Pound Declines Amid Risk Aversion

28 Juillet 2016 - 8:52AM

RTTF2

The pound weakened against its key counterparts in European

trading on Thursday, as European shares declined amid weak

corporate earnings, as well as on caution that the Bank of Japan

won't deliver radical stimulus at the end of a two-day meeting

ending Friday.

The UK gilts strengthened, diving down yields, on growing hopes

that the Bank of England would lower rates next week or resume

quantitative easing to contain the fallout of the Brexit vote. The

yield on the benchmark 10-year gilts fell more than 3 basis points

to a record low of 0.707 percent and the yield on 30-year bond

dipped nearly 2 basis points to 1.593 percent. Yields move

inversely to bond prices.

Investors digested the Federal Reserve's latest policy statement

that sent out mixed messages on the U.S. economic outlook and

future moves on interest rates.

The Fed didn't make any changes to interest rates but left the

door open for increases later this year, saying that economic

activity has been expanding at a moderate rate and risks to the

economic outlook have diminished.

In economic front, data from the Nationwide Building Society

showed that U.K. house prices increased more than expected in July

after Britons voted to leave the European Union.

Annual growth in house prices increased to a 4-month high of 5.2

percent in July from 5.1 percent in June, while it was expected to

ease to 4.5 percent.

The pound has been trading lower against most major rivals in

Asian deals, amid rising risk aversion, as the Fed sounded upbeat

over economic performance and hinted about gradual rate hikes in

the coming months.

Easing from an early 6-day high of 1.3248 against the dollar,

the pound edged down to 1.3160. The next possible downside target

for the pound-dollar pair is seen around the 1.30 zone.

The pound slid to a 2-week low of 0.8437 against the euro and a

2-day low of 1.2945 against the franc, off its early highs of

0.8358 and 1.3049, respectively. The pound is likely to locate

support around 0.86 against the euro and 1.27 against the

franc.

The pound remained lower against the Japanese yen with the pair

trading at 137.81. On the downside, 136.00 is likely seen as the

next support level for the pound-yen pair.

Looking ahead, at 8:00 am ET, German flash consumer prices for

July are set for release.

The U.S. weekly jobless claims for the week ended July 23 and

advance goods trade data for June will be out in the New York

session.

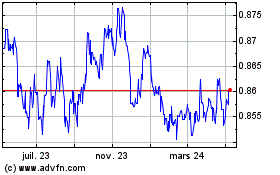

Euro vs Sterling (FX:EURGBP)

Graphique Historique de la Devise

De Mar 2024 à Avr 2024

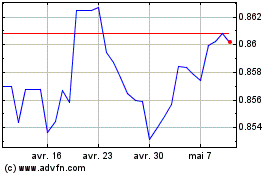

Euro vs Sterling (FX:EURGBP)

Graphique Historique de la Devise

De Avr 2023 à Avr 2024