Pound Strengthens Amid Risk Appetite

25 Mai 2016 - 7:11AM

RTTF2

The pound gained ground against the other major currencies in

early European trading on Wednesday, as risk sentiment improved on

receding Brexit concerns and as Eurozone finance ministers approved

in principle a reform package for Greece that will unblock new

loans.

Worries about a likely rate hike by the Federal Reserve ebbed

somewhat as robust U.S. housing data fueled speculation the world's

largest economy can withstand higher interest rates.

Oil prices edged towards $50 a barrel, buoyed by gains in global

equities and industry data showing a larger-than-expected drawdown

in U.S. crude inventories last week.

The pound has been already underpinned by receding fears over a

'Brexit' in a referendum on the U.K.'s membership of the European

Union in June.

The latest ORB Telegraph poll showed Tuesday that the supporters

for remain camp surged to 55 percent, a 13-point lead over the

'Leave' campaign, whose campaigners stood just 42 percent.

In economic news, survey data from the Society of Motor

Manufacturers and Traders showed that British car production rose

strongly in April driven by a surge in export volumes and marked

the ninth straight month of growth.

Car production grew 16.4 percent year-on-year to 149,334 units,

the SMMT said. Export volumes surged 23.7 percent, offsetting a 7.8

percent slump in domestic demand.

The pound was modestly lower in Asian deals.

In European deals, the pound climbed to 6-day highs of 1.4663

versus the dollar and 161.36 versus the yen, off its early lows of

1.4601 and 160.44, respectively. On the upside, the pound is likely

to find resistance around 1.48 against the greenback and 163.00

against the yen.

The pound strengthened to near 4-month highs of 0.7602 against

the euro and 1.4544 against the franc, reversing from its previous

lows of 0.7639 and 1.4477, respectively. If the pound rises

further, it may find resistance around 1.48 against the franc and

0.75 against the euro.

Looking ahead, Swiss ZEW economic sentiment index for May is due

to be released shortly.

At 6:30 am ET, European Central Bank board member Vitor

Constancio is expected to speak at Session 2 "The International

Monetary and Financial System - A European Perspective" at Joint

Bank of England/FESSUD Workshop "Mapping the future of Finance" in

London.

In the New York session, U.S. advance goods trade balance for

April, Markit's flash services PMI for May, FHFA house price index

for March and U.S. crude oil inventories data are slated for

release.

At 9:00 am ET, Federal Reserve Bank of Philadelphia President

Patrick Harker is expected to speak on the economic outlook before

the Forum on America's Economy 2016 in Philadelphia.

The Bank of Canada's interest rate decision is due at 10:00 am

ET. The economists expect the bank to hold rates at 0.5

percent.

At 2:00 pm ET, Federal Reserve Bank of Dallas President Robert

Kaplan will participate in a moderated question-and-answer session

before the Greater Houston Partnership Thought Leader Series.

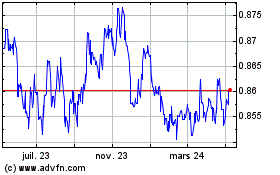

Euro vs Sterling (FX:EURGBP)

Graphique Historique de la Devise

De Mar 2024 à Avr 2024

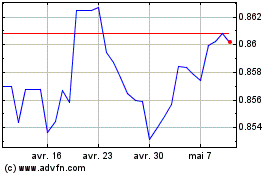

Euro vs Sterling (FX:EURGBP)

Graphique Historique de la Devise

De Avr 2023 à Avr 2024