Pound Slides On Weak U.K. Economic Data

11 Mai 2017 - 8:06AM

RTTF2

The British pound weakened against the other major currencies in

the early European session on Thursday, following the releases of

weak industrial production numbers and widening trade balance.

Data from the Office for National Statistics showed that U.K.

industrial production declined for the third consecutive month in

March. Industrial output fell 0.5 percent month-on-month, following

a 0.8 percent drop in February. Production was expected to decrease

0.4 percent. On a yearly basis, growth in industrial production

slowed more-than-expected to 1.4 percent in March from 2.5 percent

in February. The expected pace of growth was 1.9 percent.

Likewise, manufacturing output slid 0.6 percent after easing 0.3

percent in the previous month. Economists had forecast a moderate

0.2 percent fall for March. Manufacturing output growth came in at

2.3 percent versus 3 percent in February. Economists had forecast

the rate to remain unchanged at 3 percent.

Also, data from the ONS showed that the U.K. visible trade

deficit widened in March.The visible trade deficit increased to GBP

13.44 billion from GBP 11.44 billion in February. The expected

level was GBP 11.6 billion.

On a monthly basis, export and import prices increased by 1.5

percent and 1.4 percent respectively.

The total trade deficit widened to GBP 4.9 billion from GBP 2.65

billion in the prior month. The visible trade deficit widened to

GBP 36.87 billion in the first quarter from GBP 31.64 billion in

the prior quarter.

At the same tine, the ONS said the U.K. construction output

declined for the third straight month in March, defying economists'

expectations for an increase. Construction output fell 0.7 percent

month-over-month in March, slower than the 1.3 percent decreased in

February. In contrast, economists had expected a 0.4 percent rise

for the month.

On a yearly basis, construction output grew at a faster pace of

2.4 percent in March, following a 0.9 percent gain a month ago.

However, that was below the 2.9 percent rise expected by

economists.

In the Asian trading today, the pound held steady against the

other major currencies.

In the European trading, the pound fell to 2-day lows of 1.2904

against the U.S. dollar, 1.2999 against the Swiss franc and 0.8428

against the euro, from early highs of 1.2948, 1.3064 and 0.8395,

respectively. If the pound extends its downtrend, it is likely to

find support around 1.27 against the greenback, 1.27 against the

franc and 0.85 against the euro.

Against the yen, the pound dropped to 147.32 from an early high

of 147.95. The pound may test support near the 145.00 region.

Looking ahead, at 6:25 am ET, Federal Reserve Bank of New York

President William Dudley is expected to deliver a speech titled

"Benefits and Challenges of Globalization," in Mumbai.

The Bank of England will announce its interest rate decision at

7:00 am ET. Economists expect the bank to retain interest rates

unchanged at 0.25 percent and asset purchase target at GBP 435

billion.

As seen at the March meeting, BOE Governor Kristin Forbes is

expected to call for a rate hike citing rising inflation.

In its quarterly Inflation Report, the bank is also set to cut

its growth outlook as consumers curb their spending amid higher

prices.

In the New York session, Canada new housing price index for

March, U.S. PPI for April and U.S. weekly jobless claims for the

week ended May 6, are set to be published.

At 11:30 am ET, IMF Chief Economist Maurice Obstfeld will

deliver a speech at Geneva Graduate Institute, in Geneva,

Switzerland.

At 11:35 am ET, President of the European Central Bank Mario

Draghi and Member of the ECB Executive Board Benoit Coeure

participate in G7 Finance Ministers and Central Bank Governors

meeting, in Bari, Italy.

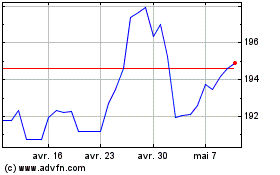

Sterling vs Yen (FX:GBPJPY)

Graphique Historique de la Devise

De Mar 2024 à Avr 2024

Sterling vs Yen (FX:GBPJPY)

Graphique Historique de la Devise

De Avr 2023 à Avr 2024