, to the extent implemented in the

relevant Member State of the EEA (as defined below)) and any

implementing measure in each relevant Member State of the EEA (the

"Prospectus Directive"). This communication cannot be used as basis

for any investment agreement or decision. Acquiring investments to

which this announcement relates may expose an investor to a

significant risk of losing the entire amount invested. Persons

considering making such investments should consult an authorised

person specialising in advising on such investments. This

announcement does not constitute a recommendation concerning the

securities referred to herein.

The

information contained in this announcement is for general

information only and does not purport to be full or complete. This

announcement does not constitute, or form part of, an offer to sell

or issue, or any solicitation of an offer to purchase or subscribe

for shares, and any purchase of, subscription for or application

for, shares. This announcement and the information contained herein

are not for publication, distribution or release in, or into, the

United States, Australia, Canada, Japan, South Africa or any other

jurisdiction where to do so would be prohibited by applicable law.

Any persons reading this announcement should inform themselves of

and observe any such restrictions.

This

announcement is not for distribution, directly or indirectly, in or

into the United States. It does not constitute or form a part of

any offer or solicitation to purchase or subscribe for securities

in the United States. The securities mentioned herein have not

been, and will not be, registered under the U.S. Securities Act of

1933, as amended (the "Securities Act") and may not be offered or

sold in the United States, except pursuant to an exemption from the

registration requirements of the Securities Act. The Company and

its affiliates have not registered, and do not intend to register,

any portion of the offering of the securities concerned in the

United States, and do not intend to conduct a public offering of

securities in the United States.

An

offer of securities to which this announcement relates is only

addressed to and directed at persons in member states of the

European Economic Area ("EEA") who are 'qualified investors' within

the meaning of Article 2(1)(e) of the Prospectus Directive

("Qualified Investors"), or such other investors as shall not

constitute an offer to the public within the meaning of Article

3(2) of the Prospectus Directive. In addition, any offer of

securities to which this announcement relates is in the United

Kingdom being distributed only to, and is directed only at, (i)

persons who have professional experience in matters relating to

investments falling within Article 19(5) of the Financial Services

and Markets Act 2000 (Financial Promotion) Order 2005, as amended

(the "Order"), (ii) high net worth entities etc. falling within

Article 49(2)(a) to (d) of the Order, and (iii) any other person to

whom it may otherwise lawfully be communicated (all such persons

together being referred to as "relevant persons"). The offering of

securities to which this announcement relates will only be

available to, and any invitation, offer or agreement to subscribe

for, purchase, or otherwise acquire securities will be engaged in

only with relevant persons. Any person who is not a relevant person

should not act or rely on this announcement or any of its

contents.

No

announcement or information regarding the offering, listing or

securities of the Company referred to above may be disseminated to

the public in jurisdictions where a prior registration or approval

is required for such purpose. No steps have been taken, or will be

taken, for the offering or listing of securities of the Company in

any jurisdiction where such steps would be required, except for the

admission of the new shares on Euronext Brussels. The issue,

exercise, or sale of, and the subscription for or purchase of,

securities of the Company are subject to special legal or statutory

restrictions in certain jurisdictions. The Company is not liable if

the aforementioned restrictions are not complied with by any

person.

J.P.

Morgan Securities plc., which is authorised by the Prudential

Regulation Authority and regulated by the Financial Conduct

Authority and the Prudential Regulation Authority in the UK, and

KBC Securities NV which is authorised by and under the supervision

of the National Bank of Belgium and under the supervision on

investor and consumer protection of the Belgian Financial Services

and Markets Authority, are acting exclusively for the Company and

no one else in connection with the Placement. In connection

with such matters, the Joint Bookrunners, their affiliates and

their respective directors, officers, employees and agents will not

regard any other person as their client, nor will they be

responsible to any other person for providing the protections

afforded to their clients or for providing advice in relation to

the Placement or any other matters referred to in this

announcement.

The full press release can be downloaded from the

following link:

Press Release (English)

This

announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: Nyrstar via Globenewswire

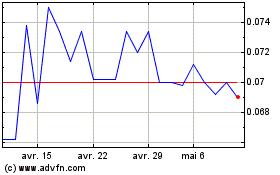

Nyrstar NV (EU:NYR)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Nyrstar NV (EU:NYR)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024