Nyrstar prices €400 million notes offering

03 Mars 2017 - 2:30PM

Regulated Information - Inside

Information

THIS ANNOUNCEMENT

IS NOT FOR DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN THE UNITED

STATES OF AMERICA, AUSTRALIA, CANADA, JAPAN, SOUTH AFRICA OR ANY

OTHER JURISDICTION WHERE TO DO SO WOULD BE PROHIBITED BY APPLICABLE

LAW.

3 March 2017 at 14.30 CET

Nyrstar Netherlands (Holdings)

B.V. (the "Issuer"), a subsidiary of Nyrstar NV (the "Company" or

"Nyrstar"), announced today that it has priced its offering (the

"Notes Offer") of €400 million senior unsecured notes due 2024 (the

"Notes"). The Notes were priced at 100% with a coupon of 6.875% per

annum. The principal amount of the Notes offered was increased from

€350 million to €400 million. The Notes will be guaranteed by

Nyrstar, as parent guarantor, and certain subsidiaries of the

Company. The issuance of the Notes, which is subject to conditions,

is expected to occur on 10 March 2017.

The Issuer intends to use the net

proceeds from the Notes Offer to refinance amounts outstanding

under the convertible bonds due 2018 issued by Nyrstar in an

original aggregate principal amount of €120 million, and to pay

down indebtedness under, but not cancel, existing revolving

facility agreements.

About

Nyrstar

Nyrstar is a global multi-metals business, with a market leading

position in zinc and lead, and growing positions in other base and

precious metals, which are essential resources that are fuelling

the rapid urbanisation and industrialisation of our changing world.

Nyrstar has mining, smelting, and other operations located in

Europe, the Americas and Australia and employs approximately 4,300

people. Nyrstar is incorporated in Belgium and has its corporate

office in Switzerland. Nyrstar is listed on Euronext Brussels under

the symbol NYR. For further information please visit the Nyrstar

website: www.nyrstar.com

For further information

Anthony Simms - Group Manager Investor

Relations T: +41 44 745 8157 M: +41 79 722

2152 anthony.simms@nyrstar.com

Franziska Morroni - Group Manager Corporate

Communications T: +41 44 745 8295 M: +41 79

719 2342 franziska.morroni@nyrstar.com

IMPORTANT NOTICE

The

information contained in this announcement is for general

information only and does not purport to be full or complete. This

announcement does not constitute, or form part of, an offer or

invitation to sell or issue, or any solicitation of an offer to

purchase or subscribe for, nor shall there be any sale or purchase

of, the securities referred to herein, in any jurisdiction in which

such offer, invitation, solicitation, sale, issue, purchase or

subscription would be unlawful under the securities laws of any

such jurisdiction. This announcement is not for distribution,

directly or indirectly, in the United States of America, Australia,

Canada, Japan, South Africa or any other jurisdiction where to do

so would be prohibited by applicable law. Any persons reading this

announcement should inform themselves of and observe any such

restrictions.

No

communication and no information in respect of the Notes Offer may

be distributed to the public in any jurisdiction where a

registration or approval is required. No steps have been or

will be taken in any jurisdiction where such steps would be

required. The offering or subscription of the Notes may be subject

to specific legal or regulatory restrictions in certain

jurisdictions. The Issuer takes no responsibility for any violation

of any such restrictions by any person.

These

materials are not an offer for sale of securities in the United

States. The securities referred to herein may not be offered

or sold in the United States absent registration with the United

States Securities and Exchange Commission or an exemption from

registration under the U.S. Securities Act of 1933, as amended. The

Issuer has not registered, and does not intend to register, any

part of the Notes Offer in the United States, and has not

conducted, and does not intend to conduct, a public offering of the

Notes in the United States.

This

announcement is not a prospectus within the meaning of Directive

2003/71/EC of the European Parliament and the Council of 4 November

2003, as amended, notably by Directive 2010/73/EU, and as

implemented respectively in each member State of the European

Economic Area (the "Prospectus Directive"). This announcement does

not, and shall not, in any circumstances constitute a public

offering nor an invitation to the public in connection with any

offer to buy or subscribe for securities in any jurisdiction. No

action has been undertaken or will be undertaken to make an offer

to the public of the Notes requiring a publication of a prospectus

in any member State of the European Economic Area. As a result, the

Notes may only be offered in member States of the European Economic

Area:

(a) to

qualified investors (as defined in Article 2(1)(e) of the

Prospectus Directive); or

(b) in

any other circumstances, not requiring the Issuer to publish a

prospectus as provided under Article 3(2) of the Prospectus

Directive.

The

distribution of this announcement is not made, and has not been

approved, by an "authorised person" within the meaning of Section

21(1) of the Financial Services and Markets Act 2000. As a

consequence, this announcement is directed only at persons who (i)

are located outside the United Kingdom, (ii) are investment

professionals falling within Article 19(5) of the Financial

Services and Markets Act 2000 (Financial Promotion) Order 2005, as

amended (the "Order"), (iii) are persons to whom it may be lawfully

communicated, falling within Article 49(2)(a) to (d) (high net

worth companies, unincorporated associations, etc.) of the Order or

(iv) are persons to whom this announcement may otherwise lawfully

be communicated (all such persons together being referred to as

"Relevant Persons"). The Notes are directed only at Relevant

Persons and no invitation, offer or agreements to subscribe,

purchase or otherwise acquire or sell Notes may be proposed or made

other than with Relevant Persons. Any person other than a

Relevant Person may not act or rely on this document or any

provision thereof. This announcement is not a prospectus

which has been approved by the Financial Conduct Authority or any

other United Kingdom regulatory authority for the purposes of

Section 85 of the Financial Services and Markets Act 2000.

In

connection with the issue of the Notes, Deutsche Bank AG, London

Branch acting as stabilising manager or any person acting on behalf

of Deutsche Bank AG, London Branch may over-allot Notes or effect

transactions with a view to supporting the market price of the

Notes at a level higher than that which might otherwise prevail.

However, there is no assurance that Deutsche Bank AG, London Branch

or any person acting on behalf of Deutsche Bank AG, London Branch

will undertake stabilisation action. Any stabilisation measure may

begin on or after the date on which adequate public disclosure of

the final terms of the Notes Offer is made and, if begun, may be

ended at any time, but it must end no later than 30 calendar days

after the date on which the Issuer received the proceeds of the

issue or no later than 60 calendar days after the date of allotment

of the Notes, whichever is earlier. The stabilisation measures can

take place over the counter (OTC) or on the Euro MTF Market of the

Luxembourg Stock Exchange. Any stabilisation measure or

over-allotment must be conducted by Deutsche Bank AG, London Branch

or any person acting on behalf of Deutsche Bank AG, London Branch

in accordance with all applicable laws and rules.

The full press release can be downloaded from the following

link:

Press Release (Dutch)

Press Release (English)

This

announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: Nyrstar via Globenewswire

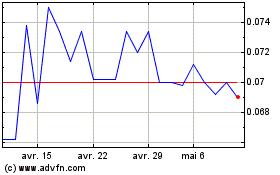

Nyrstar NV (EU:NYR)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Nyrstar NV (EU:NYR)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024