Plastic Omnium, a Growth and Innovation Strategy: SHAPE THE FUTURE NOW!

13 Décembre 2017 - 7:30AM

Business Wire

Regulatory News:

Σ-Sigmatech: To mark its Investor Day, held today at its

Σ-Sigmatech global R&D center for exterior components and

modules in Lyon, Plastic Omnium (Paris:POM) is unveiling its growth

and innovation strategy geared towards meeting the new challenges

of the connected, autonomous and carbon-free car.

2017: a year of strong growth

Plastic Omnium confirms, despite adverse currency effects, that

its 2017 economic revenue will reach 8 billion euros, representing

strong growth compared with the 6.9 billion euros recorded in 2016

and a robust outperformance compared to worldwide automotive

production.The Group’s profitability will improve and will well

exceed the 9% proforma operating margin of 2016, and net

profit-Group share will be up very strongly.

2017-2021: continued outperformance and recurring improvement

in financial indicators

- 10 billion euros in economic revenue

in 2021

Thanks to a backlog secured at more than 85% in 2021, market

share gains on its products and the success of its innovative

offer, Plastic Omnium will continue to outperform worldwide

automotive production by an average of 5 points per year over the

2017-2021 period, bringing economic revenue to 10 billion euros in

2021.Already ranked number 1 worldwide in each of its businesses,

Plastic Omnium aims to strengthen its leadership positions, with

market share of 19% expected in bumpers in 2021, vs. 16% in 2017,

and 25% in fuel systems, vs. 22% in 2017.Plastic Omnium will also

benefit from the development of its portfolio of innovative

products, with market shares of 45% expected in thermoplastic

tailgates in 2021, vs. 40% in 2017, and 26% in SCR systems for the

depollution of diesel vehicles, vs. 17 % in 2017.

- Steady improvement in operating

margin

The Group’s operating margin is expected to increase steadily

over the 2017-2021 period. Plastic Omnium stands to benefit from

the following operating levers:

- the accretive growth of the Group’s

operations in North America;

- the improvement of the utilization

rates of the Group’s industrial facilities, particularly in

China;

- the success of the innovation

portfolio;

- and the faster-than-expected turnaround

of the exterior systems business acquired in 2016.

- More than 1 billion euros in free

cash flow over the 2017-2021 period after 2.5 billion euros in

investments

To meet the commercial successes with the world’s leading

carmakers and satisfy future market needs, Plastic Omnium plans to

invest 2.5 billion euros over the 2017-2021 period. This capital

expenditure is aimed at building new capacities, continuously

optimizing industrial facilities (industry 4.0 and operational

excellence), developing new programs and launching new research

projects.The Group will generate more than 1 billion euros in free

cash flow over the period while leading this investment policy.

Premium positioning to meet the challenges of the car of

tomorrow

Building on the momentum offered by the continuous improvement

of its industrial and financial performance, Plastic Omnium is in

this way giving itself the means necessary to further accelerate

its capacity for innovation so as to meet the challenges

represented by the carbon-free, connected and autonomous car of

tomorrow. Its ambitious and determined policy will give rise to

both new technology investments and strategic acquisitions, as

opportunities arise.

In carbon-free cars, Plastic Omnium is positioned as a player of

storage for each form of energy, developing specific solutions for

plug-in hybrid vehicles (PHEV), turbocharged engine vehicles and

electric vehicles. The Group has also become involved in fuel cell

propulsion.

For the connected and autonomous car, Plastic Omnium is

positioning itself as the integrator of connectivity by developing

its innovation capacity in complex modules that integrate radar and

sensors in the exterior parts. By 2025, smart bumpers and smart

tailgates will represent greater added value and embedded

intelligence.

These new positions will enable Plastic Omnium to pursue

long-term profitable and value-creating growth.

Plastic Omnium has already established new means to achieve this

ambition:

- Ξ PO-CellTech, a fundamental

research center in the field of fuel cells in Israel;

- the construction of Δ-Deltatech,

a new Brussels-based advanced research center dedicated to new

energies, such as hydrogen;

- the launch in Wuhan (China) of

ω-Omegatech, its new testing and development center for fuel

systems for Asia, due to open in 2019;

- the launch of a program to expand and

digitize ∑-Sigmatech, its global R&D center for exterior

components and modules located near Lyon;

- the investment of 20 million euros in

Aster, a venture capital firm specializing in digital

transformation and new industrial models;

- partnerships with prominent

universities such as MIT in the United States, the Technion in

Israel and DTU in Denmark.

With this growth and innovation strategy, Plastic Omnium is

positioning itself to design the exterior modules of the vehicle of

the future and to be a reference equipment supplier for all

propulsion energies (gasoline, diesel, hybrid, hydrogen and

electric).

_____________

The detailed presentation of the 2017-2021 growth and innovation

strategy will take place on Tuesday, December 13, 2017 at

10:30 a.m. Paris time.It will also be accessible via webcast

on the Plastic Omnium Group’s website at www.plasticomnium.com.

Plastic Omnium is the world leader in automotive exterior

components and modules, automotive fuel systems, and waste

container solutions for local authorities and companies. The Group

has 33,000 employees across 124 plants, 23 R&D center s and 31

countries worldwide, serving 74 automotive brands. Plastic Omnium

is listed on Euronext Paris, compartment A. It is eligible for the

Deferred Settlement Service (SRD) and is part of the SBF 120 and

CAC Mid 60 indices (ISIN code: FR0000124570).

Glossary

1. Economic revenue corresponds to consolidated revenue, plus

revenue from the Group’s joint ventures, consolidated at their

percentage of ownership. The figure reflects the operational and

managerial realities of the Group.

2. Consolidated revenue, in implementation of IFRS 10-11-12,

does not include the share of joint ventures, which are

consolidated by using the equity method.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171212006126/en/

Plastic OmniumFinancial informationTel. : +33 (0)1 40 87 66

78Fax : +33 (0)1 40 87 96

62investor.relations@plasticomnium.com

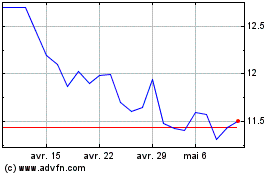

Compagnie Plastic Omnium (EU:POM)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Compagnie Plastic Omnium (EU:POM)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024