Pound Declines Amid Risk Aversion; Moody's Warning

12 Juin 2017 - 9:06AM

RTTF2

The pound dropped against its major opponents in the European

session on Monday, as European shares fell amid sharp decline in

tech stocks, and as Moody's warned that U.K. election outcome would

"complicate and probably delay" Brexit negotiations.

Sell-off in technology shares continued after reports emerged

that Apple's next iPhones won't include support for gigabit LTE

speeds.

Political uncertainty persisted as the U.K. election shock left

Conservative party in disarray, making the Brexit negotiations more

complex.

Credit agency Moody's said that U.K.'s inconclusive election

result "will complicate and probably delay Brexit negotiations,"

which is planned to begin next Monday.

"In our view, the budget deficit will increase this year and

next, as the government reacts to the economic slowdown under way,"

it said in a report.

This comes on the heels of a Fitch warning that the U.K. general

election result created uncertainty over the policy platform,

political cohesion and longevity of the next U.K. government. This

will have implications for Brexit as well as potentially fiscal

policy, the agency said.

Standard & Poor's chief economist Jean-Michel Six cautioned

that the current political instability may harm Britian's economic

growth for this year and dent business environment and consumer

confidence.

"For the time being, the outlook remains negative," Six told the

AJEF association of financial journalists in Paris.

Survey by the Institute of Directors showed that UK business

confidence sharply deteriorated following the inconclusive election

on June 8 and business leaders are very concerned about the impact

of the political uncertainty on the Brexit talks.

"There has been a negative swing of 34 points in confidence in

the UK economy from our last survey in May," the IoD said.

The pound showed mixed trading against its major rivals in the

Asian session. While the currency ticked up against the greenback

and the franc, it held steady against the yen and the euro.

The pound retreated to 1.2682 against the greenback, from a high

of 1.2769 hit at 1:45 am ET. The next possible support for the

pound is seen around the 1.25 region.

Reversing from an early high of 140.80 against the Japanese yen,

the pound declined to near a 2-month low of 139.48. The pound is

poised to target 137.00 as the next support level.

Data from the Bank of Japan showed that Japan's producer prices

were flat in May.

That was beneath expectations for an increase of 0.1 percent and

down from 0.2 percent in April.

The pound weakened to 0.8844 against euro and 1.2276 against

franc, off its early highs of 0.8779 and 1.2371, respectively. If

the pound extends decline, 0.90 and 1.21 are likely seen as its

next support levels against the euro and the franc,

respectively.

Looking ahead, U.S. Federal Reserve's monthly budget statement

for May is due to be released at 2:00 pm ET.

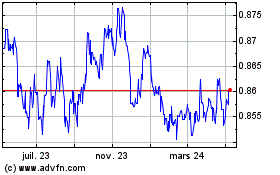

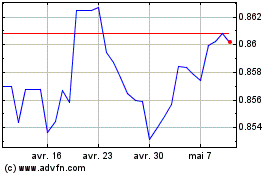

Euro vs Sterling (FX:EURGBP)

Graphique Historique de la Devise

De Mar 2024 à Avr 2024

Euro vs Sterling (FX:EURGBP)

Graphique Historique de la Devise

De Avr 2023 à Avr 2024