Pound Weakens As U.K. Inflation Rises Less Than Forecast

14 Novembre 2017 - 6:40AM

RTTF2

The pound slipped against its major rivals in early European

deals on Tuesday, as the U.K. consumer prices grew less than

expected in October and output price inflation slowed further.

Data from the Office for National Statistics showed that the

U.K. consumer prices climbed 3 percent year-on-year in October,

compared to expectations for a 3.2 percent rise.

The index was unchanged from last month.

Month-on-month, consumer prices edged up 0.1 percent versus the

expected growth of 0.2 percent.

Core inflation that excludes energy, food, alcoholic beverages

and tobacco, also held steady at 2.7 percent in October.

Another report from the ONS showed that output price inflation

slowed to 2.8 percent in October from 3.3 percent in September. The

expected rate was 2.9 percent.

On a monthly basis, output prices gained 0.2 percent, the same

rate as posted a month ago.

At the same time, input price inflation eased notably to 4.6

percent in October from 8.1 percent in September. Inflation was

forecast to slow to 4.8 percent.

Input prices climbed 1 percent in October from September, when

they rose 0.2 percent.

European stocks were mostly higher, with encouraging economic

data from Germany and upbeat corporate earnings supporting

sentiment.

Investors looked ahead to European Central Bank's conference in

Frankfurt, where the European Central Bank chief Mario Draghi,

Federal Reserve Chair Janet Yellen, Bank of Japan Governor Haruhiko

Kuroda and Bank of England Governor Mark Carney participate in a

panel discussion titled "At the heart of policy: challenges and

opportunities of central bank communication."

The currency has been trading in a negative territory in the

Asian session.

The pound depreciated to 0.8954 against the euro, its lowest

since October 26. This may be compared to a high of 0.8889 hit at

6:45 pm ET. The next possible support for the pound is seen around

the 0.92 mark.

Data from the Federal Statistical Office showed that Germany's

economic growth accelerated in the third quarter.

Gross domestic product grew 0.8 percent sequentially, faster

than the 0.6 percent expansion logged in the second quarter. The

growth rate was forecast to remain at 0.6 percent.

Pulling away from an early Asian session's peak of 1.3128

against the greenback, the pound edged down to 1.3074. Continuation

of the pound's downtrend may see it challenging support around the

1.29 region.

The pound retreated to 148.78 against the yen and 1.3009 against

the franc, from its early highs of 149.43 and 1.3077, respectively.

If the pound extends slide, 147.00 and 1.29 are likely seen as its

next support levels against the yen and the franc,

respectively.

Looking ahead, U.S. producer prices for October are due in the

New York session.

At 12:30 pm ET, the Bank of England Deputy Governor Jon Cunliffe

speaks at the Oxford Economics Society.

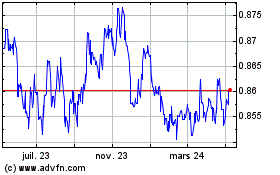

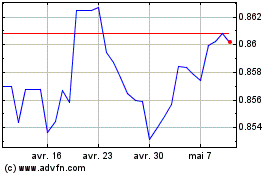

Euro vs Sterling (FX:EURGBP)

Graphique Historique de la Devise

De Mar 2024 à Avr 2024

Euro vs Sterling (FX:EURGBP)

Graphique Historique de la Devise

De Avr 2023 à Avr 2024