Pound Climbs As BoE Carney Says Bank's Next Move Is Raising Rates

27 Mars 2015 - 2:06PM

RTTF2

The pound drifted higher against its major rivals in European

deals on Friday, after the Bank of England governor Mark Carney

told that the next move in interest rates would be an increase and

not a cut, even as the U.K. is experiencing record low

inflation.

"We're still in a position where our message is... that the next

move in interest rates is going to be up," Carney said during a

panel discussion at a Bundesbank conference in Frankfurt.

In a speech at Imperial College Business School in London, the

BoE deputy governor Ben Broadbent said that low inflation in the UK

is likely to be temporary, and it "is positive, not negative, for

demand and output."

"Base effects will naturally give a big positive impetus to

annual inflation in early 2016," he said.

European markets advanced, after Germany's import prices

declined at a slower-than-expected pace in February, and optimism

emerged that conflict in Yemen would have little effect on oil

supplies even as concerns remained about the situation.

In economic front, U.K. house price growth softened for the

seventh consecutive month in March, data from the Nationwide

Building Society showed.

House prices advanced 5.1 percent year-on-year in March, slower

than February's 5.7 percent increase. The annual growth was also

slower than a 5.3 percent rise forecast by economists.

The pound ended Thursday's trading on a mixed note. Although

upbeat retail sales data gave some support to the pound-dollar

pair, that was short lived and it declined at the end of Thursday's

trading.

The pound appreciated to 1.4913 against the greenback, up by 0.8

percent from an early weekly low of 1.4796. The next possible

resistance for the pound-greenback pair may be located around the

1.50 zone.

The pound added 0.8 percent to hit a 3-day high of 1.4403

against the franc, compared to 1.4294 hit at Thursday's New York

session close. If the pound-franc pair extends rise, 1.46 is likely

seen as its next resistance level.

The pound spiked up to a 4-day high of 0.7265 against the euro,

a 0.8 percent rise from yesterday's closing value of 0.7326. On the

upside, the pound may find resistance around the 0.72 mark.

The pound advanced to a 2-day high of 177.92 against the

Japanese yen, following a decline to 176.69 at 5:30 am ET.

Continuation of the pound's uptrend may lead it to a resistance

surrounding the 180.00 area.

Looking ahead, U.S. final fourth quarter GDP data and

Reuters/University of Michigan's final consumer sentiment index for

March are due in the New York session.

At 3:35 pm ET, U.S. Federal Reserve Chair Janet Yellen is

expected to speak about monetary policy at the Federal Reserve Bank

Conference titled "The New Normal for Monetary Policy" at San

Fransisco.

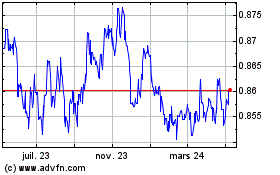

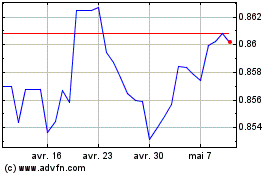

Euro vs Sterling (FX:EURGBP)

Graphique Historique de la Devise

De Mar 2024 à Avr 2024

Euro vs Sterling (FX:EURGBP)

Graphique Historique de la Devise

De Avr 2023 à Avr 2024