Nyrstar successfully re-finances its Structured Commodity Trade Finance Facility

20 Décembre 2017 - 7:00PM

Regulated

Information

20 December 2017 at 19.00

CET

Nyrstar

today announced that it has successfully executed the refinancing

of its existing EUR 500 million multi-currency Structured Commodity

Trade Finance Facility due to expire in June 2019 with a one year

runoff period starting in June 2018.

The new

facility closed at EUR 600 million and replaces the previous EUR

500 million facility and includes an accordion feature to increase

its size to EUR 750 million on a pre-approved but uncommitted

basis. The new facility has very similar terms and conditions as

the previous facility including a maturity of 4 years until

December 2021 (with a 12 month run-off period during the fourth

year). As with the previous facility, the amount that Nyrstar may

draw-down under the new facility is determined by reference to the

value of Nyrstar's inventories and receivables (the borrowing base)

and accordingly adjusts as commodity prices change. The new

facility has an equivalent margin of 2.25% above EURIBOR (or LIBOR

for drawings in currencies other than USD), leveraging on the

strength of the secured borrowing base and the underlying exchange

traded commodities.

The new

facility represents an increase of EUR 100 million over the

previous facility due to a successful syndication which resulted in

some significant over-subscription. In addition, as a result

of the rising zinc price environment and foreign exchange

volatility, Nyrstar has seen an increase in working capital

requirements.

The

participating banks in the new facility are:

-

Deutsche Bank AG as Coordinating Mandated Lead

Arranger and Bookrunner; and

-

ABN AMRO BANK N.V., AKA

Ausfuhrkredit-Gesellschaft mbH, Amsterdam Trade Bank N.V., Bank of

Montreal, BNP Paribas Fortis, CREDIT SUISSE (Schweiz) AG, Deutsche

Bank AG, Goldman Sachs Bank USA, HSBC, ING Bank N.V., J.P. Morgan

Securities plc, KBC, National Westminster Bank Plc, Raiffeisen Bank

International AG, Société Générale and Zürcher Kantonalbank as

Lenders.

"The renewal of the Structured

Commodity Trade Finance Facility with a EUR 600 million limit is a

further step in strengthening our balance sheet and demonstrates

the on-going and strong support from the financial markets of our

company as we deliver against our strategic initiatives. The

facility remains a cornerstone in our financing portfolio and is

ideally structured to meet our working capital requirements as well

as maintaining a sufficient amount of liquidity," said Chris Eger,

Chief Financial Officer of Nyrstar.

About Nyrstar

Nyrstar

is a global multi-metals business, with a market leading position

in zinc and lead, and growing positions in other base and precious

metals, which are essential resources that are fuelling the rapid

urbanisation and industrialisation of our changing world. Nyrstar

has mining, smelting, and other operations located in Europe, the

Americas and Australia and employs approximately 4,300 people.

Nyrstar is incorporated in Belgium and has its corporate office in

Switzerland. Nyrstar is listed on Euronext Brussels under the

symbol NYR. For further information please visit the Nyrstar

website: www.nyrstar.com

For further information

contact:

Anthony Simms - Group Manager Investor

Relations T: +41 44 745 8157 M: +41 79 722

2152 anthony.simms@nyrstar.com

Franziska Morroni - Group Manager Corporate

Communications T: +41 44 745 8295 M: +41 79 719 2342

franziska.morroni@nyrstar.com

The full press release can be downloaded from the

following link:

Press Release (English)

This

announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: Nyrstar via Globenewswire

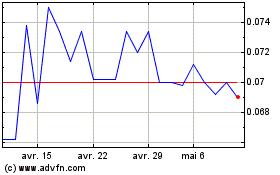

Nyrstar NV (EU:NYR)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

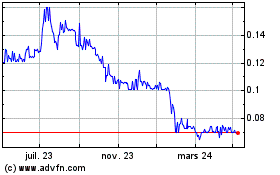

Nyrstar NV (EU:NYR)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024