Oil Search Makes $400 Million Move Into Big Alaska Oil Find -- Update

01 Novembre 2017 - 3:22AM

Dow Jones News

By Robb M. Stewart

MELBOURNE, Australia--Oil Search Ltd. has struck a deal to

operate what may be one of the largest U.S. oil discoveries in

decades.

The mid-sized energy company said Wednesday that it will pay

$400 million for interests in assets in Alaska's North Slope,

including the Nanushuk oil field sandwiched between two established

fields controlled by ConocoPhillips.

Earlier this year, Spanish oil company Repsol SA and exploration

firm Armstrong Energy LLC estimated Nanushuk could hold 1.2 billion

barrels of recoverable light oil, which would be one of the biggest

onshore U.S. finds in 30 years.

"I didn't believe assets of this quality could necessarily be

found," Peter Botten, managing director of Oil Search said. "These

are unusual assets."

Oil Search, based in the Papua New Guinea capital of Port

Moresby and listed in Australia, has been on the hunt for assets

that would help balance a portfolio heavily weighted to gas

operations in a single country.

The agreement signed by Oil Search will see it purchase stakes

in three exploration blocks in the North Slope from privately-held

Armstrong and GMT Exploration Co., and assume the role of operator

from June 2018. It has an option to buy majority control of the

blocks for a further $450 million by mid-2019, while Repsol retains

a 49% interest in the central block and 25% stakes in another block

as well as exploration acreage.

The deal was struck on the assumption of a 500 million barrel

resource, which Mr. Botten said worked out to a purchase price of

$3.10 a barrel, with the potential for that to fall to $1.30 based

on Repsol's estimate of a 1.2 billion barrel discovery.

Oil Search operates all of Papua New Guinea's producing oil

fields, though these are dwarfed by output from Exxon Mobil Corp.'s

big liquefied natural gas operation in the country, in which Oil

Search has a 29% interest. It also has interests in a number of

undeveloped gas fields in Papua New Guinea, including assets

operated by France's Total SA.

The Alaskan assets, which sit near to existing infrastructure,

are set to bring oil to the market more quickly than the proposed

LNG expansion projects in Papua New Guinea and have the potential

for higher returns, Mr. Botten said. The Alaska business could in

time rival the scale of the Papua New Guinea gas-export operations,

he added.

Mr. Botten said Oil Search had the capacity to fund both its

share of LNG expansion and the development of the Nanushuk field

without a change to its dividend policy or any need to raise

additional equity, with the initial acquisition in the North Slope

paid from surplus cash. He said the company would work with

Halliburton Co. to develop its Alaska operating capabilities.

The companies are targeting a final investment decision on the

Nanushuk field in 2020 and first oil three years after that, aiming

to reach production of 80,000-120,000 barrels a day. There have

been 19 exploration and appraisal wells drilled to date in the

field, which was discovered in 2013, Oil Search said.

Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

October 31, 2017 22:07 ET (02:07 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

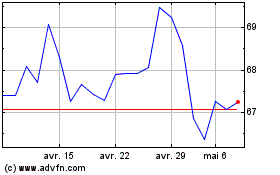

TotalEnergies (EU:TTE)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

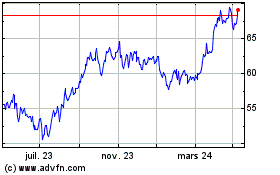

TotalEnergies (EU:TTE)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024