Pound Falls As BoE Broadbent Says Drop In EU Trade To Hurt UK Economy

11 Juillet 2017 - 12:32PM

RTTF2

The pound declined against its key counterparts in early New

York deals on Tuesday, after the Bank of England Deputy Governor

Ben Broadbent warned that a significant drop in trade with the

Europe after Brexit would harm the U.K. and increase costs.

"A significant curtailment of trade with Europe would force the

U.K. to shift away from producing the things it's been relatively

good at, and therefore tends to export to the EU, and towards the

things it currently imports and is relatively less good at,"

Broadbent said in a speech at the Scottish Council for Development

and Industry, in Aberdeen.

"Trade really is mutually beneficial and less of it costs us

all," he added.

Broadbent was mum on monetary policy, disappointing investors

who had been looking for clues on the likelihood of the BoE rate

hike this year.

Data from the British Retail Consortium and KPMG showed that UK

retail sales increased in June as consumers spent more on summer

clothing and beauty products.

Retail sales grew 1.2 percent on a like-for-like basis in June

from previous year, when they had decreased 0.5 percent from the

preceding year.

The pound trimmed its early gains in the European session.

The pound fell to near 2-week lows of 0.8874 against the euro

and 1.2842 versus the dollar, off its previous 4-day highs of

0.8815 and 1.2927, respectively. The pound is likely to find

support around 1.27 against the greenback and 0.90 against the

euro.

The pound retreated to 1.2446 versus the franc and 146.79

against the yen, from its early near 5-week high of 1.2518 and a

2-month high of 147.77, respectively. Continuation of the pound's

downtrend may see it challenging support around 1.22 against the

franc and 142.00 against the yen.

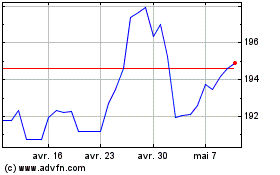

Sterling vs Yen (FX:GBPJPY)

Graphique Historique de la Devise

De Mar 2024 à Avr 2024

Sterling vs Yen (FX:GBPJPY)

Graphique Historique de la Devise

De Avr 2023 à Avr 2024