Pound Climbs As UK Factory Activity Growth Accelerates

01 Novembre 2017 - 7:19AM

RTTF2

The pound strengthened against its major counterparts in early

European deals on Wednesday, as the UK manufacturing sector

activity expanded notably in October before the Bank of England

decision tomorrow.

Survey data from IHS Markit showed that the IHS Markit/Chartered

Institute of Procurement & Supply Purchasing Managers' Index

rose to 56.3 in October from revised 56.0 in September.

The expected score was 55.9. The headline PMI has now signaled

expansion for 15 consecutive months.

The currency was also buoyed by rising European shares, as

Catalonia worries eased and encouraging data from the U.S. and

China stoked optimism about the global economy.

Investors looked ahead to the FOMC decision later in the day.

While no policy changes are expected, investors may get some clues

in the policy statement as to whether the U.S. central bank is on

track to raise rates in December.

The Bank of England will reveal its interest-rate decision on

Thursday, with traders bracing for what could be the central bank's

first rate increase in more than a decade.

The currency showed mixed performance in the Asian session.

While it rose against the franc and the yen, it held steady against

the greenback and the euro.

The pound climbed to 151.79 against the yen, its highest since

September 25. The pound is seen finding resistance around the

153.00 region.

Survey data from IHS Markit showed that Japan's manufacturing

activity continued to expand strongly in October, underpinned by

solid expansions in output, new orders and employment.

The Nikkei Manufacturing Purchasing Managers' Index, or PMI

dropped marginally to 52.8 in October from 52.9 in September.

However, any reading above 50 indicates expansion in the

sector.

The pound that finished Tuesday's trading at 0.8768 against the

euro hit more than a 4-month high of 0.8738. Continuation of the

pound's uptrend may see it challenging resistance around the 0.84

region.

The U.K. currency firmed to near a 3-week high of 1.3321 against

the greenback and more than a 4-month high of 1.3329 against the

franc, up from Tuesday's closing values of 1.3282 and 1.3249,

respectively. Further uptrend may see the pound challenging

resistance around 1.34 against both the greenback and the

franc.

Looking ahead, ADP private payrolls data and ISM manufacturing

index for October and construction spending for September are set

for release in the New York session.

At 1:15 pm ET, SNB Governing Board Member Fritz Zurbrugg will

deliver a speech titled "Loans, Debt, and Growth" at the University

of Bern.

At 2:00 pm ET, the Fed announces its decision on monetary

policy. The central bank is widely expected to leave interest rates

unchanged at 1 percent to 1.25 percent range.

The Bank of Canada Governor Stephen Poloz will testify along

with Senior Deputy Governor Carolyn Wilkins before the Standing

Senate Committee on Banking, Trade and Commerce, in Ottawa at 4:15

pm ET.

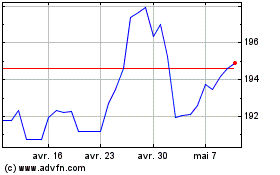

Sterling vs Yen (FX:GBPJPY)

Graphique Historique de la Devise

De Mar 2024 à Avr 2024

Sterling vs Yen (FX:GBPJPY)

Graphique Historique de la Devise

De Avr 2023 à Avr 2024